Gold Digger: Who’s better for gold, Trump or Kamala?

Who's good for gold? Pic: Getty Images

- Gold has hit record highs ahead of the US election

- There are cases for both Trump and Kamala being better or worse for bullion investors

- Ora Gold and Southern Palladium move markets with mid-week news

One event will set the tone for gold in the next week as US punters head to the polls on Tuesday to select Donald Trump or Kamala Harris as their next president.

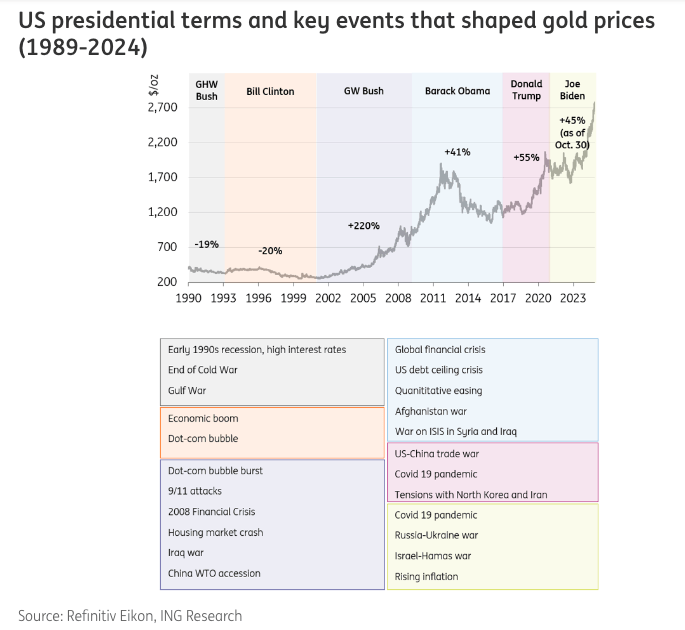

The last Trump presidency saw a 55% gain for bullion, second in percentage terms only to the eight-year reign of George W. Bush (220%), on the back of a trade war between the US and China and the Covid pandemic.

But ING commodity strategist Ewa Manthey suggests a Democratic presidency under Harris could be more positive for the precious metal and safe haven commodity.

“Under Kamala Harris, relatively less inflationary pressure due to lower growth, the absence of an escalation in trade tensions and relatively looser immigration policy means the Fed may feel more comfortable with looser monetary policy, which would eventually provide support to gold prices,” she said in a note.

“However, less uncertainty over trade could decrease demand for the precious metal as a safe-haven asset.”

That’s a key factor in favour of a higher gold price environment under the Don.

“In the longer term, Trump’s proposed policies, including tariffs and stricter immigration controls which are inflationary in nature, will limit interest rate cuts from the Federal Reserve,” Manthey said.

“A stronger USD and tighter monetary policy could eventually provide some headwinds to gold. However, increased trade friction could add to gold’s safe haven appeal.”

Short term momentum

Regardless of the victor in Tuesday’s poll, Manthey says the short to medium term outlook is positive for gold, which this week hit record highs of close to US$2800/oz.

“We believe gold’s positive momentum will continue in the short to medium term. The macro backdrop will likely [be] favourable for the precious metal as interest rates decline and foreign-reserve diversification continues amid geopolitical tensions, creating a perfect storm for gold,” she wrote.

“In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022. A World Gold Council survey conducted in April 2024 found that 29% of central bank respondents intend to increase their gold reserves in the next 12 months.

“These drivers are likely to continue regardless of who wins the presidential election next week. They could, however, be heightened with Trump in the White House – at least in the short to medium term.”

ING sees fourth quarter gold averaging US$2700/oz, taking its price average to US$2400. In 2025, ING predicts prices will average US$2760/oz.

Saxo’s head of commodity strategy Ole S. Hanson thinks the strong run in gold prices reflects fears of an extreme ‘Red Sweep’, which would see Republicans claim both the White House and Congress. Should that not eventuate, the fear rally could yet unwind.

“Having rallied as much as it has, gold can still run into a deep correction – potentially after November 5, should the election result not deliver the keys to the White House and Congress to one party,” he said.

“With that in mind, we see the risk of a USD 100+ correction next week; however, a correction will find support at USD 2,685, while a break below USD 2,600 is likely needed to trigger an even bigger move.”

Gold is 34% higher this year, with silver rising over 42%.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.009 | 13% | 13% | -25% | -36% | -47% | $ 9,221,373.78 |

| NPM | Newpeak Metals | 0.012 | 0% | -20% | -33% | -87% | -16% | $ 3,664,860.78 |

| ASO | Aston Minerals Ltd | 0.0105 | 5% | -25% | -13% | -65% | -56% | $ 12,950,642.69 |

| MTC | Metalstech Ltd | 0.18 | 29% | 6% | -12% | 6% | -18% | $ 35,461,508.94 |

| GED | Golden Deeps | 0.03 | 3% | -21% | -27% | -41% | -35% | $ 4,545,670.47 |

| G88 | Golden Mile Res Ltd | 0.017 | 13% | 70% | 42% | -6% | -11% | $ 7,402,011.39 |

| LAT | Latitude 66 Limited | 0.11 | 5% | -19% | -45% | -45% | -45% | $ 15,687,768.03 |

