Gold Digger: Buckle up! Central Banks are buying gold at the fastest pace on record

Pic: Ken Redding,The Image Bank/ Via Getty Images

- Central banks buying gold at the fastest pace on record

- Another gold bull signal for 2023 — the crypto collapse

- Global silver demand on course for record high in 2022

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

Central banks buying gold at the fastest pace on record

UBS are the latest investment bank getting bullish on gold.

With anaemic global growth in the range of around 2% next year, UBS can foresee a switch into gold, particularly in a falling USD environment.

The reasoning was partially based around their observation that longer term investors (particularly central banks) were starting to accumulate heavily.

Justin McQueen, Senior Market Analyst at Capital.com, says central banks have been buying gold in Q3 at the fastest pace on record at roughly $20bn.

Among the largest buyers of gold are Turkey, Qatar and Uzbekistan.

However, there have been central banks that have not been identified that have purchased a sizeable amount of gold. Some speculate this may be in fact China, as per reports in the Nikkei.

“The rationale is that China would look to reduce their exposure to the US dollar and therefore has been stockpiling on gold,” McQueen says.

“Now while China’s involvement cannot be confirmed, the fact that central banks have been excessively accumulating does provide an undercurrent of support for the precious metal.”

Another gold bull signal — the crypto collapse

Earlier this week two of Australia’s biggest gold miners said the “unravelling of cryptocurrency” would add to bullish conditions for the precious metal in the coming year.

The vast bulk of gold price moves are driven by demand from investors, an area where cryptos like Bitcoin have proved a disrupter in recent years at a time when the degeneration of global diplomatic relations between Russia, China and the West should have been a tailwind for gold prices, writes Josh Chiat.

Evolution Mining (ASX:EVN) boss Jake Klein, who chairs Australia’s third largest gold miner, told shareholders at the company’s AGM today the FTX platform’s multi-billion dollar collapse reinforced gold’s place as the superior store of wealth globally.

“A stronger US dollar and the Federal Reserve’s aggressive monetary tightening, particularly since June, have until recently been a key headwind for the gold price whilst inflation has concurrently put upward pressure on costs,” he said.

“Looking forward though, the outlook for gold is stronger with the Fed expected to ease interest rate increases within 12 months as inflation reduces and the global economy is expected to slow significantly.

“The recent developments in the crypto space, with significant losses incurred by investors in FTX and other crypto assets, have also reinforced gold’s worth as a superior storer of value.

“In uncertain times like this, we believe that Evolution is well placed to prosper through these headwinds the sector is currently experiencing.”

Regis Resources (ASX:RRL) chairman James MacTier said much the same.

“Recently, buying of gold by central banks, a weaker USD, stabilising bond yields, continued geopolitical risk and the unravelling of crypto “currencies” are combining to give renewed support to the gold price and gold equities,” he said.

“This, combined with our own improving performance and growth initiatives, bodes well for the future of our company.”

EVN, RRL share price charts

Global silver demand on course for record high in 2022

Gold isn’t the only precious metal in demand.

This year, global physical silver demand is expected to jump by 16% year-on-year to a new high of 1.2 billion ounces (37,644t), Metals Focus says.

To put this into perspective, over the previous 12 years, silver demand has averaged “just” 1Bn ounces (30,907t).

“This year’s performance will comfortably outstrip an estimated 2% rise for global silver supply,” it says.

“As a result, the physical deficit is expected to surge to 194Moz (6,023t) this year, which at the very least will be a multi-decade high.”

The sharp increase has been reflected in a steep fall in exchange-held silver bullion stocks, which have fallen by around 400Moz over the first 10 months to around 1.3Bn ounces.

Even so, the silver price has generally underperformed this year, dropping by around 6% intra-year against a 2% loss for gold, Metals Focus says.

Silver – which has a dual role as an investment and industrial product — has come under pressure for two main reasons.

“First, expectations this year of aggressive rate tightening by the Fed, which has contributed to the multi-decade high in the US dollar, has weighed on gold, which in turn has affected silver,” it says.

“Second, growing concerns about a recession have impacted base metals, especially over the past 3-4 months, which in turn has hit silver, given its importance as an industrial metal.

“As a result, silver’s dual role as a precious and industrial metal has meant that investors have responded by building short positions on the CME, especially during much of the second half of this year.

“This helps explain why the gold:silver ratio has trended higher over this timeframe, reaching the low 80s.”

The often-mentioned ‘gold-silver ratio’ is simply the amount of silver it takes to purchase one ounce of gold.

