Gold Digger: Yellow metal on the March as WGC eyes central bank and election boosts

"This one time, at band camp…" (Pic via Getty Images)

- Gold hit an all-time high this week, ending Friday in reasonably strong form

- The World Gold Council predicts global elections and Fed cuts could keep the precious metal elevated

- ASX gold stocks performing well this week included: KNB, SXG, AWJ

What’s happening in the world near and far pertaining to gold on Friday March 8? Let’s take a quick squizz.

What with the yellow metal achieving an all-time high this week, it’s been a very good time to be a gold bug just lately. Bitcoin bug, too, actually – but that’s another story of value.

At last check, spot gold pricing was soaring around US$2,160, while the precious yellow commodity was changing hands for a handy $3,260 Aussie bucks.

Yes, there’s been a bit of profit taking end of week, but what’s been causing the surges? Mostly, it’s bets on rate cuts from Jerome Powell and mates over at the US Federal Reserve.

Powell has been testifying before the US Senate Banking Committee this week and said that the Fed is “not far” from achieving the confidence that inflation is moving closer to the Fed’s 2% goal, in which case the central bank would begin a series of interest-rate cuts.

And what’s the CME Fedwatch Tool Bat Computer saying? Just waiting for the printout… A 74% chance of a June rate cut and up around 91% for July. Holy perfect storm, Batman – particularly if the USD itself continues to spiral.

As for March, April and May interest rate cuts? Expectations for those seem to be thrown out the window, but the Fed has surprised the market before.

By the way, why are interest rate cuts good for gold? Actually, our Josh explained it very nicely recently:

“Rate cuts are good for investments like gold because bullion does not pay interest. As rates fall the attractiveness of liquidating solid investments like gold to cash dissipates.”

Thanks Josh.

Low interest rates tend to weigh on the US dollar, which historically has an inclination to inversely correlate to the price of gold.

As Eddy reported in his Closing Bell column just now, all eyes are now tonight’s key US employment data.

“Friday’s jobs data could be a wild one,” Andrew Brenner at Natalliance Securities told Bloomberg, adding that bond yields could swing dramatically.

World Gold Council takes

A prominent and respected market data and analytical source for the global gold industry, the World Gold Council works across all sections of the broad gold galaxy – from mining to investment – with, it says, the aim of stimulating and sustaining demand for gold.

The WGC has just released its latest market commentary since the commodity hit all time highs again late this week. Here are some of the more noteworthy takeaways from that – their specific words in quotes, obviously:

• Gold is on the March after a lacklustre February. But why the Feb dip?

“A rise in the US 10-year Treasury yield (+34bps) appeared to be the major culprit in driving gold lower… Continued outperformance from the Magnificent Seven stocks (Mag7), also likely contributed to gold’s lacklustre performance.

• Fed up? The March Fed meeting looms as important, says the WGC:

“It will provide investors, following a slew of strong data, with the first set of dot plots since December’s dovish tilt. Even though markets have priced out a cut, the argument for is as vehement as the argument against. Uncertainty reigns in monetary policy.”

• And Iran, Iran so far away… the WGC is keeping an eye on the volatile Middle Eastern country’s elections: “The country’s consumers are major gold buyers and their elections could pave the way for an important political secession.”

Iran is the sixth largest buyer of gold jewellery, bars and coins, according to the WGC.

