Galan shaping up to master its lithium carbonate craft

Pic: John W Banagan / Stone via Getty Images

Special Report: Model. Study. Test. Repeat. Quizzed on what 2021 will look like for market darling Galan Lithium, managing director JP Vargas de la Vega’s response is all about optimisation.

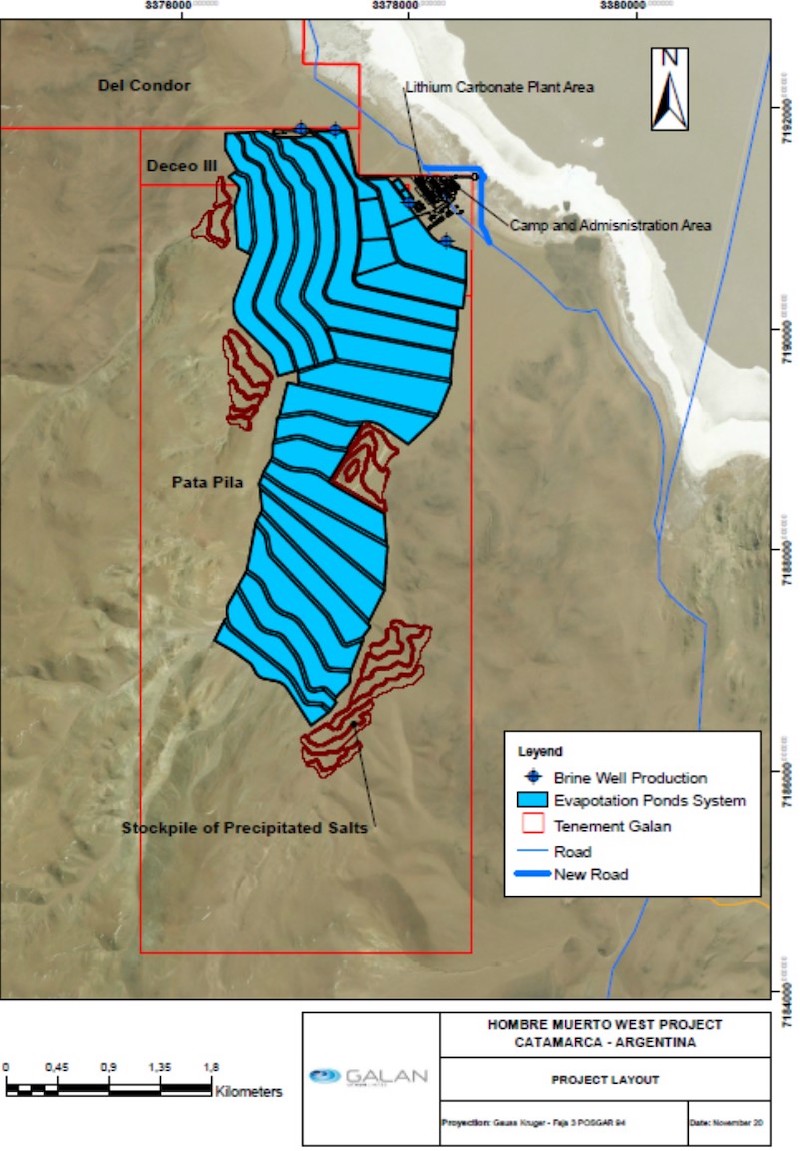

Speaking to Stockhead just days after Galan Lithium’s (ASX:GLN) release of a compelling preliminary economic assessment (PEA) on the Hombre Muerto West (HMW) lithium project, Vargas de la Vega said the Argentinian focused lithium developer saw further improvement to be made.

