Gold Digger: Gold snags a Straya Day recovery on mixed US inflation data

Pic via Getty Images

- The price of gold made a decent recovery at back end of week after mixed US economy/inflation data flowed in

- But… all-in sustaining costs for global gold producers is still a strain in the current climate, says top gold analysts Metals Focus

- The week’s top ASX gold-related stocks led by NRM, DTR, AYM

Your gold and ASX gold stocks roundup, Straya Day, January 26.

After a droopy handful of days, the price of gold has recovered a tad towards the end of this work-shortened Australia Day week.

The XAU/USD spot gold price is trading around US$2,026 – back close again to where it was this time last week, having been down more than a tenner a few days ago.

In plastic fantastic, dinky-di, you-beaut Aussie dollars, it’s passing hands for $3,075.

No disaster, then, and the bulls still have the overall trend, this column reckons.

Analytical types were putting the earlier dip down to rising US yields ahead of key economic indicators from the US.

Those Personal Consumption Expenditures (PCE) and preliminary Q4 Gross Domestic Product (GDP) figures are now released into the wild over in the States, which will have some sort of bearing on the Fed’s interest rates stance.

To back off in March, or nay… that is the question. Many a cautious trader has reportedly been predicting cuts are more likely to kick in come May now. The CME Fedwatch probability tool shows a slump to about 49% for March on a potential cut, from up around 70% a week or two ago.

But those Treasury bond yields… they’ve now fallen back a bit amid a strong US GDP and weak durable goods and labour market data print.

As reported by Reuters, the US economy grew faster than expected in the fourth quarter amid strong consumer spending, with growth for the full year coming in at 2.5%. The report also revealed fourth-quarter inflation pressures subsiding.

And so far, gold has responded well to the mixed news that, on the whole, indicates the pace of inflation is slowing in the US of A.

And that’s despite gold so often being regarded as a high-inflation hedge. That narrative is not always so cut and dried. A sticky, “higher-for-longer” inflation path in the US can also strengthen the US dollar, limiting gold’s upside.

In any case, some things are worth more than the price of gold – in fact many, many things are, even Bitcoin (in actual US dollars per designated favoured unit anyway).

Obviously human life is one of those things, so a solemn nod today to this tragic occurrence over in one of Africa’s biggest gold producing countries – Mali – where an unregulated mine collapsed on Thursday, killing more than 70…

More than 70 people were killed in a collapse of a tunnel at a gold mining site in southwest Mali, local media reported Wednesday. pic.twitter.com/5W529UIiL2

— China Xinhua News (@XHNews) January 25, 2024

A lack of compliance within the “artisinal” mining sector in Mali and other African countries is an ongoing issue, hence an increased potential for horrendous accidents like this one.

High all-in sustaining costs tempering miner profits

Independent precious metals research outfit Metals Focus has released its latest report, and it reveals the global AISC (all in sustaining costs) for primary global gold producers is still high, still a challenge to negotiate in the current climate, despite the uptrending yellow metal spot price.

“The global average all-in sustaining cost (AISC) of primary gold producers broke the quarterly all-time high record again as it reached $1,343/oz in Q3.23,” according to the Metals Focus Gold Mines Cost Service published in December.

“Although inflation, in the input costs of gold production, has shown signs of easing, AISC continued to rise due to some operational constraints.”

Persistent inflation then, along with rising fuel and energy costs due to geopolitical turmoil, has been having a strong impact on AISC, keeping it elevated. For now.

“Mines operating with a $1,343/oz AISC would have been driven to suspension or closure if this persisted five years ago, but currently AISC margins remain healthy due to a higher gold price,” wrote Metals Focus.

“However, the inflated cost of extracting gold is dampening what mining companies could earn in profits in this high gold price market.”

Roll on that Fed inflation-taming, interest-rate-cutting narrative, then. Roll on, May 2024.

Moving on, let’s look for some more immediate happier news. We’ll find that locally.

Best-performing ASX gold stocks over the past week

The week’s biggest gainers

Native Mineral Resources (ASX:NMR) +69%

Up on no news.

Recap: in mid November, we reported the following >

- NMR agreed to purchase interests in two near-term gold projects in QLD

- A JV will be created with Ashby Mining

- The company is committing to spend $2m in exploration

Australia United Mining (ASX:AYM) +50%

Up on no fresh news.

Dateline Resources (ASX:DTR) +44%

Trending up on an update on exploration at the Colosseum gold mine in California, where drilling resumed in December.

A significant intersection reported – with sulphides (pyrite, sphalerite, galena and minor electrum) over 133m.

