Gold Digger: Where do we go from here?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

It’s been a frustrating few months for gold bulls.

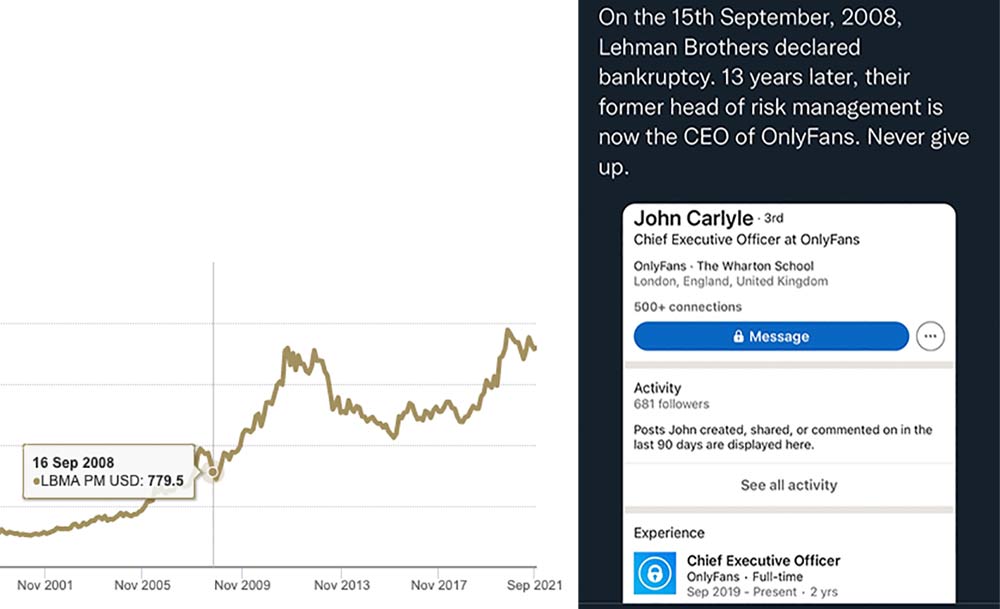

As an investment hedge, gold shines during periods of poor or volatile market sentiment. It loves drama like pandemics, civil wars, or the unprecedented failure of the Lehman Brothers in 2008.

Now, the unwinding of economic support measures by central banks as global markets recover are dimming gold’s status as a ‘safe haven’.

After punching though that psychologically important $US1,800/oz mark recently, gold was down nearly 3% on Thursday as strong US retail sales data boosted the dollar.

Gold also often falls when the value of the USD goes up relative to other currencies worldwide.

Retail sales in the US unexpectedly rose 0.7% month-on-month in August — handily beating market forecasts of a 0.8% drop — giving ammo to those experts saying the Federal Reserve may hasten the unwinding of economic support and boost rates to help control inflationary pressures.

The strong retail sales figures show “consumer sentiment is starting to come back, a good indicator for the Fed to bring in those expectations on the next rate hike,” said Phillip Streible, chief market strategist at Blue Line Futures told Reuters.

An expected interest rates hike in the medium term could also translate to increased ‘opportunity cost’ of holding non-yielding assets like bullion.

Opportunity cost would be the potential losses suffered by not investing in something more appetising, like uranium stocks.

The next key moment for gold will be the Federal Reserve’s September 21-22 policy meeting.

So, what’s next? Opinions on the outlook vary widely.

“There are a lot of members in the FOMC in favour of commencing tapering this year, and therefore the outlook for gold is not positive,” said Quantitative Commodity Research analyst Peter Fertig.

Meanwhile, Metals Focus believes that despite growing expectations of monetary tapering in the US/Europe, “rate hikes may not occur as early as some anticipate, which should benefit non-yielding assets such as gold”.

“As nominal yields remain low and real yields negative, a lack of meaningful returns on key reserves currencies should favour gold’s role as an effective portfolio diversifier,” it says.

Also of importance will be geopolitical factors, Metals Focus says.

“Since President Biden’s inauguration, tensions between the US and its geopolitical rivals have shown little sign of easing.

“Going forward, for some countries a desire to cut exposure to dollar-denominated assets will continue to justify a rotation into gold.”