The 20-year average is 60:1, which means silver is currently trading at a historically wide discount to the gold price.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ICL | Iceni Gold | 167% | 121% | 35% | -23% | 0.155 | $17,947,500 |

| HAW | Hawthorn Resources | 69% | 76% | 25% | 50% | 0.15 | $33,351,561 |

| RDS | Redstone Resources | 67% | 25% | 25% | -33% | 0.01 | $7,368,324 |

| CDR | Codrus Minerals Ltd | 64% | 74% | 46% | -23% | 0.12 | $4,800,000 |

| LCL | Los Cerros Limited | 48% | 79% | -32% | -67% | 0.043 | $23,423,359 |

| BEZ | Besragoldinc | 40% | 14% | -29% | -61% | 0.056 | $14,118,369 |

| MI6 | Minerals260Limited | 36% | 47% | 8% | -33% | 0.455 | $99,000,000 |

| TSC | Twenty Seven Co. Ltd | 33% | 0% | -5% | -37% | 0.002 | $7,982,442 |

| EMU | EMU NL | 33% | 33% | -56% | -65% | 0.008 | $4,810,877 |

| MZZ | Matador Mining Ltd | 26% | 45% | -34% | -61% | 0.145 | $42,149,815 |

| SIH | Sihayo Gold Limited | 25% | 25% | -38% | -69% | 0.0025 | $12,204,256 |

| VKA | Viking Mines Ltd | 25% | 25% | 25% | -47% | 0.01 | $10,252,584 |

| AMI | Aurelia Metals Ltd | 22% | 22% | -60% | -64% | 0.14 | $160,866,838 |

| OAU | Ora Gold Limited | 20% | -25% | -50% | -63% | 0.006 | $5,905,388 |

| GSM | Golden State Mining | 20% | 53% | -20% | -45% | 0.055 | $6,669,810 |

| MKR | Manuka Resources. | 19% | 32% | -16% | -49% | 0.185 | $74,073,388 |

| IPT | Impact Minerals | 18% | 67% | 0% | -26% | 0.01 | $22,332,335 |

| AWJ | Auric Mining | 17% | 14% | -12% | -39% | 0.082 | $5,812,751 |

| PUA | Peak Minerals Ltd | 17% | 0% | -50% | -51% | 0.007 | $6,768,910 |

| FML | Focus Minerals Ltd | 15% | 39% | 11% | -34% | 0.195 | $54,446,143 |

| BBX | BBX Minerals Ltd | 14% | 41% | -26% | -54% | 0.0775 | $37,720,914 |

| SVL | Silver Mines Limited | 14% | 17% | 14% | 0% | 0.21 | $264,825,589 |

| ASO | Aston Minerals Ltd | 13% | -3% | -45% | -33% | 0.077 | $82,401,289 |

| CHN | Chalice Mining Ltd | 13% | 17% | -21% | -43% | 5.245 | $1,975,560,269 |

| MLS | Metals Australia | 11% | 20% | -49% | 23% | 0.049 | $29,744,773 |

| TBR | Tribune Res Ltd | 11% | 12% | -6% | -25% | 3.8 | $199,378,693 |

| LCY | Legacy Iron Ore | 11% | 0% | -13% | -17% | 0.02 | $115,322,872 |

| AGG | AngloGold Ashanti | 11% | 39% | 11% | 0% | 5.64 | $477,261,543 |

| TMZ | Thomson Res Ltd | 11% | 11% | -25% | -70% | 0.021 | $16,127,338 |

| SFR | Sandfire Resources | 10% | 51% | -3% | -15% | 5.215 | $2,116,537,097 |

| KAL | Kalgoorliegoldmining | 10% | 5% | -4% | -33% | 0.11 | $7,743,460 |

| G50 | Gold50Limited | 10% | 83% | 5% | -21% | 0.22 | $12,527,460 |

| ZAG | Zuleika Gold Ltd | 10% | 16% | -42% | 16% | 0.022 | $11,474,114 |

| RMS | Ramelius Resources | 10% | 46% | -32% | -45% | 0.9125 | $754,536,291 |

| ICG | Inca Minerals Ltd | 10% | 6% | -59% | -70% | 0.034 | $17,354,262 |

| YRL | Yandal Resources | 9% | 9% | -41% | -69% | 0.12 | $18,147,067 |

| AAJ | Aruma Resources Ltd | 8% | 5% | 1% | 4% | 0.077 | $12,399,959 |

| TAR | Taruga Minerals | 8% | 26% | 77% | -13% | 0.039 | $25,825,670 |

| RRL | Regis Resources | 8% | 31% | -4% | 1% | 1.965 | $1,438,324,387 |

| KCC | Kincora Copper | 8% | 13% | -20% | -46% | 0.068 | $4,843,331 |

| BGL | Bellevue Gold Ltd | 8% | 35% | 11% | 16% | 0.97 | $1,021,339,170 |

| BCN | Beacon Minerals | 8% | 12% | -13% | -10% | 0.028 | $101,432,741 |

| CY5 | Cygnus Gold Limited | 7% | 9% | 248% | 166% | 0.505 | $79,675,535 |

| RED | Red 5 Limited | 7% | 18% | -53% | -32% | 0.1825 | $512,846,149 |

| MEI | Meteoric Resources | 7% | 25% | 7% | -12% | 0.015 | $22,894,461 |

