Eye on Lithium: EV front-runner Tesla reportedly struggling with new battery tech

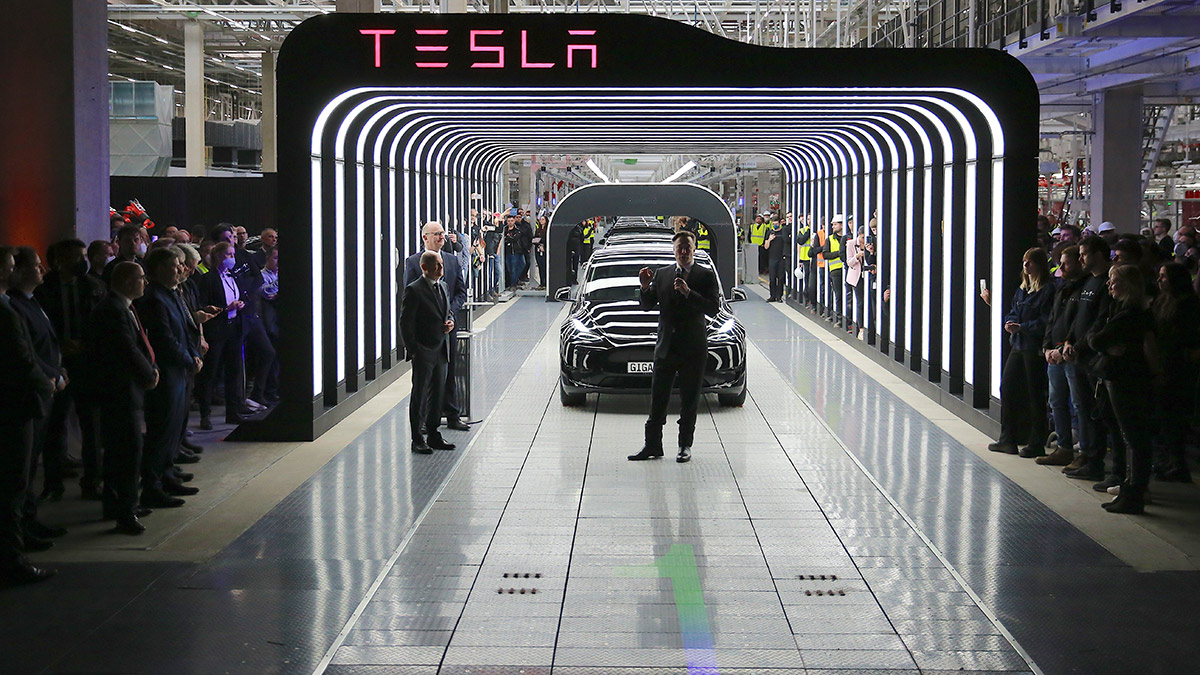

Pic: Getty Images

- Tesla’s 4680 battery might not reach high production volumes until 2023

- Charger Metals pushes Medcalf lithium prospect towards drilling with a program earmarked for December

- Xantippe’s conducting pre-drilling surface mapping at the Upper Coondina Lithium Project

All your lithium news, Thursday September 8.

Tesla is reportedly undergoing issues with the dry coating technique currently being used to produce bigger cells in its 4680 battery.

While notably light on detail, Reuters said ‘12 anonymous experts close to Tesla’ predict the auto-car maker will find it difficult to fully implement its dry coating manufacturing process before the end of this year, and perhaps not until 2023.

This comes hot on the heels of Elon Musk announcing to shareholders that the company would be producing ‘high volumes of 4680 batteries’ by the end of this year.

But Reuters suggests the dry coating tech is ‘so new and unproven that the company is having trouble scaling up manufacturing to the point where the big cost savings kick in’.

Tesla acquired its dry-coating technology via its acquisition of Maxwell Technologies back in 2019 under the intention the technology would dramatically cut battery costs through the elimination of parts of the manufacturing process – saving up to US$5,500 per Model Y battery pack.