Winners & Losers

Here’s how ASX-listed gold & silver stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| TSC | Twenty Seven Co. Ltd | 86 | 117 | 8 | -19 | 0.0065 | $ 21,286,511.24 |

| KWR | Kingwest Resources | 64 | 69 | -11 | -29 | 0.12 | $ 26,034,648.88 |

| GTR | Gti Resources | 63 | 150 | 93 | 63 | 0.0425 | $ 37,420,679.26 |

| DLC | Delecta Limited | 56 | 133 | 133 | 100 | 0.014 | $ 15,129,318.08 |

| NPM | Newpeak Metals | 50 | -25 | -25 | -57 | 0.0015 | $ 13,654,870.31 |

| THR | Thor Mining PLC | 50 | 50 | 50 | 62 | 0.021 | $ 10,431,803.74 |

| NXM | Nexus Minerals Ltd | 47 | 175 | 247 | 329 | 0.33 | $ 85,453,084.85 |

| MTC | Metalstech Ltd | 45 | 91 | 147 | 95 | 0.42 | $ 65,851,219.77 |

| REZ | Resourc & En Grp Ltd | 44 | 70 | 18 | 109 | 0.046 | $ 19,857,316.29 |

| XAM | Xanadu Mines Ltd | 38 | 16 | -32 | -22 | 0.036 | $ 44,066,321.25 |

| M24 | Mamba Exploration | 33 | 13 | -19 | 0.22 | $ 7,400,000.00 | |

| XTC | Xantippe Res Ltd | 33 | 0 | 0 | -50 | 0.002 | $ 8,149,128.80 |

| SBR | Sabre Resources | 33 | 33 | 50 | -48 | 0.006 | $ 10,098,381.89 |

| A8G | Australasian Gold | 33 | 181 | 0.38 | $ 8,739,884.66 | ||

| A8G | Australasian Gold | 33 | 181 | 0.38 | $ 8,739,884.66 | ||

| ICG | Inca Minerals Ltd | 27 | 43 | 33 | 139 | 0.14 | $ 66,107,311.88 |

| AM7 | Arcadia Minerals | 26 | 26 | 0.265 | $ 9,063,000.00 | ||

| TIN | Tnt Mines Limited | 26 | 64 | 64 | 42 | 0.27 | $ 33,013,262.98 |

| KCN | Kingsgate Consolid. | 25 | 21 | 5 | -18 | 0.9 | $ 189,228,987.32 |

| LNY | Laneway Res Ltd | 25 | 0 | 0 | -38 | 0.005 | $ 19,520,329.67 |

| MHC | Manhattan Corp Ltd | 25 | 36 | -17 | -70 | 0.015 | $ 21,367,901.70 |

| PDI | Predictive Disc Ltd | 24 | 2 | 101 | 93 | 0.1425 | $ 195,969,001.19 |

| MBK | Metal Bank Ltd | 22 | 38 | 10 | 10 | 0.011 | $ 11,890,683.04 |

| DCX | Discovex Res Ltd | 20 | 20 | -14 | -14 | 0.006 | $ 15,411,984.46 |

| NAE | New Age Exploration | 20 | 0 | -14 | 33 | 0.012 | $ 17,230,786.92 |

| TNR | Torian Resources Ltd | 20 | 50 | -40 | 112 | 0.036 | $ 29,559,163.17 |

| MEU | Marmota Limited | 19 | 11 | 11 | -4 | 0.05 | $ 49,395,218.19 |

| GSM | Golden State Mining | 17 | 4 | -10 | -42 | 0.14 | $ 11,171,028.33 |

| BRB | Breaker Res NL | 16 | 33 | 46 | 19 | 0.285 | $ 102,639,892.64 |

| PRX | Prodigy Gold NL | 16 | 5 | 8 | -38 | 0.043 | $ 25,547,614.66 |

| GIB | Gibb River Diamonds | 16 | 36 | -17 | 53 | 0.072 | $ 15,228,680.04 |

| PF1 | Pathfinder Resources | 15 | 11 | 51 | 0.34 | $ 16,465,759.20 | |

| BBX | BBX Minerals Ltd | 13 | 0 | -19 | -39 | 0.215 | $ 96,184,509.75 |

| CEL | Challenger Exp Ltd | 13 | 17 | 0 | 44 | 0.31 | $ 306,007,933.77 |

| IDA | Indiana Resources | 13 | 5 | -15 | 24 | 0.063 | $ 26,935,711.52 |

| STK | Strickland Metals | 13 | 18 | 110 | -14 | 0.045 | $ 50,789,751.19 |

| IPT | Impact Minerals | 12 | 8 | -46 | -44 | 0.014 | $ 30,356,923.79 |

| AGC | AGC Ltd | 12 | -3 | -18 | 0.14 | $ 8,127,274.08 | |

| AGC | AGC Ltd | 12 | -3 | -18 | 0.14 | $ 8,127,274.08 | |

| BYH | Bryah Resources Ltd | 12 | -2 | 0 | 6 | 0.056 | $ 11,891,187.45 |

| BNR | Bulletin Res Ltd | 12 | 38 | 14 | 2 | 0.076 | $ 13,267,687.48 |

