Eye on Lithium: Lower spot prices are water off a duck’s back for US majors who only see revenue increases

A duck, not giving a quack about lower spot prices, earlier. (Pic via Getty Images)

All your lithium news, August 10.

Has the Delta Lithium (ASX:DLI) presentation at Diggers & Dealers yesterday backfired?

What could be construed as just a bit of a joke at the conference – simple black text on white background presentation slides – has made Delta’s share price slide too, to the tune of 15% yesterday.

Delta’s share price actually dropped from a near ATH of 93c down to 82.5c the day before the presentation, so one might wonder if it was a clever trick to tank the share price further for a big buyback.

DLI has the sizeable Yinnetharra lithium find in the up-and-coming Gascoyne mineral province – and a bunch of other explorers have staked tenements all around it looking for hard rock spodumene and rare earths, including Reach Resources (ASX:RR1), Voltaic Strategic Resources (ASX:VSR), Minerals 260 (ASX:MI6), Dalaroo Metals (ASX:DAL) and Hastings Technology Metals (ASX:HAS).

Shares today, however, have stagnated around the 72.5c mark, so we’ll keep an eagle eye on how this develops.

Meanwhile, a QoQ drop in revenue from US lithium giants Albemarle and Livent looks like water off a duck’s back seemingly as both are confident of a price recovery and are posting higher revenues than in 2022.

Livent reported second-quarter revenue of US$235.8m, 7% lower than Q1 2023 but 8% higher than Q2 2022, with project revenue expected to be a raised guidance of ~US$1.125bn this year, says Fastmarkets analysis.

Albemarle expects its annual revenue of US$10.4-$11.5bn this year, up from its previous projection back in May of US$9.8-US$11.5bn.

That’s a big gain of ~40-55% compared with the 2022 revenue of US$7.32 billion and likely a testament to its refining capacity changes at its WA operations and overall raw material production rate increases.

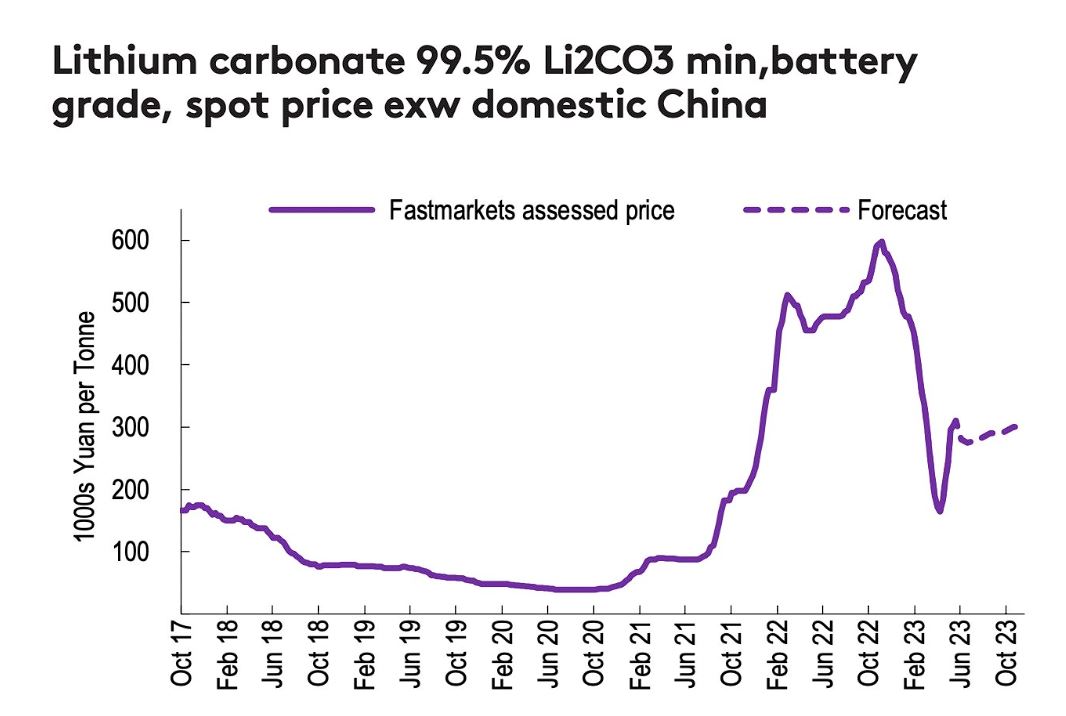

Fastmarkets also has eyes on a spot price recovery for lithium carbonate, projecting an uptick towards the end of this year as consumers in China are running down inventories that were replenished in June, the analyst says.

