Eye on Lithium: Bolivia’s President wants to produce 40pc of the world’s lithium by 2030

Salty brines as far as the eye can see. Pic: Sebastiàn Arias / EyeEm via Getty Images

- Bolivia’s President wants the country to supply 40% of global lithium by 2030

- Pilbara Minerals nabs US$6188/dmt for 5.5% Li2O cargo of spodumene at latest auction

- Greenland Minerals expands into lithium with Spanish acquisition

All your ASX lithium news for Thursday, July 14

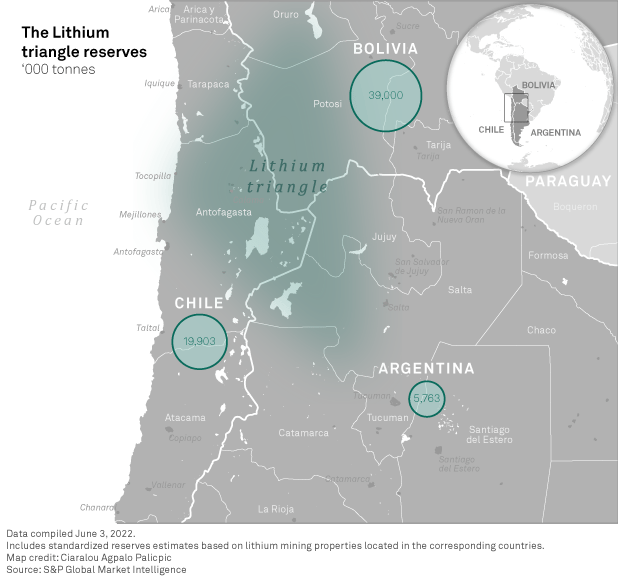

Bolivian President Luis Arce is angling to join the lithium club in South America’s lithium triangle with Argentina and Chile.

Chile is the second-largest global lithium producer and had output of nearly 150,000 tonnes in 2021 and S&P Global Market Intelligence reckons Bolivia’s salt flats could host an estimated 39 million tonnes of lithium reserves.

That would make the country a significant supplier in a market that is expected to explode over the next decade, with global supplies of raw lithium set to increase by about 143% from 2021 to 2026.

Arce aims to have Bolivia producing up to 40% of the world’s supply by 2030, a hugely ambitious goal that would make the country “the world capital of lithium,” he said.

Arce needs foreign expertise and capital to achieve these targets, yet the government’s policies place strict rules on outside investment, including a requirement that every project be majority-owned by the state.

Environmentally friendly extraction tech

In April, the country called for proposals from companies using direct lithium extraction (DLE) technology to launch pilot programs.

In a nutshell, DLE promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes – partly because traditional evaporation ponds have failed in countries due to naturally high concentrations of magnesium.

And in June, Bolivia narrowed it down to six companies, including Russia’s Uranium One, US start-up Lilac Solutions (backed by German carmaker BMW and Bill Gates’s Breakthrough Energy Ventures) along with giant Chinese battery maker CATL and Chinese firms Fusion Enertech, TBEA and CITIC Guoan Group.

The program marks the beginning of what the government hopes will be a lucrative new industry for Bolivia, whose 2020 GDP was $40.41 billion, compared to Chile’s $317.06 billion, according to the World Bank.

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| GW1 | Greenwing Resources | 0.24 | -6% | 7% | 20% | $24,649,469.80 |