| E2M | E2 Metals | 7% | 11% | -14% | -62% | 0.15 | $25,887,202 |

| ZNC | Zenith Minerals Ltd | 7% | 7% | -15% | 31% | 0.315 | $107,108,806 |

| WRM | White Rock Min Ltd | 7% | 22% | -27% | -70% | 0.095 | $19,090,356 |

| REZ | Resourc & En Grp Ltd | 6% | 0% | -55% | -66% | 0.017 | $8,496,698 |

| AM7 | Arcadia Minerals | 6% | -19% | 11% | 19% | 0.255 | $11,907,962 |

| CLA | Celsius Resource Ltd | 6% | 31% | -11% | -35% | 0.017 | $25,548,094 |

| LRL | Labyrinth Resources | 6% | -6% | -37% | -58% | 0.017 | $15,720,602 |

| SBM | St Barbara Limited | 6% | 38% | -47% | -54% | 0.6475 | $538,587,486 |

| TIE | Tietto Minerals | 6% | 16% | 86% | 76% | 0.8 | $863,621,992 |

| GMR | Golden Rim Resources | 6% | -8% | -44% | -63% | 0.036 | $11,300,882 |

| GOR | Gold Road Res Ltd | 6% | 33% | 34% | 15% | 1.7625 | $1,899,020,506 |

| OZM | Ozaurum Resources | 6% | -8% | -63% | -51% | 0.074 | $5,019,552 |

| NST | Northern Star | 6% | 27% | 19% | 10% | 10.62 | $12,265,364,037 |

| AUT | Auteco Minerals | 5% | 18% | 7% | -24% | 0.058 | $124,070,178 |

| SPQ | Superior Resources | 5% | 28% | 74% | 247% | 0.059 | $103,774,445 |

| EVN | Evolution Mining Ltd | 5% | 38% | -27% | -33% | 2.695 | $5,027,664,730 |

| BRB | Breaker Res NL | 5% | 33% | 33% | -18% | 0.305 | $97,843,350 |

| TAM | Tanami Gold NL | 5% | 5% | -24% | -41% | 0.042 | $48,178,979 |

| TG1 | Techgen Metals Ltd | 5% | -9% | -32% | -48% | 0.105 | $4,982,155 |

| KSN | Kingston Resources | 5% | 43% | -24% | -42% | 0.11 | $40,512,869 |

| SSR | SSR Mining Inc. | 5% | 1% | -23% | -14% | 22.45 | $405,711,148 |

| FAL | Falconmetalsltd | 5% | 15% | -12% | 0% | 0.23 | $40,710,000 |

| BNR | Bulletin Res Ltd | 4% | 4% | -26% | 56% | 0.125 | $35,110,932 |

| MOH | Moho Resources | 4% | 4% | -26% | -58% | 0.025 | $5,191,555 |

| MVL | Marvel Gold Limited | 4% | 4% | -36% | -64% | 0.025 | $17,612,359 |

| NSM | Northstaw | 4% | -29% | -53% | -69% | 0.1 | $12,012,700 |

| GSR | Greenstone Resources | 4% | 4% | -42% | -13% | 0.026 | $27,939,053 |

| TUL | Tulla Resources | 4% | -12% | -31% | -29% | 0.395 | $77,228,203 |

| BYH | Bryah Resources Ltd | 4% | 8% | -37% | -50% | 0.027 | $7,593,844 |

| TBA | Tombola Gold Ltd | 4% | -4% | -53% | -18% | 0.027 | $33,065,371 |

| DEG | De Grey Mining | 4% | 21% | 18% | 1% | 1.275 | $1,988,415,943 |

| AQI | Alicanto Min Ltd | 4% | 68% | -24% | -61% | 0.057 | $25,348,676 |

| VMC | Venus Metals Cor Ltd | 4% | 21% | -17% | -26% | 0.145 | $25,821,409 |

| KCN | Kingsgate Consolid. | 3% | 24% | 28% | 37% | 1.94 | $437,107,895 |

| GIB | Gibb River Diamonds | 3% | 9% | 9% | -27% | 0.06 | $12,690,567 |

| ALY | Alchemy Resource Ltd | 3% | 15% | 15% | 150% | 0.03 | $30,629,983 |

| GWR | GWR Group Ltd | 3% | 2% | -49% | -39% | 0.064 | $20,557,866 |

| WAF | West African Res Ltd | 3% | 13% | -8% | -14% | 1.165 | $1,189,910,664 |

| NCM | Newcrest Mining | 3% | 15% | -21% | -17% | 19.84 | $17,731,183,028 |

| RXL | Rox Resources | 3% | -11% | -48% | -56% | 0.17 | $34,999,930 |

| BMR | Ballymore Resources | 3% | -10% | -17% | -24% | 0.175 | $16,267,718 |

| WCN | White Cliff Min Ltd | 3% | -13% | -17% | 35% | 0.0175 | $12,709,257 |

| HXG | Hexagon Energy | 3% | 25% | -38% | -81% | 0.0175 | $9,745,402 |

| MEK | Meeka Metals Limited | 3% | 15% | 15% | 43% | 0.07 | $76,867,843 |

| AXE | Archer Materials | 3% | -6% | -5% | -49% | 0.715 | $184,235,733 |

| AGC | AGC Ltd | 3% | 4% | -17% | -31% | 0.072 | $5,147,274 |

| KAU | Kaiser Reef | 3% | 0% | -14% | -10% | 0.18 | $24,710,860 |