Here’s how Aussie lithium stocks are tracking:

| CODE | COMPANY | PRICE | % TODAY | YTD % | MARKET CAP |

|---|---|---|---|---|---|

| XTC | Xantippe Res Ltd | 0.0015 | 50% | -0.0015 | $11,480,100 |

| THR | Thor Energy PLC | 0.0045 | 29% | -0.0015 | $5,107,520 |

| TEM | Tempest Minerals | 0.016 | 23% | -0.007 | $6,588,681 |

| LKE | Lake Resources | 0.2 | 21% | -0.6 | $234,703,377 |

| KGD | Kula Gold Limited | 0.017 | 13% | -0.008 | $5,598,179 |

| PGD | Peregrine Gold | 0.305 | 13% | -0.080593 | $15,147,705 |

| FTL | Firetail Resources | 0.135 | 13% | -0.025 | $11,550,000 |

| A11 | Atlantic Lithium | 0.385 | 12% | -0.235 | $210,188,373 |

| LRV | Larvottoresources | 0.15 | 11% | -0.01 | $9,079,387 |

| SBR | Sabre Resources | 0.041 | 11% | 0.003 | $10,784,989 |

| ZNC | Zenith Minerals Ltd | 0.076 | 9% | -0.189 | $24,666,662 |

| KAI | Kairos Minerals Ltd | 0.027 | 8% | 0.006091 | $65,522,805 |

| DAL | Dalaroometalsltd | 0.055 | 8% | -0.045 | $2,645,625 |

| NIS | Nickelsearch | 0.07 | 8% | -0.088352 | $6,215,975 |

| REC | Rechargemetals | 0.215 | 8% | 0.08 | $21,116,895 |

| IPT | Impact Minerals | 0.016 | 7% | 0.009 | $42,670,558 |

| EPM | Eclipse Metals | 0.017 | 6% | 0.001 | $32,448,957 |

| L1M | Lightning Minerals | 0.17 | 6% | 0.005 | $6,274,912 |

| CHR | Charger Metals | 0.265 | 6% | -0.18 | $15,528,592 |

| CMD | Cassius Mining Ltd | 0.038 | 6% | 0.018 | $17,882,215 |

| AZL | Arizona Lithium Ltd | 0.02 | 5% | -0.042 | $60,096,750 |

| WC8 | Wildcat Resources | 0.2 | 5% | 0.176 | $126,458,604 |

| TYX | Tyranna Res Ltd | 0.021 | 5% | -0.003 | $65,728,507 |

| INR | Ioneer Ltd | 0.2725 | 5% | -0.1075 | $548,447,325 |

| WML | Woomera Mining Ltd | 0.011 | 5% | -0.008 | $10,040,043 |

| LPD | Lepidico Ltd | 0.0115 | 5% | -0.0045 | $84,021,363 |

| PSC | Prospect Res Ltd | 0.115 | 5% | -0.005 | $50,848,541 |

| KOB | Kobaresourceslimited | 0.115 | 5% | -0.025 | $11,595,833 |

| CAI | Calidus Resources | 0.175 | 4% | -0.095 | $101,819,877 |

| GSM | Golden State Mining | 0.048 | 4% | 0.005 | $8,790,061 |

| DRE | Dreadnought Resources Ltd | 0.05 | 4% | -0.055 | $160,429,355 |

| OCN | Oceanalithiumlimited | 0.255 | 4% | -0.09 | $13,003,743 |

| TON | Triton Min Ltd | 0.026 | 4% | -0.01 | $39,033,890 |