“Drillhole CM23-14 was drilled to test a revised geological model and expand upon the high-grade sedimentary breccia zone identified in CM23-08, which returned exceptional results of 76.2m at 8.62g/t Au,” detailed the company this week.

Castile Resources (ASX:CST) +38%

Up on no fresh news.

Castle Minerals (ASX:CDT) +33%

Up on no fresh news.

Other head-turning Aussie goldies…

… although not necessarily reflected in head-turning share-price gains. Yet.

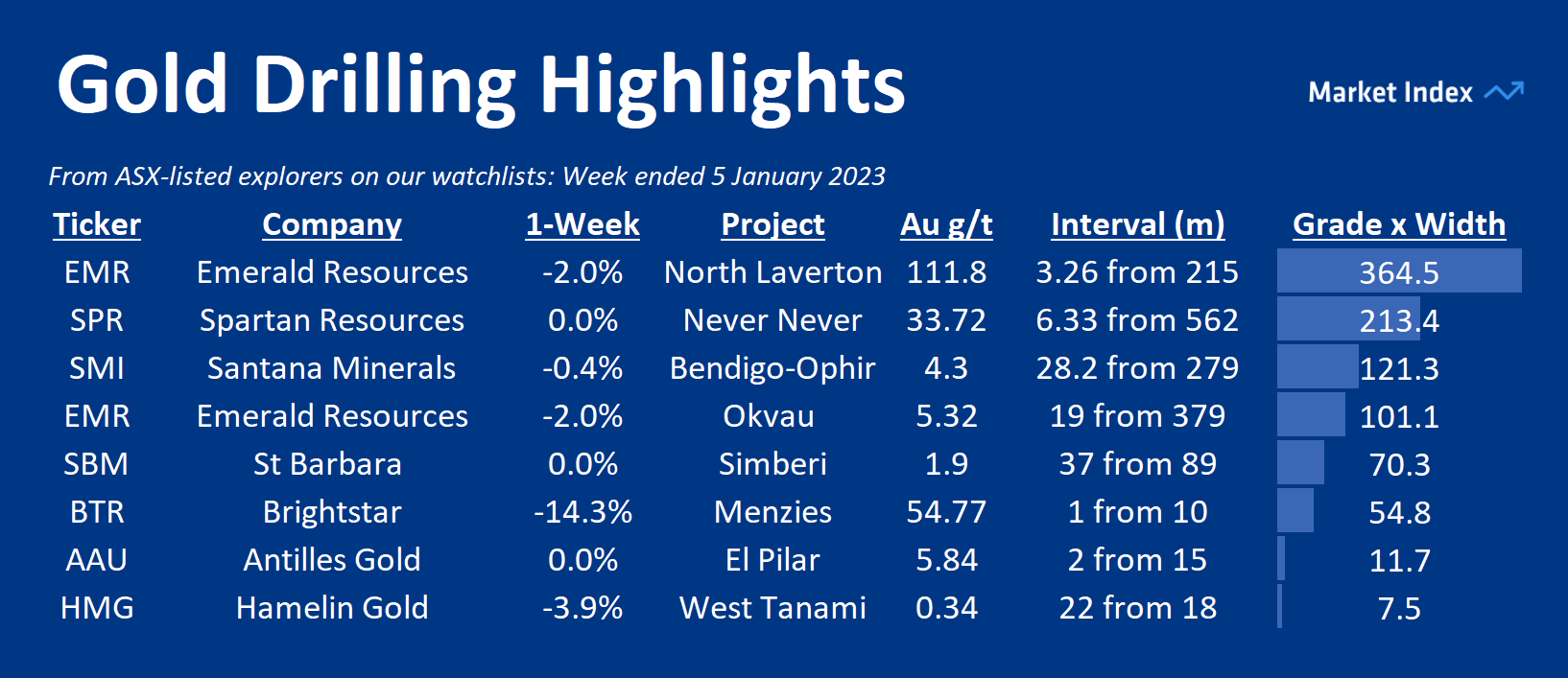

One of the ASX’s top performing gold producers Emerald Resources (ASX:EMR) had a notable drilling week, hitting significant gold mineralisation figures at two of its big projects, North Laverton in WA and Okvau in Cambodia.

This table, per Market Index, shows the standout results for EMR, with 3.26m at 111.79g/t Au from 214.74m at North Laverton… and 19m at 5.32g/t Au from 379m at Okvau.

And you can see for yourself the other standout drillers on that list, including Spartan, Santana, St Barbara, Brightstar, Antilles and Hamelin.

… is also worth a special mention because along with pure-play copper hunter Cobre (ASX:CBE), it got a major boost this week after being selected for BHP’s latest cohort of six projects (whittled down from more than 500) in the titan miner’s accelerator/funding program Xplor.