| MRZ | Mont Royal Resources | 3% | 0% | -41% | -53% | 0.19 | $12,736,831 |

| MTC | Metalstech Ltd | 2% | 2% | 6% | 71% | 0.42 | $71,933,201 |

| MKG | Mako Gold | 2% | 2% | -47% | -61% | 0.043 | $19,337,706 |

| SLR | Silver Lake Resource | 2% | 8% | -19% | -26% | 1.2525 | $1,162,180,416 |

| MEU | Marmota Limited | 2% | 2% | -30% | 4% | 0.047 | $49,763,627 |

| ADN | Andromeda Metals Ltd | 2% | 19% | -49% | -70% | 0.05 | $158,610,430 |

| RDT | Red Dirt Metals Ltd | 2% | 7% | 2% | -23% | 0.57 | $191,319,265 |

| KTA | Krakatoa Resources | 2% | -3% | -20% | 7% | 0.06 | $20,682,595 |

| ALK | Alkane Resources Ltd | 2% | -2% | -39% | -23% | 0.64 | $389,215,185 |

| CHZ | Chesser Resources | 1% | 5% | -21% | -43% | 0.077 | $47,049,849 |

| WGX | Westgold Resources. | 1% | 4% | -43% | -60% | 0.82 | $388,370,639 |

| TSO | Tesoro Gold Ltd | 1% | 4% | -53% | -51% | 0.037 | $35,711,308 |

| CWX | Carawine Resources | 1% | 3% | -41% | -58% | 0.089 | $17,516,755 |

| M2R | Miramar | 1% | -9% | -20% | -53% | 0.096 | $6,785,447 |

| ARL | Ardea Resources Ltd | 1% | 6% | -10% | 104% | 1.02 | $176,527,283 |

| CMM | Capricorn Metals | 1% | 29% | 16% | 45% | 4.28 | $1,634,053,058 |

| PRU | Perseus Mining Ltd | 0% | 24% | 16% | 31% | 2.18 | $3,048,202,882 |

| GMD | Genesis Minerals | 0% | 10% | -8% | -10% | 1.28 | $540,865,787 |

| MRR | Minrex Resources Ltd | 0% | 0% | -15% | 100% | 0.044 | $47,134,064 |

| NPM | Newpeak Metals | 0% | 0% | 0% | 0% | 0.001 | $9,040,417 |

| FFX | Firefinch Ltd | 0% | 0% | -39% | -18% | 0.2 | $236,248,644 |

| GED | Golden Deeps | 0% | -29% | -38% | -17% | 0.01 | $11,552,267 |

| G88 | Golden Mile Res Ltd | 0% | -12% | -56% | -50% | 0.023 | $4,705,564 |

| NMR | Native Mineral Res | 0% | 45% | 27% | -17% | 0.21 | $23,129,970 |

| AQX | Alice Queen Ltd | 0% | -33% | -60% | -82% | 0.002 | $4,400,500 |

| PNX | PNX Metals Limited | 0% | 25% | 11% | -26% | 0.005 | $19,998,260 |

| TMX | Terrain Minerals | 0% | 17% | -30% | -13% | 0.007 | $5,325,327 |

| NXM | Nexus Minerals Ltd | 0% | 12% | -39% | -62% | 0.19 | $61,836,129 |

| SKY | SKY Metals Ltd | 0% | -9% | -38% | -43% | 0.05 | $20,723,091 |

| LM8 | Lunnonmetalslimited | 0% | 5% | -7% | 119% | 0.81 | $90,098,424 |

| CST | Castile Resources | 0% | 13% | -24% | -37% | 0.13 | $30,237,803 |

| SMS | Starmineralslimited | 0% | -16% | -65% | -56% | 0.073 | $2,159,340 |

| PRX | Prodigy Gold NL | 0% | 20% | -36% | -61% | 0.012 | $20,974,594 |

| LEX | Lefroy Exploration | 0% | -5% | -4% | -22% | 0.27 | $39,386,160 |

| SRN | Surefire Rescs NL | 0% | -4% | -61% | 0% | 0.012 | $18,976,362 |

| AWV | Anova Metals Ltd | 0% | 14% | 33% | -20% | 0.016 | $25,569,507 |

| AVM | Advance Metals Ltd | 0% | -14% | 9% | -37% | 0.012 | $5,784,529 |

| MCT | Metalicity Limited | 0% | 14% | -20% | -58% | 0.004 | $13,968,157 |

| AME | Alto Metals Limited | 0% | -3% | -17% | -33% | 0.07 | $39,377,704 |

| CTO | Citigold Corp Ltd | 0% | 17% | 0% | -30% | 0.007 | $19,835,614 |

| TRY | Troy Resources Ltd | 0% | 0% | 0% | 0% | 0.0295 | $62,920,961 |

| CGN | Crater Gold Min Ltd | 0% | 0% | 0% | 0% | 0.017 | $21,063,474 |

| GUL | Gullewa Limited | 0% | -2% | -18% | -24% | 0.061 | $11,645,089 |

| ADV | Ardiden Ltd | 0% | 29% | -22% | -31% | 0.009 | $24,015,018 |

| RMX | Red Mount Min Ltd | 0% | -17% | -38% | -55% | 0.005 | $8,211,819 |

| XTC | Xantippe Res Ltd | 0% | -13% | -36% | 40% | 0.007 | $57,016,609 |

| TTM | Titan Minerals | 0% | 32% | 37% | 0% | 0.1 | $148,183,685 |

