Gold demand hits record high in 2024, setting the stage for bull market to continue

Gold demand scaled new heights in 2024. Pic: Getty Images

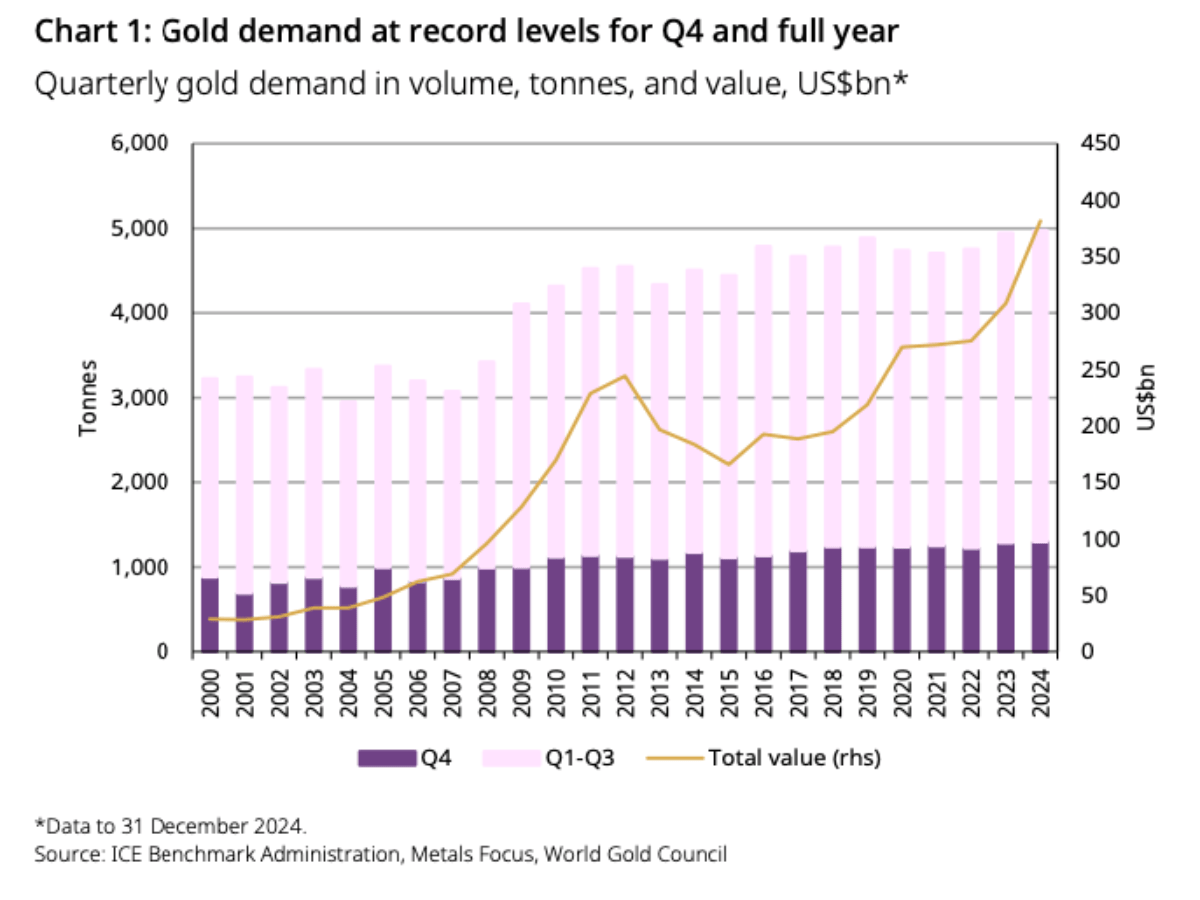

- Gold demand hit a record high in 2024, up 1% to 4974t

- Central bank buying cleared 1000t for the third straight year, while investment demand rose 25% to 1180t

- Gold hit record price of US$2843.55/oz on Tuesday – but figures suggest it’s not a ‘flash in the pan’

Gold prices cracked a new record high of US$2843.55/oz on Tuesday according to the London Bullion Markets Association, raising the question of how far the bulls have left to run.

Incredibly vulnerable on both the upside and downside to sentiment, there’s always the risk of a bubble in the yellow metal, a sizeable chunk of which is stored as an investment by private individuals, funds and central banks rather than consumed the way industrial commodities are.

But new figures from the World Gold Council have put meat on the bones of the modern day gold rush, with demand from all quarters hitting a record high in 2024 as prices clocked 41 new record highs and an all time high average price of US2386/oz (up 23% YoY).

The latest Gold Demand Trends report from the WGC showed a 1% lift in demand globally to 4974t last year, identical to mined and recycled supply.

That was despite the impact of higher prices on the largest single demand segment, with jewellery consumption down 11% to 1877.1t.

Driving forces behind the record figure included central bank buying, which clocked in above 1000t for the third straight year (1044.6t, down 1%).

But it was demand from the investment market that really shone, up 25% to a four-year high of 1180t, largely resulting from a 10% lift in bar purchases to 860t and massive fall in ETF outflows from 244.2t to 6.8t.

ETF inflows clocked in at 18.6t as western ETF buyers returned to the market in the December quarter, complementing strong demand from Asian funds.

“It is a very strong lift for sure,” WGC head of Asia-Pacific (ex China) and global head of central banks Shaokai Fan said of the turnaround in investment demand.

“It does reflect the world that we saw in 2024 though, with lowering interest rates, for one, attracting some people into gold, but also increasing geopolitical uncertainty.