| PKO | Peako Limited | 12 | 4 | 12 | -26 | 0.029 | $ 9,253,623.03 |

| SMI | Santana Minerals Ltd | 11 | -12 | -24 | -48 | 0.11 | $ 12,543,589.96 |

| DRE | Drednought Resources | 11 | -5 | 141 | 116 | 0.041 | $ 109,446,209.12 |

| AAR | Anglo Australian | 11 | 22 | -2 | -49 | 0.094 | $ 53,656,131.51 |

| ONX | Orminexltd | 11 | -24 | 27 | 31 | 0.042 | $ 23,559,464.53 |

| PUR | Pursuit Minerals | 10 | -17 | -10 | 279 | 0.053 | $ 50,598,751.46 |

| GBZ | GBM Rsources Ltd | 10 | 0 | 5 | -21 | 0.115 | $ 52,417,116.84 |

| SFM | Santa Fe Minerals | 9 | 13 | -7 | 3 | 0.093 | $ 6,772,147.38 |

| CDR | Codrus Minerals Ltd | 9 | 3 | 0.175 | $ 7,000,000.00 | ||

| VRC | Volt Resources Ltd | 9 | 25 | 94 | 133 | 0.035 | $ 92,672,200.43 |

| PNM | Pacific Nickel Mines | 9 | 38 | 26 | 89 | 0.072 | $ 15,472,442.59 |

| HXG | Hexagon Energy | 9 | 9 | -15 | 49 | 0.085 | $ 37,465,161.47 |

| FFX | Firefinch Ltd | 9 | 18 | 176 | 318 | 0.6475 | $ 627,715,320.05 |

| NSM | Northstaw | 8 | -3 | -26 | 0.32 | $ 13,400,000.00 | |

| ADT | Adriatic Metals | 8 | 9 | 41 | 36 | 3.11 | $ 572,687,790.70 |

| AQI | Alicanto Min Ltd | 8 | -7 | 13 | -19 | 0.13 | $ 44,397,107.24 |

| SPQ | Superior Resources | 8 | -7 | 0 | 44 | 0.013 | $ 17,957,365.28 |

| FAU | First Au Ltd | 8 | 8 | -19 | -28 | 0.013 | $ 7,990,173.80 |

| CAI | Calidus Resources | 8 | 22 | 27 | 4 | 0.59 | $ 239,957,008.20 |

| CLA | Celsius Resource Ltd | 7 | 4 | -37 | -22 | 0.029 | $ 30,369,614.35 |

| M2R | Miramar | 7 | 1 | -8 | 0.1925 | $ 9,206,928.90 | |

| WGX | Westgold Resources. | 7 | -3 | -18 | -31 | 1.705 | $ 757,073,788.59 |

| CHN | Chalice Mining Ltd | 7 | 18 | 71 | 360 | 7.56 | $ 2,770,564,713.00 |

| MKG | Mako Gold | 7 | 12 | -4 | -42 | 0.096 | $ 37,077,435.39 |

| MOH | Moho Resources | 7 | 0 | -24 | -42 | 0.064 | $ 6,816,176.53 |

| OAU | Ora Gold Limited | 6 | -19 | -26 | -32 | 0.017 | $ 15,157,714.00 |

| VMC | Venus Metals Cor Ltd | 6 | 0 | 0 | -31 | 0.18 | $ 26,438,769.53 |

| TAR | Taruga Minerals | 6 | -2 | 17 | -20 | 0.055 | $ 28,163,300.33 |

| TAM | Tanami Gold NL | 6 | -1 | -10 | 12 | 0.075 | $ 88,132,278.45 |

| E2M | E2 Metals | 6 | -5 | -15 | 50 | 0.285 | $ 42,884,295.71 |

| SLR | Silver Lake Resource | 5 | 2 | -16 | -46 | 1.35 | $ 1,239,455,712.60 |

| ARL | Ardea Resources Ltd | 5 | -4 | -8 | -9 | 0.485 | $ 67,636,767.31 |

| MCT | Metalicity Limited | 5 | 0 | -33 | -60 | 0.01 | $ 21,437,715.32 |

| CXU | Cauldron Energy Ltd | 5 | 33 | 5 | 0 | 0.04 | $ 21,616,919.72 |

| AQX | Alice Queen Ltd | 5 | -25 | -61 | -72 | 0.0105 | $ 15,072,453.11 |

| OBM | Ora Banda Mining Ltd | 5 | -13 | -61 | -72 | 0.105 | $ 107,110,795.55 |

| TIE | Tietto Minerals | 5 | -4 | -10 | -45 | 0.33 | $ 152,822,127.76 |

| ANX | Anax Metals Ltd | 5 | 26 | 53 | 350 | 0.11 | $ 38,520,227.90 |

| SKY | SKY Metals Ltd | 5 | 1 | -43 | -32 | 0.092 | $ 28,602,902.58 |

| LM8 | Lunnonmetalslimited | 5 | -12 | 0.575 | $ 44,045,089.70 | ||

| ICL | Iceni Gold | 5 | 15 | 0.23 | $ 28,148,298.36 | ||

| MRZ | Mont Royal Resources | 4 | 42 | 37 | 39 | 0.355 | $ 13,446,233.83 |