| NMR | Native Mineral Res | 0.032 | -11% | 60% | 33% | 0% | 60% | $ 12,747,939.97 |

| AQX | Alice Queen Ltd | 0.008 | 0% | -11% | 60% | -33% | 60% | $ 8,028,230.48 |

| SLZ | Sultan Resources Ltd | 0.01 | -17% | 67% | -9% | -40% | -56% | $ 1,975,864.89 |

| MKG | Mako Gold | 0.018 | 0% | 100% | 29% | 29% | 80% | $ 17,759,143.35 |

| KSN | Kingston Resources | 0.105 | 7% | 22% | 44% | 29% | 37% | $ 74,255,091.54 |

| AMI | Aurelia Metals Ltd | 0.18 | -5% | 3% | -10% | 89% | 64% | $ 312,939,447.67 |

| GIB | Gibb River Diamonds | 0.043 | 0% | 13% | 39% | 13% | 43% | $ 9,223,906.14 |

| KCN | Kingsgate Consolid. | 1.6 | 3% | 15% | -2% | 39% | 16% | $ 412,402,707.20 |

| TMX | Terrain Minerals | 0.003 | 0% | -33% | -25% | -40% | -40% | $ 5,400,086.41 |

| BNR | Bulletin Res Ltd | 0.044 | 2% | -8% | -6% | -73% | -69% | $ 13,212,599.54 |

| NXM | Nexus Minerals Ltd | 0.054 | -10% | 17% | -16% | 35% | 15% | $ 26,747,883.80 |

| SKY | SKY Metals Ltd | 0.054 | -2% | 17% | 64% | 35% | 50% | $ 31,897,970.96 |

| LM8 | Lunnonmetalslimited | 0.36 | 14% | 118% | 18% | -52% | -40% | $ 79,368,748.92 |

| CST | Castile Resources | 0.09 | 5% | 15% | -3% | 50% | 10% | $ 21,771,218.43 |

| YRL | Yandal Resources | 0.305 | 27% | 239% | 144% | 455% | 267% | $ 77,664,208.06 |

| FAU | First Au Ltd | 0.002 | 33% | 0% | -33% | 0% | -33% | $ 3,623,986.55 |

| ARL | Ardea Resources Ltd | 0.395 | -7% | -2% | -41% | -25% | -17% | $ 79,873,166.00 |

| GWR | GWR Group Ltd | 0.087 | -2% | 6% | -21% | 7% | -8% | $ 27,945,848.99 |

| IVR | Investigator Res Ltd | 0.046 | -12% | 24% | -8% | 5% | 21% | $ 76,266,219.55 |

| GTR | Gti Energy Ltd | 0.004 | -11% | 0% | -27% | -43% | -50% | $ 11,841,798.65 |

| IPT | Impact Minerals | 0.0125 | -4% | -4% | -34% | 32% | 14% | $ 36,713,204.62 |

| BNZ | Benzmining | 0.26 | 0% | 41% | 63% | -34% | 4% | $ 27,787,350.76 |

| MOH | Moho Resources | 0.006 | 0% | 0% | 20% | 0% | -40% | $ 3,235,069.18 |

| BCM | Brazilian Critical | 0.01 | 25% | -17% | -57% | -60% | -62% | $ 6,953,530.67 |

| PUA | Peak Minerals Ltd | 0.005 | -17% | 150% | 141% | 101% | 101% | $ 12,485,551.32 |

| MRZ | Mont Royal Resources | 0.05 | -6% | -6% | -14% | -71% | -67% | $ 4,251,489.65 |

| SMS | Starmineralslimited | 0.055 | -2% | -2% | 49% | 57% | 38% | $ 5,209,753.51 |

| MVL | Marvel Gold Limited | 0.011 | -8% | 0% | 22% | 0% | -8% | $ 9,501,697.73 |

| PRX | Prodigy Gold NL | 0.002 | 0% | 0% | -25% | -68% | -62% | $ 6,192,443.43 |

| AAU | Antilles Gold Ltd | 0.004 | 0% | 33% | -69% | -81% | -83% | $ 7,422,970.90 |

| CWX | Carawine Resources | 0.095 | -2% | 1% | -10% | -20% | -14% | $ 22,195,792.21 |

| RND | Rand Mining Ltd | 2.04 | -3% | 15% | 28% | 57% | 49% | $ 114,889,441.22 |

| CAZ | Cazaly Resources | 0.014 | -7% | -7% | -18% | -61% | -52% | $ 6,919,544.87 |

| BMR | Ballymore Resources | 0.155 | 24% | 11% | 24% | 19% | 24% | $ 27,393,240.68 |

| DRE | Dreadnought Resources Ltd | 0.0155 | -9% | -3% | -9% | -52% | -48% | $ 56,291,250.00 |

| ZNC | Zenith Minerals Ltd | 0.055 | 22% | 12% | -35% | -38% | -63% | $ 21,053,559.62 |

| REZ | Resourc & En Grp Ltd | 0.027 | 2% | 4% | 108% | 80% | 93% | $ 16,728,478.05 |

| LEX | Lefroy Exploration | 0.075 | -9% | -1% | -42% | -57% | -57% | $ 16,036,678.56 |