Perth-based Hamelin is on the hunt for gold as well as nickel-copper-PGE mineralised intrusions over in the Tanami Gold Province in Western Australia.

It’s the Ni-cu-PGE aspect that’s essentially helped land Hamelin in the program, though, which will see BHP provide HMG with up to US$500,000 in non-dilutive funding to support its exploration plans for those minerals.

Hamelin Gold MD Peter Bewick noted:

“The Xplor funded program will be completed in parallel to our ongoing gold exploration in the Tanami which includes a planned RC drill program at the Sultan prospect commencing in March-April 2024.

“This program is following up the identification through aircore drilling of extensive bedrock gold mineralisation at Sultan announced earlier in January 2024.”

Magnetic Resources may have just enjoyed an upgrade to gold resources at its Laverton project in WA, but new drilling has proven there’s plenty of room for growth after returning a 550m depth extension at Lady Julie North 4.

Read more > here.

Mt Malcolm Mines has started reverse circulation drilling at its brownfields Golden Crown gold prospect to advance its strategy of building high-grade resources to support a sustainable production base.

Read more > here.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.014 | 0% | -18% | -62% | $15,188,145 |

| NPM | Newpeak Metals | 0.016 | -16% | -11% | -84% | $1,599,228 |

| ASO | Aston Minerals Ltd | 0.019 | -5% | -27% | -81% | $24,606,221 |

| MTC | Metalstech Ltd | 0.22 | 0% | 13% | -56% | $41,570,010 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.039 | -3% | -17% | -61% | $4,505,372 |

| G88 | Golden Mile Res Ltd | 0.015 | -6% | -12% | -35% | $4,940,843 |

| DCX | Discovex Res Ltd | 0.001 | -33% | -33% | -67% | $3,302,568 |

| NMR | Native Mineral Res | 0.027 | 69% | 17% | -72% | $5,663,264 |

| AQX | Alice Queen Ltd | 0.006 | -14% | 20% | -82% | $4,145,905 |

| SLZ | Sultan Resources Ltd | 0.016 | 0% | -30% | -79% | $2,371,041 |

| MKG | Mako Gold | 0.009 | 0% | 0% | -80% | $5,961,685 |

| KSN | Kingston Resources | 0.081 | 7% | -1% | -33% | $40,334,909 |

| AMI | Aurelia Metals Ltd | 0.099 | -1% | -6% | -28% | $167,286,973 |

| PNX | PNX Metals Limited | 0.0035 | -13% | 17% | -7% | $18,832,187 |

| GIB | Gibb River Diamonds | 0.029 | -6% | -3% | -57% | $6,133,774 |

| KCN | Kingsgate Consolid. | 1.28 | 4% | -7% | -31% | $329,922,166 |

| TMX | Terrain Minerals | 0.005 | 0% | 0% | -23% | $7,158,353 |

| BNR | Bulletin Res Ltd | 0.089 | -11% | -26% | -7% | $26,131,586 |

| NXM | Nexus Minerals Ltd | 0.04 | -9% | -7% | -81% | $15,562,405 |

| SKY | SKY Metals Ltd | 0.031 | -16% | -16% | -54% | $14,303,341 |

| LM8 | Lunnonmetalslimited | 0.31 | -28% | -48% | -69% | $67,381,983 |

| CST | Castile Resources | 0.088 | 38% | 7% | -5% | $21,287,414 |

| YRL | Yandal Resources | 0.083 | -25% | 2% | -15% | $19,482,271 |

| FAU | First Au Ltd | 0.003 | 0% | 0% | -33% | $4,985,980 |

| ARL | Ardea Resources Ltd | 0.4 | -7% | -15% | -50% | $78,806,766 |

| GWR | GWR Group Ltd | 0.087 | 2% | -4% | 45% | $27,945,849 |

| IVR | Investigator Res Ltd | 0.035 | 3% | -5% | -24% | $55,435,785 |

| GTR | Gti Energy Ltd | 0.01 | -17% | 33% | -8% | $20,499,471 |

| IPT | Impact Minerals | 0.013 | 8% | 30% | 18% | $37,241,151 |

| BNZ | Benzmining | 0.19 | -10% | -19% | -56% | $21,178,535 |

| MOH | Moho Resources | 0.01 | 0% | -9% | -55% | $5,359,412 |

| BCM | Brazilian Critical | 0.0245 | -2% | -6% | -80% | $18,128,942 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | -17% | -50% | $2,603,442 |