| GUL | Gullewa Limited | 4 | 8 | 27 | 13 | 0.095 | $ 17,514,325.20 |

| FFR | Firefly Resources | 4 | 2 | -8 | -23 | 0.12 | $ 37,000,743.60 |

| DTM | Dart Mining NL | 4 | 9 | -27 | -40 | 0.12 | $ 10,994,002.36 |

| TCG | Turaco Gold Limited | 4 | -11 | 100 | 50 | 0.12 | $ 38,621,601.50 |

| MAU | Magnetic Resources | 4 | 8 | 9 | 49 | 1.695 | $ 361,077,125.95 |

| FML | Focus Minerals Ltd | 4 | -9 | -20 | -39 | 0.245 | $ 44,773,398.43 |

| KZR | Kalamazoo Resources | 4 | -1 | -20 | -51 | 0.37 | $ 52,393,159.26 |

| PRU | Perseus Mining Ltd | 4 | 2 | 20 | -4 | 1.48 | $ 1,938,611,920.60 |

| BMO | Bastion Minerals | 4 | 52 | 22 | 0.25 | $ 15,225,378.90 | |

| SI6 | SI6 Metals Limited | 4 | 4 | -34 | -22 | 0.0125 | $ 17,137,727.82 |

| AOP | Apollo Consolidated | 4 | 0 | 7 | 12 | 0.38 | $ 112,273,927.15 |

| GOR | Gold Road Res Ltd | 4 | 8 | 11 | -20 | 1.325 | $ 1,233,828,034.60 |

| MVL | Marvel Gold Limited | 4 | -7 | 17 | -11 | 0.055 | $ 31,262,371.63 |

| PRS | Prospech Limited | 4 | -6 | -38 | 0 | 0.084 | $ 5,475,204.42 |

| NVA | Nova Minerals Ltd | 4 | 27 | -15 | 59 | 0.14 | $ 243,737,263.82 |

| CST | Castile Resources | 4 | -7 | 4 | -37 | 0.2175 | $ 43,936,226.62 |

| KAU | Kaiser Reef | 4 | 8 | -38 | -44 | 0.225 | $ 24,031,879.65 |

| BRV | Big River Gold Ltd | 3 | -14 | -23 | -25 | 0.3 | $ 65,832,735.60 |

| AGS | Alliance Resources | 3 | 3 | -16 | -35 | 0.155 | $ 32,242,655.77 |

| SLZ | Sultan Resources Ltd | 3 | -11 | -14 | -26 | 0.16 | $ 11,125,502.24 |

| EMU | EMU NL | 3 | 14 | -43 | 7 | 0.032 | $ 14,608,463.49 |

| RND | Rand Mining Ltd | 3 | -1 | 0 | -29 | 1.5 | $ 85,313,941.50 |

| AMI | Aurelia Metals Ltd | 3 | 2 | -12 | -33 | 0.335 | $ 438,359,988.14 |

| WMC | Wiluna Mining Corp | 3 | 3 | -5 | -49 | 1.02 | $ 164,639,575.36 |

| CWX | Carawine Resources | 3 | -11 | -39 | -9 | 0.2 | $ 21,233,530.89 |

| HWK | Hawkstone Mng Ltd | 3 | -2 | 8 | 186 | 0.04 | $ 68,650,443.88 |

| DCN | Dacian Gold Ltd | 3 | -15 | -49 | -40 | 0.205 | $ 198,323,150.82 |

| OKR | Okapi Resources | 2 | 52 | 247 | 205 | 0.625 | $ 66,621,180.53 |

| CAZ | Cazaly Resources | 2 | -8 | 5 | -12 | 0.046 | $ 16,999,910.28 |

| AAJ | Aruma Resources Ltd | 2 | 14 | 75 | -29 | 0.096 | $ 11,336,535.27 |

| ENR | Encounter Resources | 2 | 53 | 58 | 88 | 0.245 | $ 75,901,565.52 |

| WWI | West Wits Mining Ltd | 2 | -17 | -50 | 61 | 0.05 | $ 66,830,263.50 |

| AXE | Archer Materials | 2 | -38 | 59 | 187 | 1.65 | $ 373,438,735.44 |

| GBR | Greatbould Resources | 2 | 80 | 299 | 228 | 0.1475 | $ 53,543,371.35 |

| VAN | Vango Mining Ltd | 2 | -2 | -19 | -36 | 0.064 | $ 70,346,777.66 |

| SAU | Southern Gold | 2 | -2 | -19 | -54 | 0.065 | $ 14,079,697.90 |

| PAK | Pacific American Hld | 2 | 7 | -12 | -23 | 0.018 | $ 5,734,528.20 |

| NUS | Nusantara Resources | 1 | 4 | 30 | 9 | 0.35 | $ 79,927,187.42 |

| KTA | Krakatoa Resources | 1 | 37 | 8 | -29 | 0.07 | $ 19,450,854.52 |

| SVL | Silver Mines Limited | 1 | -8 | -10 | -12 | 0.2025 | $ 250,292,605.09 |

| SVY | Stavely Minerals Ltd | 1 | 2 | -40 | -22 | 0.435 | $ 114,823,038.88 |

| S2R | S2 Resources | 1 | -29 | -39 | -62 | 0.1 | $ 37,419,359.78 |