| ERM | Emmerson Resources | 0.046 | 2% | 7% | 2% | -25% | -22% | $ 25,601,360.04 |

| AM7 | Arcadia Minerals | 0.034 | -13% | 0% | -53% | -60% | -53% | $ 3,979,703.40 |

| ADT | Adriatic Metals | 4.3 | 4% | 23% | -6% | 26% | 7% | $ 1,198,767,437.01 |

| AS1 | Asara Resources Ltd | 0.022 | -4% | 47% | 120% | 0% | 120% | $ 20,929,866.45 |

| CYL | Catalyst Metals | 3.54 | 2% | 29% | 281% | 406% | 340% | $ 784,159,427.68 |

| CHN | Chalice Mining Ltd | 1.8025 | -7% | 17% | 49% | 1% | 6% | $ 706,083,620.22 |

| KAL | Kalgoorliegoldmining | 0.021 | -7% | -9% | -42% | -28% | -22% | $ 5,946,784.84 |

| MLS | Metals Australia | 0.024 | 9% | 0% | 9% | -37% | -35% | $ 15,998,829.53 |

| ADN | Andromeda Metals Ltd | 0.0065 | -7% | -7% | -66% | -69% | -74% | $ 24,001,035.36 |

| MEI | Meteoric Resources | 0.1 | 3% | -9% | -53% | -59% | -62% | $ 241,364,677.37 |

| SRN | Surefire Rescs NL | 0.0055 | -8% | -21% | -45% | -66% | -35% | $ 9,931,539.07 |

| WA8 | Warriedarresourltd | 0.054 | -7% | -10% | 29% | -17% | 2% | $ 41,979,593.87 |

| HMX | Hammer Metals Ltd | 0.039 | -13% | 11% | -15% | -15% | -25% | $ 38,173,624.10 |

| WCN | White Cliff Min Ltd | 0.019 | -14% | -5% | 27% | 90% | 111% | $ 35,918,944.21 |

| AVM | Advance Metals Ltd | 0.046 | 64% | 92% | 92% | -17% | 25% | $ 7,919,461.18 |

| ASR | Asra Minerals Ltd | 0.0035 | -30% | -30% | -50% | -46% | -50% | $ 8,926,231.99 |

| ARI | Arika Resources | 0.027 | -18% | -4% | 35% | 35% | 8% | $ 17,320,366.06 |

| AME | Alto Metals Limited | 0.079 | 13% | 23% | 114% | 76% | 84% | $ 59,164,900.10 |

| CTO | Citigold Corp Ltd | 0.004 | 0% | -20% | -20% | -20% | -20% | $ 12,000,000.00 |

| SMIDB | Santana Minerals Ltd | 0.66 | -6% | -11% | 69% | 247% | 96% | $ 408,505,410.30 |

| M2R | Miramar | 0.006 | -25% | -14% | -36% | -72% | -70% | $ 2,380,939.71 |

| MHC | Manhattan Corp Ltd | 0.002 | 0% | 33% | 20% | -52% | -40% | $ 8,995,939.72 |

| GRL | Godolphin Resources | 0.019 | 12% | 27% | -34% | -47% | -51% | $ 5,691,801.98 |

| SVG | Savannah Goldfields | 0.022 | 5% | 5% | -21% | -56% | -56% | $ 6,183,868.15 |

| EMC | Everest Metals Corp | 0.1325 | 2% | 6% | 34% | 35% | 66% | $ 24,216,804.17 |

| GUL | Gullewa Limited | 0.07 | -13% | 8% | 27% | 25% | 27% | $ 14,631,552.04 |

| CY5 | Cygnus Metals Ltd | 0.135 | -4% | 59% | 69% | -29% | 0% | $ 68,824,202.88 |

| G50 | G50Corp Ltd | 0.145 | -15% | -17% | -24% | 16% | 7% | $ 18,996,800.00 |

| ADV | Ardiden Ltd | 0.145 | 12% | 7% | -9% | -33% | -17% | $ 9,377,625.90 |

| AAR | Astral Resources NL | 0.15 | 11% | 25% | 138% | 88% | 105% | $ 173,609,740.20 |

| VMC | Venus Metals Cor Ltd | 0.073 | 7% | 20% | -19% | -30% | -27% | $ 13,729,007.81 |

| NAE | New Age Exploration | 0.006 | 0% | 0% | 71% | 20% | 0% | $ 10,763,393.46 |

| VKA | Viking Mines Ltd | 0.0105 | 17% | 31% | -5% | 17% | -25% | $ 10,625,917.64 |

| LCL | LCL Resources Ltd | 0.01 | 0% | 0% | -23% | -62% | -41% | $ 9,648,780.26 |

| MTH | Mithril Silver Gold | 0.49 | -13% | -22% | 145% | 227% | 145% | $ 61,879,399.05 |

| ADG | Adelong Gold Limited | 0.005 | 0% | 25% | 25% | -29% | 0% | $ 5,589,944.79 |

| RMX | Red Mount Min Ltd | 0.011 | 22% | 10% | -27% | -69% | -58% | $ 5,035,651.35 |

| PRS | Prospech Limited | 0.028 | 0% | -20% | -39% | 40% | -10% | $ 8,473,577.14 |

