Gold Digger: A weekly recap of the news driving ASX small cap gold stocks

Pic: Getty

The World Gold Council’s new Qaurum tool helps investors forecast how gold prices could react under different macroeconomic and geopolitical conditions.

What will gold do if the global economy slows? If interest rates increase? If markets tank? This is really handy stuff.

“Because gold has a unique dual nature as both a consumer good and an investment, some view its performance as unpredictable,” says Juan Carlos Artigas, director of Investment Research and Qaurum project lead.

“Qaurum … helps investors intuitively understand gold’s drivers and the connection between demand, supply and financial, economic and geopolitical events.”

>>>Scroll down for this week’s biggest winners and losers

For example, under the ‘Global Deceleration’ scenario the model forecasts successive gold returns between 2020-2022 of 21.5 per cent, 9 per cent and 8 per cent, before slowing to 4 per cent and 3.5 per cent in 2023 and 2024, respectively.

You can play around with Qaurum here.

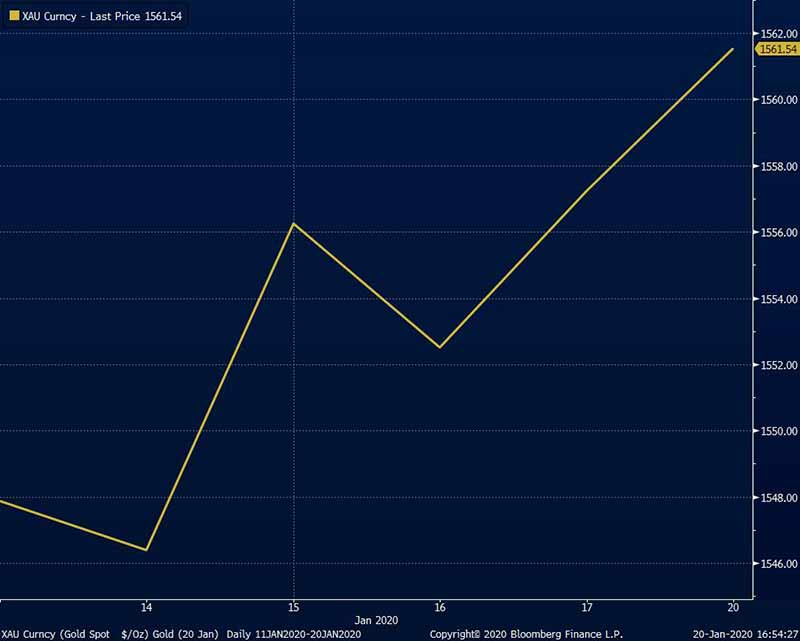

This week, gold moved to $US1561.60/oz ($2271.71/oz), after briefly hitting $US1611/oz the week prior on rising tensions between US and Iran.

At these prices most producers are reaping massive profits – and share prices are telling the story.

Nine of the top 12 ASX players by market cap posted gains over the past week, led by Regis Resources (ASX:RRL) and St Barbara (SBM) who were both up 10 per cent.

It was a good week overall for our basket of ASX-listed gold plays, with 63 going up, 48 going down, and 29 treading water.

Here’s how ASX gold stocks performed for the period January 13 — January 20 [intraday]:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Code | Name | 1 Week Total Return % | 1 Year Total Return % | Price [Intraday Monday] | Market Cap |