| WWI | West Wits Mining Ltd | 0% | -6% | -37% | -50% | 0.017 | $34,765,640 |

| RML | Resolution Minerals | 0% | -18% | -18% | -50% | 0.009 | $9,537,716 |

| AL8 | Alderan Resource Ltd | 0% | -11% | -56% | -78% | 0.008 | $4,626,129 |

| PF1 | Pathfinder Resources | 0% | 0% | 0% | 59% | 0.5 | $28,984,082 |

| HRN | Horizon Gold Ltd | 0% | 5% | -14% | -15% | 0.325 | $40,684,033 |

| RDN | Raiden Resources Ltd | 0% | -11% | -33% | -67% | 0.008 | $13,059,537 |

| TCG | Turaco Gold Limited | 0% | 29% | -35% | -54% | 0.058 | $24,807,567 |

| X64 | Ten Sixty Four Ltd | 0% | -6% | -25% | -28% | 0.58 | $131,326,148 |

| RVR | Red River Resources | 0% | -8% | -62% | -62% | 0.073 | $37,847,908 |

| CBY | Canterbury Resources | 0% | -11% | -30% | -59% | 0.039 | $5,226,918 |

| WMC | Wiluna Mining Corp | 0% | 0% | -58% | -78% | 0.205 | $74,238,031 |

| BMO | Bastion Minerals | 0% | -12% | -60% | -76% | 0.06 | $5,694,996 |

| HRZ | Horizon | 0% | 25% | -47% | -51% | 0.069 | $42,976,389 |

| CXU | Cauldron Energy Ltd | 0% | 10% | -15% | -59% | 0.011 | $5,354,113 |

| VAN | Vango Mining Ltd | 0% | -3% | -17% | -36% | 0.039 | $49,137,568 |

| AVW | Avira Resources Ltd | 0% | 0% | -33% | -50% | 0.003 | $6,401,370 |

| SBR | Sabre Resources | 0% | -27% | -20% | -20% | 0.004 | $11,659,424 |

| STK | Strickland Metals | 0% | -25% | -43% | -39% | 0.043 | $61,786,786 |

| XAM | Xanadu Mines Ltd | 0% | -4% | 4% | -4% | 0.027 | $38,131,026 |

| MBKDA | Metal Bank Ltd | 0% | 0% | -50% | -67% | 0.03 | $7,845,743 |

| NES | Nelson Resources. | 0% | 0% | -47% | -74% | 0.007 | $4,120,160 |

| PUR | Pursuit Minerals | 0% | 9% | -37% | -66% | 0.012 | $11,978,150 |

| GNM | Great Northern | 0% | 0% | -20% | -43% | 0.004 | $6,836,204 |

| M24 | Mamba Exploration | 0% | -15% | -15% | -50% | 0.11 | $4,639,250 |

| TRM | Truscott Mining Corp | 0% | 0% | -40% | -3% | 0.034 | $5,367,598 |

| DEX | Duke Exploration | 0% | 0% | -59% | -76% | 0.053 | $5,587,240 |

| MOM | Moab Minerals Ltd | 0% | -9% | -64% | -71% | 0.01 | $6,819,635 |

| SNG | Siren Gold | 0% | -5% | -55% | -50% | 0.18 | $20,461,958 |

| AYM | Australia United Min | 0% | 0% | -33% | -60% | 0.004 | $7,370,310 |

| GCY | Gascoyne Res Ltd | 0% | -15% | -28% | -41% | 0.195 | $83,082,880 |

| PNT | Panthermetalsltd | 0% | -3% | -16% | 0% | 0.185 | $5,642,500 |

| ADT | Adriatic Metals | 0% | 28% | 24% | 11% | 2.94 | $623,725,120 |

| GAL | Galileo Mining Ltd | 0% | -13% | 11% | 345% | 1.045 | $212,213,880 |

| HCH | Hot Chili Ltd | -1% | -8% | -30% | -57% | 0.9 | $103,917,329 |

| MAU | Magnetic Resources | -1% | -6% | -45% | -50% | 0.795 | $188,018,019 |

| GRL | Godolphin Resources | -1% | -1% | -32% | -43% | 0.082 | $9,824,664 |

| KIN | KIN Min NL | -1% | -1% | 0% | -26% | 0.078 | $79,687,635 |

| ANX | Anax Metals Ltd | -1% | 14% | -20% | -30% | 0.067 | $27,228,453 |

| CYL | Catalyst Metals | -1% | 15% | -17% | -38% | 1.33 | $131,931,238 |

| HAV | Havilah Resources | -1% | 12% | 25% | 74% | 0.33 | $107,657,331 |

| AAR | Astral Resources NL | -2% | 3% | -27% | -32% | 0.062 | $39,259,189 |

| SMI | Santana Minerals Ltd | -2% | -13% | -35% | 89% | 0.585 | $88,522,671 |

| KAI | Kairos Minerals Ltd | -2% | 0% | 7% | 4% | 0.029 | $54,994,618 |

| AZS | Azure Minerals | -2% | -8% | 4% | -24% | 0.285 | $90,403,359 |

| IVR | Investigator Res Ltd | -2% | 13% | -2% | -26% | 0.053 | $69,532,510 |

| PNR | Pantoro Limited | -2% | -5% | -52% | -60% | 0.1325 | $228,795,403 |

| DRE | Dreadnought Resources Ltd | -2% | -15% | 124% | 104% | 0.094 | $282,781,463 |

