Gateway has early mover advantage in hot overlooked WA gold province

Pic: Schroptschop / E+ via Getty Images

Special Report: Gateway already had an established footprint in a gold-rich region of Western Australia that for years had been overlooked and is now the subject of an exploration frenzy.

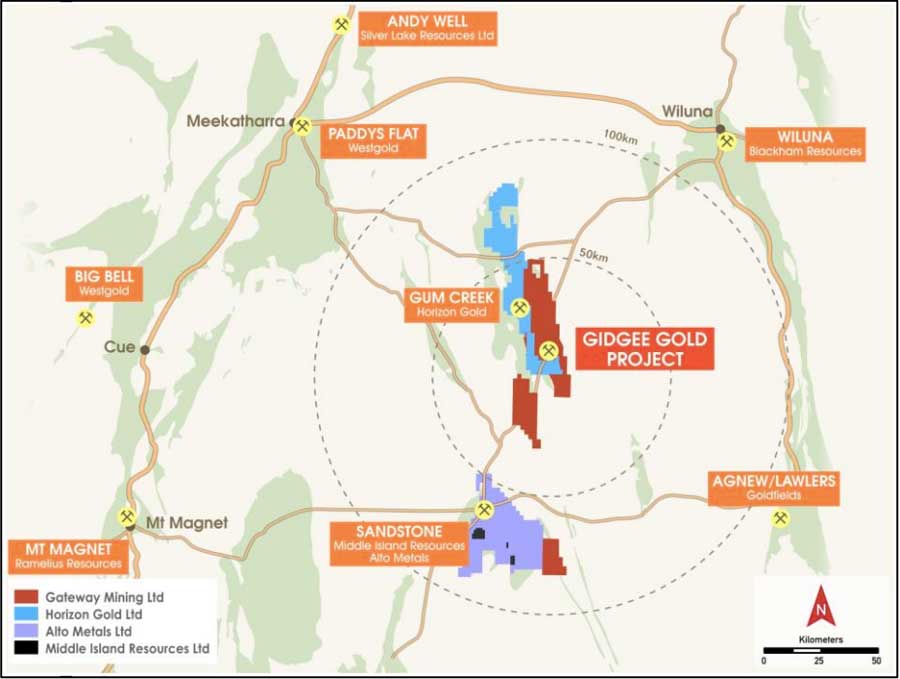

Gateway Mining (ASX: GML) owns the Gidgee gold project, an emerging large-scale gold system in the heart of WA’s mineral-rich Murchison and Northern Goldfields.

The company has held ground in this region since the late 90s, but it wasn’t until 2018 – when experienced geologist and mining executive Peter Langworthy took the helm – that the company realised the true value of what it was sitting on.

Langworthy knows what to look for. Over his +32-year career, he has worked for several big-name mining companies and has led exploration teams responsible for making multiple major discoveries.

Most notably, he led the exploration team for the Kerry Harmanis-led nickel producer Jubilee Mines, a company that was eventually acquired in a $3.3bn deal by heavyweight Xstrata.

Meanwhile, Langworthy was also a founding director of Northern Star Resources (ASX: NST), which is now an $11bn gold producer, and was also instrumental in leading Capricorn Metals (ASX: CMM) to the start of construction of its Karlawinda gold mine.

Low-cost, early mover advantage

Over the past couple of years, Gateway has been consolidating a large land package, which now covers 1,000sqkm, at the southern extension of the Gum Creek Greenstone Belt, a region which has historically produced 1.5 million ounces of gold.

Five shallow open pits were mined on the company’s Gidgee ground between 1988 and 1992, producing about 150,000oz back when the gold price languished at around $500/oz.

“It’s a pretty unique opportunity in that there’s not too many places in WA where you can go and build such a large landholding on the majority of an entire greenstone belt,” executive technical director Mark Cossom told Stockhead.

“[Langworthy] saw the opportunity there and in the meantime, we were able to secure a lot of other ground around the project well before the recent surge in interest in the area. So we did it pretty cheaply when it’s all said and done.