|---|---|---|---|---|---|

| GBZ | GBM RESOURCES | 84 | 18 | 0.059 | $ 10,921,637.00 |

| MLS | METALS AUSTRALIA | 50 | -63 | 0.0015 | $ 3,207,352.75 |

| SMI | SANTANA MINERALS | 50 | -25 | 0.004 | $ 10,735,782.00 |

| CY5 | CYGNUS GOLD | 45 | -27 | 0.055 | $ 3,753,809.50 |

| MSR | MANAS RESOUCES | 25 | -38 | 0.0025 | $ 5,286,325.00 |

| HRN | HORIZON GOLD LIMITED | 24 | 49 | 0.26 | $ 16,071,430.00 |

| ALK | ALKANE RESOURCES | 22 | 263 | 0.725 | $ 391,522,496.00 |

| AQI | ALICANTO MINERALS | 21 | 63 | 0.051 | $ 10,071,123.00 |

| CTO | CITIGOLD CORP | 20 | -14 | 0.005 | $ 14,407,039.00 |

| AUC | AUSGOLD | 20 | -31 | 0.018 | $ 18,805,392.00 |

| MLL | MALI LITHIUM | 18 | -52 | 0.087 | $ 27,291,938.00 |

| TAR | TARUGA MINERALS | 17 | -71 | 0.014 | $ 4,473,487.50 |

| CHN | CHALICE GOLD MINES | 16 | 128 | 0.285 | $ 79,479,760.00 |

| MAU | MAGNETIC RESOURCES | 15 | 203 | 0.58 | $ 109,094,512.00 |

| CDV | CARDINAL RESOURCES | 13 | 3 | 0.385 | $ 182,789,072.00 |

| ARL | ARDEA RESOURCES | 13 | 33 | 0.595 | $ 70,673,512.00 |

| ONX | ORMINEX | 13 | -57 | 0.09 | $ 49,058,296.00 |

| PDI | PREDICTIVE DISCOVERY | 13 | -40 | 0.008 | $ 6,074,170.50 |

| TNR | TORIAN RESOURCES | 13 | -57 | 0.01 | $ 2,871,035.00 |

| SLZ | SULTAN RESOURCES | 12 | 7 | 0.065 | $ 2,857,518.00 |

| E2M | E2 METALS | 11 | 150 | 0.2 | $ 17,914,608.00 |

| AAR | ANGLO AUSTRALIAN RESOURCES | 10 | 42 | 0.099 | $ 42,399,308.00 |

| SBM | ST BARBARA | 10 | -35 | 3.02 | $ 2,041,550,336.00 |

| RRL | REGIS RESOURCES | 10 | -4 | 4.55 | $ 2,281,730,304.00 |

| ALY | ALCHEMY RESOURCES | 9 | -17 | 0.011 | $ 6,606,292.00 |

| TTM | TITAN MINERALS | 9 | -25 | 0.18 | $ 51,899,176.00 |

| KCN | KINGSGATE CONSOLIDATED | 9 | 210 | 0.485 | $ 107,457,320.00 |

| EVN | EVOLUTION MINING | 9 | 2 | 3.875 | $ 6,561,643,008.00 |

| GED | GOLDEN DEEPS | 9 | -42 | 0.025 | $ 7,015,214.00 |

| HRZ | HORIZON MINERALS | 9 | -26 | 0.1 | $ 44,937,396.00 |

| RSG | RESOLUTE MINING | 8 | 3 | 1.1825 | $ 1,065,721,408.00 |

| NST | NORTHERN STAR RESOURCES | 7 | 32 | 12.46 | $ 8,733,859,840.00 |

| SLR | SILVER LAKE RESOURCES | 7 | 166 | 1.465 | $ 1,205,386,368.00 |

| TRY | TROY RESOURCES | 7 | 0 | 0.1 | $ 63,206,376.00 |

| ADN | ANDROMEDA METALS | 7 | 557 | 0.047 | $ 65,341,716.00 |

| PUA | PURE ALUMINA | 7 | -57 | 0.016 | $ 3,326,412.25 |

| KRM | KINGSROSE MINING | 7 | -48 | 0.032 | $ 22,630,228.00 |

| OKU | OKLO RESOURCES | 6 | -33 | 0.165 | $ 70,174,184.00 |

| MKG | MAKO GOLD | 6 | -39 | 0.07 | $ 6,946,634.50 |

| GSM | GOLDEN STATE MINING | 6 | -65 | 0.059 | $ 2,160,945.75 |

| A1G | AFRICAN GOLD | 6 | 0.185 | $ 9,877,000.00 | |

| GBR | GREAT BOULDER RESOURCES | 5 | -72 | 0.04 | $ 4,937,798.00 |

| TAM | TANAMI GOLD NL | 5 | -16 | 0.04 | $ 45,828,784.00 |

| EMR | EMERALD RESOURCES NL | 5 | 19 | 0.044 | $ 137,180,368.00 |

| MML | MEDUSA MINING | 5 | 134 | 0.885 | $ 179,742,064.00 |

| MAT | MATSA RESOURCES | 4 | -22 | 0.125 | $ 30,368,432.00 |

| STN | SATURN METALS | 4 | 95 | 0.38 | $ 27,445,982.00 |

| ARV | ARTEMIS RESOURCES | 4 | -77 | 0.027 | $ 24,407,620.00 |