| NST | Northern Star | 1 | -3 | -2 | -39 | 9.17 | $ 11,106,965,034.00 |

| RMS | Ramelius Resources | 1 | -8 | -7 | -43 | 1.42 | $ 1,208,933,287.65 |

| EMR | Emerald Res NL | 1 | 2 | 6 | 32 | 0.855 | $ 458,703,514.23 |

| EVN | Evolution Mining Ltd | 1 | -3 | -8 | -39 | 3.8 | $ 7,185,121,836.48 |

| AWV | Anova Metals Ltd | 0 | -12 | -12 | -29 | 0.022 | $ 31,528,072.40 |

| KCC | Kincora Copper | 0 | -13 | 0.175 | $ 13,624,349.38 | ||

| TRY | Troy Resources Ltd | 0 | -5 | -50 | -63 | 0.037 | $ 30,073,993.35 |

| CDT | Castle Minerals | 0 | 0 | 27 | 17 | 0.014 | $ 10,255,011.45 |

| AWJ | Auric Mining | 0 | -4 | -24 | 0.13 | $ 5,810,999.61 | |

| BTR | Brightstar Resources | 0 | -3 | -42 | 4 | 0.028 | $ 12,313,021.39 |

| GMR | Golden Rim Resources | 0 | -13 | -13 | -56 | 0.007 | $ 18,692,447.75 |

| AL8 | Alderan Resource Ltd | 0 | -2 | -32 | -57 | 0.049 | $ 16,760,805.50 |

| G88 | Golden Mile Res Ltd | 0 | -5 | 2 | -8 | 0.054 | $ 7,614,989.71 |

| ERM | Emmerson Resources | 0 | -4 | -6 | -26 | 0.068 | $ 33,880,217.25 |

| AME | Alto Metals Limited | 0 | -9 | 4 | -7 | 0.079 | $ 35,570,519.14 |

| IVR | Investigator Res Ltd | 0 | -2 | -24 | 14 | 0.065 | $ 88,704,422.67 |

| ALY | Alchemy Resource Ltd | 0 | 7 | 25 | -17 | 0.015 | $ 9,411,408.34 |

| KGM | Kalnorth Gold Ltd | 0 | 0 | 0 | 0 | 0.013 | $ 11,625,120.78 |

| SIH | Sihayo Gold Limited | 0 | 11 | -17 | -55 | 0.01 | $ 36,854,614.13 |

| CTO | Citigold Corp Ltd | 0 | 0 | -29 | -23 | 0.01 | $ 31,170,250.00 |

| GED | Golden Deeps | 0 | 0 | 10 | -33 | 0.011 | $ 8,922,291.56 |

| CGN | Crater Gold Min Ltd | 0 | 0 | -15 | 21 | 0.017 | $ 20,867,429.74 |

| RMX | Red Mount Min Ltd | 0 | 0 | -9 | 11 | 0.01 | $ 16,109,041.32 |

| NES | Nelson Resources. | 0 | -2 | -61 | -34 | 0.046 | $ 8,743,148.78 |

| CHZ | Chesser Resources | 0 | -10 | -23 | -33 | 0.135 | $ 62,571,976.88 |

| POL | Polymetals Resources | 0 | -4 | 0.135 | $ 4,658,790.84 | ||

| KAI | Kairos Minerals Ltd | 0 | 10 | 28 | -48 | 0.032 | $ 53,648,626.88 |

| MML | Medusa Mining Ltd | 0 | -1 | -12 | -9 | 0.81 | $ 171,495,473.33 |

| TG1 | Techgen Metals Ltd | 0 | 6 | 0.19 | $ 7,320,469.15 | ||

| PNR | Pantoro Limited | 0 | 2 | 2 | -9 | 0.215 | $ 309,979,713.56 |

| FG1 | Flynngold | 0 | -3 | 0.155 | $ 9,299,999.69 | ||

| HCH | Hot Chili Ltd | 0 | 3 | -15 | 5 | 0.041 | $ 157,538,426.64 |

| TTM | Titan Minerals | 0 | 19 | 14 | 0 | 0.125 | $ 150,866,736.93 |

| TSO | Tesoro Resources Ltd | 0 | 5 | -49 | -54 | 0.11 | $ 55,110,755.59 |

| DDD | 3D Resources Limited | 0 | 0 | -27 | -31 | 0.004 | $ 15,521,488.37 |

| PNX | PNX Metals Limited | 0 | -19 | -13 | -41 | 0.0065 | $ 21,913,161.07 |

| RED | Red 5 Limited | 0 | 10 | 16 | -39 | 0.215 | $ 494,835,736.92 |

| AVW | Avira Resources Ltd | 0 | 0 | -17 | -38 | 0.005 | $ 7,562,720.00 |

| ADV | Ardiden Ltd | 0 | 15 | -17 | -44 | 0.015 | $ 32,240,313.24 |

| WCN | White Cliff Min Ltd | 0 | 8 | -28 | 8 | 0.013 | $ 6,723,553.19 |

| NCM | Newcrest Mining | 0 | -7 | -2 | -28 | 23.83 | $ 20,056,289,041.68 |

| RSG | Resolute Mining | -1 | -12 | -31 | -58 | 0.4325 | $ 491,232,254.17 |