| MRZ | Mont Royal Resources | 0.11 | 0% | -27% | -33% | $9,353,277 |

| SMS | Starmineralslimited | 0.037 | -8% | 6% | -58% | $2,809,144 |

| MVL | Marvel Gold Limited | 0.009 | -18% | -31% | -61% | $7,774,116 |

| PRX | Prodigy Gold NL | 0.005 | -17% | -17% | -58% | $8,755,539 |

| AAU | Antilles Gold Ltd | 0.022 | 0% | 0% | -45% | $18,884,459 |

| CWX | Carawine Resources | 0.105 | 0% | -5% | -11% | $24,793,172 |

| RND | Rand Mining Ltd | 1.375 | 0% | 1% | -4% | $78,204,446 |

| CAZ | Cazaly Resources | 0.02 | -26% | -35% | -38% | $9,092,726 |

| BMR | Ballymore Resources | 0.14 | 0% | 14% | -13% | $24,686,282 |

| DRE | Dreadnought Resources Ltd | 0.022 | -21% | -29% | -77% | $76,539,605 |

| ZNC | Zenith Minerals Ltd | 0.16 | -3% | -6% | -36% | $56,380,941 |

| REZ | Resourc & En Grp Ltd | 0.011 | -15% | -8% | -21% | $5,497,864 |

| LEX | Lefroy Exploration | 0.15 | -6% | -14% | -40% | $29,960,595 |

| ERM | Emmerson Resources | 0.05 | 2% | -9% | -38% | $27,235,489 |

| AM7 | Arcadia Minerals | 0.07 | 0% | -9% | -71% | $7,633,507 |

| ADT | Adriatic Metals | 3.21 | -6% | -8% | -3% | $777,165,637 |

| AS1 | Asara Resources Ltd | 0.012 | 0% | 0% | -61% | $9,512,771 |

| CYL | Catalyst Metals | 0.69 | 1% | -12% | -49% | $151,908,705 |

| CHN | Chalice Mining Ltd | 1.05 | -1% | -37% | -84% | $408,411,469 |

| KAL | Kalgoorliegoldmining | 0.026 | 0% | 4% | -69% | $4,121,019 |

| MLS | Metals Australia | 0.033 | -8% | -6% | -41% | $20,593,194 |

| ADN | Andromeda Metals Ltd | 0.024 | -8% | 9% | -57% | $74,640,202 |

| MEI | Meteoric Resources | 0.2 | -15% | -18% | 115% | $398,023,969 |

| SRN | Surefire Rescs NL | 0.011 | 22% | 22% | -27% | $21,594,736 |

| SIH | Sihayo Gold Limited | 0.002 | 0% | 33% | 0% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.04 | -32% | -26% | -75% | $20,416,876 |

| HMX | Hammer Metals Ltd | 0.041 | -2% | -16% | -41% | $36,342,701 |

| WCN | White Cliff Min Ltd | 0.015 | -6% | 67% | 25% | $19,400,390 |

| AVM | Advance Metals Ltd | 0.033 | -8% | -18% | -86% | $1,322,803 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -6% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.007 | 17% | -13% | -56% | $11,455,470 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | -33% | $8,970,108 |

| AME | Alto Metals Limited | 0.031 | -16% | -28% | -56% | $22,367,218 |

| CTO | Citigold Corp Ltd | 0.005 | 0% | -17% | -17% | $15,000,000 |

| TIE | Tietto Minerals | 0.61 | 1% | -1% | -21% | $689,233,175 |

| SMI | Santana Minerals Ltd | 1.295 | 0% | 34% | 77% | $230,291,803 |

| M2R | Miramar | 0.024 | -14% | 14% | -68% | $3,572,869 |

| MHC | Manhattan Corp Ltd | 0.004 | 0% | 0% | -43% | $11,747,919 |

| GRL | Godolphin Resources | 0.042 | 0% | 5% | -58% | $7,108,165 |

| SVG | Savannah Goldfields | 0.039 | 0% | -10% | -76% | $8,772,769 |

| EMC | Everest Metals Corp | 0.079 | 3% | -4% | -20% | $12,978,366 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | 6% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.075 | -25% | -40% | -83% | $21,866,935 |

| G50 | Gold50Limited | 0.1 | -17% | -23% | -50% | $10,929,000 |

| ADV | Ardiden Ltd | 0.16 | -9% | -11% | -50% | $10,002,801 |

| AAR | Astral Resources NL | 0.067 | 3% | -7% | -15% | $53,137,535 |

| VMC | Venus Metals Cor Ltd | 0.096 | -1% | -9% | 3% | $18,213,954 |

| NAE | New Age Exploration | 0.004 | -20% | -33% | -50% | $7,175,596 |

| VKA | Viking Mines Ltd | 0.012 | -14% | -8% | 50% | $12,303,101 |

| LCL | LCL Resources Ltd | 0.013 | -13% | -19% | -69% | $12,364,905 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | -33% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.005 | 11% | 0% | -64% | $3,498,278 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | 0% | -40% | $8,020,728 |

