Gateway Mining increases footprint at one of WA’s premier ‘forgotten’ gold belts

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

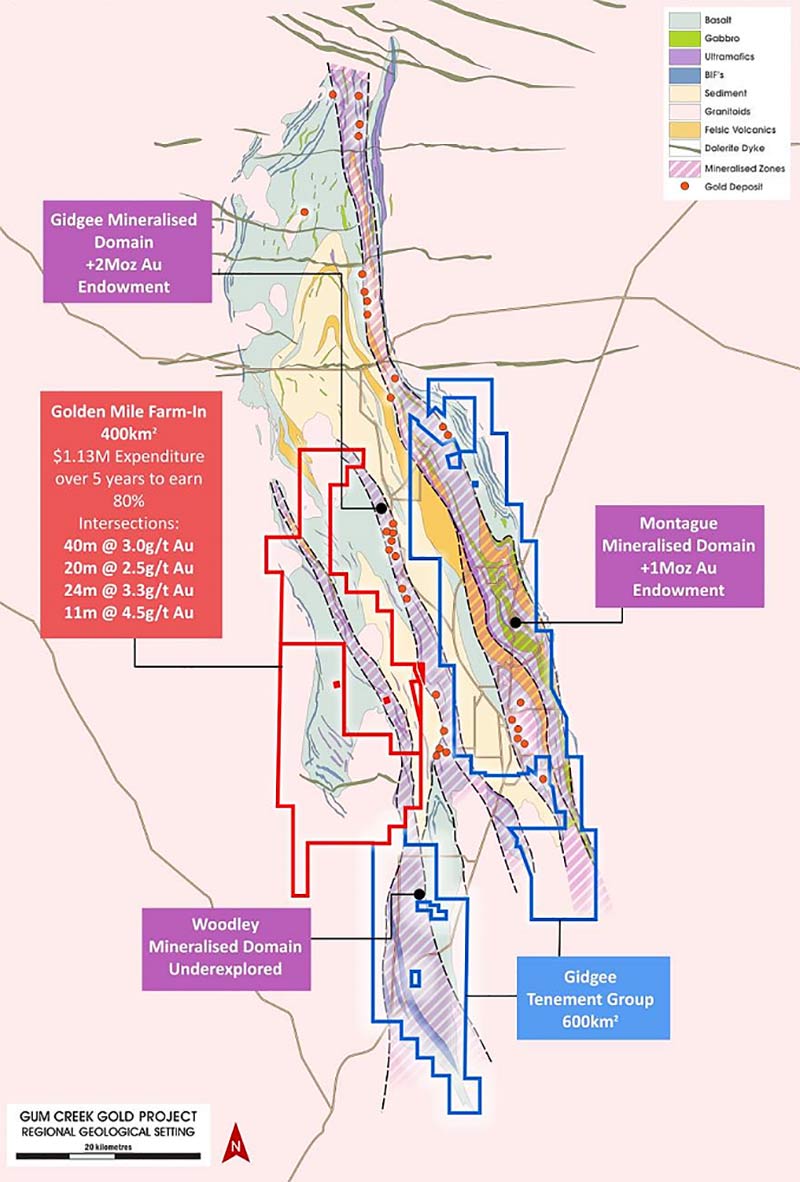

Special Report: Gateway’s (ASX:GML) main asset is the Gidgee gold project, an emerging large-scale gold system in the heart of WA’s mineral-rich Murchison and Northern Goldfields.

Five shallow open pits were mined here between 1988 and 1992, producing about 150,000oz back when the gold price languished at around $500/oz.

But over the past 25 years exploration has been sporadic, at best.

The explorer has now entered into a strategic Earn-In Agreement with Golden Mile Resources (ASX:G88)that significantly increases the project footprint to over 1,000sqkm.

This new project area includes a ~30km long major gold-bearing structural corridor called the ‘Woodley Domain’, the third major identified gold trend within the belt.

The other two, Eastern Montague Domain (+1moz) and the Central Gidgee Domain (+2Moz), already have significant gold endowments, while Woodley does not.

Gateway believes this reflects the lack of systematic previous exploration.

Woodley is just as prospective as the other two established domains in the belt, it says, with the same rock sequence and greenstone scale structural control.

Historic exploration at Woodley highlighted significant geochemical gold anomalies, which have only been followed up by rudimentary drilling.

Several outstanding, shallow historical drilling intercepts, including 40 metres at 3g/t gold from surface remain largely open with little to no follow-up work.

Gateway intends to leverage off its understanding of the geology and controls on mineralisation within the belt to follow up on this historical work.

“This new ground package, which adjoins our existing tenure, will increase the total land-holding under Gateway’s control to over 1,000sqkm of highly prospective, under-explored greenstone within one of the world’s premier gold exploration jurisdictions,” Gateway managing director Peter Langworthy says.

“Importantly, it means that Gateway now can explore two major gold-bearing structural corridors, applying the knowledge we have gained from the Montague Domain to this new Woodley Domain.

“This deal is consistent with Gateway’s strategy of accumulating significant land-holdings through low-cost entry means.

“The sensible, staged approach to this farm-in will allow Gateway to significantly de-risk the project over time without committing to significant up-front capital.”

Cashed up and drilling hard

In October 2019, Gateway announced a maiden 240,000oz resource estimate for its cornerstone Whistler and Montague deposits.

Following a recent $7m cap raise, Gateway is now embarking on a sustained drilling blitz at a range of high-priority gold targets.

These range from brownfields resource expansion to greenfields (untouched) opportunities – all aimed at establishing Gidgee as a significant new Australian gold development project.

Importantly for investors, news flow will be strong.

The company is positioned to undertake continuous programs of drilling that over the next six months will see at least 15,000m of Reverse Circulation (RC) and 10,000m of air-core (AC) drilling completed at priority targets around the Montague Dome.

A similar approach to drilling is expected to be maintained into 2021, it says.

This story was developed in collaboration with Gateway Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.