Gold Digger: Gold wins popularity contest with US punters, a long way ahead of DOGE, BONK and ASS

"Give me a G! Give me an O! Give me an A! Wait… can we start over?" (Pic via Getty Images)

- Gold was the most sought-after personal investment for Americans in 2023: new study

- Get ready for a 20% rally for the yellow metal in 2024, believes Swedish investment firm

- The week’s top ASX gold-related stocks led by Koonenberry Gold with an 86% gain

Your gold and ASX gold stocks roundup, Friday January 19.

Go Team Gold, Go! YaaaaaAAAAYYYY… GOLD!

Give me a G… give me an O… give… cutting to the chase we’re spelling gold.

Why the cheerleading? A few reasons, but the article-headlining one is this:

A new study has shown that gold remained the most popular personal investment in the United States in 2023.

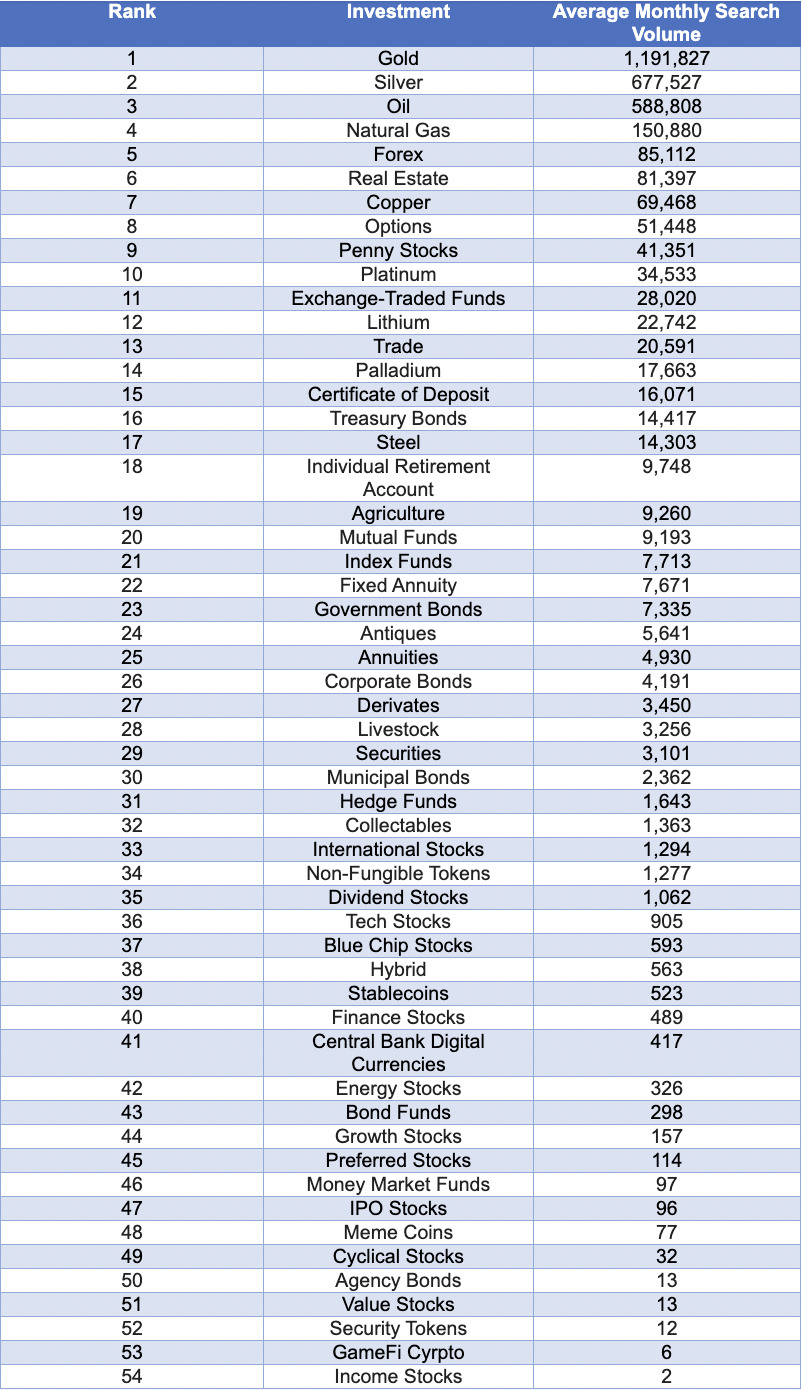

The findings come from a financial publisher called The Lazy Trader, which used Google search data to examine the number of searches for each type of personal investment on its list (see below).

