Galan Lithium’s PEA returns robust economics for 25-year Candelas Lithium project

Pic: Schroptschop / E+ via Getty Images

A competitive cash production cost for lithium carbonate of US$4,277/t positions the Candelas project as a low-cost developer in the lithium industry.

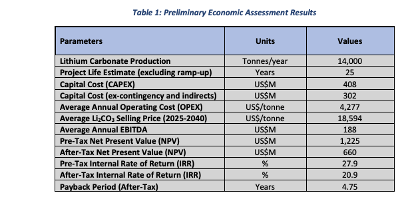

Galan Lithium’s preliminary economic assessment (PEA) for the Candelas Project in Argentina’s Catamarca Province has returned ‘robust’ economic results, featuring a pre-tax NPV of US$1,225 million and IRR of 29.9% with a four-year payback period.

The study has estimated a production profile of 14,000 tonnes per annum of battery grade lithium carbonate (LCE) product including some technical grade product for the first three years.

This means Galan (ASX:GLN) now has two PEA study level projects with combined long term production potential of 34,000 tpa LCE.

The company believes the outcomes at Candelas can be further optimised and enhanced to refine the project’s potential.

‘Projects among the lowest cost of any future products’

Galan (ASX:GLN) managing director Juan Pablo Vargas de la Vega said: “We remain excited about the potential value add for our shareholders once we enter the lithium market with prices expected to be +US25k/t LCE.

“Our projects would now be among the lowest cost of any future producers in the lithium industry, due to their high grade and low impurity setting, green credentials and a low carbon footprint.

“Galan is excited to be a part of the solution to the global decarbonisation story.”

Optimising next steps

Vega added that the company now has a solid commercial base to move forward with a clean, low-tech, and low energy solution.

“We also believe we have capability to further review and reduce Opex and Capex.

“We have learnt so much more about Candelas on this journey and will continue to apply our findings in optimising our next steps at the pre-feasibility and definitive feasibility studies.

“Importantly, we will also continue to review the possibility to produce lithium chloride concentrate to reduce time to market and capital expenditure at both of our projects.

“As a result, we remain determined to bring our projects to market in the shortest possible time so that we can supply lithium for future lithium battery requirements needed for electric vehicles.”

Preparation of the project’s PEA was managed by Ad Infinitum and Galan’s project manager for the engineering inputs including the recovery method, project layout and infrastructure, capital cost and operating cost estimates and overall economic evaluation.

The other sections of the study were managed by consultants and employees of Galan Lithium Limited.

Market outlook

Galan has assumed a conservative view to long term lithium pricing and as a result, has taken a mid-point between the long-term pricing between the 17th and 18th Editions from Roskill of US$18,594/t.

Roskill expects contract prices for lithium carbonate battery grade and hydroxide to remain near to or above US$25,000/t on a long-term real (inflation adjusted) basis.

After softening in 2019 and 2020, prices on a nominal basis the long-term lithium carbonate battery grade price is projected to rise to around US$30,000-40,000/t .

Strong demand growth for refined lithium products is forecast to be sustained by expanding production, new market entrants and the draw-down of stockpiled material through to 2026, though a fundamental supply deficit is expected to form in the late 2020s.

Significant further investment in expanding production capacity at existing operations, in addition to new projects and secondary lithium sources will be necessary to meet projected demand growth through to 2030.

This article was developed in collaboration with Galan Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.