| SYA | Sayona Mining Ltd | 0.135 | 4% | -0.055 | $1,338,128,482 |

| BUR | Burleyminerals | 0.135 | 4% | -0.085 | $13,168,578 |

| ANX | Anax Metals Ltd | 0.058 | 4% | 0.005 | $24,074,619 |

| CY5 | Cygnus Metals Ltd | 0.3 | 3% | -0.08 | $64,748,456 |

| EG1 | Evergreenlithium | 0.3 | 3% | 0 | $16,306,700 |

| ESS | Essential Metals Ltd | 0.46 | 3% | 0.135 | $119,642,685 |

| QXR | Qx Resources Limited | 0.032 | 3% | -0.01 | $27,802,732 |

| DTM | Dart Mining NL | 0.033 | 3% | -0.022 | $5,513,191 |

| VSR | Voltaic Strategic | 0.034 | 3% | 0.0105 | $14,892,907 |

| GW1 | Greenwing Resources | 0.195 | 3% | -0.08 | $32,826,463 |

| CXO | Core Lithium | 0.595 | 3% | -0.43 | $1,077,939,741 |

| G88 | Golden Mile Res Ltd | 0.041 | 3% | 0.020666 | $13,175,580 |

| FBM | Future Battery | 0.1075 | 2% | 0.0545 | $44,923,739 |

| RAG | Ragnar Metals Ltd | 0.022 | 2% | 0.010554 | $10,190,591 |

| AKE | Allkem Limited | 14.54 | 2% | 3.3 | $9,067,497,983 |

| AS2 | Askarimetalslimited | 0.26 | 2% | -0.175 | $17,434,465 |

| EMS | Eastern Metals | 0.056 | 2% | -0.01804 | $3,659,691 |

| LPI | Lithium Pwr Int Ltd | 0.285 | 2% | -0.155 | $176,186,517 |

| PMT | Patriotbatterymetals | 1.42 | 1% | 0.67 | $487,704,266 |

| AZI | Altamin Limited | 0.079 | 1% | -0.001 | $30,553,907 |

| EMH | European Metals Hldg | 0.82 | 1% | 0.18 | $101,214,646 |

| MAN | Mandrake Res Ltd | 0.043 | 1% | 0.003 | $25,447,297 |

| PLS | Pilbara Min Ltd | 5.35 | 1% | 1.6 | $15,860,411,774 |

| WES | Wesfarmers Limited | 50.38 | 1% | 4.47 | $56,552,202,434 |

| QPM | Queensland Pacific | 0.099 | 1% | -0.011 | $171,142,096 |

| NMT | Neometals Ltd | 0.525 | 1% | -0.275 | $287,425,412 |

| LLI | Loyal Lithium Ltd | 0.54 | 1% | 0.245 | $36,642,151 |

| LTR | Liontown Resources | 2.735 | 1% | 1.415 | $5,990,135,194 |

| MIN | Mineral Resources. | 69.46 | 0% | -7.74 | $13,504,735,919 |

| ADV | Ardiden Ltd | 0.006 | 0% | -0.001 | $16,130,012 |

| 1MC | Morella Corporation | 0.007 | 0% | -0.005 | $42,690,063 |

| AML | Aeon Metals Ltd. | 0.016 | 0% | -0.011 | $17,542,410 |

| ASN | Anson Resources Ltd | 0.16 | 0% | -0.025 | $203,308,510 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0 | $2,752,409,203 |