| XTC | XTC Lithium Limited | 0.2 | 19900% | 19900% | 19900% | 0% | 19900% | $ 17,528,272.20 |

| TTM | Titan Minerals | 0.535 | -2% | 22% | 78% | 55% | 91% | $ 115,543,795.19 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | 0% | 0% | 0% | $ 28,555,653.83 |

| AAM | Aumegametals | 0.056 | 10% | 22% | -18% | 24% | 19% | $ 28,939,335.76 |

| KZR | Kalamazoo Resources | 0.092 | 1% | 18% | 2% | 2% | -23% | $ 18,273,495.86 |

| BCN | Beacon Minerals | 0.023 | -4% | 5% | -23% | -15% | -8% | $ 90,162,436.10 |

| MAU | Magnetic Resources | 1.245 | 2% | -6% | 21% | 16% | 22% | $ 330,760,402.40 |

| BC8 | Black Cat Syndicate | 0.5525 | -13% | 20% | 101% | 157% | 121% | $ 259,488,261.05 |

| EM2 | Eagle Mountain | 0.049 | 9% | -2% | -36% | -23% | -34% | $ 17,286,496.57 |

| EMR | Emerald Res NL | 4.18 | -2% | 8% | 18% | 61% | 39% | $ 2,772,339,663.94 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 0% | -50% | -69% | -69% | $ 1,509,860.57 |

| HCH | Hot Chili Ltd | 0.845 | 0% | -2% | -32% | -21% | -22% | $ 127,950,280.25 |

| WAF | West African Res Ltd | 1.8125 | 4% | 4% | 35% | 145% | 92% | $ 2,091,398,758.74 |

| MEU | Marmota Limited | 0.038 | -10% | 4% | -16% | -7% | -12% | $ 41,289,977.38 |

| NVA | Nova Minerals Ltd | 0.25 | -4% | 85% | -11% | -4% | -31% | $ 67,984,220.25 |

| SVL | Silver Mines Limited | 0.1125 | -13% | 24% | -32% | -36% | -30% | $ 165,883,988.27 |

| PGD | Peregrine Gold | 0.15 | -17% | -25% | -35% | -44% | -38% | $ 10,181,763.15 |

| ICL | Iceni Gold | 0.046 | -4% | 18% | 77% | -25% | -12% | $ 12,274,247.34 |

| FG1 | Flynngold | 0.033 | 10% | 18% | 0% | -36% | -27% | $ 8,623,443.51 |

| WWI | West Wits Mining Ltd | 0.015 | -6% | 0% | -6% | 7% | 25% | $ 38,140,902.21 |

| RML | Resolution Minerals | 0.002 | 0% | 0% | 0% | -60% | -33% | $ 3,220,043.61 |

| AAJ | Aruma Resources Ltd | 0.017 | 0% | 6% | 6% | -50% | -37% | $ 3,997,047.10 |

| AL8 | Alderan Resource Ltd | 0.0035 | 17% | -13% | -21% | -67% | -21% | $ 6,682,522.34 |

| GMN | Gold Mountain Ltd | 0.002 | 0% | -33% | -43% | -64% | -64% | $ 7,814,946.37 |

| MEG | Megado Minerals Ltd | 0.017 | 6% | 0% | 55% | -54% | -51% | $ 4,325,744.49 |

| HMG | Hamelingoldlimited | 0.084 | 1% | 24% | 12% | 1% | 6% | $ 13,230,000.00 |

| BM8 | Battery Age Minerals | 0.1 | -5% | -5% | 0% | -52% | -47% | $ 10,177,414.00 |

| TBR | Tribune Res Ltd | 4.83 | -1% | 0% | 7% | 52% | 64% | $ 261,291,023.46 |

| FML | Focus Minerals Ltd | 0.185 | 1% | 37% | -3% | 3% | 0% | $ 55,878,935.78 |

| VRC | Volt Resources Ltd | 0.004 | 0% | 0% | -20% | -43% | -38% | $ 16,634,712.51 |

| ARV | Artemis Resources | 0.0135 | 4% | 4% | -21% | -39% | -29% | $ 25,877,912.75 |

| HRN | Horizon Gold Ltd | 0.395 | 1% | 7% | 46% | 30% | 32% | $ 55,763,370.36 |

| CLA | Celsius Resource Ltd | 0.01 | -17% | -17% | 0% | -17% | -17% | $ 25,710,245.01 |

| QML | Qmines Limited | 0.071 | -3% | -29% | 15% | -15% | -13% | $ 24,403,065.15 |

| RDN | Raiden Resources Ltd | 0.032 | 3% | -27% | -14% | -6% | -20% | $ 97,022,934.08 |

| TCG | Turaco Gold Limited | 0.3375 | -1% | 2% | 99% | 537% | 160% | $ 279,841,947.34 |

| KCC | Kincora Copper | 0.039 | 0% | -11% | 0% | 22% | -5% | $ 8,086,688.48 |

| GBZ | GBM Rsources Ltd | 0.009 | 0% | 0% | -25% | -50% | 0% | $ 10,410,200.00 |

| DTM | Dart Mining NL | 0.013 | 0% | -19% | -47% | -25% | -17% | $ 5,599,389.19 |

