Gold: Dacian just made a high-grade discovery, two weeks after a production downgrade

Two weeks ago Dacian Gold (ASX: DCN) downgraded its 50-55,000oz production to 36-38,000oz. The company blamed poor productivity and the failure of some equipment.

Dacian shareholders sent the stock down 62 per cent in two hours, adding to a decline over several months as investors feared Dacian wouldn’t hit its targets.

Analysts became similarly bearish. Hartleys cut its price target by 70 per cent (from $1.34 to 42 cents).

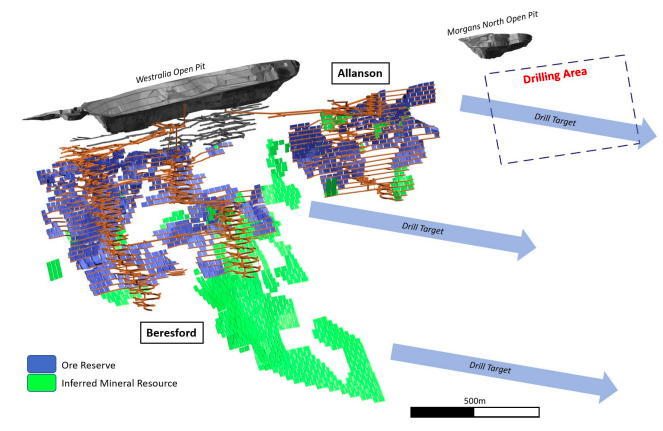

But this morning Dacian announced a new gold area immediately to the north of its Westralia deposit and shares climbed 12 per cent. It’s called the results “some of the thickest and highest grade gold mineralisation intersected at Westralia”.

Scroll down for more ASX gold news>>>>

The best result was 1.7m @ 127.0g/t of gold from 297.3 metres. Others included 3.2m @ 12.5g/t of gold from 365.1m and 1.7m @ 7.5 g/t from 248.9 metres.

In addition to the mineralisation being an excellent grade it was very close to its mine area and just below a historically open pit.

Dacian chairman Rohan Williams said it was “a significant discovery which supports our strategy of bringing forward asset value through accelerating exploration activity at Mt Morgans”.

“The combination of these results and their location immediately below and along strike from an historic open pit shows there is excellent potential for new, additional production opportunities.”

While the company has not formally changed its production forecast yet, shareholders have been told more drilling will be undertaken “to identify additional production opportunities that can be used to optimise production schedules”.

In other ASX small cap gold news today…

While West Africa Resources (ASX: WAF) is not yet at the production phase it also announced a high-grade discovery. The Burkina-Faso focused explorer announced a maiden control program returned results including 29m at 13.2 g/t and 20m at 7.8g/t of gold. Managing director Richard Hyde told shareholders WAF was fully funded and on track for its first pour next year.

Beacon Minerals (ASX: BCN) has begun commissioning its Juardi Gold Project and full production will be reached by the end of this year. The commissioning will involve energisation and testing of its HV and LV transformers and electrical drives. The infrastructure for the project is already in place including a mill conveyor, lime silo and a bulk cyanide tank.

The company estimated it could generate 126,000oz of gold – costing $21.4 million. The company recovered 26oz during relining activities alone. Managing director Graham McGarry reminded shareholders the current gold price ($1,955 per ounce) was higher than the study’s $1,650 spot price. He said this “will only increase the company’s success and shareholder value from the project”.

Artemis Resources (ASX: ARV) has the final approvals made for a third storage facility at Radio Hill. It also secured a native vegetation clearing permit for its West Pilbara project. The company called the approval “a major milestone” for the company.

Turkish-focused Zenith Minerals (ASX: ZNC) has also announced results this morning. The company is in the middle of assay drilling at its Kavaklitepe project which involves three distinct prospects. The most impressive result was 20m @ 15.6 g/t of gold.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.