| EUR | European Lithium Ltd | 0.082 | 0% | 0.008 | $114,327,612 |

| MLS | Metals Australia | 0.032 | 0% | -0.0125 | $19,969,158 |

| RLC | Reedy Lagoon Corp. | 0.008 | 0% | -0.001688 | $4,533,757 |

| TKL | Traka Resources | 0.007 | 0% | -0.001 | $6,099,305 |

| AX8 | Accelerate Resources | 0.026 | 0% | 0.003 | $9,869,646 |

| AM7 | Arcadia Minerals | 0.105 | 0% | -0.1 | $9,875,261 |

| BYH | Bryah Resources Ltd | 0.019 | 0% | -0.006675 | $6,640,600 |

| FG1 | Flynngold | 0.07 | 0% | -0.03 | $9,546,781 |

| FRS | Forrestaniaresources | 0.078 | 0% | -0.062 | $7,263,548 |

| IMI | Infinitymining | 0.13 | 0% | -0.145 | $10,036,180 |

| MMC | Mitremining | 0.3 | 0% | 0.02 | $11,470,530 |

| CTN | Catalina Resources | 0.005 | 0% | -0.005 | $6,192,434 |

| WCN | White Cliff Min Ltd | 0.009 | 0% | -0.005 | $11,313,167 |

| CRR | Critical Resources | 0.043 | 0% | 0 | $76,426,062 |

| PNN | Power Minerals Ltd | 0.33 | 0% | -0.2 | $24,161,339 |

| SCN | Scorpion Minerals | 0.061 | 0% | -0.009 | $21,088,078 |

| ENT | Enterprise Metals | 0.004 | 0% | -0.006 | $3,197,884 |

| STM | Sunstone Metals Ltd | 0.024 | 0% | -0.013 | $73,967,637 |

| AVW | Avira Resources Ltd | 0.002 | 0% | -0.001 | $4,267,580 |

| BNR | Bulletin Res Ltd | 0.054 | 0% | -0.039 | $15,853,919 |

| MRR | Minrex Resources Ltd | 0.014 | 0% | -0.018 | $15,188,145 |

| A8G | Australasian Metals | 0.15 | 0% | -0.04 | $7,818,074 |

| EFE | Eastern Resources | 0.01 | 0% | -0.019 | $12,419,465 |

| MQR | Marquee Resource Ltd | 0.037 | 0% | 0 | $12,236,178 |

| SRZ | Stellar Resources | 0.012 | 0% | -0.001 | $12,071,571 |

| LSR | Lodestar Minerals | 0.007 | 0% | 0.002 | $12,903,781 |

| AOA | Ausmon Resorces | 0.004 | 0% | -0.003 | $3,877,157 |

| VKA | Viking Mines Ltd | 0.01 | 0% | 0 | $10,252,584 |

| VMC | Venus Metals Cor Ltd | 0.135 | 0% | 0.056511 | $25,613,372 |

| RAS | Ragusa Minerals Ltd | 0.055 | 0% | -0.06 | $7,842,933 |

| YAR | Yari Minerals Ltd | 0.019 | 0% | 0.002 | $9,164,798 |

| LRD | Lordresourceslimited | 0.089 | 0% | -0.0785 | $3,304,759 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0 | $74,238,031 |