| EMR | Emerald Res NL | -2% | 0% | -6% | 6% | 1.13 | $676,591,121 |

| NML | Navarre Minerals Ltd | -2% | -6% | -44% | -39% | 0.045 | $66,142,441 |

| CDT | Castle Minerals | -2% | -10% | -40% | -26% | 0.0215 | $20,989,353 |

| SVG | Savannah Goldfields | -3% | -3% | -3% | -15% | 0.195 | $33,656,695 |

| OKR | Okapi Resources | -3% | -17% | -21% | -64% | 0.19 | $27,994,314 |

| RSG | Resolute Mining | -3% | 12% | -33% | -44% | 0.19 | $306,712,104 |

| AAU | Antilles Gold Ltd | -3% | -23% | -47% | -52% | 0.036 | $14,552,449 |

| DTM | Dart Mining NL | -3% | -16% | 4% | -27% | 0.07 | $10,868,211 |

| DTR | Dateline Resources | -3% | 3% | -36% | -15% | 0.07 | $39,345,622 |

| KWR | Kingwest Resources | -3% | 3% | -77% | -84% | 0.034 | $9,578,712 |

| GBR | Greatbould Resources | -3% | -2% | -10% | -38% | 0.09 | $37,635,623 |

| TLM | Talisman Mining | -4% | -4% | -10% | -27% | 0.135 | $25,344,832 |

| DCN | Dacian Gold Ltd | -4% | -7% | -37% | -40% | 0.13 | $146,016,113 |

| CLZ | Classic Min Ltd | -4% | -26% | -91% | -91% | 0.0125 | $8,836,600 |

| GSN | Great Southern | -4% | -6% | 7% | -31% | 0.045 | $26,695,107 |

| HMX | Hammer Metals Ltd | -5% | 9% | -6% | 37% | 0.063 | $50,865,256 |

| IGO | IGO Limited | -5% | -6% | 27% | 48% | 15.12 | $11,964,831,445 |

| PNM | Pacific Nickel Mines | -5% | 0% | 1% | -30% | 0.07 | $25,083,060 |

| KRM | Kingsrose Mining Ltd | -5% | 4% | -15% | -29% | 0.056 | $44,399,065 |

| PGD | Peregrine Gold | -5% | -22% | -6% | 26% | 0.46 | $17,825,869 |

| BNZ | Benzmining | -5% | 0% | -27% | -33% | 0.455 | $31,378,609 |

| SLZ | Sultan Resources Ltd | -5% | -7% | -42% | -42% | 0.09 | $7,495,595 |

| RND | Rand Mining Ltd | -5% | -13% | -10% | -10% | 1.35 | $76,782,547 |

| OBM | Ora Banda Mining Ltd | -5% | 0% | 119% | 16% | 0.081 | $107,293,082 |

| BTR | Brightstar Resources | -5% | 20% | -18% | -68% | 0.018 | $12,968,957 |

| TGM | Theta Gold Mines Ltd | -5% | -9% | -28% | -58% | 0.072 | $43,369,474 |

| ARN | Aldoro Resources | -5% | 37% | 69% | -25% | 0.355 | $40,495,434 |

| IDA | Indiana Resources | -5% | -7% | -5% | -17% | 0.053 | $25,906,655 |

| RGL | Riversgold | -5% | -19% | -19% | 93% | 0.035 | $34,982,305 |

| NAG | Nagambie Resources | -5% | -7% | 35% | -15% | 0.07 | $35,420,986 |

| VRC | Volt Resources Ltd | -6% | -43% | -11% | -41% | 0.017 | $62,070,782 |

| SVY | Stavely Minerals Ltd | -6% | 13% | -53% | -66% | 0.17 | $58,131,838 |

| MM8 | Medallion Metals. | -6% | 10% | -26% | -23% | 0.17 | $23,792,360 |

| CEL | Challenger Exp Ltd | -6% | 3% | -39% | -48% | 0.165 | $172,410,356 |

| SFM | Santa Fe Minerals | -6% | -6% | -18% | -32% | 0.082 | $5,825,503 |

| A1G | African Gold Ltd. | -6% | 14% | -30% | -53% | 0.078 | $9,314,006 |

| CAZ | Cazaly Resources | -6% | 3% | -16% | -28% | 0.031 | $11,495,476 |

| GBZ | GBM Rsources Ltd | -6% | -8% | -52% | -62% | 0.046 | $26,914,266 |

| GML | Gateway Mining | -6% | -19% | -45% | -59% | 0.061 | $14,464,702 |