| CZL | Cons Zinc Ltd | 0.02 | -9% | 5% | 11% | $6,540,440.63 |

| ASN | Anson Resources Ltd | 0.12 | 4% | 14% | 9% | $113,070,356.85 |

| RMX | Red Mount Min Ltd | 0.006 | 0% | 20% | 9% | $9,033,001.22 |

| BMM | Balkanminingandmin | 0.19 | -16% | 6% | 9% | $5,731,250.00 |

| LRV | Larvottoresources | 0.195 | -19% | -17% | 8% | $7,475,850.00 |

| LSR | Lodestar Minerals | 0.0065 | -7% | -19% | 8% | $10,430,624.09 |

| RAS | Ragusa Minerals Ltd | 0.082 | -7% | -2% | 8% | $9,555,947.86 |

| TMB | Tambourahmetals | 0.145 | -19% | 7% | 7% | $5,561,000.73 |

| LLL | Leolithiumlimited | 0.39 | 0% | -20% | 7% | $360,129,772.88 |

| DRE | Dreadnought Resources Ltd | 0.048 | 30% | 4% | 7% | $127,740,759.80 |

| SYA | Sayona Mining Ltd | 0.1375 | -2% | -8% | 6% | $1,072,077,847.10 |

| EPM | Eclipse Metals | 0.02 | -13% | 5% | 5% | $36,501,401.85 |

| ESS | Essential Metals Ltd | 0.3625 | -16% | 1% | 5% | $85,038,161.63 |

| VUL | Vulcan Energy | 5.88 | -9% | 7% | 5% | $804,111,038.61 |

| CAI | Calidus Resources | 0.655 | -4% | 5% | 5% | $254,706,848.75 |

| MXR | Maximus Resources | 0.046 | -23% | -4% | 5% | $13,987,853.79 |

| QPM | Queensland Pacific | 0.125 | 0% | -4% | 4% | $187,633,575.72 |

| EFE | Eastern Resources | 0.026 | -4% | 4% | 4% | $24,860,915.78 |

| RGL | Riversgold | 0.027 | -21% | -7% | 4% | $19,665,775.97 |

| TUL | Tulla Resources | 0.54 | -4% | 2% | 4% | $83,312,773.44 |

| PNN | Power Minerals Ltd | 0.415 | -10% | 0% | 4% | $24,606,746.00 |

| MIN | Mineral Resources. | 46.035 | -19% | 7% | 4% | $8,398,644,242.13 |

| FRS | Forrestaniaresources | 0.14 | -13% | -22% | 4% | $4,196,651.04 |

| EVR | Ev Resources Ltd | 0.028 | -10% | -3% | 4% | $25,001,569.92 |

| AML | Aeon Metals Ltd. | 0.029 | 7% | 16% | 4% | $27,751,677.04 |

| LTR | Liontown Resources | 0.975 | -13% | 3% | 3% | $2,071,652,812.11 |

| LRS | Latin Resources Ltd | 0.069 | -3% | -1% | 3% | $129,314,270.45 |

| PLS | Pilbara Min Ltd | 2.43 | 8% | 12% | 3% | $7,025,362,186.24 |

| CXO | Core Lithium | 0.9 | -28% | -3% | 3% | $1,516,035,251.50 |

| MM1 | Midasmineralsltd | 0.18 | -28% | -10% | 3% | $9,998,058.70 |

| CRR | Critical Resources | 0.038 | -30% | -14% | 3% | $55,056,563.84 |

| MNS | Magnis Energy Tech | 0.2925 | -15% | -4% | 3% | $275,448,318.77 |

| IGO | IGO Limited | 9.975 | -13% | 6% | 3% | $7,360,643,142.36 |

| A8G | Australasian Metals | 0.21 | -18% | -7% | 2% | $8,439,951.27 |

| RIO | Rio Tinto Limited | 96.39 | -17% | 3% | 2% | $34,931,445,737.40 |