| PRS | Prospech Limited | 0.04 | -9% | 18% | 24% | $10,805,949 |

| TTM | Titan Minerals | 0.023 | 0% | -18% | -69% | $38,899,195 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -54% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.033 | -3% | -28% | -69% | $17,312,707 |

| KZR | Kalamazoo Resources | 0.099 | -1% | -6% | -54% | $17,128,765 |

| BCN | Beacon Minerals | 0.024 | -4% | -8% | -20% | $90,162,436 |

| MAU | Magnetic Resources | 0.965 | 7% | -4% | 21% | $236,103,906 |

| BC8 | Black Cat Syndicate | 0.245 | 14% | -4% | -37% | $74,422,509 |

| EM2 | Eagle Mountain | 0.073 | 1% | -3% | -72% | $22,262,581 |

| EMR | Emerald Res NL | 3.26 | 0% | 6% | 132% | $2,038,451,848 |

| BYH | Bryah Resources Ltd | 0.012 | -8% | -14% | -51% | $5,203,287 |

| HCH | Hot Chili Ltd | 1.04 | 6% | 3% | 5% | $124,223,014 |

| WAF | West African Res Ltd | 0.94 | 1% | -3% | -20% | $964,757,792 |

| MEU | Marmota Limited | 0.048 | 9% | 9% | 4% | $50,822,428 |

| NVA | Nova Minerals Ltd | 0.35 | 8% | 3% | -50% | $73,811,486 |

| SVL | Silver Mines Limited | 0.15 | -3% | -6% | -33% | $210,649,821 |

| PGD | Peregrine Gold | 0.32 | 0% | 33% | -44% | $21,438,874 |

| ICL | Iceni Gold | 0.046 | -15% | -13% | -56% | $11,341,808 |

| FG1 | Flynngold | 0.069 | 15% | 35% | -33% | $10,054,973 |

| WWI | West Wits Mining Ltd | 0.012 | 0% | 0% | -33% | $29,164,700 |

| RML | Resolution Minerals | 0.003 | 0% | 0% | -63% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.02 | -26% | -23% | -76% | $3,937,830 |

| AL8 | Alderan Resource Ltd | 0.004 | -20% | -27% | -56% | $4,427,445 |

| GMN | Gold Mountain Ltd | 0.004 | 0% | -20% | -33% | $9,076,314 |

| MEG | Megado Minerals Ltd | 0.023 | -15% | -12% | -48% | $5,852,478 |

| HMG | Hamelingoldlimited | 0.075 | -4% | 14% | -44% | $11,812,500 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.17 | -8% | -8% | -66% | $15,153,288 |

| TBR | Tribune Res Ltd | 3.02 | 3% | 7% | -23% | $158,453,593 |

| FML | Focus Minerals Ltd | 0.175 | -3% | 0% | -5% | $50,147,763 |

| GSR | Greenstone Resources | 0.008 | 14% | 14% | -74% | $10,944,908 |

| VRC | Volt Resources Ltd | 0.007 | 8% | 17% | -50% | $28,910,747 |

| ARV | Artemis Resources | 0.015 | -17% | -25% | -42% | $25,367,942 |

| HRN | Horizon Gold Ltd | 0.3 | 0% | 0% | -14% | $43,451,977 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | -15% | -45% | $24,706,568 |

| QML | Qmines Limited | 0.072 | -4% | -12% | -61% | $15,186,676 |

| RDN | Raiden Resources Ltd | 0.026 | -7% | -32% | 447% | $69,070,693 |

| TCG | Turaco Gold Limited | 0.125 | -4% | 4% | 102% | $73,511,111 |

| KCC | Kincora Copper | 0.031 | -23% | -33% | -66% | $6,161,717 |

| GBZ | GBM Rsources Ltd | 0.008 | 0% | -11% | -84% | $5,851,463 |

| DTM | Dart Mining NL | 0.014 | -7% | -13% | -74% | $3,186,115 |

| MKR | Manuka Resources. | 0.084 | 20% | 2% | -10% | $47,470,085 |

| AUC | Ausgold Limited | 0.026 | 0% | -10% | -56% | $59,699,671 |

| ANX | Anax Metals Ltd | 0.02 | -17% | -33% | -69% | $9,670,353 |

| EMU | EMU NL | 0.001 | 0% | -33% | -82% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -43% | $3,131,208 |