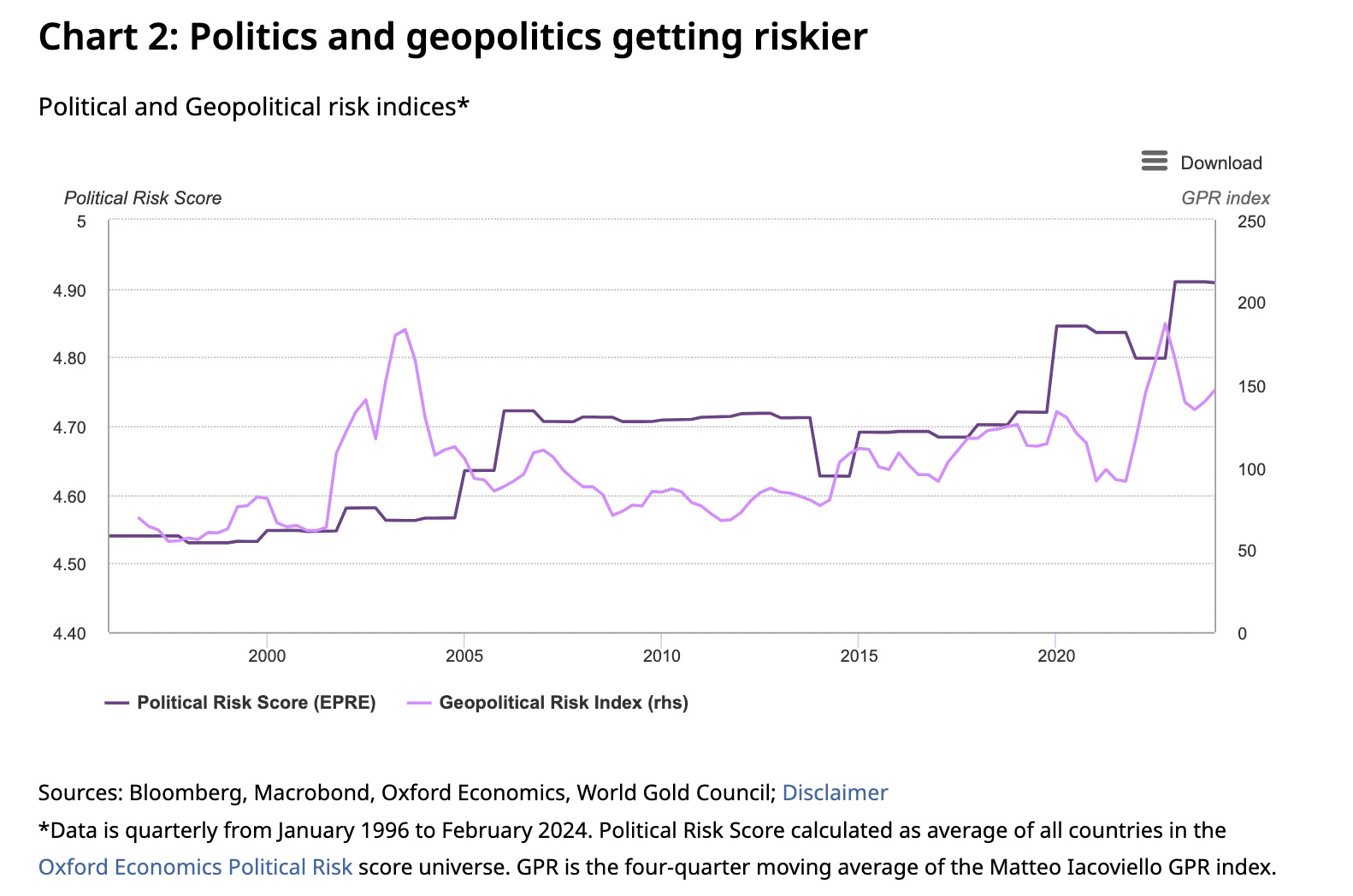

• Election risks. “2024 is peppered with political event risk as important elections line up in a more divisive world,” added the Council.

This includes, of course, the blockbuster US election Fight of the Century between gaffe-prone, hair-challenged, limp-bellied senior citizens.

“Elections will come thick and fast this year. Some outcomes will be domestically contained but others may spill over into the current tense geopolitical climate.”

As we know, geopolitical risks are a major driver for bullion, and there remain plenty of those to keep the safe haven narrative afloat for months/years to come.

• Central banks keep buying in January. The Council noted that the world’s central banks added another 39 tonnes to global gold reserves in the first month of this year.

“Turkey and China again led the charge among buyers, while significant sales were virtually non-existent,” said the WGC, adding:

“The themes underpinning central bank demand remain in play, and have in some cases intensified, likely keeping central bank demand well supported in 2024.”

• In conclusion, the WGC noted:

“Gold’s strong bounce at the start of March has taken gold to new consecutive all-time highs. This suggests a market itching for a trigger, aided by recent strong reported Chinese demand, a quietly bullish sell-side gold forecast and weaker US ISM numbers on 1 March.”