| CAI | CALIDUS RESOURCES | 4 | 2 | 0.265 | $ 54,745,712.00 |

| SAR | SARACEN MINERAL HOLDINGS | 4 | 30 | 3.815 | $ 4,025,551,872.00 |

| GWR | GWR GROUP | 4 | -19 | 0.081 | $ 21,394,482.00 |

| NCM | NEWCREST MINING | 4 | 37 | 32.09 | $ 24,326,199,296.00 |

| CMM | CAPRICORN METALS | 4 | 279 | 1.27 | $ 415,737,344.00 |

| TLM | TALISMAN MINING | 3 | 12 | 0.097 | $ 18,102,954.00 |

| RND | RAND MINING | 3 | 18 | 2.27 | $ 136,537,040.00 |

| BGL | BELLEVUE GOLD | 3 | -1 | 0.53 | $ 293,505,984.00 |

| AME | ALTO METALS | 3 | -6 | 0.037 | $ 10,854,830.00 |

| LEX | LEFROY EXPLORATION | 3 | 9 | 0.19 | $ 19,092,482.00 |

| TBR | TRIBUNE RESOURCES | 3 | 42 | 5.4 | $ 303,601,536.00 |

| MOH | MOHO RESOURCES NL | 2 | -58 | 0.046 | $ 2,257,018.25 |

| CWX | CARAWINE RESOURCES | 2 | 42 | 0.235 | $ 17,771,524.00 |

| HAW | HAWTHORN RESOURCES | 1 | 42 | 0.081 | $ 26,455,864.00 |

| WGX | WESTGOLD RESOURCES | 1 | 148 | 2.33 | $ 911,247,488.00 |

| AAJ | ARUMA RESOURCES | 0 | -57 | 0.003 | $ 2,128,241.75 |

| AYR | ALLOY RESOURCES | 0 | -33 | 0.002 | $ 4,177,354.75 |

| SVL | SILVER MINES | 0 | 69 | 0.11 | $ 91,090,400.00 |

| GUL | GULLEWA | 0 | 0 | 0.029 | $ 4,498,570.00 |

| BSR | BASSARI RESOURCES | 0 | -16 | 0.016 | $ 38,008,880.00 |

| WAF | WEST AFRICAN RESOURCES | 0 | 89 | 0.435 | $ 343,839,136.00 |

| DTM | DART MINING NL | 0 | -25 | 0.09 | $ 4,816,719.50 |

| NXM | NEXUS MINERALS | 0 | -13 | 0.046 | $ 5,439,066.00 |

| SFM | SANTA FE MINERALS | 0 | -25 | 0.07 | $ 5,097,315.00 |

| ERM | EMMERSON RESOURCES | 0 | 57 | 0.11 | $ 46,733,928.00 |

| CDT | CASTLE MINERALS | 0 | 0 | 0.009 | $ 2,135,081.50 |

| AZM | AZUMAH RESOURCES | 0 | 10 | 0.033 | $ 32,293,200.00 |

| SIH | SIHAYO GOLD | 0 | -22 | 0.014 | $ 29,368,780.00 |

| PRX | PRODIGY GOLD NL | 0 | -15 | 0.067 | $ 40,063,304.00 |

| PRU | PERSEUS MINING | 0 | 168 | 1.0625 | $ 1,232,219,392.00 |

| RMS | RAMELIUS RESOURCES | 0 | 164 | 1.305 | $ 826,380,352.00 |

| ARM | AURORA MINERALS | 0 | -28 | 0.01 | $ 2,342,665.75 |

| ANL | AMANI GOLD | 0 | -36 | 0.002 | $ 12,270,899.00 |

| AOP | APOLLO CONSOLIDATED | 0 | 61 | 0.245 | $ 53,154,368.00 |

| AGS | ALLIANCE RESOURCES | 0 | -11 | 0.105 | $ 16,944,216.00 |

| GNM | GREAT NORTHERN MINERALS | 0 | -67 | 0.01 | $ 3,469,358.25 |

| BCN | BEACON MINERALS | 0 | 104 | 0.037 | $ 102,910,776.00 |

| OKR | OKAPI RESOURCES | 0 | -55 | 0.099 | $ 3,568,243.75 |

| RGL | RIVERSGOLD | 0 | -83 | 0.01 | $ 1,959,783.50 |

| ARS | ALT RESOURCES | 0 | -31 | 0.021 | $ 12,924,667.00 |

| GMR | GOLDEN RIM RESOURCES | 0 | -52 | 0.01 | $ 11,629,661.00 |

| DTR | DATELINE RESOURCES | 0 | 0 | 0.002 | $ 16,420,156.00 |

| BBX | BBX MINERALS | 0 | -26 | 0.125 | $ 53,740,920.00 |

| CGN | CRATER GOLD MINING | 0 | -8 | 0.012 | $ 14,729,950.00 |

| GOR | GOLD ROAD RESOURCES | -1 | 93 | 1.35 | $ 1,168,939,520.00 |

| DGR | DGR GLOBAL | -1 | -38 | 0.074 | $ 45,375,460.00 |

| CYL | CATALYST METALS | -1 | 69 | 2.96 | $ 247,196,672.00 |

| GMN | GOLD MOUNTAIN | -1 | -3 | 0.072 | $ 43,793,140.00 |

| BC8 | BLACK CAT SYNDICATE | -1 | 138 | 0.33 | $ 26,095,682.00 |

| FML | FOCUS MINERALS | -2 | 36 | 0.235 | $ 47,514,628.00 |

