Galan’s HWM project value jumps 120pc after update on lithium prices

Pic: John W Banagan / Stone via Getty Images

Galan Lithium has updated the Preliminary Economic Assessment (PEA) study for its flagship Hombre Muerto West (HWM) Project in Catamarca Province, Argentina, based on a revised lithium price.

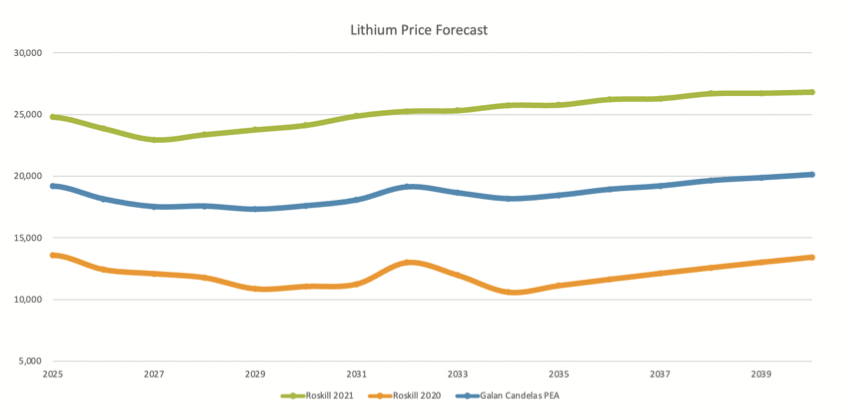

The original PEA was based on an average lithium price of US$11,687/tonne to the year 2040, with the updated study using the long-term average real lithium price assumption (2025-2040) of US$18,594/tonne battery grade lithium carbonate (LCE).

The unleveraged pre-tax net present value (NPV) has increased to US$2.2 billion – a 120% increase from US$1 billion in 2020.

The internal rate of return (IRR) is 37.5%, the project has less than a three-year payback period and the average life-of-mine annual EBITDA is US$287 million, up from US$174 million.

The company now has two PEA study level projects – HMW and Candelas – which have a combined long term production potential of 34ktpa LCE and a combined pre-tax NPV of US$3.4 billion.

‘Phenomenal’ NPV on conservative price assumption

The updated economic study retains the original production profile of a long-life 40 years+ project at 20,000 tonnes per annum of battery grade LCE, including competitive cash production cost for Li2CO3 of US$3,518/tonne in the first quartile of global lithium cost production curve.

Galan Lithium (ASX:GLN) managing director Juan Pablo Vargas de la Vega said the updated project economics for HMW show how healthy the project is.

“Despite using a conservative long-term price assumption, HMW has delivered a phenomenal pre-tax NPV of nearly US$2.2 billion,” he said.

“The company is in an enviable space whereby it has two study level projects that can potentially deliver combined long term production levels of 34ktpa LCE along with NPVs that are above US$3.4 billion.

“As we have previously said, Galan remains excited about the potential value add for our shareholders once we enter the lithium market with prices expected to be +US25k/tonne LCE.

“Our projects would now be among the lowest cost of any future producers in the lithium industry, due to their high grade and low impurity setting, green credentials and a low carbon footprint.

“Galan is excited to be a part of the solution to the global decarbonisation story.”

DFS planned in 2022

Since the release of the original HMW PEA Study in 2020, the company has confirmed laboratory lithium chloride concentrations of 6% lithium several times and confirmed production of lithium carbonate battery grade of 99.88% LCE from its concentrate.

It has also received permits for new drilling and Stage 1 construction permits for the HMW camp and pilot plant.

During 2022, Galan will be undertaking a definitive feasibility level study (DFS) with the appointment of an independent, well credentialed engineering firm imminent.

The company also expects the new HMW drilling to increase its indicated resources as well as a likely move into the measured and indicated mineral resource category.

This article was developed in collaboration with Galan Lithium Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.