The methodology used is interesting – data was gathered from Google Keyword Planner search volumes of different personal investments, averaged over the period from January 2023 to October 2023 in the US.

Each investment type was combined with terms such as ‘investment tips’, ‘tips’, ‘buy’ and ‘prices’ to discover which ones had the highest search volumes.

Silver was the second most popular, closely followed by oil. Sorry, PEPE the frog, BONK and ASS (Australian Safe Shepherd) fans, but crypto meme coins came in a fair way down the list at 48th.

Judging by these stats and methodology, then, gold has been smashing it, with an average monthly search volume of 1,191,827. It did have a pretty good year overall, with about a 13% return, making it a top commodity play.

“With the elevated interest rates and the continual concerns of a recession in the US, gold can be a reliable long-term investment and outperform other assets like properties and different equities as it is easier to liquidate,” reads The Lazy Trader report.

“There are also tax advantages in gold investments; gold prices have increased considerably in 2023 and have shown stability compared to other markets.”

How’s gold faring this week, then?

Gold has picked up pretty well on Friday after a stagnant week. It had been struggling a bit over the past few days, thanks to the cold water poured by the US Fed on great expectations of interest-rate-cutting in 2024.

That’s not to say cuts aren’t likely at some point, but the timeline seems like it has a strong chance of pushing out a tad from the initial anticipation which pegged March as the month for a first cut in 2024.

Traders revised their views on rates after Fed Reserve Governor Christopher Waller said earlier this week that the central bank won’t rush to cut interest rates until it is clear lower inflation will be sustained. However he admits that the Fed is “within striking distance” of the 2% inflation goal.

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” he added.

Despite this, though, gold has recovered somewhat at the back end of this week, with the US spot price lifting from near the psychologically important level of US$2,000/oz, to US$2,027 at the time of writing.

In plastic fantastic Aussie bucks, it’s sporting a reasonably healthy glow, too, trading near $3,080.

Rising tensions (again) in the Middle East may well have something to do with the late-week pick-up, with the safe haven aspect once more coming back into consideration.

Unfortunately for that messy part of the world, sh*t just got even real-er, after Pakistan launched retaliatory airstrikes inside Iran, killing at least nine people.

This comes after Iran’s Tuesday attack in Pakistan territory that killed two. Escalation fears remain palpable, with the US also initiating more air strikes earlier this week against Iranian-backed Houthi rebel targets in Yemen.

Swedish investment firm sees 20% gold rally in 2024

Here’s something else, though. According to Swedish investment firm AuAg, “there is no bull market quite like a gold bull market”.

That may be true, but have they ever studied crypto bull markets? Just sayin’.

The AuAg analysts, though, have a very positive outlook on the yellow metal, expecting a 20% rally in the commodity this year, which would push it past US$2,400 an ounce.

Thesis? This, mainly, per the firm’s latest report:

“We believe that central banks will shift away from rate hikes and adopt a more accommodative policy stance in 2024, which will catalyze a substantial upswing in gold prices for the foreseeable future,” said the analysts.

Also, this:

“Since the great financial crisis, central banks have consistently increased their gold reserves, setting new records in both 2022 and 2023.”

And this – a scenario based on a crumbling USD:

“The USD is anticipated to continue its decline against the EUR and GBP in 2024, as the Federal Reserve is likely to commence a cycle of interest rate reductions. Moreover, the USD is gradually shedding some of its premium as the world’s reserve currency. Both these factors are expected to provide significant support for gold priced in USD.”

The firm also thinks silver is going to have an even better year, predicting a 48% return by year’s end.

And, along with its gold and silver price expectations, the firm thinks the mining sector will benefit. Take note, ASX goldie fans:

“Gold miners are historically undervalued relative to gold, a trend likely to reverse and overshoot during the forthcoming secular gold bull market.

“Gold miners are also historically undervalued compared to the S&P 500, presenting a unique and attractive entry point.”

Part of the reason the firm is bullish on good gold mining stocks broadly (but in particular smaller and mid-cap producers) is that it believes miners have reduced debt levels significantly over the past decade. Something that can’t be said for too many other sectors.

“Since 2021, companies in the commodity sector have sustained robust cash flows, with precious metal producers boasting the highest margins. Gold miners have become more shareholder-friendly and are more cautious with new costly projects.”

