FMG’s Eliwana mine starts production as iron ore price hits $US150 per tonne

Iron ore producer Fortescue has brought online its new Eliwana mine as iron ore prices hit an eight-year high. Image: Getty

- FMG’s Eliwana mine starts up, 2021FY production guidance at 180 million tonnes

- ‘We have the ability to increase output from our existing hubs on an incremental level’

- Chinese scrap steel prices more expensive than pig iron sourced from iron ore

Fortescue Metals Group (ASX:FMG) will seek to maximise its iron ore shipments this year as it marked the start-up this week of its $1.8bn Eliwana mine and rail project in WA’s Pilbara region.

The arrival of Eliwana comes at a euphoric time for the iron ore sector with spot prices rising to $US150 per tonne ($200.60/tonne) this week for cargoes landed in China.

Some commentators are talking about a possible new super cycle for iron ore prices, as supply becomes stretched by China’s accelerating demand.

Eliwana adds 30 million tonnes per year of production capacity to Fortescue’s output, although some of its production is to replace output from its Firetail mine.

“Eliwana will see us maintain our low-cost status and provide us with greater flexibility across our product mix,” said chief executive, Elizabeth Gaines.

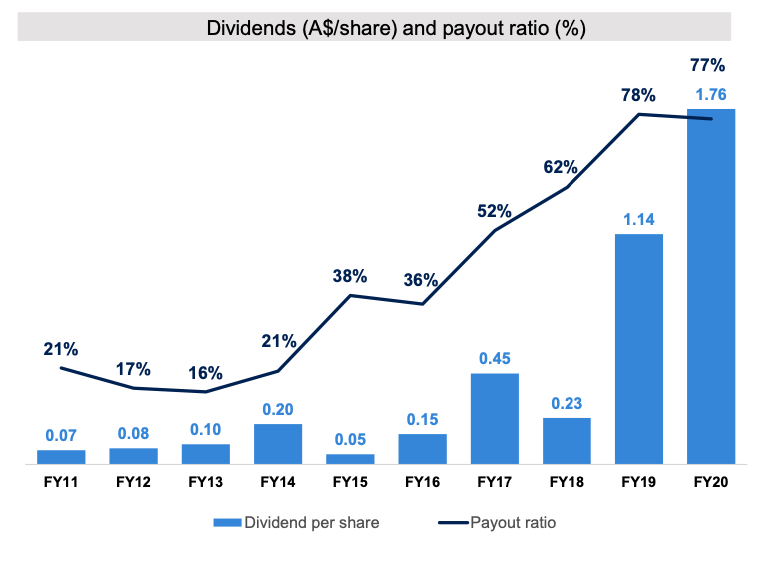

The company is keeping to its generous dividend policy, in the current high-priced environment, despite committing investment to hydrogen and renewable energy projects.

“Our dividend policy is to pay a range of 50 to 80 per cent of net profit after tax, and we are targeting the upper end of the range,” said Gaines in the company’s Investor and Media Day webinar broadcast.

Fortescue has scope for an incremental production increase

The company shipped 178 million tonnes of iron ore in the 2020 financial year, and its guidance for this year is to ship 175 million to 180 million tonnes of product.

The company is seeking to maximise its exports to benefit from current high prices for iron ore in the spot seaborne market.

“Clearly in this market, any opportunity to put more tonnes through the system we are absolutely looking at for the next year or two. That holds true for our hematite operations and we seek to maximise throughput,” chief operating officer, Greg Lilleyman, said.

Fortescue produces iron ore from three mining hubs in the Pilbara region: Chichester, Solomon with its Firetail and Kings and Queens operations, and Western with Eliwana.

“We have the ability to increase output from our existing hubs on an incremental level,” said Lilleyman.

Options available to the company outside of its three mining hubs are its Nyidinghu project area next to Chichester, ore from which could be processed at its Cloudbreak operation.

First ore on ship from the company’s $2.6bn Iron Bridge iron ore project is expected in the first half of 2022, of which Fortescue’s share is $US2.1bn, said Gaines.

Iron Bridge has a production target of 22 million tonnes per year, and Fortescue has a 69 per cent interest in the Pilbara iron ore project.

Costs for the miner remain low at $US13.50 per wet metric tonne ($18/tonne) for the 2021 financial year, said Gaines.

This is compared with $US27/wmt in 2015.

Chinese scrap steel use remains at low levels

China is making efforts to recycle more scrap steel, but it is around $US25 to $US30 per tonne more expensive to make steel in China from scrap than from pig iron.

“The feedback from our customers is that scrap continues to be expensive, and some of them say making steel from scrap is more expensive than from pig iron,” said sales and marketing director, Danny Goeman.

China collects 220 million tonnes of scrap per year, including a small amount of imports, and this year is on track to produce more than 1 billion tonnes of steel.

The country is looking to import more scrap steel from current levels of 10 million to 15 million tonnes per year.

“Ten or 15 million tonnes per year of scrap is not going to change the hot metal dynamics,” said Goeman.

Goeman added that considerable challenges and uncertainties exist in bringing new iron ore supply to the market.

These include the speed and extent of the supply recovery in Brazil; the scale and pace of Australian mine depletions; and the potential exit of high cost supply from Chinese and non-Chinese sources.

“We envisage significant ongoing challenges associated with expansions of Brazilian supply,” he said.

ASX share price for Fortescue Metals Group (ASX:FMG)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.