ASX Winners & Losers

Here’s how ASX-listed precious metals stocks are performing, circa 3pm March 8:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Please email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.013 | -13% | 8% | -58% | $14,103,278 |

| NPM | Newpeak Metals | 0.012 | 0% | -25% | -88% | $1,199,421 |

| ASO | Aston Minerals Ltd | 0.015 | 0% | -21% | -88% | $20,721,028 |

| MTC | Metalstech Ltd | 0.19 | 27% | 15% | -57% | $32,122,280 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.041 | 3% | 8% | -57% | $4,620,894 |

| G88 | Golden Mile Res Ltd | 0.011 | 0% | -21% | -21% | $4,523,451 |

| DCX | Discovex Res Ltd | 0.002 | 100% | 33% | -33% | $6,605,136 |

| NMR | Native Mineral Res | 0.023 | -12% | 15% | -66% | $4,824,262 |

| AQX | Alice Queen Ltd | 0.005 | 0% | 0% | -71% | $3,454,921 |

| SLZ | Sultan Resources Ltd | 0.025 | 92% | 69% | -51% | $3,852,941 |

| MKG | Mako Gold | 0.015 | 25% | -38% | -63% | $14,640,123 |

| KSN | Kingston Resources | 0.084 | 8% | 2% | -12% | $40,832,870 |

| AMI | Aurelia Metals Ltd | 0.14 | 4% | 27% | 28% | $236,567,437 |

| PNX | PNX Metals Limited | 0.005 | 0% | 11% | 67% | $32,283,748 |

| GIB | Gibb River Diamonds | 0.028 | -7% | -15% | -49% | $5,922,264 |

| KCN | Kingsgate Consolid. | 1.395 | 16% | 17% | -7% | $358,274,852 |

| TMX | Terrain Minerals | 0.004 | -20% | 0% | -43% | $5,726,683 |

| BNR | Bulletin Res Ltd | 0.07 | -5% | -16% | -33% | $20,846,546 |

| NXM | Nexus Minerals Ltd | 0.039 | 11% | 8% | -77% | $15,173,345 |

| SKY | SKY Metals Ltd | 0.042 | 0% | 31% | -18% | $18,455,924 |

| LM8 | Lunnonmetalslimited | 0.245 | 2% | -9% | -73% | $55,548,240 |

| CST | Castile Resources | 0.07 | -4% | -21% | -25% | $17,416,975 |

| YRL | Yandal Resources | 0.11 | 5% | -6% | 21% | $31,912,209 |

| FAU | First Au Ltd | 0.003 | 0% | 0% | 0% | $4,985,980 |

| ARL | Ardea Resources Ltd | 0.545 | 16% | 40% | 3% | $107,374,219 |

| GWR | GWR Group Ltd | 0.096 | 4% | 8% | 55% | $30,515,582 |

| IVR | Investigator Res Ltd | 0.04 | 21% | 11% | 11% | $63,355,183 |

| GTR | Gti Energy Ltd | 0.0085 | 6% | -15% | -14% | $17,424,550 |

| IPT | Impact Minerals | 0.015 | 25% | 36% | 88% | $42,970,558 |

| BNZ | Benzmining | 0.135 | -7% | -18% | -68% | $16,135,306 |

| MOH | Moho Resources | 0.005 | -17% | -17% | -71% | $3,235,069 |

| BCM | Brazilian Critical | 0.024 | 4% | -4% | -77% | $18,498,920 |

| PUA | Peak Minerals Ltd | 0.0025 | 0% | -17% | -50% | $2,603,442 |

| MRZ | Mont Royal Resources | 0.064 | -19% | -29% | -63% | $5,441,907 |

| SMS | Starmineralslimited | 0.034 | -8% | -26% | -51% | $2,885,066 |

| MVL | Marvel Gold Limited | 0.011 | 0% | 10% | -42% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.005 | 67% | 25% | -55% | $7,004,431 |