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.014 | -7% | -18% | -65% | $15,188,145 |

| NPM | Newpeak Metals | 0.019 | -5% | 6% | -81% | $1,899,083 |

| ASO | Aston Minerals Ltd | 0.0195 | -7% | -25% | -76% | $25,901,285 |

| MTC | Metalstech Ltd | 0.22 | -2% | 33% | -50% | $41,570,010 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.04 | -9% | -9% | -60% | $4,620,894 |

| G88 | Golden Mile Res Ltd | 0.017 | -6% | -6% | -32% | $5,270,232 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 0% | -50% | $4,953,852 |

| NMR | Native Mineral Res | 0.014 | -30% | -42% | -86% | $3,356,008 |

| AQX | Alice Queen Ltd | 0.006 | 0% | 20% | -82% | $4,145,905 |

| SLZ | Sultan Resources Ltd | 0.016 | -6% | -33% | -82% | $2,519,231 |

| MKG | Mako Gold | 0.009 | 0% | -5% | -79% | $5,961,685 |

| KSN | Kingston Resources | 0.071 | -10% | -14% | -35% | $37,845,099 |

| AMI | Aurelia Metals Ltd | 0.1025 | -11% | -2% | -33% | $168,976,740 |

| PNX | PNX Metals Limited | 0.004 | 33% | 0% | 7% | $21,522,499 |

| GIB | Gibb River Diamonds | 0.031 | 3% | 3% | -50% | $6,556,793 |

| KCN | Kingsgate Consolid. | 1.215 | -4% | -9% | -31% | $315,745,823 |

| TMX | Terrain Minerals | 0.0055 | -8% | 38% | -21% | $6,767,139 |

| BNR | Bulletin Res Ltd | 0.105 | -22% | -13% | 0% | $29,361,332 |

| NXM | Nexus Minerals Ltd | 0.044 | -2% | 0% | -80% | $17,118,646 |

| SKY | SKY Metals Ltd | 0.037 | 3% | -3% | -26% | $17,071,729 |

| LM8 | Lunnonmetalslimited | 0.38 | -32% | -45% | -60% | $93,368,970 |

| CST | Castile Resources | 0.064 | -19% | -26% | -38% | $15,481,755 |

| YRL | Yandal Resources | 0.099 | -36% | 18% | 0% | $25,819,877 |

| FAU | First Au Ltd | 0.003 | 0% | 0% | -25% | $4,985,980 |

| ARL | Ardea Resources Ltd | 0.42 | -8% | -20% | -49% | $84,717,273 |

| GWR | GWR Group Ltd | 0.085 | -6% | 0% | 37% | $27,303,416 |

| IVR | Investigator Res Ltd | 0.035 | -3% | -5% | -22% | $53,851,906 |

| GTR | Gti Energy Ltd | 0.012 | 33% | 50% | -6% | $24,599,365 |

| IPT | Impact Minerals | 0.012 | 0% | 33% | 33% | $34,376,447 |

| BNZ | Benzmining | 0.2 | -9% | -23% | -49% | $23,407,855 |

| MOH | Moho Resources | 0.01 | -9% | 11% | -52% | $5,359,412 |

| BCM | Brazilian Critical | 0.025 | 9% | 14% | -77% | $18,498,920 |

| PUA | Peak Minerals Ltd | 0.003 | 0% | 0% | -40% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.11 | -15% | -29% | -39% | $9,353,277 |

| SMS | Starmineralslimited | 0.04 | 0% | 14% | -45% | $3,036,912 |

| MVL | Marvel Gold Limited | 0.011 | 0% | 0% | -58% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.006 | 0% | -14% | -54% | $10,506,647 |