Here’s how ASX lithium stocks are tracking today:

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | MARKET CAP |

|---|---|---|---|---|---|---|

| ASN | Anson Resources Ltd | 0.39 | 32% | 10% | 189% | $303,280,975 |

| LRD | Lordresourceslimited | 0.24 | 23% | 23% | 20% | $6,490,501 |

| WCN | White Cliff Min Ltd | 0.0285 | 19% | 43% | 148% | $15,686,481 |

| RAS | Ragusa Minerals Ltd | 0.26 | 13% | 6% | 210% | $29,588,136 |

| WR1 | Winsome Resources | 0.305 | 13% | 13% | 20% | $36,480,778 |

| SHH | Shree Minerals Ltd | 0.009 | 13% | 0% | 13% | $9,907,895 |

| MM1 | Midasmineralsltd | 0.2 | 11% | -13% | 8% | $10,283,718 |

| EVR | Ev Resources Ltd | 0.031 | 11% | 11% | 7% | $25,927,554 |

| OCN | Oceanalithiumlimited | 0.65 | 10% | 6% | 44% | $19,779,750 |

| TYX | Tyranna Res Ltd | 0.045 | 10% | 36% | 61% | $96,590,287 |

| PGD | Peregrine Gold | 0.745 | 10% | -4% | 1% | $26,330,658 |

| CRR | Critical Resources | 0.047 | 9% | 4% | 2% | $63,984,655 |

| BNR | Bulletin Res Ltd | 0.14 | 8% | 0% | 27% | $38,036,843 |

| RMX | Red Mount Min Ltd | 0.007 | 8% | 0% | 17% | $10,675,365 |

| MQR | Marquee Resource Ltd | 0.072 | 7% | -4% | -9% | $21,146,378 |

| EUR | European Lithium Ltd | 0.087 | 7% | 1% | -1% | $113,419,373 |

| LIS | Lisenergylimited | 0.6175 | 7% | 22% | -20% | $95,400,658 |

| SYA | Sayona Mining Ltd | 0.295 | 7% | 0% | 40% | $2,282,165,378 |

| QXR | Qx Resources Limited | 0.03 | 7% | 0% | -9% | $24,062,145 |

| KAI | Kairos Minerals Ltd | 0.03 | 7% | 7% | 0% | $54,994,618 |

| LTR | Liontown Resources | 1.845 | 7% | 6% | 23% | $3,788,850,979 |

| GL1 | Globallith | 2.02 | 7% | 17% | 29% | $299,939,704 |

| RDT | Red Dirt Metals Ltd | 0.635 | 7% | 8% | 44% | $181,209,883 |

| IPT | Impact Minerals | 0.008 | 7% | 0% | 0% | $18,610,279 |

| DRE | Drednought Resources | 0.1225 | 7% | -13% | 63% | $349,718,858 |

| CHR | Charger Metals | 0.495 | 6% | 5% | -2% | $15,150,181 |

| INR | Ioneer Ltd | 0.675 | 6% | 2% | 5% | $1,332,315,138 |

| CAI | Calidus Resources | 0.595 | 6% | -2% | -23% | $245,157,755 |

| LLL | Leolithiumlimited | 0.62 | 6% | 8% | 38% | $577,194,294 |

| PLS | Pilbara Min Ltd | 4.18 | 6% | 15% | 46% | $11,782,357,771 |

| RGL | Riversgold | 0.037 | 6% | 0% | 23% | $27,131,648 |

| AGY | Argosy Minerals Ltd | 0.47 | 6% | 13% | 21% | $607,804,918 |

| AKE | Allkem Limited | 14.87 | 6% | 7% | 26% | $8,978,225,851 |

| RAG | Ragnar Metals Ltd | 0.038 | 6% | -7% | -10% | $13,650,656 |

| XTC | Xantippe Res Ltd | 0.0095 | 6% | -5% | 19% | $73,131,612 |

| LKE | Lake Resources | 1.275 | 5% | 9% | 37% | $1,681,868,188 |

| PLL | Piedmont Lithium Inc | 0.91 | 5% | 5% | 38% | $456,348,742 |