| MKR | Manuka Resources. | 0.05 | -9% | 47% | -32% | 11% | -35% | $ 42,887,221.80 |

| AUC | Ausgold Limited | 0.57 | -3% | 20% | 104% | 97% | 78% | $ 197,736,214.74 |

| ANX | Anax Metals Ltd | 0.012 | -4% | -45% | -57% | -66% | -60% | $ 10,457,219.30 |

| EMU | EMU NL | 0.027 | 4% | 17% | 63% | -35% | -2% | $ 4,101,977.24 |

| SFM | Santa Fe Minerals | 0.03 | 0% | -19% | -36% | -30% | -30% | $ 2,184,563.67 |

| SSR | SSR Mining Inc. | 9.31 | -3% | 9% | 11% | -58% | -41% | $ 35,942,267.54 |

| PNR | Pantoro Limited | 0.125 | 0% | 9% | 44% | 291% | 119% | $ 806,753,814.25 |

| CMM | Capricorn Metals | 6.455 | 2% | 12% | 29% | 36% | 37% | $ 2,382,201,875.61 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | 0% | 0% | $ 129,844,903.32 |

| SI6 | SI6 Metals Limited | 0.001 | 0% | 0% | -67% | -82% | -80% | $ 2,767,292.01 |

| HAW | Hawthorn Resources | 0.059 | 2% | -3% | -21% | -38% | -37% | $ 19,765,921.17 |

| BGD | Bartongoldholdings | 0.28 | 0% | 12% | -3% | 17% | 6% | $ 65,597,676.60 |

| SVY | Stavely Minerals Ltd | 0.029 | -6% | -6% | 4% | -57% | -36% | $ 14,446,212.72 |

| AGC | AGC Ltd | 0.22 | 19% | -10% | 159% | 244% | 210% | $ 56,451,388.84 |

| RGL | Riversgold | 0.003 | -25% | -40% | -50% | -68% | -75% | $ 5,696,119.08 |

| TSO | Tesoro Gold Ltd | 0.029 | -6% | -22% | -26% | 53% | 0% | $ 49,709,249.31 |

| GUE | Global Uranium | 0.088 | 21% | 22% | -8% | -27% | -10% | $ 22,583,414.98 |

| CPM | Coopermetalslimited | 0.048 | -11% | -11% | -64% | -47% | -86% | $ 3,917,782.50 |

| MM8 | Medallion Metals. | 0.081 | -26% | 53% | 45% | 45% | 25% | $ 37,127,549.73 |

| FFM | Firefly Metals Ltd | 1.3 | 23% | 22% | 55% | 180% | 106% | $ 713,357,162.85 |

| CBY | Canterbury Resources | 0.03 | -6% | -12% | -44% | 30% | 20% | $ 5,725,785.98 |

| LYN | Lycaonresources | 0.215 | -10% | -27% | -35% | -2% | 8% | $ 12,981,281.64 |

| SFR | Sandfire Resources | 10.385 | -1% | -4% | 9% | 74% | 41% | $ 4,753,612,158.37 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | 0% | 0% | 0% | $ 4,881,018.47 |

| TAM | Tanami Gold NL | 0.032 | -14% | -3% | -18% | -9% | -9% | $ 38,778,202.52 |

| NWM | Norwest Minerals | 0.017 | -15% | -23% | -60% | -44% | -37% | $ 8,247,031.67 |

| ALK | Alkane Resources Ltd | 0.545 | -7% | 21% | -13% | -8% | -17% | $ 344,884,744.35 |

| BMO | Bastion Minerals | 0.008 | 14% | 33% | 33% | -56% | -56% | $ 4,114,940.17 |

| IDA | Indiana Resources | 0.1075 | 11% | 11% | 32% | 120% | 35% | $ 69,945,840.36 |

| GSM | Golden State Mining | 0.011 | 10% | -8% | -8% | -39% | -27% | $ 3,073,076.93 |

| NSM | Northstaw | 0.012 | -14% | -33% | -63% | -61% | -71% | $ 3,817,471.00 |

| GSN | Great Southern | 0.014 | -7% | -22% | -30% | -44% | -26% | $ 12,698,755.47 |

| VAU | Vault Minerals Ltd | 0.3825 | -3% | 18% | -15% | 20% | 23% | $ 2,686,976,985.89 |

| DEG | De Grey Mining | 1.4825 | 3% | 7% | 14% | 26% | 20% | $ 3,655,055,195.13 |

| THR | Thor Energy PLC | 0.016 | 7% | 0% | -16% | -41% | -47% | $ 3,625,099.04 |

| CDR | Codrus Minerals Ltd | 0.02 | -5% | 0% | -49% | -66% | -64% | $ 3,307,750.08 |

| MDI | Middle Island Res | 0.018 | 6% | 13% | 20% | 12% | 13% | $ 4,915,669.05 |

| WTM | Waratah Minerals Ltd | 0.3 | -12% | 2% | 131% | 538% | 150% | $ 61,550,270.33 |

| POL | Polymetals Resources | 0.74 | 32% | 147% | 160% | 147% | 139% | $ 155,808,532.00 |

