Gold eclipsed by rising US dollar ahead of US presidential election

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Gold price takes a back seat to US dollar in final week of US election campaign

- ‘Investors are holding fire ahead of the US election next week’: ANZ bank

- ASX Gold Stocks Guide: Everything you need to know

Gold’s safe haven status has been overtaken by the US dollar this week, as investors flocked to the US currency as a refuge while uncertainty swirls around the outcome of next week’s US presidential election.

The yellow metal dipped to a one-month low of $US1,868 per ounce ($2,655/oz) Friday as global investors parked more capital in US dollars.

“We think there will be ongoing downward pressure on gold prices in the near term as the US dollar finds support from global growth concerns,” Commonwealth Bank of Australia analyst Vivek Dhar told Bloomberg.

“A deterioration in the economic backdrop saw the US dollar record its biggest gain in five weeks. Investors are holding fire ahead of the US election next week,” ANZ bank commodities analyst, Daniel Hynes said.

Traders are buying US dollars instead of gold as they take a risk-averse stance with the approach of the November 3 US presidential election.

“We are seeing some position-trimming ahead of the election, with the market still short dollars,” Vassili Serebriakov, foreign exchange strategist at Swiss bank UBS told Reuters.

Cash-strapped central banks offload gold to capture high prices

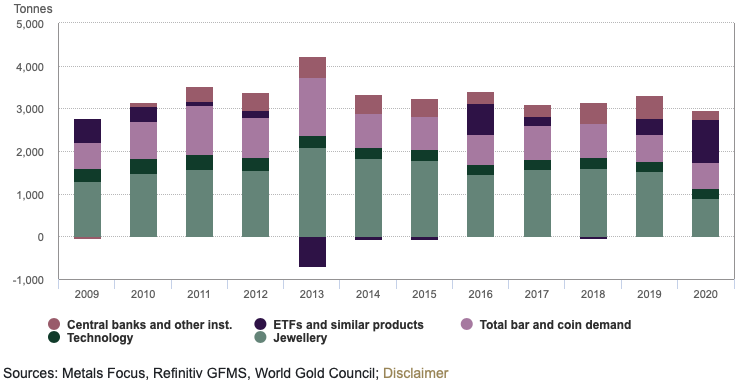

Year-to-date physical gold demand at 2,972 tonnes is at its lowest since 2009 and down 10 per cent on last year’s level because of higher gold prices and net sales by central banks, said the World Gold Council.

Central banks in Turkey, Uzbekistan and Russia – a seller for the first time since 2013 – offloaded a net 12 tonnes of gold in the September quarter, reported Bloomberg.

“Virtually all of the selling is from banks who buy from domestic sources taking advantage of the high gold price at a time when they are fiscally stretched,” World Gold Council analyst, Louise Street, told Bloomberg.

Silver’s price is still at a seven-year high of $US23.27 per ounce ($33.07/oz), but is down from its 2020 peak of $US26.92/oz in early August, according to Bullion Vault.

Barra Resources intersects high-grade gold at Burbanks project

Several ASX gold companies reported positive drilling results Friday, including Barra Resources’ (ASX:BAR) for its Burbanks gold project in WA.

5,000m of follow-up drilling has intersected high-grade gold mineralisation at a depth of 600m between the Main Lode underground mine and the Burbanks North deposit.

The Burbanks project includes the Burbanks mining centre and 5km of the prospective Burbanks shear zone, a historic gold-producing structure in the Coolgardie goldfield in WA.

Burbanks mining centre hosts the Birthday Gift and Main Lode underground gold mines and historic production from the area totals 44,600 tonnes at 22.7 g/t gold for 324,479 ounces.

Argentina gold project could be ‘company maker’ for Challenger Exploration

A major intrusion-hosting gold system has been confirmed at Challenger Exploration’s (ASX:CEL) Hualilan gold project in Argentina’s San Juan province following initial drilling.

Assay results for drill holes at the project showed hits, including 39m at 5.5 g/t gold, 2 g/t silver and 0.3 per cent zinc, for a large-scale intrusion-hosted mineralised system.

Managing director, Kris Knauer, said the results for Hualilan demonstrate high-grade mineralisation that “could potentially be a company maker”.

“We are now confident that there is an extensive intrusion-hosted gold system associated with the high-grade skarn mineralisation, and that this will vastly change the scale of the project,” he said.

Minerals estimate confirmed for Trouser Legs gold deposit in WA

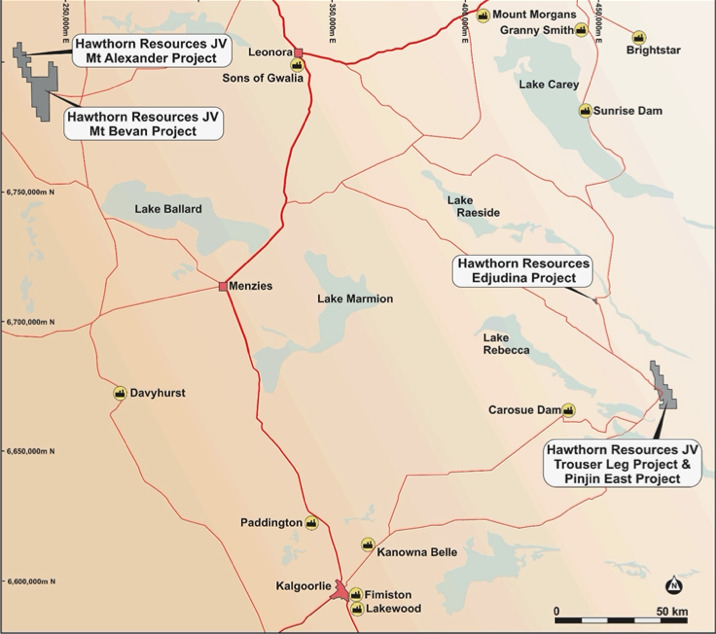

Hawthorn Resources (ASX:HAW) said drilling has confirmed a JORC-compliant underground mineral resource estimate of 157,000 ounces for its Trouser Legs gold project in WA.

Drilling was carried out in more than 700 drill holes over the deposit and its gold mineralisation has been defined to a depth of 250m that is down dip and down plunge.

Intercepts for the Trouser Legs deposit include 6m at 3.1 grams per tonne gold from 49m.

The company has submitted an underground mining proposal for the deposit located 140km northeast of Kalgoorlie to the WA Department of Mines.

ASX share prices for Barra Resources (ASX:BAR), Challenger Resources (ASX:CEL), Hawthorn Resources (ASX:HAW)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.