| CYL | Catalyst Metals | -1 | -4 | -12 | -23 | 1.88 | $ 184,795,959.24 |

| SBM | St Barbara Limited | -1 | -12 | -30 | -59 | 1.41 | $ 1,065,977,812.03 |

| DTR | Dateline Resources | -1 | -7 | 20 | 20 | 0.09 | $ 39,105,857.97 |

| NML | Navarre Minerals Ltd | -1 | -3 | -40 | -30 | 0.087 | $ 60,723,577.14 |

| EM2 | Eagle Mountain | -1 | 5 | 60 | 202 | 0.8 | $ 169,704,216.81 |

| RVR | Red River Resources | -1 | -1 | -28 | 33 | 0.1725 | $ 90,610,514.23 |

| BCN | Beacon Minerals | -2 | -2 | -12 | -8 | 0.0325 | $ 114,672,836.64 |

| BDC | Bardoc Gold Ltd | -2 | -12 | -19 | -28 | 0.06 | $ 105,850,699.94 |

| RRL | Regis Resources | -2 | -13 | -27 | -62 | 2.08 | $ 1,621,547,634.30 |

| DGO | DGO Gold Limited | -2 | -11 | -1 | -26 | 2.9 | $ 231,905,216.34 |

| BC8 | Black Cat Syndicate | -2 | -1 | -20 | -29 | 0.545 | $ 77,444,296.05 |

| YRL | Yandal Resources | -2 | 0 | 12 | 117 | 0.51 | $ 51,726,575.80 |

| GSN | Great Southern | -2 | -9 | -17 | -58 | 0.05 | $ 27,305,662.68 |

| G50 | Gold50Limited | -2 | -16 | 0.245 | $ 12,327,910.25 | ||

| HAW | Hawthorn Resources | -2 | 7 | -35 | -51 | 0.048 | $ 16,675,780.65 |

| ZNC | Zenith Minerals Ltd | -2 | 12 | 88 | 114 | 0.235 | $ 75,732,746.65 |

| BGL | Bellevue Gold Ltd | -2 | -13 | 0 | -27 | 0.8125 | $ 823,049,483.34 |

| STN | Saturn Metals | -3 | -20 | 10 | -48 | 0.39 | $ 44,482,731.45 |

| AUC | Ausgold Limited | -3 | -5 | -20 | 3 | 0.039 | $ 64,999,331.18 |

| HMX | Hammer Metals Ltd | -3 | -1 | -18 | 100 | 0.078 | $ 63,452,580.59 |

| KSN | Kingston Resources | -3 | -3 | -17 | -28 | 0.195 | $ 55,800,138.62 |

| VKA | Viking Mines Ltd | -3 | -24 | -54 | 44 | 0.0175 | $ 18,382,651.76 |

| AZS | Azure Minerals | -3 | 45 | 6 | 55 | 0.34 | $ 108,232,502.35 |

| GRL | Godolphin Resources | -3 | 6 | -20 | -21 | 0.165 | $ 13,878,359.72 |

| TLM | Talisman Mining | -3 | -14 | 68 | 35 | 0.155 | $ 30,793,683.53 |

| ADN | Andromeda Metals Ltd | -3 | -11 | -63 | 60 | 0.155 | $ 381,540,567.13 |

| MTH | Mithril Resources | -3 | -16 | -18 | -68 | 0.0155 | $ 41,123,728.66 |

| BMR | Ballymore Resources | -3 | 0 | 0 | 0 | 0.31 | $ 20,728,643.49 |

| TBR | Tribune Res Ltd | -3 | -14 | -3 | -39 | 4.83 | $ 252,371,450.37 |

| MGV | Musgrave Minerals | -3 | -11 | -18 | -54 | 0.28 | $ 146,636,310.98 |

| AUT | Auteco Minerals | -4 | -15 | -9 | -45 | 0.082 | $ 138,375,851.69 |

| ZAG | Zuleika Gold Ltd | -4 | -7 | -36 | -10 | 0.027 | $ 10,662,427.70 |

| AAU | Antilles Gold Ltd | -4 | -1 | -20 | 100 | 0.079 | $ 20,443,475.63 |

| RDN | Raiden Resources Ltd | -4 | 13 | 4 | 44 | 0.026 | $ 32,464,678.90 |

| PGD | Peregrine Gold | -4 | -10 | 0.385 | $ 12,935,536.08 | ||

| NAG | Nagambie Resources | -4 | 15 | 35 | 54 | 0.077 | $ 38,494,790.64 |

| SNG | Siren Gold | -4 | 0 | -34 | 0.25 | $ 17,923,671.00 | |

| CY5 | Cygnus Gold Limited | -4 | -17 | -26 | -32 | 0.125 | $ 13,281,462.01 |

| WAF | West African Res Ltd | -4 | -5 | 9 | -14 | 0.975 | $ 892,236,134.13 |

| NWM | Norwest Minerals | -4 | 0 | -6 | -33 | 0.07 | $ 12,461,901.98 |

| HRZ | Horizon | -4 | 0 | 15 | -18 | 0.115 | $ 65,317,148.00 |

| KRM | Kingsrose Mining Ltd | -4 | -6 | -6 | 22 | 0.045 | $ 32,850,330.84 |