“Of course, with the lead up into the US election, there was always some jitters as well.

“So all those factors, I think, contributed to strong gold price sentiment and then the sentiment begets more interest in gold and it’s kind of a virtuous cycle.”

The path to dedollarisation

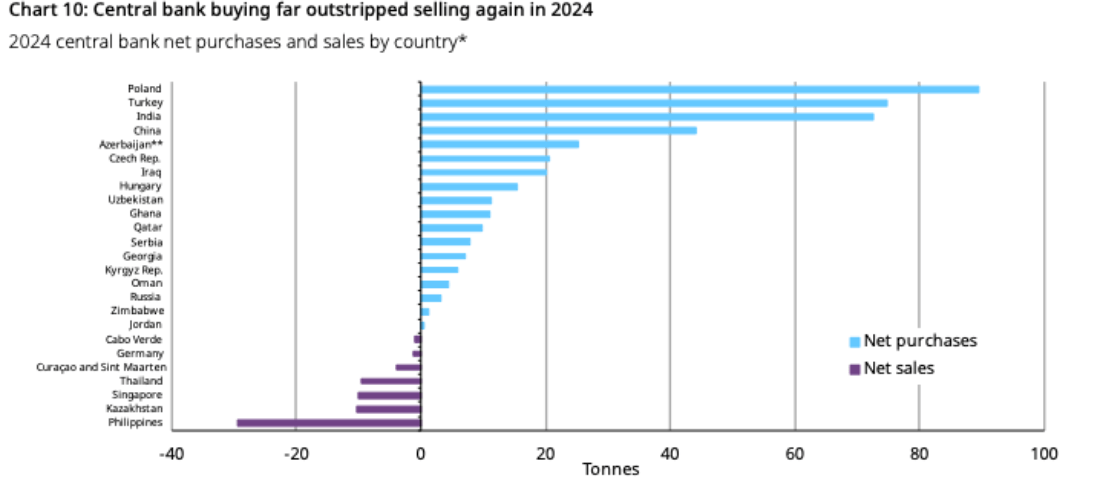

Central banks in emerging markets again provided a solid foundation for gold demand, led by Poland, Turkiye, India and China, which paused purchases by the People’s Bank for half the year only to resume its buying strategy in November and December.

That came amid a movement to reduce exposure to the US dollar and shield countries against the risks associated with debt and geopolitical uncertainty.

“At this time last year, I thought that 2024 would still be a very strong year for central bank buying, but maybe not over 1000t,” Fan, who monitors central banks’ gold purchases for the WGC, said.

“Partly because the gold price was high already and moved even higher throughout 2024.

“A higher gold price might make some central banks pause a little bit if they had plans to buy gold. Maybe they would be a little bit more conservative … no one wants to be seen as buying at a record high and then the price corrects.”

Companies which accumulate gold domestically were not large sellers either, Fan said.

While Donald Trump’s re-election in November came alongside threats to countries who tried to divest of US dollars, that has not played out yet.

“That signals that there is still appetite for central banks to buy gold even in this new geopolitical climate that we find ourselves in.

“I can’t speak for them, obviously, but we have seen central banks still buy gold after Trump was elected.

“Of course, a big element of our central bank number is unreported buying as well. So I think there are still some institutions out there that are buying gold and not reporting it.

“I don’t know if they’re not put off by it, but I do think that they probably are viewing gold as an even more important asset to hold now than before.”

Fan added that technology demand, driven by AI data centres, was extremely strong, rising 7% to 326.1t.

Not a flash in the pan

Australian fund manager Hedley Widdup said the demand record validated the market’s confidence in the strength of gold.

“I think it validates the gold price trend is not a flash in the pan,” the CEO of Lion Selection Group (ASX:LSX) said.

“When you see building demand and growing demand, particularly when it’s large groups like central banks contributing to it, it’s got some longevity to it.

“You get all sorts of volatility in the gold market, but I think this is a harbinger of it being something which should have more than just a short term turnaround to it.”

Widdup doesn’t predict the gold price, but he noted that because the price is set by buyers looking at it as an investment rather than a cost input for a product, prices can run higher, and quickly, without friction from end users.

“Gold has often had an ‘x’ rather than a percentage in terms of performance through gold bull markets,” he said.

“So I think we’re sitting above 2x in this bull market now, but 2x is a pretty low return for a gold bull market.

“It’s generally gone multiples higher than that before.

“That also contributes to my view that if we’re starting now, we are starting rather than hitting the heights yet.”

Widdup says the recovery in western ETF demand late last year, joining the new demand centre out of China and India, was also encouraging.

His favourite way to approach the gold boom is through development stage juniors, who have leverage to gold prices but are coming from a far lower level than producers.

“Our biggest holdings are typically in Western Australia,” he said, including Brightstar Resources (ASX:BTR), Saturn Metals (ASX:STN), Antipa Minerals (ASX:AZY) and, this week, Ravensthorpe gold project owner Medallion Metals (ASX:MM8).

“We’ve been seeing very attractive value on offer, just based on the prevailing gold price in those,” Widdup said.

“Feeling that either strategic investment or just the market coming to them would bring them into production and rerate them, but with the gold price continuing to go up we think that just magnifies that perspective.”

Will the trend continue in 2025?

The link between gold and traditional levers such as the US dollar and interest rates, against which it typically has an inverse relationship, has weakened.

But Fan said strong demand from China and safe haven flows seen in response to geopolitical turbulence showed factors outside the US, where interest rates are likely to fall this year as well, now play on the gold price.

Now Read: As bullion booms ASX gold miners could soon be raking in $1 billion a quarter

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.