| KTA | Krakatoa Resources | 0.061 | 5% | -5% | 24% | $19,993,175 |

| MNS | Magnis Energy Tech | 0.52 | 5% | 13% | 41% | $480,314,084 |

| INF | Infinity Lithium | 0.21 | 5% | 35% | 50% | $83,002,613 |

| AUN | Aurumin | 0.105 | 5% | -9% | -30% | $12,530,714 |

| CXO | Core Lithium | 1.6 | 5% | 14% | 25% | $2,649,222,918 |

| MIN | Mineral Resources. | 62.36 | 5% | -3% | 8% | $11,269,357,180 |

| LRV | Larvottoresources | 0.22 | 5% | -6% | -2% | $8,721,825 |

| PNN | Power Minerals Ltd | 0.56 | 5% | 11% | 11% | $32,938,704 |

| LRS | Latin Resources Ltd | 0.115 | 5% | 0% | 53% | $214,840,302 |

| EPM | Eclipse Metals | 0.023 | 5% | -4% | -4% | $44,533,651 |

| CZL | Cons Zinc Ltd | 0.023 | 5% | 10% | -6% | $8,521,872 |

| GLN | Galan Lithium Ltd | 1.28 | 4% | -1% | -5% | $373,098,104 |

| GT1 | Greentechnology | 0.745 | 4% | 3% | 6% | $134,836,232 |

| IGO | IGO Limited | 13.375 | 4% | 0% | 15% | $9,723,318,719 |

| ESS | Essential Metals Ltd | 0.51 | 4% | 13% | 4% | $121,266,393 |

| MLS | Metals Australia | 0.051 | 4% | -6% | -16% | $29,744,773 |

| LNR | Lanthanein Resources | 0.053 | 4% | 15% | 152% | $49,104,104 |

| NMT | Neometals Ltd | 1.505 | 4% | 8% | 17% | $800,902,437 |

| EFE | Eastern Resources | 0.028 | 4% | -7% | 0% | $27,181,729 |

| AZL | Arizona Lithium Ltd | 0.085 | 4% | -1% | 5% | $197,613,896 |

| TON | Triton Min Ltd | 0.029 | 4% | 4% | 0% | $35,245,957 |

| WC8 | Wildcat Resources | 0.031 | 3% | 11% | 35% | $19,358,182 |

| MRR | Minrex Resources Ltd | 0.0505 | 3% | -8% | -14% | $52,747,995 |

| JRL | Jindalee Resources | 2.51 | 3% | 0% | -4% | $140,004,677 |

| EMH | European Metals Hldg | 0.74 | 3% | 2% | -7% | $86,211,701 |

| FRS | Forrestaniaresources | 0.195 | 3% | 18% | 39% | $6,338,648 |

| TEM | Tempest Minerals | 0.04 | 3% | 5% | -15% | $19,685,881 |

| MMG | Monger Gold Ltd | 0.41 | 3% | 0% | 71% | $16,016,000 |

| DTM | Dart Mining NL | 0.1075 | 2% | -14% | 38% | $14,202,317 |

| PSC | Prospect Res Ltd | 0.096 | 2% | -9% | -26% | $43,452,389 |

| VUL | Vulcan Energy | 8.17 | 2% | -1% | 3% | $1,148,115,761 |

| WES | Wesfarmers Limited | 46.62 | 2% | -1% | -2% | $51,839,175,864 |

| AS2 | Askarimetalslimited | 0.345 | 1% | -4% | 0% | $15,323,552 |

| RIO | Rio Tinto Limited | 90.59 | 1% | -4% | -7% | $33,190,441,694 |

| LEL | Lithenergy | 0.97 | 1% | -1% | -2% | $43,344,000 |

| ADV | Ardiden Ltd | 0.008 | 0% | 0% | 0% | $21,346,683 |

| 1MC | Morella Corporation | 0.026 | 0% | 4% | 44% | $149,906,790 |

| AML | Aeon Metals Ltd. | 0.03 | 0% | 3% | 7% | $32,802,923 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| LIT | Lithium Australia | 0.061 | 0% | -21% | -22% | $63,159,969 |