| RDS | Redstone Resources | 0.003 | 0% | -25% | -25% | -57% | -50% | $ 2,776,135.38 |

| NAG | Nagambie Resources | 0.018 | 6% | 20% | 50% | -10% | -38% | $ 15,932,713.54 |

| BGL | Bellevue Gold Ltd | 1.59 | -3% | 20% | -11% | 10% | -5% | $ 2,079,998,353.88 |

| GBR | Greatbould Resources | 0.049 | -4% | -14% | -18% | -23% | -25% | $ 30,470,580.85 |

| KAI | Kairos Minerals Ltd | 0.0165 | -3% | 27% | 38% | 3% | 18% | $ 42,094,595.02 |

| KAU | Kaiser Reef | 0.195 | -7% | 26% | 39% | 15% | 15% | $ 48,966,559.20 |

| HRZ | Horizon | 0.048 | -24% | 2% | 50% | 37% | 14% | $ 55,927,955.10 |

| CAI | Calidus Resources | 0.115 | 0% | 0% | -18% | -41% | -47% | $ 93,678,205.58 |

| CDT | Castle Minerals | 0.003 | 0% | 0% | -50% | -70% | -68% | $ 4,118,442.32 |

| RSG | Resolute Mining | 0.79 | -8% | 7% | 85% | 119% | 78% | $ 1,745,821,010.66 |

| MXR | Maximus Resources | 0.045 | -6% | 0% | 35% | 15% | 32% | $ 19,684,673.79 |

| EVN | Evolution Mining Ltd | 5.12 | -2% | 10% | 26% | 43% | 29% | $ 10,423,499,558.52 |

| CXU | Cauldron Energy Ltd | 0.0135 | -10% | -31% | -67% | 54% | -42% | $ 18,987,787.94 |

| DLI | Delta Lithium | 0.265 | 15% | 13% | -13% | -54% | -44% | $ 178,351,785.50 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | -13% | 0% | -30% | -30% | $ 8,246,533.79 |

| HXG | Hexagon Energy | 0.025 | 14% | 9% | 32% | 257% | 108% | $ 12,309,981.62 |

| OBM | Ora Banda Mining Ltd | 0.935 | 2% | 50% | 179% | 484% | 290% | $ 1,744,284,903.19 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | -50% | -50% | $ 2,938,790.00 |

| LCY | Legacy Iron Ore | 0.013 | 0% | 0% | -24% | -24% | -24% | $ 100,276,127.41 |

| PDI | Predictive Disc Ltd | 0.275 | 6% | 6% | 31% | 17% | 31% | $ 658,252,555.24 |

| MAT | Matsa Resources | 0.044 | 13% | 33% | 38% | 29% | 69% | $ 30,554,112.64 |

| ZAG | Zuleika Gold Ltd | 0.016 | 0% | 23% | -20% | 0% | -11% | $ 11,854,078.83 |

| GML | Gateway Mining | 0.027 | 0% | 15% | 59% | 13% | 8% | $ 11,468,323.33 |

| SBM | St Barbara Limited | 0.46 | 0% | 28% | 74% | 163% | 119% | $ 376,437,075.74 |

| SBR | Sabre Resources | 0.012 | -14% | -20% | -29% | -71% | -64% | $ 5,108,505.13 |

| STK | Strickland Metals | 0.074 | 6% | -22% | -36% | -30% | -22% | $ 167,763,520.39 |

| ION | Iondrive Limited | 0.014 | 8% | 0% | 75% | 8% | 17% | $ 10,627,612.52 |

| CEL | Challenger Gold Ltd | 0.059 | 5% | 9% | -23% | -30% | -20% | $ 94,252,407.94 |

| LRL | Labyrinth Resources | 0.026 | -4% | 53% | 639% | 516% | 428% | $ 124,363,210.44 |

| NST | Northern Star | 17.475 | 0% | 9% | 17% | 49% | 28% | $ 20,383,912,585.53 |

| OZM | Ozaurum Resources | 0.038 | 6% | 0% | -30% | -59% | -75% | $ 5,715,000.00 |

| TG1 | Techgen Metals Ltd | 0.03 | -3% | -14% | -3% | 7% | -62% | $ 4,759,971.30 |

| XAM | Xanadu Mines Ltd | 0.064 | -6% | 3% | -10% | 0% | 8% | $ 109,824,384.58 |

| AQI | Alicanto Min Ltd | 0.035 | -5% | 30% | 91% | -25% | 6% | $ 27,681,289.59 |

| KTA | Krakatoa Resources | 0.01 | 5% | -17% | -9% | -58% | -72% | $ 4,721,072.20 |

| ARN | Aldoro Resources | 0.088 | 10% | 6% | 26% | -2% | -30% | $ 12,250,760.61 |

| WGX | Westgold Resources. | 3.07 | -6% | 15% | 36% | 47% | 41% | $ 3,036,813,201.80 |

| MBK | Metal Bank Ltd | 0.017 | -11% | -11% | -15% | -45% | -37% | $ 6,637,807.95 |

| A8G | Australasian Metals | 0.095 | -14% | -14% | 48% | -53% | -44% | $ 4,951,446.93 |