| AAU | Antilles Gold Ltd | 0.022 | 0% | 5% | -33% | $18,866,074 |

| CWX | Carawine Resources | 0.11 | 15% | 10% | 23% | $23,612,545 |

| RND | Rand Mining Ltd | 1.25 | 0% | -7% | -10% | $71,094,951 |

| CAZ | Cazaly Resources | 0.02 | 0% | -5% | -31% | $8,638,090 |

| BMR | Ballymore Resources | 0.1 | 4% | -17% | -33% | $17,280,397 |

| DRE | Dreadnought Resources Ltd | 0.02 | 5% | 5% | -72% | $66,149,886 |

| ZNC | Zenith Minerals Ltd | 0.09 | 10% | -22% | -59% | $31,714,279 |

| REZ | Resourc & En Grp Ltd | 0.01 | 11% | 0% | -23% | $4,998,058 |

| LEX | Lefroy Exploration | 0.11 | -8% | -21% | -51% | $22,969,789 |

| ERM | Emmerson Resources | 0.048 | -4% | -6% | -38% | $27,235,489 |

| AM7 | Arcadia Minerals | 0.07 | -13% | 6% | -69% | $7,633,507 |

| ADT | Adriatic Metals | 3.565 | 2% | 2% | -2% | $854,014,966 |

| AS1 | Asara Resources Ltd | 0.009 | 0% | -25% | -69% | $7,134,578 |

| CYL | Catalyst Metals | 0.63 | 29% | 19% | -51% | $133,195,314 |

| CHN | Chalice Mining Ltd | 1.295 | 15% | 36% | -80% | $517,321,194 |

| KAL | Kalgoorliegoldmining | 0.025 | 9% | 14% | -69% | $3,645,517 |

| MLS | Metals Australia | 0.026 | 0% | -13% | -42% | $18,391,608 |

| ADN | Andromeda Metals Ltd | 0.03 | 11% | 30% | -41% | $93,308,128 |

| MEI | Meteoric Resources | 0.215 | 19% | 23% | 87% | $437,826,366 |

| SRN | Surefire Rescs NL | 0.012 | 9% | 0% | -37% | $21,596,386 |

| SIH | Sihayo Gold Limited | 0.001 | 0% | -50% | -50% | $12,204,256 |

| WA8 | Warriedarresourltd | 0.04 | 38% | 0% | -75% | $21,849,814 |

| HMX | Hammer Metals Ltd | 0.036 | 0% | -5% | -43% | $32,797,072 |

| WCN | White Cliff Min Ltd | 0.016 | -6% | -6% | 60% | $21,016,144 |

| AVM | Advance Metals Ltd | 0.035 | 13% | -3% | -83% | $1,402,973 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -5% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.005 | 0% | -17% | -58% | $9,983,974 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | 0% | $11,212,634 |

| AME | Alto Metals Limited | 0.032 | 14% | 19% | -48% | $21,645,695 |

| CTO | Citigold Corp Ltd | 0.005 | 0% | 0% | -9% | $12,000,000 |

| TIE | Tietto Minerals | 0.61 | 2% | 0% | 1% | $694,882,627 |

| SMI | Santana Minerals Ltd | 1.365 | 23% | -5% | 65% | $242,740,008 |

| M2R | Miramar | 0.016 | -6% | -20% | -67% | $2,381,913 |

| MHC | Manhattan Corp Ltd | 0.003 | 0% | 0% | -50% | $8,810,939 |

| GRL | Godolphin Resources | 0.033 | -3% | -13% | -47% | $5,584,987 |

| SVG | Savannah Goldfields | 0.033 | 10% | -11% | -79% | $8,189,455 |

| EMC | Everest Metals Corp | 0.078 | -3% | -5% | -5% | $12,649,799 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -7% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.059 | -6% | -16% | -84% | $18,076,667 |

| G50 | Gold50Limited | 0.086 | 19% | -14% | -62% | $8,415,330 |

| ADV | Ardiden Ltd | 0.145 | 4% | -22% | -52% | $9,065,038 |

| AAR | Astral Resources NL | 0.06 | 2% | -15% | -14% | $45,999,657 |

| VMC | Venus Metals Cor Ltd | 0.095 | -1% | -5% | 9% | $18,024,225 |

| NAE | New Age Exploration | 0.004 | -20% | 0% | -33% | $8,969,495 |

| VKA | Viking Mines Ltd | 0.01 | -17% | -29% | -5% | $10,252,584 |

| LCL | LCL Resources Ltd | 0.012 | 20% | 9% | -63% | $10,507,481 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | 0% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.0045 | 0% | -10% | -44% | $2,871,956 |

| RMX | Red Mount Min Ltd | 0.002 | 0% | -33% | -56% | $5,347,152 |

| PRS | Prospech Limited | 0.034 | 6% | 10% | 41% | $8,914,908 |

| TTM | Titan Minerals | 0.029 | 32% | 53% | -53% | $49,179,542 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -44% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.041 | 3% | 14% | -49% | $20,986,443 |

