Gold: Barra eyes 2020 production from historic Burbanks operation

Pic: Tyler Stableford / Stone via Getty Images

Barra Resources (ASX:BAR) could be mining the historic, high-grade Burbanks project in 2020 if everything goes according to plan.

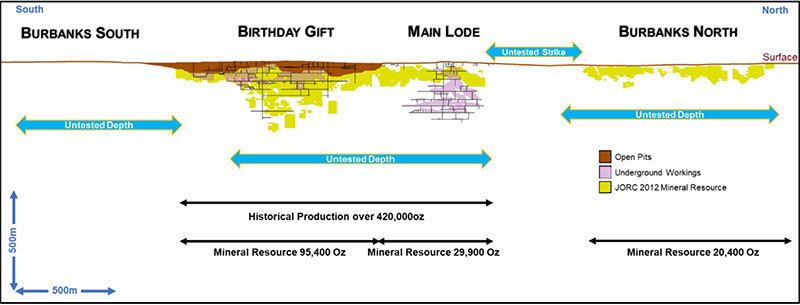

The $12m market cap explorer released a scoping study which envisaged mining the “easy ounces” at the historic Birthday Gift and Main Lode underground gold mines, which have a total resource of 1.2 million tonnes at 3.7 grams per tonne (g/t) gold for 145,700oz.

A stone’s throw from Coolgardie in WA, Barra plans to cart ore to one of the many established nearby mills to save cash and get things moving quickly.

“With fast tracked approvals, in-fill drilling, further studies, partnering and/or funding a timeframe for development and production could be as soon as 2020,” Barra told investors.

Other lodes at Birthday Gift may also be suitable for future mining, but these were excluded from the study which was focused on “quick wins”, Barra says.

Birthday Gift historically produced at 27.4g/t average – making it one of the richest goldmines in WA — and the “down depth potential” still remains open in all directions, the company says.

Barra says cashflow from early mining will fund ongoing exploration and development across Burbanks and Mt Thirsty, its advanced cobalt-nickel asset.

Barra has made some recent gold discoveries between the two gold mines at Burbanks – which are just 800m apart.

These “remain open in all directions and vastly underexplored at depth”, managing director Sean Gregory says.

“Especially considering their immediate proximity between two high-grade and productive gold mines separated by only 800m,” he says.

“We will be applying our recently advanced geological and economic understanding of the deposits to further drilling at Main Lode scheduled to begin next month.”

But Burbanks has suffered false starts in recent years.

In 2011, Barra entered an agreement with FMR Investments to advance Burbanks to production, but this deal loitered in purgatory for a few years before it was mercifully terminated in 2013.

Barra then sold Birthday Gift for $2m cash and a royalty of $25 per ounce of gold mined, before buying it back in 2017 for just $121,000 plus a capped royalty of $20 per ounce.

That’s some solid deal-making right there.

In more gold news today:

Northern Star Resources’ (ASX:NST) friendly all-cash takeover offer for Echo Resources (ASX:EAR) at 33c per share is now unconditional. Northern Star, which holds a 21.99 per cent interest in Echo right now, says the likelihood of a counter bidder emerging with a superior proposal is low. The offer, unless extended, is currently scheduled to close on October 14.

Black Cat Syndicate (ASX:BC8) has significantly boosted total grade and ounces at the flagship 206,000oz Bulong project in WA. The Trump and Boundary resources increased a respective 89 and 87 per cent in size, the explorer says. An ongoing feasibility study will continue to assess the Myhree resource as the “base load producer”, but will now incorporate Boundary and Trump as potential satellite mines.

“Recent drilling has also shown that grades within both Trump and Boundary are better than historic drilling indicates, causing us to review the potential of a number of historic deposits,” managing director Gareth Solly says. “The current gold price environment, combined with the quality of the Bulong resources and our location near infrastructure, provide strong impetus to move to production.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.