| AUN | Aurumin | 0.023 | 0% | -0.038 | $6,785,911 |

| ZEO | Zeotech Limited | 0.042 | 0% | -0.005 | $71,648,769 |

| ALY | Alchemy Resource Ltd | 0.014 | 0% | -0.009 | $16,493,068 |

| DAF | Discovery Alaska Ltd | 0.026 | 0% | -0.006 | $6,090,102 |

| LNR | Lanthanein Resources | 0.017 | 0% | -0.004 | $19,066,785 |

| TUL | Tulla Resources | 0 | 0% | -0.330511 | $118,262,971 |

| LLL | Leolithiumlimited | 1.14 | 0% | 0.655 | $1,125,447,873 |

| SGQ | St George Min Ltd | 0.04 | 0% | -0.028 | $33,862,999 |

| PAT | Patriot Lithium | 0.205 | 0% | -0.06 | $12,584,438 |

| PL3 | Patagonia Lithium | 0.165 | 0% | 0 | $8,085,578 |

| RMX | Red Mount Min Ltd | 0.0045 | 0% | -0.0005 | $11,359,580 |

| ENT | Enterprise Metals | 0.004 | 0% | -0.006 | $3,197,884 |

| LPM | Lithium Plus | 0.27 | 0% | -0.1 | $17,816,814 |

| LRD | Lordresourceslimited | 0.089 | 0% | -0.0785 | $3,304,759 |

| DYM | Dynamicmetalslimited | 0.22 | 0% | 0 | $7,700,000 |

| ICL | Iceni Gold | 0.11 | 0% | 0.03 | $22,942,857 |

| TMX | Terrain Minerals | 0.006 | 0% | 0 | $6,499,196 |

| MHK | Metalhawk. | 0.13 | 0% | -0.035 | $10,240,231 |

| NKL | Nickelxltd | 0.07 | 0% | -0.01 | $6,050,470 |

| IGO | IGO Limited | 13.265 | 0% | -0.195 | $10,079,234,591 |

| PLL | Piedmont Lithium Inc | 0.725 | -1% | 0.08 | $279,482,325 |

| JRL | Jindalee Resources | 1.81 | -1% | -0.075 | $104,716,613 |

| AGY | Argosy Minerals Ltd | 0.2775 | -1% | -0.2925 | $393,234,099 |

| LLO | Lion One Metals Ltd | 1.05 | -1% | -0.12 | $14,637,905 |

| TKM | Trek Metals Ltd | 0.087 | -1% | 0.011 | $43,394,567 |

| BM8 | Battery Age Minerals | 0.38 | -1% | -0.12 | $28,573,993 |

| LRS | Latin Resources Ltd | 0.355 | -1% | 0.257 | $944,352,947 |

| NVA | Nova Minerals Ltd | 0.325 | -2% | -0.355 | $69,593,687 |

| GL1 | Globallith | 1.59 | -2% | -0.255 | $419,566,016 |

| LIS | Lisenergylimited | 0.305 | -2% | -0.015 | $51,433,398 |

| MTM | MTM Critical Metals | 0.059 | -2% | -0.02 | $5,822,803 |

| GT1 | Greentechnology | 0.545 | -2% | -0.28 | $118,202,525 |

| PAM | Pan Asia Metals | 0.27 | -2% | -0.14 | $42,834,395 |

| GLN | Galan Lithium Ltd | 0.785 | -2% | -0.285 | $277,337,202 |

| LIT | Lithium Australia | 0.047 | -2% | 0.002 | $58,617,200 |

| DLI | Delta Lithium | 0.705 | -2% | 0.23 | $376,253,775 |

| LEL | Lithenergy | 0.67 | -2% | -0.1 | $70,561,850 |

| AAJ | Aruma Resources Ltd | 0.038 | -3% | -0.015 | $7,651,872 |

| MM1 | Midasmineralsltd | 0.34 | -3% | 0.14 | $26,952,883 |

| AZS | Azure Minerals | 2.64 | -3% | 2.415 | $1,061,442,116 |

| RIO | Rio Tinto Limited | 109.5 | -3% | -6.91 | $41,891,749,750 |

| ARN | Aldoro Resources | 0.155 | -3% | -0.005 | $21,539,799 |

| EMC | Everest Metals Corp | 0.155 | -3% | 0.076 | $20,709,297 |

| EMC | Everest Metals Corp | 0.155 | -3% | 0.076 | $20,709,297 |

| KZR | Kalamazoo Resources | 0.14 | -3% | -0.07 | $24,367,706 |

| TOR | Torque Met | 0.14 | -3% | -0.04 | $13,968,871 |

| VUL | Vulcan Energy | 3.81 | -4% | -2.52 | $660,974,439 |

| KTA | Krakatoa Resources | 0.027 | -4% | -0.017 | $11,938,544 |

| RGL | Riversgold | 0.0125 | -4% | -0.0175 | $12,366,399 |

| INF | Infinity Lithium | 0.11 | -4% | -0.01 | $53,198,091 |

| SRI | Sipa Resources Ltd | 0.021 | -5% | -0.011 | $5,019,479 |

| MNS | Magnis Energy Tech | 0.1 | -5% | -0.27 | $123,847,306 |

| WR1 | Winsome Resources | 1.78 | -5% | 0.55 | $303,836,697 |

| MXR | Maximus Resources | 0.036 | -5% | -0.004 | $12,169,719 |

| LM1 | Leeuwin Metals Ltd | 0.35 | -5% | 0 | $16,570,450 |

| MHC | Manhattan Corp Ltd | 0.008 | -6% | 0.0025 | $24,964,328 |

| NWM | Norwest Minerals | 0.045 | -6% | -0.009 | $13,803,336 |

| EVR | Ev Resources Ltd | 0.015 | -6% | 0.001 | $14,975,745 |

| IR1 | Irismetals | 2.06 | -8% | 0.9 | $177,797,900 |

| BMM | Balkanminingandmin | 0.21 | -9% | -0.12 | $14,046,563 |

| TMB | Tambourahmetals | 0.21 | -9% | 0.105 | $9,721,917 |