| KZR | Kalamazoo Resources | 0.095 | -2% | -14% | -44% | $14,858,301 |

| BCN | Beacon Minerals | 0.025 | 9% | 4% | -14% | $90,162,436 |

| MAU | Magnetic Resources | 1.09 | 12% | 17% | 51% | $270,357,322 |

| BC8 | Black Cat Syndicate | 0.255 | 31% | 19% | -34% | $73,435,591 |

| EM2 | Eagle Mountain | 0.074 | 12% | 19% | -61% | $20,432,780 |

| EMR | Emerald Res NL | 3.09 | 12% | 1% | 117% | $1,952,522,495 |

| BYH | Bryah Resources Ltd | 0.008 | 0% | -11% | -65% | $3,483,628 |

| HCH | Hot Chili Ltd | 1.03 | 0% | -1% | 13% | $119,445,206 |

| WAF | West African Res Ltd | 1.0425 | 18% | 23% | 9% | $1,057,371,420 |

| MEU | Marmota Limited | 0.047 | 4% | -13% | 9% | $48,704,826 |

| NVA | Nova Minerals Ltd | 0.29 | 16% | 4% | -44% | $60,103,668 |

| SVL | Silver Mines Limited | 0.15 | 7% | 7% | 0% | $219,538,710 |

| PGD | Peregrine Gold | 0.22 | -4% | -19% | -48% | $14,529,361 |

| ICL | Iceni Gold | 0.025 | 32% | -38% | -73% | $7,643,393 |

| FG1 | Flynngold | 0.042 | -7% | -21% | -44% | $7,058,059 |

| WWI | West Wits Mining Ltd | 0.017 | 31% | 70% | 55% | $41,316,658 |

| RML | Resolution Minerals | 0.0035 | 17% | 17% | -42% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.018 | 20% | -10% | -72% | $3,347,156 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 67% | -29% | $6,641,168 |

| GMN | Gold Mountain Ltd | 0.005 | 25% | 43% | 25% | $9,111,514 |

| MEG | Megado Minerals Ltd | 0.011 | 0% | -35% | -75% | $2,799,011 |

| HMG | Hamelingoldlimited | 0.071 | 0% | -10% | -22% | $11,182,500 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.14 | -7% | 0% | -71% | $13,764,048 |

| TBR | Tribune Res Ltd | 3.22 | 11% | 12% | 0% | $168,947,208 |

| FML | Focus Minerals Ltd | 0.17 | 3% | 6% | 0% | $50,147,763 |

| GSR | Greenstone Resources | 0.007 | 0% | 17% | -68% | $9,576,794 |

| VRC | Volt Resources Ltd | 0.005 | -23% | 0% | -58% | $24,780,640 |

| ARV | Artemis Resources | 0.02 | 43% | 43% | 33% | $30,441,531 |

| HRN | Horizon Gold Ltd | 0.27 | 10% | -2% | -9% | $35,485,781 |

| CLA | Celsius Resource Ltd | 0.013 | 8% | 18% | -19% | $29,198,672 |

| QML | Qmines Limited | 0.061 | -13% | -19% | -62% | $13,221,324 |

| RDN | Raiden Resources Ltd | 0.024 | -4% | 9% | 405% | $66,414,628 |

| TCG | Turaco Gold Limited | 0.15 | 7% | 36% | 134% | $85,272,889 |

| KCC | Kincora Copper | 0.031 | 0% | -11% | -59% | $6,135,504 |

| GBZ | GBM Rsources Ltd | 0.009 | 13% | 0% | -75% | $8,910,781 |

| DTM | Dart Mining NL | 0.015 | 7% | 7% | -67% | $3,413,694 |

| MKR | Manuka Resources. | 0.085 | 16% | 16% | 27% | $47,988,011 |

| AUC | Ausgold Limited | 0.031 | 19% | 15% | -40% | $66,588,095 |

| ANX | Anax Metals Ltd | 0.0195 | -3% | -7% | -70% | $10,848,959 |

| EMU | EMU NL | 0.001 | 0% | 0% | -50% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.045 | 0% | 5% | -34% | $3,276,846 |

| SSR | SSR Mining Inc. | 6.67 | 4% | -54% | -67% | $32,637,116 |

| PNR | Pantoro Limited | 0.051 | 24% | 24% | -7% | $260,201,526 |

| CMM | Capricorn Metals | 5.25 | 11% | 21% | 34% | $1,966,400,042 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.004 | 0% | -20% | -33% | $7,975,438 |

