Felix Gold bites into antimony as drilling deepens high-grade mineralisation

Felix Gold strikes 5.87m intersection at 4.34% antimony at NW Array prospect in Alaska. Pic: Getty Images.

- Felix Gold records 5.87m of 4.34% antimony at 54m depth in drilling at NW Array prospect

- Antimony prices hit US$60,000 per tonne following China export ban and supply shortages

- Company targets Q4 2025 production start using simple processing methods to extract direct shipping concentrate

Special Report: Drilling by Felix Gold at the NW Array gold-antimony prospect within its Treasure Creek project in Alaska’s Fairbanks mining district has confirmed downdip extensions of surface mineralisation.

Latest results from the drilling, which also demonstrated strong grades and continuity of antimony at shallow depths, included a top hit of 5.87m grading 4.34% Sb from a down-hole depth of 54.08m with two high-grade intervals of up to 38% Sb in hole 25TCDC019.

Notably for Felix Gold (ASX:FXG), the results confirm the down-dip extension of the high-grade structure exposed in surface trench 25NWTR005.

Additionally, true widths of 4.2m to 5m were estimated with reasonable confidence for the vein zone intersected in holes 25TCDC019 and 25TCDC015.

“These latest results continue to validate the exceptional quality of our antimony discovery at Treasure Creek,” executive director Joe Webb said.

“Intersecting 5.87 metres at 4.34% antimony from 54 metres depth—including ultra-high-grade intervals up to 21.83%—confirms the down-dip extension of our surface mineralization with estimated true widths of 4 to 5 metres.

“The strategic timing couldn’t be more relevant.

“With China’s export ban creating acute supply shortages and antimony prices reaching US$60,000 per tonne, the US government has issued emergency declarations and mobilized unprecedented funding for domestic production.

“Our project sits 20 minutes from Fairbanks with full infrastructure access, targeting production within months, not years.”

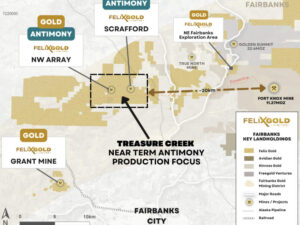

Treasure Creek location. Pic: Felix Gold

Treasure Creek project

Treasure Creek hosts significant antimony mineralisation across multiple antimony and gold prospects with NW Array and Scrafford representing the most advanced prospects.

Mineralisation occurs primarily as stibnite and oxidised forms hosted within vein and breccia zones in felsic porphyry and quartz-mica schist and associated with gold mineralisation.

With very high antimony grades exposed at surface and strong existing infrastructure, the company is advancing a streamlined development pathway targeting the potential start of production in Q4 2025 to Q1 2026.

Webb noted the company had lodged a permit amendment for a 1600t bulk sample targeting zones where metallurgical testing showed more than 80% stibnite direct from the ground.

“Our processing flowsheet is elegantly simple: excavate, hand sort, bag. No crushing plants, no complex metallurgy—just direct-ship concentrate potentially exceeding military-grade specifications with very low capital expenditure,” he added.

“Simultaneously, we’re advancing the foundation for sustained operations—winter drilling continuing through the season, comprehensive environmental baseline studies underway, and targeting early Q1 2026 for multi-year permit submission.”

FXG is progressing an extensive program of drilling and trenching at the NW Array prospect.

To date, it has completed 52 reverse circulation holes totalling 2889.5m including four water monitoring bores and 38 diamond holes totalling 2719.9m.

Drilling is aimed at better defining the extent and grade of high-grade antimony and gold mineralisation intersected in previous drilling and trenching campaigns.

Shallow trenching over the expected surface position of the breccia zone and east-trending vein zones is being planned.

This article was developed in collaboration with Felix Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.