| TAR | Taruga Minerals | 0.011 | 0% | 10% | 38% | 10% | 0% | $ 8,472,321.42 |

| DTR | Dateline Resources | 0.004 | 0% | -20% | -67% | -64% | -60% | $ 10,065,041.88 |

| GOR | Gold Road Res Ltd | 1.9825 | 1% | 16% | 21% | 5% | 1% | $ 2,168,042,180.00 |

| S2R | S2 Resources | 0.076 | 1% | -5% | -44% | -61% | -54% | $ 33,511,491.48 |

| NES | Nelson Resources. | 0.002 | -20% | -33% | -33% | -56% | -50% | $ 1,410,521.99 |

| TLM | Talisman Mining | 0.23 | -2% | -6% | -13% | 48% | -2% | $ 45,196,883.76 |

| BEZ | Besragoldinc | 0.08 | 1% | -4% | -11% | -38% | -47% | $ 33,239,116.08 |

| PRU | Perseus Mining Ltd | 2.82 | -4% | 8% | 22% | 65% | 52% | $ 3,949,555,912.82 |

| SPQ | Superior Resources | 0.007 | 8% | -13% | -29% | -73% | -46% | $ 15,189,046.59 |

| PUR | Pursuit Minerals | 0.003 | 0% | 0% | -40% | -73% | -63% | $ 10,906,199.96 |

| RMS | Ramelius Resources | 2.335 | -3% | 6% | 12% | 41% | 39% | $ 2,760,361,902.21 |

| PKO | Peako Limited | 0.004 | 33% | 0% | 30% | 4% | 4% | $ 3,513,899.46 |

| ICG | Inca Minerals Ltd | 0.005 | 0% | 0% | -29% | -71% | -52% | $ 4,078,112.67 |

| A1G | African Gold Ltd. | 0.083 | -7% | 93% | 143% | 138% | 261% | $ 29,434,680.64 |

| OAU | Ora Gold Limited | 0.011 | 38% | 38% | 83% | 38% | 57% | $ 78,718,732.25 |

| GNM | Great Northern | 0.013 | -13% | -19% | 18% | -35% | -35% | $ 2,010,178.00 |

| KRM | Kingsrose Mining Ltd | 0.04 | 3% | 8% | 8% | -17% | -2% | $ 30,141,060.76 |

| BTR | Brightstar Resources | 0.023 | 2% | 35% | 35% | 119% | 44% | $ 171,185,401.32 |

| RRL | Regis Resources | 2.695 | -4% | 32% | 21% | 56% | 24% | $ 2,047,344,659.14 |

| M24 | Mamba Exploration | 0.012 | -14% | 0% | -48% | -61% | -76% | $ 2,256,987.31 |

| TRM | Truscott Mining Corp | 0.078 | 0% | 8% | 12% | 31% | 43% | $ 14,273,887.68 |

| TNC | True North Copper | 0.03 | 0% | -9% | -63% | -78% | -69% | $ 26,264,705.94 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 0% | -20% | -43% | -43% | $ 3,235,256.99 |

| KNB | Koonenberrygold | 0.0155 | -9% | 41% | 3% | -46% | -60% | $ 4,604,599.58 |

| AWJ | Auric Mining | 0.365 | -4% | 3% | 103% | 489% | 204% | $ 55,001,747.27 |

| ENR | Encounter Resources | 0.35 | 1% | -22% | -7% | 1% | 21% | $ 158,139,818.90 |

| SNG | Siren Gold | 0.076 | -37% | 6% | 23% | 17% | 12% | $ 14,916,520.37 |

| STN | Saturn Metals | 0.28 | 0% | 0% | 12% | 100% | 65% | $ 86,487,767.52 |

| USL | Unico Silver Limited | 0.31 | -7% | 44% | 107% | 195% | 148% | $ 116,526,438.93 |

| PNM | Pacific Nickel Mines | 0.024 | 0% | 0% | -25% | -75% | -71% | $ 10,103,834.52 |

| AYM | Australia United Min | 0.003 | 50% | 50% | 0% | 0% | 0% | $ 5,527,732.46 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | 0% | 0% | $ 24,692,167.95 |

| HAV | Havilah Resources | 0.2 | -9% | -2% | -13% | -7% | 3% | $ 69,547,540.68 |

| SPR | Spartan Resources | 1.5325 | -3% | 6% | 158% | 276% | 197% | $ 1,769,239,703.07 |

| PNT | Panthermetalsltd | 0.029 | -17% | 38% | 6% | -44% | -31% | $ 6,354,413.23 |

| MEK | Meeka Metals Limited | 0.087 | 5% | 43% | 156% | 118% | 118% | $ 168,319,676.04 |

| GMD | Genesis Minerals | 2.365 | -5% | 15% | 34% | 62% | 32% | $ 2,764,943,273.75 |

| PGO | Pacgold | 0.09 | 3% | -4% | -47% | -63% | -53% | $ 9,466,362.00 |

| FEG | Far East Gold | 0.195 | 0% | 18% | 44% | 22% | 56% | $ 56,086,901.91 |

| MI6 | Minerals260Limited | 0.13 | -7% | 0% | -16% | -59% | -59% | $ 30,420,000.00 |

| IGO | IGO Limited | 5.285 | 3% | -10% | -33% | -44% | -42% | $ 3,975,656,018.25 |