| HAW | Hawthorn Resources | 0.077 | -5% | -16% | -14% | $25,796,202 |

| BGD | Bartongoldholdings | 0.255 | 0% | 0% | 11% | $51,111,314 |

| SVY | Stavely Minerals Ltd | 0.034 | -3% | -3% | -85% | $13,367,903 |

| AGC | AGC Ltd | 0.075 | -12% | 6% | 42% | $17,555,556 |

| RGL | Riversgold | 0.008 | -11% | -11% | -58% | $8,708,953 |

| TSO | Tesoro Gold Ltd | 0.029 | 26% | 12% | -12% | $35,657,841 |

| GUE | Global Uranium | 0.105 | -5% | -22% | -36% | $26,351,332 |

| CPM | Coopermetalslimited | 0.315 | 17% | 5% | 17% | $24,682,030 |

| MM8 | Medallion Metals. | 0.055 | 8% | -8% | -57% | $16,920,841 |

| FFM | Firefly Metals Ltd | 0.55 | 12% | 12% | -13% | $201,295,304 |

| CBY | Canterbury Resources | 0.028 | -13% | 4% | -30% | $4,637,004 |

| LYN | Lycaonresources | 0.155 | -9% | -23% | -33% | $6,828,719 |

| SFR | Sandfire Resources | 7.85 | 3% | 10% | 31% | $3,665,079,080 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | 0% | $4,881,018 |

| TAM | Tanami Gold NL | 0.032 | 14% | 0% | -14% | $37,603,105 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.032 | 3% | 23% | -14% | $11,499,824 |