| SSR | SSR Mining Inc. | 14.58 | -4% | -10% | -40% | $93,400,369 |

| PNR | Pantoro Limited | 0.041 | -9% | -21% | -63% | $213,365,251 |

| CMM | Capricorn Metals | 4.51 | 5% | -5% | -7% | $1,701,713,254 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -14% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.005 | 0% | 0% | -17% | $9,969,297 |

| HAW | Hawthorn Resources | 0.098 | 0% | -1% | -7% | $32,831,530 |

| BGD | Bartongoldholdings | 0.25 | 4% | 0% | 9% | $49,131,134 |

| SVY | Stavely Minerals Ltd | 0.033 | -25% | -30% | -87% | $12,604,023 |

| AGC | AGC Ltd | 0.065 | 0% | -10% | 0% | $14,444,444 |

| RGL | Riversgold | 0.01 | -9% | -17% | -67% | $9,676,615 |

| TSO | Tesoro Gold Ltd | 0.024 | -8% | -4% | -27% | $29,509,937 |

| GUE | Global Uranium | 0.145 | -9% | 53% | -29% | $30,770,301 |

| CPM | Coopermetalslimited | 0.28 | -8% | -16% | 14% | $18,019,582 |

| MM8 | Medallion Metals. | 0.059 | -2% | -5% | -60% | $18,151,447 |

| FFM | Firefly Metals Ltd | 0.53 | 0% | -15% | -37% | $192,227,948 |

| CBY | Canterbury Resources | 0.03 | 20% | 0% | -25% | $5,152,227 |

| LYN | Lycaonresources | 0.19 | -5% | 6% | -27% | $8,370,688 |

| SFR | Sandfire Resources | 7.05 | 7% | 2% | 10% | $3,221,796,448 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -75% | $4,881,018 |

| TAM | Tanami Gold NL | 0.033 | -6% | -8% | -23% | $38,778,203 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.025 | -4% | -7% | -64% | $7,189,238 |