| AAU | Antilles Gold Ltd | 0.023 | 5% | 10% | -45% | $18,884,459 |

| CWX | Carawine Resources | 0.105 | 0% | -13% | -15% | $24,793,172 |

| RND | Rand Mining Ltd | 1.37 | 0% | 4% | -6% | $77,920,067 |

| CAZ | Cazaly Resources | 0.02 | -26% | -31% | -43% | $12,275,181 |

| BMR | Ballymore Resources | 0.14 | 4% | 4% | -13% | $24,686,282 |

| DRE | Dreadnought Resources Ltd | 0.027 | 0% | -13% | -71% | $97,414,043 |

| ZNC | Zenith Minerals Ltd | 0.165 | 18% | 10% | -34% | $58,142,846 |

| REZ | Resourc & En Grp Ltd | 0.013 | 8% | 0% | 8% | $6,497,475 |

| LEX | Lefroy Exploration | 0.155 | -11% | -6% | -35% | $31,957,968 |

| ERM | Emmerson Resources | 0.051 | -4% | -9% | -41% | $25,601,360 |

| AM7 | Arcadia Minerals | 0.07 | 0% | -10% | -69% | $7,633,507 |

| ADT | Adriatic Metals | 3.345 | -5% | 4% | 2% | $825,587,172 |

| AS1 | Asara Resources Ltd | 0.012 | 0% | 9% | -65% | $9,512,771 |

| CYL | Catalyst Metals | 0.695 | -1% | -19% | -50% | $149,707,130 |

| CHN | Chalice Mining Ltd | 1.085 | -17% | -38% | -84% | $412,301,102 |

| KAL | Kalgoorliegoldmining | 0.026 | -10% | 0% | -69% | $4,121,019 |

| MLS | Metals Australia | 0.034 | 0% | 0% | -29% | $22,465,303 |

| ADN | Andromeda Metals Ltd | 0.026 | 13% | 30% | -58% | $80,860,219 |

| MEI | Meteoric Resources | 0.225 | -12% | 2% | 257% | $467,678,164 |

| SRN | Surefire Rescs NL | 0.01 | 11% | 11% | -29% | $17,668,420 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 33% | 33% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.059 | 20% | 9% | -61% | $30,114,893 |

| HMX | Hammer Metals Ltd | 0.041 | -11% | -16% | -44% | $37,229,109 |

| WCN | White Cliff Min Ltd | 0.017 | 70% | 70% | 21% | $20,429,749 |

| AVM | Advance Metals Ltd | 0.036 | 0% | -10% | -85% | $1,443,058 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -9% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.006 | -14% | -25% | -68% | $9,818,974 |

| MCT | Metalicity Limited | 0.003 | 20% | 50% | 0% | $13,455,161 |

| AME | Alto Metals Limited | 0.036 | -16% | -14% | -50% | $26,696,357 |

| CTO | Citigold Corp Ltd | 0.005 | 0% | 0% | 0% | $14,368,295 |

| TIE | Tietto Minerals | 0.605 | -2% | -4% | -24% | $683,583,723 |

| SMI | Santana Minerals Ltd | 1.285 | 9% | 44% | 75% | $231,180,960 |

| M2R | Miramar | 0.027 | 8% | 4% | -64% | $4,466,086 |

| MHC | Manhattan Corp Ltd | 0.0045 | 29% | 13% | -36% | $11,747,919 |

| GRL | Godolphin Resources | 0.042 | 5% | 11% | -58% | $7,108,165 |

| SVG | Savannah Goldfields | 0.038 | -14% | -13% | -78% | $8,772,769 |

| EMC | Everest Metals Corp | 0.08 | -2% | -1% | -24% | $12,572,799 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -8% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.1 | -13% | -17% | -75% | $29,155,914 |

| G50 | Gold50Limited | 0.12 | 0% | -4% | -45% | $13,114,800 |

| ADV | Ardiden Ltd | 0.175 | 3% | 9% | -49% | $10,940,564 |

| AAR | Astral Resources NL | 0.067 | -6% | -9% | -13% | $53,137,535 |

| VMC | Venus Metals Cor Ltd | 0.098 | -2% | -15% | 16% | $18,403,682 |

| NAE | New Age Exploration | 0.005 | 0% | -17% | -38% | $8,969,495 |

| VKA | Viking Mines Ltd | 0.014 | -7% | 17% | 75% | $14,353,618 |

| LCL | LCL Resources Ltd | 0.014 | -13% | -7% | -68% | $14,267,199 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | -50% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.005 | 0% | 0% | -72% | $3,498,278 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | 0% | -40% | $8,020,728 |

| PRS | Prospech Limited | 0.039 | 18% | 26% | 28% | $11,886,544 |

| TTM | Titan Minerals | 0.022 | -12% | -15% | -72% | $38,899,195 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -53% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.035 | 0% | -34% | -73% | $17,837,334 |