| RML | Resolution Minerals | -4 | 10 | -8 | -58 | 0.022 | $ 9,848,951.51 |

| QML | Qmines Limited | -4 | -6 | 0.33 | $ 15,955,213.66 | ||

| CBY | Canterbury Resources | -5 | 15 | -5 | 5 | 0.105 | $ 12,620,845.65 |

| AGG | AngloGold Ashanti | -5 | -13 | -27 | -49 | 4.2 | $ 384,485,467.15 |

| MAT | Matsa Resources | -5 | -5 | -32 | -56 | 0.061 | $ 22,205,586.44 |

| DEG | De Grey Mining | -4 | -13 | 2 | -29 | 1.01 | $ 1,369,962,084.66 |

| TBA | Tombola Gold Ltd | -5 | -15 | -23 | -30 | 0.04 | $ 25,371,831.16 |

| TMZ | Thomson Res Ltd | -5 | -11 | -29 | 108 | 0.1 | $ 51,931,040.48 |

| RXL | Rox Resources | -5 | 0 | -28 | -58 | 0.4 | $ 66,195,197.88 |

| MDI | Middle Island Res | -5 | -3 | -64 | -77 | 0.095 | $ 11,629,731.09 |

| MZZ | Matador Mining Ltd | -5 | -11 | 17 | -31 | 0.37 | $ 83,493,316.14 |

| LCL | Los Cerros Limited | -5 | -15 | -2 | -30 | 0.1325 | $ 82,384,751.15 |

| ALK | Alkane Resources Ltd | -6 | -18 | 6 | -43 | 0.7725 | $ 482,264,928.00 |

| MEI | Meteoric Resources | -6 | -23 | -54 | -37 | 0.031 | $ 42,793,329.25 |

| MRR | Minrex Resources Ltd | -6 | -17 | -35 | -38 | 0.015 | $ 9,209,261.41 |

| GML | Gateway Mining | -6 | -17 | -50 | -32 | 0.015 | $ 28,554,534.00 |

| SRN | Surefire Rescs NL | -6 | 0 | -40 | 0 | 0.015 | $ 15,460,345.73 |

| LCY | Legacy Iron Ore | -6 | 0 | -6 | 200 | 0.015 | $ 96,071,077.76 |

| BAT | Battery Minerals Ltd | -6 | 0 | -42 | 7 | 0.015 | $ 30,490,999.23 |

| ARN | Aldoro Resources | -6 | -28 | 110 | 340 | 0.44 | $ 39,121,547.11 |

| CMM | Capricorn Metals | -7 | 7 | 44 | 2 | 2.27 | $ 843,419,441.57 |

| SSR | SSR Mining Inc. | -7 | -9 | 5 | 20.52 | $ 483,612,096.00 | |

| MM8 | Medallion Metals. | -7 | 16 | 0.2325 | $ 18,825,545.00 | ||

| BNZ | Benzmining | -7 | -1 | 3 | 0.78 | $ 37,442,480.46 | |

| ASO | Aston Minerals Ltd | -7 | 8 | 63 | 183 | 0.13 | $ 128,816,652.92 |

| OKU | Oklo Resources Ltd | -8 | -4 | -29 | -61 | 0.12 | $ 63,003,726.50 |

| TRN | Torrens Mining | -8 | -13 | 3 | 0.17 | $ 11,843,039.46 | |

| BGD | Bartongoldholdings | -8 | -13 | 0.17 | $ 15,021,999.30 | ||

| RDS | Redstone Resources | -8 | 0 | -15 | -45 | 0.011 | $ 7,908,989.69 |

| GMN | Gold Mountain Ltd | -9 | -5 | -44 | -50 | 0.021 | $ 23,543,281.74 |

| TRM | Truscott Mining Corp | -9 | -11 | 48 | 55 | 0.031 | $ 4,710,187.86 |

| RGL | Riversgold | -9 | -23 | -38 | -49 | 0.03 | $ 12,929,350.27 |

| AYM | Australia United Min | -9 | 43 | 11 | 150 | 0.01 | $ 20,268,352.34 |

| LEX | Lefroy Exploration | -9 | -4 | -37 | 50 | 0.39 | $ 48,089,866.80 |

| OZM | Ozaurum Resources | -9 | 7 | -22 | 0.145 | $ 8,260,650.00 | |

| DEX | Duke Exploration | -10 | -11 | -23 | 0.235 | $ 21,199,620.72 | |

| TMX | Terrain Minerals | -10 | 13 | -10 | -44 | 0.009 | $ 6,621,849.08 |

| BAR | Barra Resources | -10 | 35 | 35 | 13 | 0.027 | $ 21,360,712.85 |

| GNM | Great Northern | -10 | -18 | -10 | -61 | 0.009 | $ 12,090,509.76 |

| MEG | Megado | -11 | -22 | -44 | 0.098 | $ 4,218,782.20 | |

| ARV | Artemis Resources | -11 | 29 | 1 | 5 | 0.081 | $ 107,929,797.99 |

| WRM | White Rock Min Ltd | -11 | -25 | -53 | -59 | 0.28 | $ 42,027,402.74 |