| ALK | Alkane Resources Ltd | 0.5825 | 21% | 6% | -19% | $353,010,830 |

| BMO | Bastion Minerals | 0.009 | -10% | -22% | -71% | $2,802,997 |

| IDA | Indiana Resources | 0.079 | 0% | -8% | 52% | $50,449,439 |

| GSM | Golden State Mining | 0.011 | 10% | -8% | -72% | $2,793,706 |

| NSM | Northstaw | 0.034 | -11% | -29% | -74% | $4,895,652 |

| GSN | Great Southern | 0.022 | 16% | 16% | 5% | $18,111,245 |

| RED | Red 5 Limited | 0.36 | 9% | 13% | 167% | $1,246,968,198 |

| DEG | De Grey Mining | 1.305 | 3% | 11% | -8% | $2,452,926,821 |

| THR | Thor Energy PLC | 0.026 | 4% | -19% | -57% | $4,604,303 |

| CDR | Codrus Minerals Ltd | 0.044 | -8% | -12% | -54% | $4,065,050 |

| MDI | Middle Island Res | 0.015 | 0% | -12% | -67% | $3,700,118 |

| WTM | Waratah Minerals Ltd | 0.063 | -10% | -37% | -53% | $9,409,963 |

| POL | Polymetals Resources | 0.27 | -7% | 4% | 59% | $41,768,719 |

| RDS | Redstone Resources | 0.0045 | 13% | 13% | -55% | $4,164,203 |

| NAG | Nagambie Resources | 0.025 | -14% | 4% | -57% | $19,915,892 |

| BGL | Bellevue Gold Ltd | 1.555 | 2% | 21% | 32% | $1,848,426,706 |

| GBR | Greatbould Resources | 0.063 | 9% | 7% | -35% | $38,315,981 |

| KAI | Kairos Minerals Ltd | 0.014 | 8% | -7% | -19% | $36,692,771 |

| KAU | Kaiser Reef | 0.14 | 17% | 33% | -19% | $25,656,584 |

| HRZ | Horizon | 0.036 | -14% | 0% | -31% | $24,534,429 |

| CAI | Calidus Resources | 0.15 | -6% | -14% | -40% | $91,896,909 |

| CDT | Castle Minerals | 0.0065 | 0% | -7% | -69% | $7,959,204 |

| RSG | Resolute Mining | 0.385 | 15% | 3% | 38% | $840,974,755 |

| MXR | Maximus Resources | 0.033 | 10% | 0% | -3% | $10,591,210 |

| EVN | Evolution Mining Ltd | 3.315 | 12% | 7% | 15% | $6,533,537,824 |

| CXU | Cauldron Energy Ltd | 0.043 | 13% | -7% | 445% | $44,852,128 |

| DLI | Delta Lithium | 0.325 | -3% | 16% | -18% | $227,782,285 |

| ALY | Alchemy Resource Ltd | 0.008 | 0% | 0% | -50% | $9,424,610 |

| HXG | Hexagon Energy | 0.016 | 33% | 33% | 7% | $6,667,907 |

| OBM | Ora Banda Mining Ltd | 0.2775 | 9% | 16% | 122% | $469,565,795 |

| SLR | Silver Lake Resource | 1.215 | 13% | 8% | 17% | $1,140,388,086 |

| AVW | Avira Resources Ltd | 0.001 | 0% | -50% | -67% | $2,133,790 |

| LCY | Legacy Iron Ore | 0.015 | 0% | 0% | -21% | $123,416,772 |

| PDI | Predictive Disc Ltd | 0.225 | 15% | 13% | 29% | $467,154,920 |

| MAT | Matsa Resources | 0.028 | 4% | -3% | -32% | $13,407,073 |

| ZAG | Zuleika Gold Ltd | 0.017 | 0% | 0% | 13% | $12,513,454 |

| GML | Gateway Mining | 0.03 | 36% | 50% | -32% | $10,363,783 |

| SBM | St Barbara Limited | 0.175 | 17% | 6% | -30% | $147,234,668 |

| SBR | Sabre Resources | 0.018 | 6% | -14% | -45% | $6,175,322 |

| STK | Strickland Metals | 0.089 | 16% | -1% | 128% | $149,429,032 |

| ION | Iondrive Limited | 0.009 | -10% | 0% | -59% | $4,376,568 |

| CEL | Challenger Gold Ltd | 0.084 | 2% | 8% | -35% | $97,109,965 |

| LRL | Labyrinth Resources | 0.006 | 50% | -14% | -52% | $7,125,262 |

| NST | Northern Star | 14.35 | 11% | 8% | 35% | $16,548,784,070 |

| OZM | Ozaurum Resources | 0.066 | -1% | -6% | 32% | $10,636,250 |

| TG1 | Techgen Metals Ltd | 0.035 | -15% | 3% | -45% | $5,085,303 |

| XAM | Xanadu Mines Ltd | 0.043 | 2% | -16% | 43% | $72,072,252 |

| AQI | Alicanto Min Ltd | 0.035 | 35% | 40% | -29% | $18,460,104 |

| KTA | Krakatoa Resources | 0.011 | -15% | -39% | -71% | $5,193,179 |

| ARN | Aldoro Resources | 0.081 | -9% | -13% | -65% | $11,173,771 |

| WGX | Westgold Resources. | 2.44 | 24% | 23% | 154% | $1,165,111,916 |

| MBK | Metal Bank Ltd | 0.022 | 22% | 0% | 1% | $9,371,023 |

| A8G | Australasian Metals | 0.071 | -5% | -28% | -53% | $3,648,435 |

| TAR | Taruga Minerals | 0.007 | 0% | -22% | -59% | $4,942,187 |

| DTR | Dateline Resources | 0.012 | 0% | 20% | -37% | $17,433,421 |

| GOR | Gold Road Res Ltd | 1.62 | 9% | 10% | 10% | $1,790,910,725 |

| S2R | S2 Resources | 0.15 | 7% | 11% | 11% | $72,457,279 |

| NES | Nelson Resources. | 0.004 | 0% | 0% | -33% | $2,454,377 |