“With a few of the other companies active in the area, we’re now starting to see that everyone is waking up to the potential of the belt and the fact that there’s plenty of upside still be to be had.”

The area has not really seen any serious exploration activity since the Gidgee gold mine shut down in the early 2000s — that is until recently.

Gateway’s ground sits adjacent to the Gidgee mine and has shown early evidence that the same structures that host the mine extend into the company’s landholding.

Exploration has also indicated similarities to other big gold deposits in the region such as Red 5’s 4.1-million-ounce King of The Hills mine and Gold Fields’ +7-million-ounce producing Granny Smith mine.

“There’s immediate indications that the gold mineralisation is persistent through our ground as well as it is next door,” Cossom said.

“It’s a very similar geological structure and rock type to Granny Smith. So we see analogues to other big deposits in WA.”

Well-funded and ready for exploration attack

Once the share purchase plan is closed, the company will have $10m, which for a junior with a $32m market cap is some pretty significant financial firepower.

In October 2019, Gateway announced a maiden 240,000oz resource estimate for its cornerstone Whistler and Montague deposits.

The company is now embarking on a sustained drilling blitz at a range of high-priority gold targets.

These range from brownfields resource expansion to greenfields (untouched) opportunities – all aimed at establishing Gidgee as a significant new Australian gold development project.

Importantly for investors, news flow will be strong.

“We’ve now got the resources to tackle it pretty aggressively, and from a share price catalyst point of view, there’s going to be a lot of drilling going on over the next couple of years,” Cossom said.

Gateway has just completed the initial 4,500m reverse circulation (RC) drilling program at Gidgee ahead of schedule and is now waiting for assay results.

The program was aimed at following-up previous high-grade gold intersections of 21m at 2.1 grams per tonne (g/t) of gold from 32m and 2m at 24.6g/t gold from 4m.

Planning is now underway for a 10,000m aircore drilling program that is scheduled to begin soon.

Cossom said that’s about four weeks’ worth of drilling, which will then be followed by another 15,000m of RC drilling.

This will keep Gateway busy until the end of the year.

“Our plan from there-on in is to pretty much have a drill rig operating on site, whether it be an aircore rig or RC rig, for 10 months of the year,” Cossom said.

Strong expertise

Importantly, Gateway has the expertise it needs to go from greenfields discovery through to production.

Langworthy’s expertise lies in early stage exploration, and spans across major companies like WMC Resources and Jubilee Mines down to junior explorers like Syndicated Metals, now DiscovEX Resources (ASX: DCX), and Silver Mines (ASX: SVL).

Cossom’s skillset, meanwhile, covers early stage exploration as well as the later stages of development.

A geologist with over two decades of experience, Cossom was a key part of the team that transformed Doray Minerals from a junior gold explorer to an ASX-300 gold miner. He held executive positions with Doray up until its takeover by Silver Lake Resources (ASX: SLR) last year.

Before joining Doray, Cossom held a range of senior operational and exploration roles for Harmony Gold at its South Kalgoorlie operations and the major Morobe Mining joint venture with Newcrest Mining (ASX:NCM) in Papua New Guinea.

Cossom has experience in feasibility study work, which is a key part of transforming an exploration project into a mine.

Miners usually undertake up to four different types of studies — scoping, preliminary feasibility (PFS), definitive feasibility (DFS) and bankable feasibility (BFS).

“Between the two of us we’ve got a lot of past experience in moving from early stage exploration activities all the way through to mining operations and financing,” Cossom noted.

Capitalising on additional opportunities

The interest in the Gidgee region has prompted a flurry of M&A deals as explorers realise the potential of the area.

And Gateway is well positioned to take advantage of any opportunities that arise, whether it be picking up more ground, attracting a partner or potentially becoming the target of a takeover.

“We’re in a pretty strong position there to be able to capitalise on anything like that that comes around,” Cossom said.

This article was developed in collaboration with Gateway Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.