| KZR | Kalamazoo Resources | 0.09 | -33% | -7% | -58% | $17,301,782 |

| BCN | Beacon Minerals | 0.025 | 0% | -4% | -17% | $93,919,204 |

| MAU | Magnetic Resources | 0.88 | 1% | -13% | 10% | $221,423,870 |

| BC8 | Black Cat Syndicate | 0.225 | -6% | -18% | -50% | $65,309,549 |

| EM2 | Eagle Mountain | 0.074 | -3% | 1% | -66% | $21,957,614 |

| EMR | Emerald Res NL | 3.185 | 0% | 11% | 142% | $2,036,856,251 |

| BYH | Bryah Resources Ltd | 0.013 | 0% | 4% | -47% | $5,636,894 |

| HCH | Hot Chili Ltd | 0.98 | 0% | 0% | -4% | $117,056,302 |

| WAF | West African Res Ltd | 0.925 | -4% | -2% | -27% | $959,626,102 |

| MEU | Marmota Limited | 0.044 | 7% | -6% | -4% | $46,587,225 |

| NVA | Nova Minerals Ltd | 0.33 | 3% | -15% | -50% | $68,539,237 |

| SVL | Silver Mines Limited | 0.1475 | -8% | -8% | -28% | $217,671,482 |

| PGD | Peregrine Gold | 0.33 | 14% | 40% | -30% | $21,438,874 |

| ICL | Iceni Gold | 0.048 | -26% | -14% | -63% | $12,462,214 |

| FG1 | Flynngold | 0.052 | -12% | 0% | -46% | $8,743,455 |

| WWI | West Wits Mining Ltd | 0.011 | -8% | -15% | -42% | $29,164,700 |

| RML | Resolution Minerals | 0.003 | 0% | 0% | -67% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.025 | -4% | 0% | -68% | $5,316,071 |

| AL8 | Alderan Resource Ltd | 0.005 | 0% | 0% | -44% | $5,534,307 |

| GMN | Gold Mountain Ltd | 0.004 | -20% | -20% | -33% | $9,076,314 |

| MEG | Megado Minerals Ltd | 0.027 | 17% | 8% | -40% | $6,870,300 |

| HMG | Hamelingoldlimited | 0.078 | 4% | 5% | -42% | $12,285,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.18 | -12% | 0% | -64% | $16,490,343 |

| TBR | Tribune Res Ltd | 2.95 | 0% | 5% | -26% | $153,731,466 |

| FML | Focus Minerals Ltd | 0.18 | 6% | 6% | -3% | $48,714,970 |

| GSR | Greenstone Resources | 0.008 | -11% | 23% | -72% | $9,576,794 |

| VRC | Volt Resources Ltd | 0.006 | -14% | -14% | -57% | $28,910,747 |

| ARV | Artemis Resources | 0.016 | -16% | -16% | -30% | $30,441,531 |

| HRN | Horizon Gold Ltd | 0.3 | 9% | 0% | -8% | $43,451,977 |

| CLA | Celsius Resource Ltd | 0.012 | 9% | -14% | -45% | $26,952,620 |

| QML | Qmines Limited | 0.075 | -6% | -3% | -58% | $15,819,454 |

| RDN | Raiden Resources Ltd | 0.029 | -19% | -15% | 511% | $74,383,823 |

| TCG | Turaco Gold Limited | 0.125 | 0% | 4% | 112% | $76,336,000 |

| KCC | Kincora Copper | 0.04 | 0% | 18% | -51% | $7,950,602 |

| GBZ | GBM Rsources Ltd | 0.008 | 0% | -27% | -83% | $5,851,463 |

| DTM | Dart Mining NL | 0.016 | 0% | 0% | -74% | $3,413,694 |

| MKR | Manuka Resources. | 0.07 | -3% | -20% | -24% | $39,558,404 |

| AUC | Ausgold Limited | 0.027 | 4% | -13% | -53% | $59,699,671 |

| ANX | Anax Metals Ltd | 0.024 | -11% | -14% | -65% | $11,604,423 |

| EMU | EMU NL | 0.001 | 0% | 0% | -82% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -41% | $3,131,208 |

| SSR | SSR Mining Inc. | 15.06 | -1% | -6% | -39% | $97,244,006 |

| PNR | Pantoro Limited | 0.045 | -6% | -12% | -59% | $234,181,373 |

| CMM | Capricorn Metals | 4.37 | -4% | -4% | -6% | $1,622,476,052 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -14% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.005 | 0% | 0% | -17% | $9,969,297 |