| KAI | Kairos Minerals Ltd | 0.0225 | 2% | 7% | 2% | $43,166,056.80 |

| NMT | Neometals Ltd | 0.94 | -11% | 3% | 2% | $504,506,284.32 |

| TEM | Tempest Minerals | 0.047 | 4% | -43% | 2% | $23,219,244.10 |

| AKE | Allkem Limited | 9.83 | -9% | 2% | 2% | $6,147,023,949.04 |

| GL1 | Globallith | 1.065 | -25% | -5% | 2% | $165,839,677.52 |

| AGY | Argosy Minerals Ltd | 0.33 | -14% | 2% | 2% | $440,716,570.78 |

| GLN | Galan Lithium Ltd | 0.995 | -17% | -1% | 2% | $298,311,374.76 |

| NVA | Nova Minerals Ltd | 0.695 | 23% | -1% | 1% | $123,438,565.23 |

| OCN | Oceanalithiumlimited | 0.37 | 0% | 7% | 1% | $12,236,625.00 |

| LPI | Lithium Pwr Int Ltd | 0.405 | -6% | -6% | 1% | $139,657,939.20 |

| AZL | Arizona Lithium Ltd | 0.085 | -23% | -2% | 1% | $187,613,747.16 |

| INR | Ioneer Ltd | 0.44 | 0% | 1% | 1% | $912,254,508.00 |

| PSC | Prospect Res Ltd | 0.985 | 3% | 2% | 1% | $450,702,975.45 |

| PLL | Piedmont Lithium Inc | 0.51 | -31% | -3% | 1% | $266,423,254.00 |

| LIS | Lisenergylimited | 0.57 | 20% | 1% | 1% | $93,741,515.66 |

| LEL | Lithenergy | 0.65 | -28% | -4% | 1% | $29,121,750.00 |

| WES | Wesfarmers Limited | 45.43 | 4% | 3% | 0% | $51,374,301,365.02 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| INF | Infinity Lithium | 0.11 | -21% | 0% | 0% | $45,651,437.26 |

| JRL | Jindalee Resources | 2.6 | -15% | -9% | 0% | $149,185,311.60 |

| LPD | Lepidico Ltd | 0.027 | -4% | 0% | 0% | $175,693,631.39 |

| MLS | Metals Australia | 0.046 | -19% | -4% | 0% | $26,129,664.79 |

| RLC | Reedy Lagoon Corp. | 0.017 | -6% | -6% | 0% | $9,476,257.50 |

| TON | Triton Min Ltd | 0.017 | -37% | 0% | 0% | $21,399,331.01 |

| ARN | Aldoro Resources | 0.15 | -14% | -3% | 0% | $14,915,597.55 |

| AAJ | Aruma Resources Ltd | 0.06 | -14% | -5% | 0% | $9,417,690.18 |

| PAM | Pan Asia Metals | 0.4 | -15% | 0% | 0% | $29,568,096.80 |

| AX8 | Accelerate Resources | 0.029 | -12% | 12% | 0% | $7,843,308.07 |

| AM7 | Arcadia Minerals | 0.135 | -41% | -16% | 0% | $6,304,215.42 |

| DTM | Dart Mining NL | 0.067 | 3% | 26% | 0% | $9,062,430.72 |

| EMS | Eastern Metals | 0.15 | 0% | 0% | 0% | $5,340,000.00 |

| GSM | Golden State Mining | 0.042 | -19% | 8% | 0% | $4,889,695.40 |

| MMC | Mitremining | 0.125 | -4% | -4% | 0% | $3,385,637.50 |

| RAG | Ragnar Metals Ltd | 0.04 | -11% | 8% | 0% | $15,167,395.56 |

| SHH | Shree Minerals Ltd | 0.008 | 0% | 0% | 0% | $9,907,895.14 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | -29% | 0% | 0% | $6,652,034.76 |