| BDC | BARDOC GOLD | -2 | 57 | 0.085 | $ 115,378,152.00 |

| NWM | NORWEST MINERALS | -3 | -2 | 0.16 | $ 13,414,429.00 |

| TIE | TIETTO MINERALS | -4 | 279 | 0.265 | $ 79,906,432.00 |

| MEU | MARMOTA | -4 | 73 | 0.026 | $ 21,532,000.00 |

| RXL | ROX RESOURCES | -4 | 213 | 0.029 | $ 36,448,680.00 |

| RML | RESOLUTION MINERALS | -4 | -31 | 0.048 | $ 5,465,613.50 |

| NUS | NUSANTARA RESOURCES | -4 | 63 | 0.325 | $ 62,752,720.00 |

| SPX | SPECTRUM METALS | -4 | 1600 | 0.089 | $ 119,154,304.00 |

| BAR | BARRA RESOURCES | -5 | -48 | 0.021 | $ 11,930,315.00 |

| HMX | HAMMER METALS | -5 | -13 | 0.021 | $ 11,158,378.00 |

| OAU | ORA GOLD | -5 | 62 | 0.021 | $ 13,568,749.00 |

| DCN | DACIAN GOLD | -5 | -40 | 1.45 | $ 328,935,264.00 |

| BRB | BREAKER RESOURCES NL | -5 | -13 | 0.29 | $ 68,239,424.00 |

| SAU | SOUTHERN GOLD | -5 | 21 | 0.175 | $ 16,782,464.00 |

| DGO | DGO GOLD | -5 | 25 | 0.9 | $ 31,500,744.00 |

| VAN | VANGO MINING | -6 | -9 | 0.155 | $ 117,182,600.00 |

| AMG | AUSMEX MINING GROUP | -7 | 25 | 0.072 | $ 36,899,256.00 |

| DEG | DE GREY MINING | -8 | -55 | 0.049 | $ 50,888,984.00 |

| GSN | GREAT SOUTHERN MINING | -8 | 94 | 0.06 | $ 20,322,902.00 |

| VMC | VENUS METALS CORP | -8 | 11 | 0.18 | $ 27,194,162.00 |

| BLK | BLACKHAM RESOURCES | -8 | -73 | 0.0115 | $ 56,594,912.00 |

| BNR | BULLETIN RESOURCES | -9 | -16 | 0.021 | $ 3,944,447.75 |

| DAU | DAMPIER GOLD | -9 | -38 | 0.02 | $ 3,860,727.00 |

| MTH | MITHRIL RESOURCES | -9 | 100 | 0.01 | $ 4,903,892.00 |

| AWV | ANOVA METALS | -10 | 0 | 0.009 | $ 6,391,323.00 |

| KTA | KRAKATOA RESOURCES | -10 | 44 | 0.036 | $ 6,650,000.00 |

| RED | RED 5 | -10 | 211 | 0.32 | $ 404,652,704.00 |

| KWR | KINGWEST RESOURCES | -11 | -8 | 0.165 | $ 17,099,064.00 |

| PGI | PANTERRA GOLD | -11 | 50 | 0.035 | $ 6,244,533.00 |

| GML | GATEWAY MINING | -11 | -6 | 0.016 | $ 21,433,856.00 |

| NAG | NAGAMBIE RESOURCES | -12 | -49 | 0.036 | $ 16,197,564.00 |

| LNY | LANEWAY RESOURCES | -14 | 50 | 0.007 | $ 22,320,396.00 |

| DHR | DARK HORSE RESOURCES | -14 | -33 | 0.003 | $ 8,287,742.00 |

| NES | NELSON RESOURCES | -15 | -62 | 0.051 | $ 2,325,235.25 |

| WWI | WEST WITS MINING | -15 | 10 | 0.011 | $ 10,312,841.00 |

| CXU | CAULDRON ENERGY | -16 | 11 | 0.021 | $ 7,887,999.50 |

| MDI | MIDDLE ISLAND RESOURCES | -20 | -33 | 0.004 | $ 6,472,687.00 |

| TMX | TERRAIN MINERALS | -20 | 14 | 0.004 | $ 2,892,644.00 |

| TSC | TWENTY SEVEN CO | -20 | 100 | 0.008 | $ 9,921,951.00 |

| KGM | KALNORTH GOLD MINES | -20 | -43 | 0.004 | $ 4,471,200.50 |

| VKA | VIKING MINES | -23 | -41 | 0.01 | $ 4,078,332.25 |

| AVW | AVIRA RESOURCES | -25 | -50 | 0.0015 | $ 2,250,000.00 |

SMALL CAP HIGHLIGHTS

GBM Resources (ASX:GBZ) +84%

Market Cap: ~$11m

Gold-copper explorer GBM leads the pack this week on no news.

In December, the minnow finalised a deal to buy Millstream Resources and, by extension, a 50 per cent share in an advanced heap leach gold project in NSW called White Dam.

Between 2010 and 2017 White Dam produced about 170,000oz from heap leaching low-grade ore sourced from a couple of open pits.