| HAW | Hawthorn Resources | 0.098 | -2% | -1% | -11% | $32,831,530 |

| BGD | Bartongoldholdings | 0.24 | -4% | -2% | -11% | $46,928,939 |

| SVY | Stavely Minerals Ltd | 0.044 | 0% | -6% | -82% | $16,805,364 |

| AGC | AGC Ltd | 0.07 | 3% | 9% | 8% | $14,444,444 |

| RGL | Riversgold | 0.01 | -20% | -17% | -67% | $10,644,276 |

| TSO | Tesoro Gold Ltd | 0.027 | -4% | -7% | -25% | $31,969,098 |

| GUE | Global Uranium | 0.165 | 27% | 57% | 0% | $33,953,436 |

| CPM | Coopermetalslimited | 0.295 | -14% | -2% | 23% | $19,628,473 |

| MM8 | Medallion Metals. | 0.06 | -3% | -3% | -59% | $18,459,099 |

| FFM | Firefly Metals Ltd | 0.545 | 1% | -4% | -37% | $192,227,948 |

| CBY | Canterbury Resources | 0.025 | -4% | -17% | -38% | $4,293,522 |

| LYN | Lycaonresources | 0.19 | -10% | 27% | -36% | $8,811,250 |

| SFR | Sandfire Resources | 6.55 | -1% | -4% | 5% | $3,002,440,094 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -76% | $4,881,018 |

| TAM | Tanami Gold NL | 0.034 | -3% | -6% | -17% | $41,128,397 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.025 | -4% | -7% | -60% | $7,476,807 |

| ALK | Alkane Resources Ltd | 0.5625 | -10% | -13% | -20% | $340,942,084 |

| BMO | Bastion Minerals | 0.017 | 6% | 21% | -58% | $5,294,549 |

| IDA | Indiana Resources | 0.076 | -6% | 21% | 27% | $48,603,728 |

| GSM | Golden State Mining | 0.012 | -8% | -20% | -73% | $3,352,448 |

| NSM | Northstaw | 0.048 | -2% | -21% | -75% | $6,853,913 |

| GSN | Great Southern | 0.018 | -10% | -14% | -42% | $13,583,433 |

| RED | Red 5 Limited | 0.3 | 0% | -8% | 25% | $1,004,502,159 |

| DEG | De Grey Mining | 1.1675 | -5% | -13% | -23% | $2,147,468,009 |

| THR | Thor Energy PLC | 0.039 | 26% | 26% | -35% | $7,255,417 |

| CDR | Codrus Minerals Ltd | 0.062 | 3% | 11% | -56% | $5,348,938 |

| MDI | Middle Island Res | 0.017 | 0% | 21% | -64% | $3,700,118 |

| WTM | Waratah Minerals Ltd | 0.082 | -13% | -18% | -45% | $12,695,982 |

| POL | Polymetals Resources | 0.285 | -3% | -10% | 46% | $44,921,075 |

| RDS | Redstone Resources | 0.005 | 0% | 0% | -44% | $4,606,892 |

| NAG | Nagambie Resources | 0.028 | 4% | 4% | -51% | $22,233,056 |

| BGL | Bellevue Gold Ltd | 1.4425 | -5% | -14% | 12% | $1,634,317,878 |

| GBR | Greatbould Resources | 0.062 | -2% | -11% | -30% | $35,322,545 |

| KAI | Kairos Minerals Ltd | 0.013 | -4% | -7% | -43% | $34,071,858 |

| KAU | Kaiser Reef | 0.13 | -16% | -21% | -35% | $21,808,096 |

| HRZ | Horizon | 0.035 | -3% | -22% | -41% | $25,235,412 |

| CAI | Calidus Resources | 0.205 | 3% | 17% | -52% | $128,587,407 |

| CDT | Castle Minerals | 0.007 | -13% | -13% | -70% | $7,959,204 |

| RSG | Resolute Mining | 0.4075 | 2% | -7% | 66% | $872,910,505 |

| MXR | Maximus Resources | 0.042 | -7% | 20% | 0% | $13,479,722 |

| EVN | Evolution Mining Ltd | 3.155 | -17% | -16% | -5% | $6,143,825,308 |

| CXU | Cauldron Energy Ltd | 0.045 | 32% | 73% | 509% | $49,844,919 |

| DLI | Delta Lithium | 0.295 | -11% | -38% | -36% | $206,427,696 |

| ALY | Alchemy Resource Ltd | 0.009 | -10% | 0% | -47% | $10,602,686 |

| HXG | Hexagon Energy | 0.01 | 0% | -9% | -44% | $5,129,159 |

| OBM | Ora Banda Mining Ltd | 0.23 | -4% | 7% | 135% | $392,557,070 |

| SLR | Silver Lake Resource | 1.1525 | 0% | 0% | -18% | $1,074,955,983 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 100% | -33% | $4,267,580 |