| WCN | White Cliff Min Ltd | 0.013 | -28% | 18% | 0% | $8,496,843.71 |

| WML | Woomera Mining Ltd | 0.017 | -15% | -6% | 0% | $11,676,162.12 |

| WR1 | Winsome Resources | 0.2 | -37% | 0% | 0% | $27,022,798.80 |

| KZR | Kalamazoo Resources | 0.24 | -14% | 26% | 0% | $34,846,649.76 |

| MTM | Mtmongerresources | 0.12 | -20% | 4% | 0% | $4,501,203.96 |

| QXR | Qx Resources Limited | 0.027 | -16% | -16% | 0% | $23,202,782.67 |

| SCN | Scorpion Minerals | 0.07 | -11% | 0% | 0% | $23,228,183.44 |

| AZI | Altamin Limited | 0.095 | 0% | -1% | 0% | $37,213,091.44 |

| ENT | Enterprise Metals | 0.0105 | -19% | 5% | 0% | $6,768,791.98 |

| STM | Sunstone Metals Ltd | 0.042 | -18% | -13% | 0% | $108,126,749.56 |

| PGD | Peregrine Gold | 0.42 | -5% | 17% | 0% | $16,080,400.98 |

| AVW | Avira Resources Ltd | 0.003 | -25% | -14% | 0% | $6,356,370.00 |

| GT1 | Greentechnology | 0.635 | -24% | 20% | 0% | $117,011,223.31 |

| MRR | Minrex Resources Ltd | 0.032 | -20% | -6% | 0% | $33,924,702.75 |

| RDT | Red Dirt Metals Ltd | 0.355 | -21% | -11% | 0% | $108,116,821.23 |

| MQR | Marquee Resource Ltd | 0.065 | -21% | -7% | 0% | $20,515,142.70 |

| NWM | Norwest Minerals | 0.03 | -14% | 20% | 0% | $5,418,221.61 |

| AOA | Ausmon Resorces | 0.006 | -14% | 0% | 0% | $5,143,736.06 |

| VKA | Viking Mines Ltd | 0.007 | -13% | 0% | 0% | $7,176,809.02 |

| IPT | Impact Minerals | 0.007 | -13% | -13% | 0% | $17,369,593.89 |

| SRI | Sipa Resources Ltd | 0.04 | 3% | 8% | 0% | $8,200,992.12 |

| VMC | Venus Metals Cor Ltd | 0.165 | -3% | -3% | 0% | $26,412,982.70 |

| ZNC | Zenith Minerals Ltd | 0.26 | -29% | 13% | 0% | $89,638,192.54 |

| WC8 | Wildcat Resources | 0.025 | -22% | 4% | 0% | $16,131,818.18 |

| THR | Thor Mining PLC | 0.009 | -25% | -10% | 0% | $9,620,108.76 |

| M2R | Miramar | 0.09 | -18% | -2% | 0% | $5,776,799.67 |

| AOU | Auroch Minerals Ltd | 0.063 | -27% | 5% | 0% | $23,275,463.34 |

| XTC | Xantippe Res Ltd | 0.008 | -11% | 0% | 0% | $63,689,188.51 |

| MMG | Monger Gold Ltd | 0.215 | -14% | 5% | 0% | $8,608,600.00 |

| ZEO | Zeotech Limited | 0.045 | -24% | -4% | 0% | $68,621,196.15 |

| DAF | Discovery Alaska Ltd | 0.044 | -19% | 5% | 0% | $9,866,326.71 |

| FTL | Firetail Resources | 0.225 | -35% | -10% | 0% | $13,901,062.50 |

| LNR | Lanthanein Resources | 0.015 | -17% | -17% | 0% | $12,567,383.55 |

| DAL | Dalaroometalsltd | 0.1 | 22% | -5% | 0% | $2,987,500.00 |

| TKM | Trek Metals Ltd | 0.055 | -29% | -4% | 0% | $17,083,558.25 |

| LIT | Lithium Australia | 0.07 | -14% | 15% | -1% | $72,996,357.41 |

| CHR | Charger Metals | 0.44 | -3% | 21% | -1% | $14,498,560.58 |

| EUR | European Lithium Ltd | 0.065 | -3% | 7% | -2% | $91,376,433.26 |

| LRD | Lordresourceslimited | 0.205 | -7% | -9% | -2% | $6,674,770.41 |

| WMC | Wiluna Mining Corp | 0.2 | -59% | -15% | -2% | $74,238,030.68 |

| KGD | Kula Gold Limited | 0.031 | 3% | 11% | -3% | $6,885,620.22 |

| CY5 | Cygnus Gold Limited | 0.145 | -15% | -3% | -3% | $17,697,797.25 |

| BYH | Bryah Resources Ltd | 0.028 | -26% | 0% | -3% | $6,560,008.08 |

| G88 | Golden Mile Res Ltd | 0.028 | -44% | 0% | -3% | $5,908,245.81 |