| PUA | Peak Minerals Ltd | -11 | -20 | -30 | -41 | 0.016 | $ 9,835,242.43 |

| HRN | Horizon Gold Ltd | -13 | -3 | -19 | -27 | 0.35 | $ 36,275,285.44 |

| NMR | Native Mineral Res | -13 | -8 | -21 | 0.225 | $ 6,483,037.50 | |

| MKR | Manuka Resources. | -15 | -6 | -23 | -45 | 0.29 | $ 30,954,774.22 |

| A1G | African Gold Ltd. | -19 | 73 | 10 | 117 | 0.285 | $ 25,594,196.32 |

| GWR | GWR Group Ltd | -22 | -46 | -42 | -27 | 0.145 | $ 45,417,966.45 |

| MLS | Metals Australia | -25 | -25 | -25 | -50 | 0.0015 | $ 8,454,376.09 |

| ANL | Amani Gold Ltd | -25 | 0 | 50 | -25 | 0.0015 | $ 24,773,993.49 |

TOP WEEKLY GOLD PERFORMERS

Kingwest is now up 64% since announcing a gold discovery under a WA salt lake called ‘Goongarrie’ on Monday.

Exploring for gold underneath salt lakes is tough, which is probably why so many remain underexplored — regardless of how prospective they are.

That is why early results like 3m @ 6.5g/t gold and 3m @ 4.1g/t gold from Kingwest are so important.

“These results support our targeting for a potential major discovery which we have named the ‘Sir Laurence’ Prospect,” CEO Ed Turner says.

“We have just scratched the surface of bedrock mineralisation at this stage.

“I look forward to receiving the outstanding assays as well as planning follow up drilling along strike within Target A10, which includes many other similar litho-structural targets.”

The explorer keeps hitting high-grade gold at the emerging ‘Wallbrook’ gold project in WA.

Earlier this month, the previously undrilled ‘Templar’ discovery delivered numerous hits like 10m @ 5.64g/t gold (within 23m @ 2.85g/t Au from 132m).

Templar and the neighbouring ‘Crusader’ target could be part of one giant system, Nexus managing director Andy Tudor says.

“These broad high-grade results received from Templar occur in the same altered and mineralised rocks we see at the Crusader prospect, 1.2km to the south,” he says.

“This has effectively linked the two prospects together into one large mineralised system.”

A 700m deep diamond drill hole at Templar is now underway.

The $86m market cap stock is up ~170% over the past month.

$6 billion market cap Chifeng Gold Mining will buy ~5.8m shares in emerging miner MetalsTech at 34c apiece for a total investment of $2m.

This is a pretty big deal, MTC says.

“Chifeng is widely considered to be one of the most successful precious metals investors in China owing largely to the experience of their chairman Mr Wang Jianhua who before transforming Chifeng, served as CEO of $62bn capped Zijin Mining and before that, chairman of $17bn capped Shandong Gold,” MTC chairman Russell Moran says.

MTC’s 1.5moz (and growing) ‘Sturec’ project could be a world class epithermal deposit, he says.

“We hope that this recent interest from Chifeng is a sign of growing interest in our broader development plans for Sturec.”

MTC also reminds investors that they need to finalise their shareholdings by October 7 to receive free shares in lithium spinout Winsome Resources (ASX:WR1).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.