Financing next on the list for Vulcan’s monster Zero Carbon project, which could produce enough lithium for 1 million EVs per year

Vulcan’s path ahead is clear with financing for its Zero Carbon Lithium project due to start in November. Pic: via Getty Images

- Zero Carbon Lithium project to produce renewable geothermal energy and enough lithium hydroxide for 1 million EVs per year

- The project stands as the largest lithium resource in Europe

- Key Bridging Study identifies several value improvements, due for completion in October

- Critical building permit secured for CLEOP facility for optimising operating conditions

- Financing process expected to start November

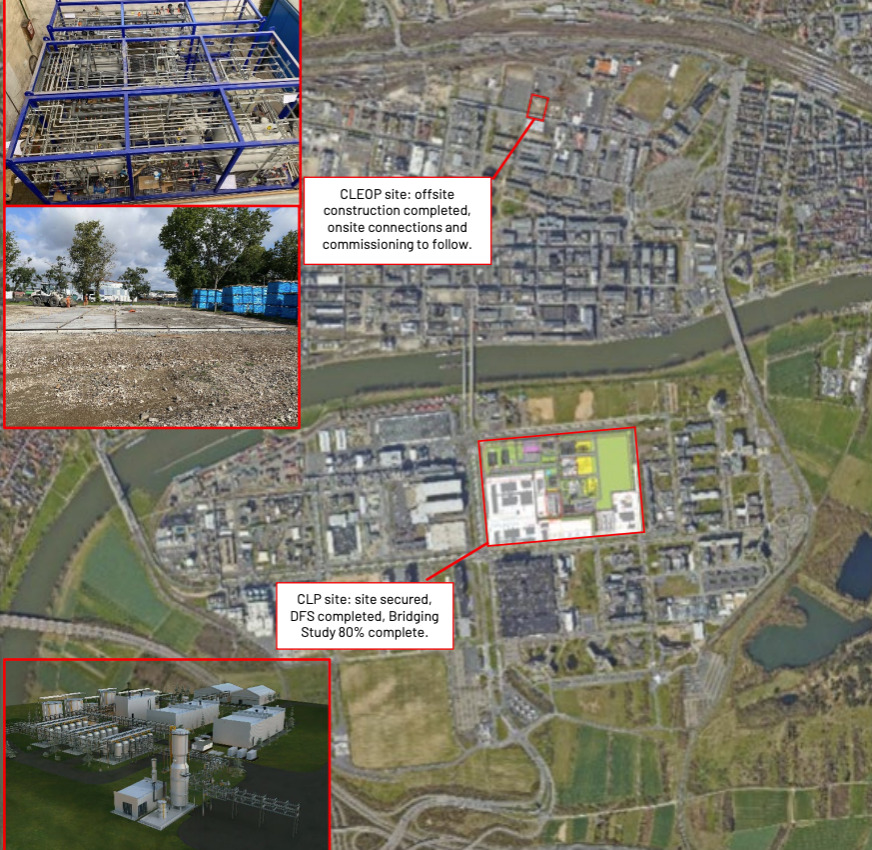

Vulcan Energy’s Zero Carbon Lithium project in Germany is making good progress towards being ‘finance-ready’ in November with the Phase One Bridging Study now 80% complete and critical permits approved.

Vulcan Energy Resources (ASX:VUL) aims to be the world’s first dual lithium chemicals and renewable energy producer with net zero greenhouse gas emissions.

Its unique Zero Carbon Lithium™ project will produce renewable geothermal energy and enough lithium hydroxide for 1 million EVs per year from the same deep brine source in the Upper Rhine Valley, Germany.

Vulcan’s project boasts the largest lithium resource in Europe, and has certainly drawn all the right type of attention.

European automaker Stellantis – which owns the Opel, Peugeot, Citroen, Fiat and Chrysler brands – became Vulcan’s second largest shareholder in June last year with a hefty $76m (at that time) equity investment. In addition, they have offtake agreements signed for 10 years and two geothermal projects to decarbonise facilities in the works.

Vulcan has inked additional offtake agreements with some of the largest battery, cathode and EV producers in Europe, such as Volkswagen, LG Energy, Umicore and Renault.

The road to production

Vulcan has made significant progress towards development of the project, noting that the Phase One Bridging Study, which is being completed together with Hatch (which also completed the Pre-Feasibility and Feasibility studies) is now 80% complete and on track for completion in October.

This study has already identified several key value improvements including driving further economies of scale through reduction of the planned two lithium extraction plants (LEPs) and two geothermal power plants, to one central LEP and geothermal power plant with 24,000tpa of lithium hydroxide equivalent capacity.

Additionally, the study will mature current key deliverables and engineering definition to target a Class 2 estimate and Level 3 schedule, which will be further validated by key potential EPCM contractors for the Phase One project execution.

The company’s revised Field Development Plan (FDP), which is part of the Bridging Study, is also approaching conclusion.

It targets increased production from the core, proven area around Vulcan’s current production/re-injection wells whilst a revised Resource/Reserve update is due this month as part of this revised FDP.

Key permit received

Vulcan has also received the key building permit for the Central Lithium Electrolysis Optimisation Plant (CLEOP) at the Frankfurt Hoechst chemical park.

CLEOP will focus on optimising operating conditions, whilst the commercial Phase One Central Lithium Plant (CLP) is being contracted in the same chemical park.

It has been built off site, consisting of pre-assembled packaged units completed, tested and ready to be shipped for on-site integration and connection.

Site preparation works are in progress and start of commissioning is targeted for Q4 2023 whilst the Lithium Extraction Optimisation Plant (LEOP) is already in the commissioning phase, which is targeted for completion in October.

Both plants follow Vulcan’s three-year piloting and laboratory test work campaign and will be available for inspection by lenders during the financing process.

The company is also progressing the environmental and social impact assessment towards debt financing lender requirements for completion in October and has secured most of the main land packages for the core Phase One production areas with negotiations for the final package expected to conclude in November.

Project financing poised to start

Once the Bridging Study and ESIA are completed and the final critical land package secured, Vulcan Energy expects to kick off the final project financing process in November.

Debt financing will be led by BNP Paribas following a successful market sounding process conducted earlier in the year, which resulted in significant in-principle support from European Export Credit Agencies.

The company will also target equity financing at the project level after receiving interest from multiple strategic corporates from the energy, chemicals and automotive sectors.

Additionally, public funding is also being sought to assist with overall funding requirements.

This article was developed in collaboration with Vulcan Energy Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.