| ALK | Alkane Resources Ltd | 0.55 | -3% | -17% | -19% | $331,890,524 |

| BMO | Bastion Minerals | 0.014 | -13% | -13% | -75% | $4,360,217 |

| IDA | Indiana Resources | 0.083 | 5% | 30% | 43% | $51,064,676 |

| GSM | Golden State Mining | 0.011 | -8% | -27% | -74% | $3,073,077 |

| NSM | Northstaw | 0.04 | -18% | -20% | -81% | $5,595,031 |

| GSN | Great Southern | 0.019 | 6% | -5% | -32% | $14,338,069 |

| RED | Red 5 Limited | 0.325 | 12% | 8% | 35% | $1,125,735,178 |

| DEG | De Grey Mining | 1.2 | 3% | -7% | -23% | $2,221,518,630 |

| THR | Thor Energy PLC | 0.035 | -10% | 21% | -42% | $6,511,271 |

| CDR | Codrus Minerals Ltd | 0.05 | -18% | -12% | -62% | $4,619,375 |

| MDI | Middle Island Res | 0.015 | -12% | 0% | -74% | $3,264,810 |

| WTM | Waratah Minerals Ltd | 0.1 | 18% | -13% | -17% | $14,936,450 |

| POL | Polymetals Resources | 0.285 | 0% | -8% | 46% | $44,921,075 |

| RDS | Redstone Resources | 0.005 | 0% | 0% | -50% | $4,626,892 |

| NAG | Nagambie Resources | 0.026 | -7% | -7% | -52% | $20,644,981 |

| BGL | Bellevue Gold Ltd | 1.295 | -9% | -23% | 4% | $1,490,451,867 |

| GBR | Greatbould Resources | 0.058 | -2% | -12% | -33% | $34,723,858 |

| KAI | Kairos Minerals Ltd | 0.013 | 0% | -13% | -40% | $34,071,858 |

| KAU | Kaiser Reef | 0.12 | -6% | -29% | -37% | $20,525,267 |

| HRZ | Horizon | 0.035 | -3% | -17% | -44% | $24,534,429 |

| CAI | Calidus Resources | 0.17 | -19% | -15% | -56% | $104,094,568 |

| CDT | Castle Minerals | 0.008 | 33% | -6% | -64% | $9,795,944 |

| RSG | Resolute Mining | 0.42 | 2% | -6% | 50% | $894,201,005 |

| MXR | Maximus Resources | 0.035 | -17% | 0% | -10% | $11,233,102 |

| EVN | Evolution Mining Ltd | 3.17 | 2% | -19% | -1% | $6,262,355,700 |

| CXU | Cauldron Energy Ltd | 0.038 | -14% | 58% | 543% | $43,525,127 |

| DLI | Delta Lithium | 0.275 | -5% | -40% | -46% | $195,750,402 |

| ALY | Alchemy Resource Ltd | 0.008 | -11% | -20% | -50% | $9,424,610 |

| HXG | Hexagon Energy | 0.012 | 20% | 0% | -20% | $6,154,991 |

| OBM | Ora Banda Mining Ltd | 0.23 | 0% | 0% | 180% | $392,557,070 |

| SLR | Silver Lake Resource | 1.2 | 4% | 1% | -18% | $1,121,693,200 |

| AVW | Avira Resources Ltd | 0.001 | -50% | -50% | -67% | $2,133,790 |

| LCY | Legacy Iron Ore | 0.017 | 6% | 6% | 0% | $108,916,045 |

| PDI | Predictive Disc Ltd | 0.2 | 3% | -5% | 8% | $415,248,818 |

| MAT | Matsa Resources | 0.028 | 0% | 4% | -28% | $13,407,073 |

| ZAG | Zuleika Gold Ltd | 0.02 | 0% | 5% | 11% | $14,721,710 |

| GML | Gateway Mining | 0.024 | 9% | -4% | -65% | $8,169,981 |

| SBM | St Barbara Limited | 0.175 | -3% | -13% | -43% | $143,144,817 |

| SBR | Sabre Resources | 0.027 | -10% | -7% | -41% | $10,105,072 |

| STK | Strickland Metals | 0.115 | 17% | 34% | 203% | $190,934,821 |

| ION | Iondrive Limited | 0.011 | -8% | -8% | -59% | $5,349,138 |

| CEL | Challenger Gold Ltd | 0.073 | 4% | 12% | -58% | $92,065,291 |

| LRL | Labyrinth Resources | 0.006 | 0% | -14% | -67% | $7,125,262 |

| NST | Northern Star | 12.9 | 6% | -6% | 2% | $14,824,952,396 |

| OZM | Ozaurum Resources | 0.079 | -25% | -34% | 5% | $12,541,250 |

| TG1 | Techgen Metals Ltd | 0.055 | -5% | -28% | -39% | $5,286,495 |

| XAM | Xanadu Mines Ltd | 0.052 | 0% | -5% | 68% | $88,442,675 |

| AQI | Alicanto Min Ltd | 0.032 | -9% | -9% | -43% | $19,690,778 |

| KTA | Krakatoa Resources | 0.02 | -5% | -44% | -50% | $9,442,144 |

| ARN | Aldoro Resources | 0.088 | 5% | 7% | -58% | $11,846,889 |

| WGX | Westgold Resources. | 2.07 | 2% | -5% | 73% | $980,399,051 |

| MBK | Metal Bank Ltd | 0.024 | -11% | -11% | -39% | $9,371,023 |

| A8G | Australasian Metals | 0.125 | -7% | -26% | -34% | $6,515,062 |

| TAR | Taruga Minerals | 0.008 | 0% | -33% | -64% | $5,648,214 |

| DTR | Dateline Resources | 0.013 | 44% | 30% | -64% | $17,284,230 |

| GOR | Gold Road Res Ltd | 1.71 | 2% | -15% | -1% | $1,848,854,120 |

| S2R | S2 Resources | 0.15 | 3% | -17% | -12% | $67,778,699 |

| NES | Nelson Resources. | 0.004 | -20% | 0% | -43% | $2,454,377 |