| LPD | Lepidico Ltd | 0.03 | 0% | 0% | 3% | $195,215,737 |

| LPI | Lithium Pwr Int Ltd | 0.695 | 0% | 11% | 15% | $242,655,669 |

| QPM | Queensland Pacific | 0.145 | 0% | -3% | -3% | $226,723,904 |

| RLC | Reedy Lagoon Corp. | 0.015 | 0% | 0% | -6% | $8,361,404 |

| BMM | Balkanminingandmin | 0.185 | 0% | -3% | -8% | $6,058,750 |

| AX8 | Accelerate Resources | 0.035 | 0% | -3% | -3% | $9,466,061 |

| BYH | Bryah Resources Ltd | 0.027 | 0% | -4% | -13% | $7,539,844 |

| EMS | Eastern Metals | 0.125 | 0% | -7% | -19% | $4,832,031 |

| FG1 | Flynngold | 0.095 | 0% | -1% | -1% | $6,085,800 |

| GSM | Golden State Mining | 0.05 | 0% | -11% | 2% | $5,850,710 |

| IMI | Infinitymining | 0.2 | 0% | -5% | 54% | $11,500,000 |

| MMC | Mitremining | 0.125 | 0% | -4% | 9% | $3,385,638 |

| TMB | Tambourahmetals | 0.145 | 0% | -2% | -17% | $5,972,927 |

| TSC | Twenty Seven Co. Ltd | 0.002 | 0% | 43% | -5% | $5,321,628 |

| WML | Woomera Mining Ltd | 0.016 | 0% | 7% | 0% | $10,989,329 |

| KZR | Kalamazoo Resources | 0.23 | 0% | -7% | 0% | $33,877,706 |

| MTM | Mtmongerresources | 0.14 | 0% | 4% | 33% | $5,251,405 |

| SCN | Scorpion Minerals | 0.079 | 0% | -2% | 25% | $26,214,664 |

| AZI | Altamin Limited | 0.095 | 0% | 4% | 6% | $37,213,091 |

| STM | Sunstone Metals Ltd | 0.043 | 0% | -7% | -4% | $111,647,196 |

| AVW | Avira Resources Ltd | 0.004 | 0% | 0% | 0% | $8,475,160 |

| A8G | Australasian Metals | 0.27 | 0% | 0% | 10% | $11,116,033 |

| SRZ | Stellar Resources | 0.015 | 0% | 7% | -12% | $14,477,964 |

| LSR | Lodestar Minerals | 0.007 | 0% | 0% | -13% | $12,169,061 |

| NWM | Norwest Minerals | 0.06 | 0% | 9% | 33% | $10,836,443 |

| AOA | Ausmon Resorces | 0.008 | 0% | -11% | 45% | $6,858,315 |

| VKA | Viking Mines Ltd | 0.008 | 0% | 0% | 14% | $8,202,067 |

| SRI | Sipa Resources Ltd | 0.047 | 0% | 12% | 4% | $9,636,166 |

| VMC | Venus Metals Cor Ltd | 0.16 | 0% | 0% | -16% | $25,612,589 |

| ZNC | Zenith Minerals Ltd | 0.31 | 0% | -5% | 3% | $106,876,306 |

| G88 | Golden Mile Res Ltd | 0.034 | 0% | 3% | 21% | $6,926,909 |

| THR | Thor Mining PLC | 0.01 | 0% | 0% | 0% | $10,991,633 |

| MXR | Maximus Resources | 0.054 | 0% | 8% | 4% | $17,220,911 |

| M2R | Miramar | 0.125 | 0% | 4% | 25% | $8,023,333 |

| AOU | Auroch Minerals Ltd | 0.062 | 0% | -3% | 2% | $23,008,932 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| ZEO | Zeotech Limited | 0.05 | 0% | -9% | -19% | $78,095,774 |