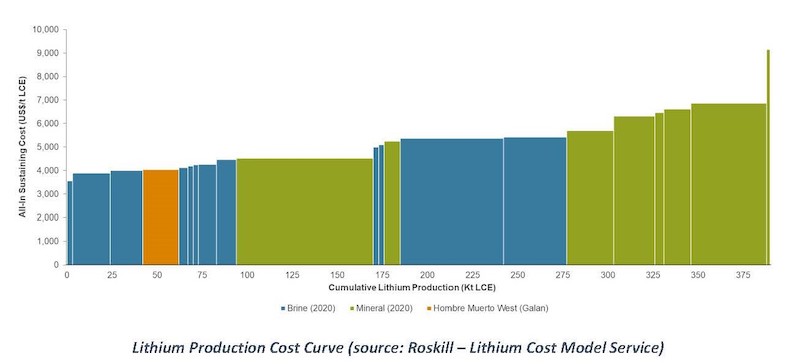

Further improvement, that is, to a PEA which placed HMW in the lowest quartile of lithium carbonate projects for production costs, with a US$1 billion pre-tax net present value and an internal rate of return of 22.8%.

HMW would produce lithium at about US$3518 per tonne – already one of the lowest cash cost points in the industry, against Roskill’s average long-term lithium carbonate price (2020-2040) of US$11,687/t.

Envisioned to produce 20,000t per annum for more than 40 years using just 60% of the current HMW resource, the capital costs for the project are estimated at US$439 million – inclusive of a 30% contingency which could be reduced through further optimisation.

That optimisation, as well as more broadly understanding the best way to skin the potentially incredible cat that is HMW, are expected to be the focus over the next 12 months.

“Over the next 12 months, our aim is to mature and advance the project as much as can be done,” Vargas de la Vega said.

“We have a number of things we want to test – yes, there is the usual lithium carbonate production we all know we’re capable of doing, because our neighbours can.

“But the question for us is, what else can we do? What else can we look at? What are the things that have changed from when we were looking at this project a year ago, and what are the things best suited to us?”

HMW the 2020 star

HMW was the big story across the whole year for Galan. Added to the resource base at the Candales project, it took the company’s resource base on its Argentinian ground from around 700,000 tonnes of lithium to closer to 3 million.

“HMW increased our resource base significantly this year, adding 2.3 million tonnes approximately – now we have a very significant, world class project with high grade and low impurities,” Vargas de la Vega said.

“You don’t find those very often in Argentina. While some Chilean projects have higher grades, we’re potentially sitting on the project with the highest grade in Argentina as well.”

Galan was also able to send enough brine for testing across the border to Chile in the second half of 2019.

COVID had implications for Galan, though they were overcome in great fashion. The PEA was delivered on time and on budget – with communication by Zoom.

“This was the first time I’d been part of a study where I never got to meet the people on the other end in person – all the meetings had to be online,” Vargas de la Vega said.

“These were conceptual results we were moulding, so we were still able to get things done. But I’m really looking forward to getting in the same room with our team in Argentina as soon as we can.”

Shifting sentiment

Perhaps one of the biggest news stories for Galan in 2020 had very little to do with Galan at all.

Elon Musk’s announcement that the Tesla Long Range Model 3, to be made in China, would run off a lithium ion phosphate battery, rather than straight lithium ion, played into the hands of those in the lithium carbonate game.

It was one of a number of significant battery announcements out of Asia which pivoted towards lithium ion phosphate batteries and caused a reassessment of the market for lithium carbonate against lithium hydroxide – the kind typically produced from hard rock spodumene deposits such as those found in Australia.

“The re-rate in prices of lithium carbonate equivalent comes from the pressures of not having enough lithium carbonate,” Vargas de la Vega said.

“The production out of Australia is pretty much reflected in the spodumene price, because spodumene doesn’t produce lithium carbonate, it produces lithium hydroxide. The spodumene price remains low, and the lithium hydroxide price is roughly the same as what it was a few months ago.

“The interesting thing is that we’re seeing the price gap between lithium carbonate, which is typically cheaper, and lithium hydroxide narrowing.

“That demand for lithium carbonate is for the lithium phosphate batteries in Asia.”

If there is a lithium carbonate boom coming, Galan’s plan to model, study and test its way through 2021 leaves it particularly well placed to ride the wave.

“This is a marathon, not a sprint,” Vargas de La Vega said.

“We have a plan, we’re optimising and executing the plan – in 2021 we’re walking our talk as we have since the beginning.”

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.