| TLM | Talisman Mining | 0.205 | -13% | -5% | 24% | $38,605,672 |

| BEZ | Besragoldinc | 0.15 | 11% | 0% | 213% | $62,715,136 |

| PRU | Perseus Mining Ltd | 1.865 | 7% | 0% | -18% | $2,561,696,778 |

| SPQ | Superior Resources | 0.014 | -7% | 8% | -79% | $28,017,086 |

| PUR | Pursuit Minerals | 0.006 | -14% | -20% | -73% | $17,663,828 |

| RMS | Ramelius Resources | 1.55 | 2% | -10% | 48% | $1,765,846,733 |

| PKO | Peako Limited | 0.004 | 0% | -20% | -79% | $2,108,339 |

| ICG | Inca Minerals Ltd | 0.009 | 0% | -10% | -61% | $5,290,437 |

| A1G | African Gold Ltd. | 0.036 | -3% | 33% | -60% | $6,095,204 |

| OAU | Ora Gold Limited | 0.006 | -14% | 0% | 37% | $34,146,005 |

| GNM | Great Northern | 0.02 | 5% | 0% | -56% | $3,092,582 |

| KRM | Kingsrose Mining Ltd | 0.033 | -15% | -18% | -55% | $24,833,375 |

| BTR | Brightstar Resources | 0.012 | -14% | -20% | -54% | $28,444,546 |

| RRL | Regis Resources | 2.16 | 4% | 0% | -5% | $1,631,531,825 |

| M24 | Mamba Exploration | 0.055 | 0% | 34% | -73% | $3,524,525 |

| TRM | Truscott Mining Corp | 0.05 | 0% | -9% | -33% | $8,668,353 |

| TNC | True North Copper | 0.09 | 10% | -18% | 70% | $34,635,731 |

| MOM | Moab Minerals Ltd | 0.007 | 0% | 0% | -30% | $4,983,744 |

| KNB | Koonenberrygold | 0.06 | -25% | 25% | 5% | $7,184,945 |

| AWJ | Auric Mining | 0.096 | -20% | -4% | 71% | $12,562,521 |

| AZS | Azure Minerals | 3.61 | -2% | -3% | 1065% | $1,655,833,266 |

| ENR | Encounter Resources | 0.27 | -4% | -10% | 64% | $108,607,711 |

| SNG | Siren Gold | 0.069 | 0% | 17% | -61% | $11,101,075 |

| STN | Saturn Metals | 0.19 | 3% | 9% | 3% | $42,436,539 |

| USL | Unico Silver Limited | 0.11 | 5% | -8% | -29% | $32,565,675 |

| PNM | Pacific Nickel Mines | 0.051 | -15% | -43% | -38% | $21,330,908 |

| AYM | Australia United Min | 0.003 | 50% | 0% | -25% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.155 | -9% | -23% | -59% | $49,079,078 |

| SPR | Spartan Resources | 0.425 | 5% | -15% | 154% | $405,476,837 |

| PNT | Panthermetalsltd | 0.05 | -17% | -17% | -73% | $4,358,308 |

| MEK | Meeka Metals Limited | 0.037 | -8% | -8% | -35% | $45,684,230 |

| GMD | Genesis Minerals | 1.565 | -2% | -11% | 20% | $1,721,284,910 |

| PGO | Pacgold | 0.165 | -13% | -13% | -55% | $13,883,998 |

| FEG | Far East Gold | 0.14 | 4% | 0% | -69% | $25,284,869 |

| MI6 | Minerals260Limited | 0.19 | -24% | -43% | -50% | $44,460,000 |

| IGO | IGO Limited | 7.47 | 5% | -17% | -53% | $5,656,790,563 |

| GAL | Galileo Mining Ltd | 0.205 | -7% | -18% | -78% | $40,513,110 |

| RXL | Rox Resources | 0.15 | -3% | -19% | -23% | $55,403,139 |

| KIN | KIN Min NL | 0.0615 | 1% | -4% | 16% | $72,456,259 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.1 | -5% | -9% | 56% | $70,707,501 |

| FAL | Falconmetalsltd | 0.135 | 8% | 0% | -49% | $23,895,000 |

| SXG | Southern Cross Gold | 1.085 | 7% | -18% | 51% | $97,710,351 |

| SPD | Southernpalladium | 0.31 | -3% | -15% | -62% | $13,354,281 |

| ORN | Orion Minerals Ltd | 0.014 | 8% | 0% | -7% | $81,830,486 |

| TMB | Tambourahmetals | 0.0825 | -13% | -28% | -31% | $6,842,579 |

| TMS | Tennant Minerals Ltd | 0.029 | -12% | -19% | -17% | $22,163,634 |

| AZY | Antipa Minerals Ltd | 0.015 | 0% | -12% | -35% | $62,022,119 |

| PXX | Polarx Limited | 0.012 | 33% | 100% | -56% | $19,675,401 |

| TREDA | Toubani Res Ltd | 0.13 | 8% | -10% | -41% | $17,402,537 |

| AUN | Aurumin | 0.028 | -7% | 27% | -56% | $10,036,406 |

| GPR | Geopacific Resources | 0.015 | -6% | -29% | -45% | $12,325,761 |

| FXG | Felix Gold Limited | 0.042 | -9% | -13% | -62% | $4,985,669 |

| ILT | Iltani Resources Lim | 0.175 | -8% | 25% | 0% | $5,951,838 |

| ARD | Argent Minerals | 0.008 | -11% | -20% | -53% | $10,334,072 |

Gold-based IPOs we’re keeping an eye on

Golden Globe Resources (ASX:GGR)

Expected listing: January 18, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was down to list on the local bourse in October 2023. In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.