Galan in full control of its destiny as it takes stake in Greenbushes South lithium project to 100pc

Pic: Mikolette/E+ via Getty Images

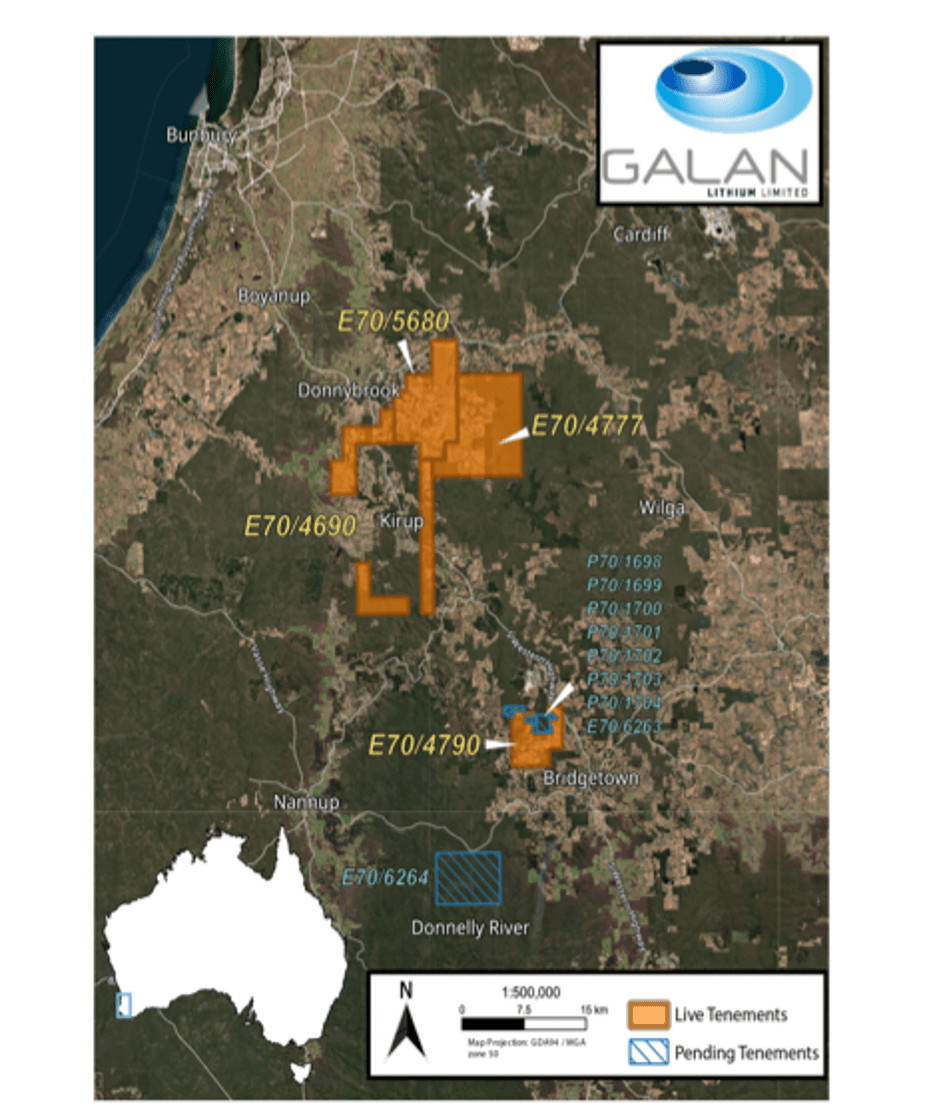

Galan Lithium has taken full control of the Greenbushes South lithium project, giving it complete ownership of 315km2 of prime exploration land just 3km from the world’s biggest lithium mine.

Grading an outrageous ~2% Li2O Greenbushes has been producing lithium since 1983 and is owned by three of the world’s largest lithium mining entities in China’s Tianqi, Australia’s IGO and America’s Albemarle.

Picking up the last 20% of Greenbushes South off minority partner Lithium Australia, Galan (ASX:GLN) has placed itself in the box seat to make a follow up discovery in the underexplored region 250km south of Perth.

Galan initially acquired the majority 80% stake due to its prediction the project hosted the strike projection of the geological structure associated with Greenbushes.

It provides $370m capped Galan with unfettered ownership of two assets that form a unique diversification strategy across the lithium world’s two brightest hotspots – the Hombre Muerte West project in Argentina where it has drilled a deep basin containing 5.8Mt of lithium carbonate equivalent in lithium rich brines, and a hard rock exploration project in WA.

“We are delighted to acquire full ownership of this highly prospective project in one of the world’s most renowned lithium districts,” Galan managing director JP Vargas de la Vega said.

“We have the necessary personnel in place to undertake the pending exploration programmes and workload at Greenbushes South and are extremely excited with what is to come there.

“Galan is in total control of its destiny with full ownership of its lithium projects in Argentina and Australia.”

The price is right

Airborne geophysics were flown over Galan’s tenements in March 2022 to develop pegmatite targets, with a pegmatite associated with spodumene bearing rocks discovered at E70/4790 in August.

Further geological mapping, soil sampling and geophysical investigations are being used to determine drill targets within E70/4790, with the same ground based methods being applied to GLN’s other tenements in the region.

If something significant is found it could be a terrific pick-up.

Galan will pay $2 million in cash and issue $1m worth of GLN shares to Lithium Australia, which will have the first right to negotiate an offtake agreement with respect to 20% of Galan’s share of lithium from the tenements.

This article was developed in collaboration with Galan Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.