| TMB | Tambourahmetals | 0.21 | -9% | 0.105 | $9,721,917 |

| FIN | FIN Resources Ltd | 0.013 | -13% | -0.006 | $9,315,530 |

| SLM | Solismineralsltd | 0.365 | -14% | 0.29 | $28,462,423 |

| M2R | Miramar | 0.048 | -14% | -0.027968 | $6,211,901 |

| IEC | Intra Energy Corp | 0.005 | -17% | -0.003 | $9,724,690 |

61 lithium stocks shot up today and 58 lay flat. 45 fell below yesterday’s prices.

WHO’S GOT NEWS OUT?

PERPETUAL RESOURCES (ASX:PEC)

Brazil’s Minas Gerais lithium valley is popping at the moment, with exploration permits being snapped up left right and centre in one of the most exciting new hard rock lithium precincts in the world.

PEC acquired tenements in the lithium valley precinct mid-July, and has purchased another three, adding 5,000ha to the now called Ponte Nova prospects, 20km down the road from Canadian miner Sigma Lithium’s Grota do Cirilo lithium project.

The Ponte Nova area is highly prospective and interpreted as an extension of the modelled pegmatite corridor which runs from Latin’s Salinas project through its Colina deposit and potentially further to the northeast.

PEC MD Robert Benussi PEC said the company has moved quickly and decisively “to build a commanding land position in what has become the premier spodumene area in Brazil, which boasts several Tier 1 deposits either adjacent or on trend from the tenements we have secured”.

“We also are forging a close working relationship with the permit vendor group and several other in-country specialists, which gives Perpetual significant capacity to quickly assess these compelling exploration ground positions and ultimately quickly add value through exploration activities.”

Latin Resources Limited’s (ASX:LRS) Colina project is just down the road, too – as is Solis Minerals’ (ASX:SLM) Jaguar, of which LRS has a sizeable ~18% stake in.

After LRS engaged DGS Lakefield laboratories to conduct a bulk metallurgical test work program on ore from the company’s 45.2Mt Colina deposit, the first bulk DMS tests have produced a high-quality concentrate grading 5.5% Li2O @ 93.1% stage recovery from a representative sample with a head grade of 1.38% Li2O.

The results aren’t just a reliable indication of commercial DMS performance but are anticipated to have a positive impact on the project economics in the upcoming PEA at the Salinas lithium project in Brazil.

The high-quality testwork results validate broker comparisons to neighbour Sigma Lithium, currently in phase one production with a similar high-purity 5.5% Li2O concentrate which has enabled a significant offtake contract with LG Energy.

RAIDEN RESOURCES (ASX:RDN)

RDN has kicked off its lithium hunt at the Roebourne, Arrow and Mt Sholl projects.

The campaign includes detailed mapping of outcropping pegmatites across a 4km-long stretch and rock sampling, following up on the recently announced high-grade, lithium-bearing pegmatites on the Roebourne project.

Rock chip results include a whopping 2.22% Li2O sample from area R21160 and 0.98% Li2O @ R21163 and the now commenced exploration campaign seeks to identify targets for drilling across its its 460km2 portfolio in the Pilbara, WA.

Raiden’s Roeburne project is adjacent to Azure Minerals (ASX:AZS) monster Andover lithium discovery, where recent drilling has intersected up to 209.4m @ 1.42% Li2O from 219m.

“With the current program, we hope to build on the potential defined in the initial and very limited scout sampling exercise on the recently acquired projects,” RDN MD Dusko Ljubojevic said.

“In parallel, we will be evaluating the greater potential of the entire portfolio of projects in the Pilbara, including Mt Sholl and Arrow for Li-bearing pegmatites.

“We hope to achieve similar success across the other projects as the Roebourne project.”

At Stockhead we tell it like it is. While Raiden Resources and Latin Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.