| LCY | Legacy Iron Ore | 0.016 | -6% | 0% | -11% | $102,509,219 |

| PDI | Predictive Disc Ltd | 0.195 | -3% | -9% | 5% | $404,867,597 |

| MAT | Matsa Resources | 0.028 | 4% | 8% | -28% | $13,407,073 |

| ZAG | Zuleika Gold Ltd | 0.02 | 18% | 18% | 18% | $14,721,710 |

| GML | Gateway Mining | 0.022 | 22% | -24% | -68% | $7,489,149 |

| SBM | St Barbara Limited | 0.18 | -8% | -10% | -51% | $147,234,668 |

| SBR | Sabre Resources | 0.03 | 0% | -3% | -35% | $10,862,663 |

| STK | Strickland Metals | 0.1 | -17% | 19% | 163% | $162,661,002 |

| ION | Iondrive Limited | 0.012 | 0% | 9% | -56% | $5,835,423 |

| CEL | Challenger Gold Ltd | 0.07 | 3% | 3% | -60% | $88,281,786 |

| LRL | Labyrinth Resources | 0.006 | 0% | 0% | -70% | $7,125,262 |

| NST | Northern Star | 12.255 | -5% | -7% | 2% | $13,963,036,559 |

| OZM | Ozaurum Resources | 0.098 | -22% | -7% | 13% | $16,668,750 |

| TG1 | Techgen Metals Ltd | 0.056 | -20% | -37% | -36% | $5,574,849 |

| XAM | Xanadu Mines Ltd | 0.051 | -2% | -9% | 70% | $88,442,675 |

| AQI | Alicanto Min Ltd | 0.037 | 12% | 3% | -37% | $21,536,788 |

| KTA | Krakatoa Resources | 0.022 | -24% | -48% | -48% | $10,386,359 |

| ARN | Aldoro Resources | 0.082 | -15% | -1% | -64% | $11,308,394 |

| WGX | Westgold Resources. | 2.01 | 4% | -8% | 71% | $961,454,142 |

| MBK | Metal Bank Ltd | 0.025 | 4% | -19% | -37% | $10,542,401 |

| A8G | Australasian Metals | 0.135 | -10% | -10% | -33% | $7,036,267 |

| TAR | Taruga Minerals | 0.008 | -27% | -27% | -65% | $5,648,214 |

| DTR | Dateline Resources | 0.009 | -10% | 0% | -76% | $11,966,005 |

| GOR | Gold Road Res Ltd | 1.6575 | -4% | -15% | -1% | $1,805,606,071 |

| S2R | S2 Resources | 0.145 | -6% | -22% | -15% | $65,519,409 |

| NES | Nelson Resources. | 0.005 | 0% | 25% | -44% | $3,067,972 |

| TLM | Talisman Mining | 0.24 | -2% | 14% | 41% | $44,255,282 |

| BEZ | Besragoldinc | 0.1325 | -5% | 2% | 155% | $56,443,622 |

| PRU | Perseus Mining Ltd | 1.76 | 2% | -4% | -24% | $2,396,869,103 |

| SPQ | Superior Resources | 0.016 | 7% | 7% | -76% | $30,018,306 |

| PUR | Pursuit Minerals | 0.007 | 0% | -13% | -71% | $20,607,800 |

| RMS | Ramelius Resources | 1.5125 | -2% | -7% | 41% | $1,724,875,082 |

| PKO | Peako Limited | 0.004 | 0% | -20% | -76% | $2,108,339 |

| ICG | Inca Minerals Ltd | 0.01 | 0% | 0% | -62% | $5,290,437 |

| A1G | African Gold Ltd. | 0.038 | 3% | 52% | -55% | $6,264,515 |

| OAU | Ora Gold Limited | 0.0075 | 7% | 7% | 50% | $39,837,006 |

| GNM | Great Northern | 0.02 | 0% | 5% | -67% | $2,937,952 |

| KRM | Kingsrose Mining Ltd | 0.037 | 0% | -10% | -52% | $29,348,534 |

| BTR | Brightstar Resources | 0.0135 | -10% | -10% | -41% | $33,185,304 |

| RRL | Regis Resources | 2.055 | -5% | 0% | -7% | $1,563,551,333 |

| M24 | Mamba Exploration | 0.055 | 8% | 25% | -75% | $3,524,525 |

| TRM | Truscott Mining Corp | 0.05 | 0% | -9% | -9% | $8,668,353 |

| TNC | True North Copper | 0.081 | -19% | -19% | 53% | $31,556,999 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 0% | -30% | $4,983,744 |