| ALY | Alchemy Resource Ltd | 0.022 | 0% | 10% | 38% | $20,967,629 |

| GW1 | Greenwing Resources | 0.275 | 0% | -4% | 10% | $33,893,021 |

| DAL | Dalaroometalsltd | 0.105 | 0% | 5% | -5% | $3,136,875 |

| TKM | Trek Metals Ltd | 0.064 | 0% | -14% | -9% | $19,879,050 |

| TUL | Tulla Resources | 0.5 | 0% | -3% | -7% | $80,108,436 |

| AM7 | Arcadia Minerals | 0.275 | -2% | -5% | 104% | $13,075,410 |

| KGD | Kula Gold Limited | 0.025 | -2% | 14% | -10% | $5,486,979 |

| FTL | Firetail Resources | 0.24 | -2% | -11% | 0% | $15,136,713 |

| PAM | Pan Asia Metals | 0.43 | -2% | -7% | 10% | $32,524,906 |

| DAF | Discovery Alaska Ltd | 0.078 | -3% | 0% | 100% | $17,938,776 |

| NVA | Nova Minerals Ltd | 0.875 | -3% | -4% | -2% | $165,295,148 |

| CY5 | Cygnus Gold Limited | 0.285 | -5% | -2% | 24% | $44,155,595 |

| AAJ | Aruma Resources Ltd | 0.065 | -7% | 0% | -4% | $10,987,305 |

| ARN | Aldoro Resources | 0.25 | -7% | -2% | 25% | $26,888,576 |

| IR1 | Irismetals | 1.4 | -8% | 26% | 226% | $92,826,750 |

| ENT | Enterprise Metals | 0.01 | -9% | 0% | 0% | $7,182,788 |

| TKL | Traka Resources | 0.006 | -14% | -14% | -14% | $4,821,422 |

72 ASX lithium stocks finished in the green today, 47 fell flat and 12 ended in the red.

Who’s got news out today?

CHARGER METALS NL (AX:CHR)

This ~$23.07m market cap is pushing the Medcalf lithium prospect towards drilling with a program earmarked to take place in December.

CHR’s geological team is completing the prerequisites for the approval process before the 20 hole RC program kicks off across spodumene bearing pegmatites at the site.

The company says drill planning is well advanced with multiple site visits made, a spring flora survey and heritage protection survey in train, access and emergency response plans updated and a drilling contract advancing.

A DMIRS program of works application will be lodged when the spring flora survey is also complete.

The Medcalf prospect is a mineralized zone within the Lake Johnston Project, which has attracted considerable interest due to its proximity to the large Mount Holland Lithium Project under development by Covalent Lithium.

ANSON RESOURCES (ASX:ASN)

The high-flying lithium project developer has released its 239,000t Paradox project definitive feasibility study (DFS), which “confirms outstanding economics and ESG credentials for Phase 1 development”.

Check out the headline numbers here.

ASN has assumed a long-term price assumption of ~US$19,000 per tonne of battery grade lithium carbonate for the purposes of this economic analysis.

At current lithium carbonate spot prices of ~US$70,000 per tonne, pre-tax NPV and IRR jump to $5,149m and 98%, respectively. That’s super profits territory.

“The DFS confirms the technical and financial viability of a major new source of high purity Lithium Carbonate available for the rapidly growing US market,” ASN executive chairman Bruce Richardson says.

The $413m market cap stock has been a standout over the past month, gaining almost 200% on strong news flow.

XANTIPPE RESOURCES (ASX:XTC)

XTC has received results for 327 soil samples covering the Glen Innis prospect on E77/2367 in Western Australia.

The soil samples program completed in June, primarily targeting gold, underwent UltraFine+ (UFF) analysis at LabWest in Perth.

Developed by CSIRO, the technique is used to detect low level gold as well as other elements by separating and analysing the <2-micron fraction.

While encouraging anomalous gold in soils were returned, a lithium trend was also spotted – which XTC says doesn’t appear to relate to the gold and requires further assessment.

METALSGROVE MINING (ASX:MGA)

Pre-drilling surface mapping is underway at the Upper Coondina project in Western Australia’s Pilbara region, which has never been explored for lithium.

MGA believes the pegmatites may be part of the same system that hosts the major Archer lithium discovery announced by Global Lithium (ASX:GL1) to the northeast of the site.

EUROPEAN LITHIUM (ASX:EUR)

High-grade lithium assays have been returned from rock chip samples taken during sampling programs at three selected Austrian lithium projects held in joint venture with EV Resources (ASX:EVR).

Assay results with a maximum of 3.24 % Li2O and an average of 1.74 % Li2O for mineralised samples were received and when added with historical data, underline the high prospectivity for the Millstätter Seerücken project area, where future exploration will be the company’s priority.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.