| CPM | Coopermetalslimited | -6% | -5% | -39% | 54% | 0.3 | $12,306,000 |

| PDI | Predictive Disc Ltd | -7% | 14% | 3% | -18% | 0.2 | $363,987,484 |

| BC8 | Black Cat Syndicate | -7% | 2% | -23% | -44% | 0.33 | $69,629,357 |

| GTR | Gti Energy Ltd | -7% | -19% | -19% | -54% | 0.013 | $20,324,028 |

| BGD | Bartongoldholdings | -7% | 31% | -14% | 3% | 0.19 | $16,386,038 |

| AUC | Ausgold Limited | -7% | -3% | -24% | -7% | 0.0435 | $85,237,931 |

| CAI | Calidus Resources | -8% | 3% | -56% | -42% | 0.36 | $159,790,322 |

| PGO | Pacgold | -8% | 0% | -33% | -11% | 0.42 | $21,984,726 |

| KNB | Koonenberrygold | -8% | -8% | -29% | -60% | 0.07 | $5,302,951 |

| EM2 | Eagle Mountain | -8% | -13% | -52% | -71% | 0.17 | $45,605,061 |

| FAU | First Au Ltd | -8% | 10% | -58% | -45% | 0.0055 | $5,235,963 |

| FG1 | Flynngold | -8% | 0% | -24% | -37% | 0.11 | $7,687,326 |

| A8G | Australasian Metals | -8% | -10% | -44% | -58% | 0.22 | $9,057,509 |

| MEG | Megado Minerals Ltd | -9% | -37% | -64% | -50% | 0.05 | $6,875,000 |

| POL | Polymetals Resources | -9% | 5% | 54% | 33% | 0.2 | $8,236,538 |

| MAT | Matsa Resources | -9% | 5% | -26% | -27% | 0.04 | $16,886,039 |

| ERM | Emmerson Resources | -9% | -5% | -17% | -3% | 0.078 | $43,576,783 |

| THR | Thor Mining PLC | -10% | 0% | -28% | -40% | 0.009 | $9,925,951 |

| KZR | Kalamazoo Resources | -10% | 19% | -37% | -38% | 0.22 | $36,460,747 |

| ASR | Asra Minerals Ltd | -11% | -32% | -54% | -26% | 0.017 | $24,892,446 |

| HMG | Hamelingoldlimited | -11% | 17% | 26% | 3% | 0.17 | $18,700,000 |

| STN | Saturn Metals | -11% | -19% | -49% | -63% | 0.2 | $27,171,466 |

| MGV | Musgrave Minerals | -11% | -7% | -28% | -36% | 0.21 | $124,343,278 |

| ADG | Adelong Gold Limited | -11% | -11% | -73% | -80% | 0.008 | $3,545,495 |

| BAT | Battery Minerals Ltd | -11% | -20% | -56% | -71% | 0.004 | $11,700,969 |

| SAU | Southern Gold | -11% | -29% | -41% | -64% | 0.024 | $6,666,522 |

| ARV | Artemis Resources | -12% | -12% | -12% | -64% | 0.03 | $43,133,970 |

| S2R | S2 Resources | -12% | 7% | -17% | -30% | 0.15 | $58,851,351 |

| ENR | Encounter Resources | -12% | 61% | 37% | 19% | 0.185 | $68,840,027 |

| FEG | Far East Gold | -12% | -23% | 48% | 0% | 0.51 | $61,018,605 |

| NAE | New Age Exploration | -13% | -13% | -30% | -36% | 0.007 | $10,769,242 |

| MDI | Middle Island Res | -13% | -11% | -57% | -44% | 0.056 | $7,100,257 |

| MXR | Maximus Resources | -13% | -5% | -41% | -37% | 0.041 | $13,394,042 |

| NWM | Norwest Minerals | -14% | 67% | 17% | -28% | 0.055 | $12,215,906 |

| DCX | Discovex Res Ltd | -14% | -14% | -48% | -37% | 0.003 | $9,907,704 |

| NVA | Nova Minerals Ltd | -15% | 5% | 4% | -49% | 0.71 | $128,562,893 |

| MHC | Manhattan Corp Ltd | -17% | -29% | -50% | -50% | 0.005 | $9,157,672 |

| PRS | Prospech Limited | -17% | 18% | -15% | -46% | 0.04 | $2,607,240 |

| MTH | Mithril Resources | -20% | -27% | -33% | -76% | 0.004 | $14,701,165 |