| KNB | Koonenberrygold | 0.08 | 86% | 100% | 33% | $9,579,927 |

| AWJ | Auric Mining | 0.12 | 0% | 74% | 100% | $15,703,151 |

| AZS | Azure Minerals | 3.67 | 0% | 1% | 1123% | $1,683,354,040 |

| ENR | Encounter Resources | 0.285 | -11% | 19% | 63% | $112,630,219 |

| SNG | Siren Gold | 0.065 | 0% | 30% | -63% | $11,101,075 |

| STN | Saturn Metals | 0.19 | 3% | 23% | 0% | $41,319,788 |

| USL | Unico Silver Limited | 0.11 | 0% | 0% | -31% | $32,565,675 |

| PNM | Pacific Nickel Mines | 0.059 | -25% | -31% | -32% | $25,095,186 |

| AYM | Australia United Min | 0.003 | 0% | 50% | -40% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.16 | -11% | -41% | -61% | $53,828,666 |

| SPR | Spartan Resources | 0.41 | -11% | -13% | 145% | $386,395,574 |

| PNT | Panthermetalsltd | 0.06 | 0% | 0% | -67% | $5,101,500 |

| MEK | Meeka Metals Limited | 0.039 | 0% | 0% | -33% | $49,388,357 |

| GMD | Genesis Minerals | 1.6025 | -1% | -8% | 18% | $1,748,781,474 |

| PGO | Pacgold | 0.19 | -3% | -12% | -47% | $15,987,634 |

| FEG | Far East Gold | 0.135 | -4% | -10% | -71% | $24,381,838 |

| MI6 | Minerals260Limited | 0.275 | 0% | -4% | -18% | $58,500,000 |

| IGO | IGO Limited | 7.125 | -10% | -20% | -50% | $5,399,319,507 |

| GAL | Galileo Mining Ltd | 0.23 | -13% | -6% | -75% | $43,477,484 |

| RXL | Rox Resources | 0.155 | -14% | -14% | -24% | $57,249,910 |

| KIN | KIN Min NL | 0.064 | -2% | -6% | 19% | $71,867,183 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -89% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.11 | -8% | -4% | 53% | $74,242,876 |

| FAL | Falconmetalsltd | 0.12 | -11% | -17% | -56% | $22,125,000 |

| SXG | Southern Cross Gold | 1.03 | -6% | -9% | 39% | $91,406,457 |

| SPD | Southernpalladium | 0.31 | -3% | -9% | -62% | $13,785,065 |

| ORN | Orion Minerals Ltd | 0.013 | -10% | -13% | -21% | $75,985,451 |

| TMB | Tambourahmetals | 0.095 | -21% | -21% | -17% | $7,879,334 |

| TMS | Tennant Minerals Ltd | 0.032 | -6% | -11% | -6% | $25,220,687 |

| AZY | Antipa Minerals Ltd | 0.016 | 0% | 14% | -33% | $62,022,119 |

| PXX | Polarx Limited | 0.011 | 38% | 83% | -58% | $14,756,551 |

| TREDA | Toubani Res Ltd | 0.12 | -4% | -20% | -37% | $16,063,880 |

| AUN | Aurumin | 0.03 | 3% | 36% | -52% | $10,753,292 |

| GPR | Geopacific Resources | 0.016 | -6% | -11% | -50% | $13,147,478 |

| FXG | Felix Gold Limited | 0.046 | 15% | 12% | -58% | $5,460,494 |

| ILT | Iltani Resources Lim | 0.19 | 12% | 36% | 0% | $6,461,996 |

| ARD | Argent Minerals | 0.008 | -20% | -20% | -58% | $10,334,072 |

Best-performing goldies over the past week

The week’s biggest gainers

Koonenberry Gold (ASX:KNB) +86%

KNB has approval to drill the Atlantis copper gold prospect, an extensive 6.5km long anomaly underneath a scattering of high grade (+15%) copper rock chips in NSW.

The $9m capped junior reckons Atlantis has a similar vibe to the +5Moz Stawell gold mine in Western Victoria.

For more, read > here

White Cliff Minerals (ASX:WCN) +70%

WCN has actually made a head-turning uranium pivot, which accounts for recent outsized gains. For more on that, read > here)

PolarX (ASX:PXX) +38%

PNX Metals (ASX:PNX) +33%

GTI Energy (ASX:GTR) +33%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.