The company says this JV with Round Oak Minerals — a subsidiary of $5.41 billion market cap Washington H. Soul Pattinson & Co (WHSP) — could mean cash flow within the next 12 months.

Alkane Resources (ASX:ALK) +22%

Market Cap: ~$391m

Alkane was thrust into the spotlight last year after announcing a big porphyry discovery called Boda in NSW.

But Alkane is already a successful — and growing — gold miner. Its 35,000oz-per-year Tomingley Operations (TGO) need more gold though, which is why the company has spent the last two years conducting an extensive (and ultimately successful) regional exploration program.

A 60,000m resource definition drilling program on the San Antonio and Roswell prospects, just south of the TGO mine and processing facility, is now in progress.

Latest results from Roswell include a massive 84m intersection grading 4.06 grams per tonne (g/t) gold, 223m from surface.

The initial Roswell resource is now expected to be released this month.

READ: Alkane is riding the rare earths wave, but don’t forget about Tomingley

Chalice Gold Mines (ASX:CHN) +16%

Market Cap: $79m

Cashed up Chalice could be dialling in on something big at the Pyramid Hill project, located in Victoria’s gold-rich Bendigo region.

A new gold trend called Karri was discovered through shallow early stage drilling late last year and is already 3km long.

Deeper drilling to test this target kicks off very soon, Chalice says.

“Given the scale of the target, the favourable geological setting and the tenor of the results being generated by this relatively early stage of exploration, we believe there is the potential to discover a largescale gold system at depth,” managing director Alex Dorsch says.

“The Karri gold trend has a consistent north-south orientation, sub-parallel to the interpreted position of the regional scale Muckleford Fault.

“This structural setting is similar to many large-scale gold deposits in the Bendigo Zone, such as Fosterville, ~70km south-east of Karri, where the high-grade gold zones are associated with a secondary structure, sub-parallel to the regional-scale fault.”

READ MORE: Who’s close to uncovering the next Nova or Fosterville?

Magnetic Resources (ASX:MAU) +15 %

Market Cap: $109m

Sliding into Stockhead’s top 10 biggest resources movers for 2019 with a 12-month, +278 per cent gain, WA-based Magnetic is a quiet achiever – but probably not for much longer.

This former iron ore play may be onto something massive at Hawks Nest 9 (HN9) – a shallow, sub 50m-from-surface mineralised zone which is 3km long, 200m-wide and counting.

Last week, the company announced the “breakthrough” discovery of a thick mineralised intrusive porphyry feeder zone up to 57m thick and +400m long.

It reckons there are similarities here with the neighbouring Wallaby (7.1 million ounces) and Jupiter (1.3 million ounces) deposits.

Like we said – Magnetic probably won’t be a ‘quiet’ stock for much longer.

READ MORE: Did Magnetic Resources’ HN9 project just go Super Saiyan?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.