| TLM | Talisman Mining | 0.18 | 3% | 0% | 22% | $35,780,866 |

| BEZ | Besragoldinc | 0.15 | 7% | -3% | 275% | $60,624,631 |

| PRU | Perseus Mining Ltd | 2.01 | 15% | 18% | -5% | $2,843,277,389 |

| SPQ | Superior Resources | 0.01 | 11% | -9% | -82% | $20,012,204 |

| PUR | Pursuit Minerals | 0.005 | 0% | 25% | -81% | $14,719,857 |

| RMS | Ramelius Resources | 1.54 | 7% | 1% | 40% | $1,763,103,234 |

| PKO | Peako Limited | 0.004 | 33% | 33% | -67% | $2,108,339 |

| ICG | Inca Minerals Ltd | 0.006 | -14% | -21% | -71% | $3,526,958 |

| A1G | African Gold Ltd. | 0.037 | 6% | -8% | -57% | $6,264,515 |

| OAU | Ora Gold Limited | 0.006 | 0% | 20% | 50% | $34,440,005 |

| GNM | Great Northern | 0.017 | 6% | -11% | -72% | $2,628,694 |

| KRM | Kingsrose Mining Ltd | 0.0345 | 11% | 8% | -49% | $27,090,955 |

| BTR | Brightstar Resources | 0.016 | 33% | 45% | -6% | $37,926,062 |

| RRL | Regis Resources | 2.04 | 12% | 4% | 17% | $1,525,784,392 |

| M24 | Mamba Exploration | 0.027 | -16% | -49% | -78% | $5,154,304 |

| TRM | Truscott Mining Corp | 0.05 | 0% | 0% | -17% | $8,668,353 |

| TNC | True North Copper | 0.089 | -7% | 2% | 68% | $33,220,160 |

| MOM | Moab Minerals Ltd | 0.007 | 0% | 0% | -13% | $4,983,744 |

| KNB | Koonenberrygold | 0.032 | 113% | -22% | -57% | $3,113,476 |

| AWJ | Auric Mining | 0.175 | 46% | 59% | 289% | $22,900,428 |

| AZS | Azure Minerals | 3.605 | 2% | -1% | 1165% | $1,651,246,470 |

| ENR | Encounter Resources | 0.28 | 4% | 4% | 93% | $110,618,965 |

| SNG | Siren Gold | 0.055 | 12% | -5% | -50% | $11,060,853 |

| STN | Saturn Metals | 0.16 | 0% | 7% | 19% | $35,804,396 |

| USL | Unico Silver Limited | 0.1 | 11% | 2% | -23% | $31,085,417 |

| PNM | Pacific Nickel Mines | 0.043 | 16% | 2% | -39% | $17,984,884 |

| AYM | Australia United Min | 0.003 | 0% | 0% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.155 | 3% | 3% | -53% | $44,329,489 |

| SPR | Spartan Resources | 0.6225 | 30% | 38% | 272% | $584,014,453 |

| PNT | Panthermetalsltd | 0.038 | 0% | -16% | -69% | $2,963,650 |

| MEK | Meeka Metals Limited | 0.036 | 20% | -5% | -10% | $43,214,813 |

| GMD | Genesis Minerals | 1.895 | 24% | 18% | 89% | $2,151,307,172 |

| PGO | Pacgold | 0.155 | -3% | -16% | -58% | $13,463,270 |

| FEG | Far East Gold | 0.16 | 23% | 14% | -48% | $27,993,963 |

| MI6 | Minerals260Limited | 0.16 | 0% | -9% | -53% | $38,610,000 |

| IGO | IGO Limited | 7.755 | -2% | 10% | -44% | $5,868,825,551 |

| GAL | Galileo Mining Ltd | 0.255 | 6% | 21% | -65% | $50,394,356 |

| RXL | Rox Resources | 0.155 | 0% | -14% | -31% | $59,096,682 |

| KIN | KIN Min NL | 0.069 | 17% | 15% | 33% | $81,292,388 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -50% | $12,357,085 |

| TGM | Theta Gold Mines Ltd | 0.13 | 8% | 30% | 91% | $92,500,179 |

| FAL | Falconmetalsltd | 0.14 | 12% | 12% | -59% | $24,780,000 |

| SXG | Southern Cross Gold | 1.79 | 49% | 61% | 184% | $153,544,837 |

| SPD | Southernpalladium | 0.335 | -12% | -11% | -32% | $14,646,631 |

| ORN | Orion Minerals Ltd | 0.013 | 0% | -7% | -24% | $76,001,701 |

| TMB | Tambourahmetals | 0.084 | -5% | -2% | -30% | $6,884,049 |

| TMS | Tennant Minerals Ltd | 0.028 | 0% | -7% | -13% | $20,641,858 |

| AZY | Antipa Minerals Ltd | 0.014 | 17% | 8% | -26% | $57,887,311 |

| PXX | Polarx Limited | 0.011 | -21% | -13% | 3% | $18,035,785 |

| TRE | Toubani Res Ltd | 0.1 | -13% | -17% | -38% | $14,725,223 |

| AUN | Aurumin | 0.042 | 17% | 27% | -19% | $14,737,723 |

| GPR | Geopacific Resources | 0.017 | 13% | 10% | -29% | $13,147,478 |

| FXG | Felix Gold Limited | 0.035 | 3% | -15% | -70% | $7,252,529 |

| ILT | Iltani Resources Lim | 0.13 | -13% | -28% | 0% | $4,761,471 |

| ARD | Argent Minerals | 0.01 | 11% | 25% | -29% | $14,209,349 |

Making weekly gains

Koonenberry Gold (ASX:KNB) +113%

Sultan Resources (ASX:SLZ) +92%

Southern Cross Gold (ASX:SXG) +49%

Artemis Resources (ASX:ARV) +43%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.