| GAL | Galileo Mining Ltd | 0.1375 | -5% | -11% | -54% | -56% | -52% | $ 26,679,365.15 |

| RXL | Rox Resources | 0.18 | -8% | 33% | 3% | -26% | -2% | $ 78,013,104.53 |

| PTN | Patronus Resources | 0.067 | 5% | 20% | -3% | 18% | 0% | $ 112,980,448.48 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | -98% | -98% | $ 1,544,025.56 |

| TGM | Theta Gold Mines Ltd | 0.175 | -8% | 3% | 9% | 30% | 52% | $ 144,567,452.34 |

| FAL | Falconmetalsltd | 0.165 | -3% | -11% | 22% | 22% | 14% | $ 30,975,000.00 |

| SXG | Southern Cross Gold | 3.2 | -1% | -4% | 23% | 264% | 154% | $ 619,153,404.48 |

| SPD | Southernpalladium | 0.725 | 34% | 61% | 45% | 86% | 93% | $ 66,415,000.00 |

| ORN | Orion Minerals Ltd | 0.018 | -10% | 6% | -5% | 0% | 29% | $ 123,057,703.40 |

| TMB | Tambourahmetals | 0.032 | 0% | -11% | -53% | -74% | -72% | $ 3,356,683.86 |

| TMS | Tennant Minerals Ltd | 0.0135 | -4% | 4% | -41% | -50% | -59% | $ 12,426,575.40 |

| AZY | Antipa Minerals Ltd | 0.025 | -22% | 4% | 108% | 79% | 47% | $ 130,235,885.26 |

| PXX | Polarx Limited | 0.008 | -11% | -20% | -38% | 18% | 18% | $ 16,628,506.85 |

| TRE | Toubani Res Ltd | 0.29 | -3% | -3% | 132% | 137% | 100% | $ 74,054,486.68 |

| AUN | Aurumin | 0.065 | 27% | 37% | 55% | 124% | 150% | $ 26,888,851.40 |

| GPR | Geopacific Resources | 0.031 | 19% | 29% | 24% | 82% | 55% | $ 36,675,245.05 |

| FXG | Felix Gold Limited | 0.082 | -11% | -29% | 3% | 61% | 67% | $ 26,949,776.91 |

| ILT | Iltani Resources Lim | 0.225 | -6% | -2% | 15% | 50% | 41% | $ 10,122,416.15 |

| BRX | Belararoxlimited | 0.23 | -5% | -8% | 5% | -47% | -26% | $ 23,535,423.00 |

| TM1 | Terra Metals Limited | 0.043 | 10% | 13% | -20% | -9% | -7% | $ 18,669,382.77 |

| TOR | Torque Met | 0.066 | -13% | -13% | -49% | -66% | -70% | $ 16,849,002.67 |

| ARD | Argent Minerals | 0.028 | -3% | 56% | 65% | 180% | 211% | $ 43,317,769.98 |

Top ASX Gold Stories This Week

Alex Passmore’s Ora rose strongly after announcing high-grade results from a 7500m RC program at its Crown Prince project in WA’s Mid West, where production is being targeted in 2025.

They included some stonker hits like 20m at 277g/t from 40m (4m at 1358g/t inclusive), 15m at 14.7g/t and 9m at 21.44g/t.

Results came from infill drilling, a key step to define an ore reserve at the deposit, located in its broader Garden Gully tenure.

“Such high-grade headline results demonstrate the high-quality nature of the Crown Prince Project and point to its likely strong economics during development and production,” CEO Passmore said.

“We look forward to providing further information on the updated resource estimate in coming weeks and then to follow up with an ore reserve as work progresses.”

Ora is seeking to finalise an ore purchase agreement with Westgold Resources (ASX:WGX), which owns a number of mills in the region.

This column’s called Gold Digger but here’s something a bit different for you.

SPD released a pre-feasibility study for its Bengwenyama palladium and platinum project this week just gone.

It highlighted a NPV of ~US$1.05b and all in sustaining cost of US$800/oz (6E), putting the project in the lowest quartile of the platinum industry cost curve.

Situated on the eastern limb of South Africa’s distinctively endowed Bushveld Complex, extensive metallurgical testing during the PFS phase further de-risked the asset, demonstrating both high and consistent recoveries for both PGMs and chrome.

The project is underpinned by a measured and indicated resource which accounts for 74% of the total planned ore production over the life of mine.

The total resource increased to 40Moz in the last resource update in October, including 7.92Moz at 9.653g/t PGE (6E) in the measured and indicated categories. This represents a notable leap in resource confidence since an initial 18.8Moz inferred resource reported in July 2021.

“Capital costs for the plant and infrastructure have been refined, decreasing by 6% to USD385m and including a 15% contingency,” SPD said.

“The PFS results are compelling and firmly establish Bengwenyama as a Tier 1 PGM asset.

“They confirm the commercial viability of the project, and we are now preparing to progress to a definitive feasibility study (DFS), which is expected to be completed in 2025.”

Palladium futures have lifted 12.5% in the past month to US$1119/oz with the US prepping sanctions on exports from Russia, the world’s largest exporter of the metal, which is used in investing and catalytic converters.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.