| QML | Qmines Limited | -22% | 11% | -26% | -53% | 0.1825 | $17,139,716 |

| PKO | Peako Limited | -24% | -19% | -32% | -48% | 0.013 | $4,929,799 |

| LYN | Lycaonresources | -27% | 64% | -1% | -14% | 0.385 | $12,015,344 |

| SI6 | SI6 Metals Limited | -29% | 0% | -44% | -55% | 0.005 | $7,476,973 |

| GMN | Gold Mountain Ltd | -31% | 64% | 50% | -50% | 0.009 | $14,203,343 |

| ANL | Amani Gold Ltd | -33% | 0% | -33% | -50% | 0.001 | $23,693,441 |

SMALL CAP STANDOUTS

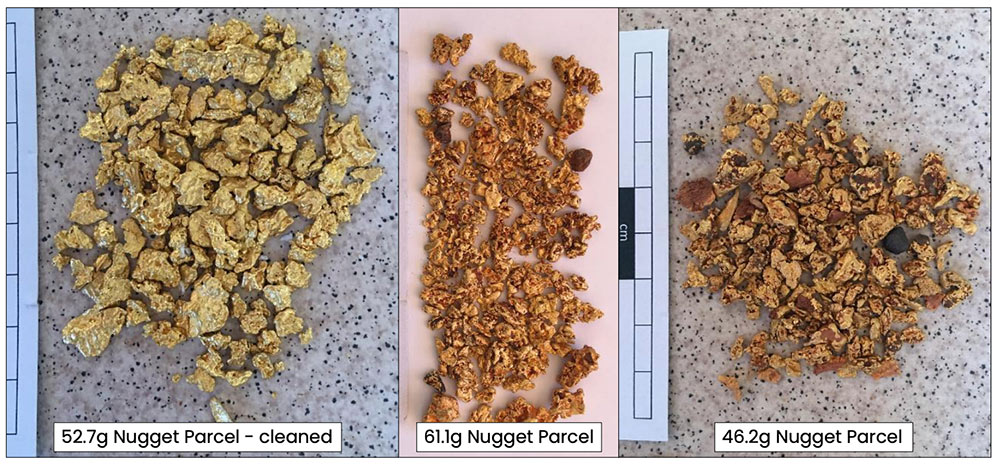

Iceni Gold (ASX:ICL) is picking up gold nuggs like this over several kilometres at the Guyer and Everleigh prospects, part of the flagship 14 Mile Well project in WA:

The shape and composition of the nuggets suggest primary sources – aka THE MOTHERLODES — are nearby, says ICL technical director David Nixon.

“The results of the air core program at Guyer that covers the same area will help to confirm if there is mineralisation in that area,” he says.

That aircore drilling program (usually shallow but covering a wide area) comprised 363 holes for 23,000m and the results are imminent.

Advanced South American gold stock Los Cerros (ASX:LCL) has diversified, inking a deal to buy five large projects in PNG which are prospective for copper, nickel, and gold from private company Footprint Resources.

It gives LCL some juicy exploration targets to play with, in a jurisdiction known for its monster mineral deposits.

It also gives the company options as it waits for “greater clarity on new government mine development policies” in Colombia, where left-leaning Gustavo Petro won Colombia’s June 19 presidential election.

LCL’s 2.6Moz Quinchia project in Colombia is currently the focus of low-cost project development studies.

Microcap Besra Gold (ASX:BEZ) surged after hitting “exceptional high and bonanza grade gold intercepts” at its 3.3Moz Bau project.

One hole into the Bekajang target hit more than 47m of high-grade gold, including:

- 10m @ 7.09g/t Au from 8 to 18m;

- 2m @ 8.81g/t Au from 40m to 42m; and

- 13m @ 22.91g/t Au from 58m to 71m.

But the important part is this: historical mining and exploration along the Bau corridor focused on mineralisation within the Pedawan Shale Contact (LSC) target, 5-30m from surface.

This means most historical RC drilling terminated at depths shallower than 50m. The deeper, high-grade hits announced today came from the limestone and indicate there may be a monster gold source lurking nearby.

A second round of drilling will commence shortly to follow up.

Today, there was more good news – major shareholder Quantum Metals Recovery is in discussions to provide BEZ up to US$300 million in financial support, commencing as soon as CY2023, by way of a gold offtake purchase facility. The proposed facility, if implemented, would accelerate production at Bau.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.