| IMI | Infinitymining | 0.135 | -13% | -4% | -4% | $8,050,000.00 |

| AUN | Aurumin | 0.135 | -18% | 13% | -4% | $15,291,255.28 |

| IR1 | Irismetals | 0.27 | -2% | 15% | -4% | $16,695,000.00 |

| KTA | Krakatoa Resources | 0.046 | -28% | -4% | -4% | $16,546,076.02 |

| 1MC | Morella Corporation | 0.017 | -6% | -11% | -6% | $93,171,851.75 |

| LKE | Lake Resources | 0.6375 | -54% | -11% | -6% | $938,054,186.55 |

| EMH | European Metals Hldg | 0.63 | -25% | -5% | -7% | $80,907,434.55 |

| AS2 | Askarimetalslimited | 0.225 | -29% | -8% | -8% | $10,190,596.15 |

| BNR | Bulletin Res Ltd | 0.11 | -19% | -4% | -8% | $35,110,932.00 |

| ALY | Alchemy Resource Ltd | 0.015 | -17% | -12% | -9% | $15,725,721.94 |

| TYX | Tyranna Res Ltd | 0.019 | 19% | -5% | -10% | $32,179,574.01 |

| SRZ | Stellar Resources | 0.015 | -21% | -12% | -12% | $14,268,144.64 |

| ADV | Ardiden Ltd | 0.006 | -33% | -14% | -14% | $18,678,347.49 |

| TKL | Traka Resources | 0.005 | -38% | -17% | -17% | $4,132,647.37 |

| FG1 | Flynngold | 0.1 | -23% | -29% | -17% | $7,687,326.00 |

A total of 52 stocks were in the green today, 54 were flat and 24

Who’s got news out today?

Pilbara Minerals has raked in US$6188/dmt for a 5.5% Li2O cargo of spodumene in its latest auction.

The company has seen a pullback in lithium prices at its Battery Material Exchange auction for the first time since it launched the platform one year ago.

Regarded as the dregs of the Pilgangoora offerings (at 5.5% the product falls well short of the benchmark 6% Li2O grade used in spodumene benchmarks), that puts the sale at an equivalent price of US$6841/t.

Down, we know, from the US$7017/t 6% price received in a pre-auction bid last month, but still extraordinary given the first auction last July garnered a price of just US$1250/dmt (5.5% basis).

It’s the first fall in prices since BMX platform launched but still five times higher than same time in 2021, but PLS fielded 41 bids in just 30 minutes.

At the third auction in October last year it saw 25 bids in a 45 minute window.

At current prices the company’s margins are outstanding, with an FID on a major expansion of its Pilgangoora mine from 540,000-580,000tpa to 640,000-680,000tpa (and early investment in a potential expansion to a whopping 1Mtpa) complementing what is expected to be an almost $600 million cash build in the June quarter.

The company is expanding its focus to include lithium exploration in Continental Europe, with plans to earn-in 51% in Technology Metals Europe SL (TME) – the sole owner of the Villasrubias lithium exploration licence in Spain.

Greenland can earn its interest in TME by spending $3,000,000 on a jointly agreed works program in relation to the tenement within three years.

The transaction remains conditional on completion of due diligence by Greenland on TME and its assets and shareholder approval.

Neometals says its lithium-ion battery (LIB) recycling joint venture company Primobius GmbH (Primobius),is progressing commercialisation, with an engineering and cost study for a 50tpd lithium-ion battery shredding ‘Spoke’ expected end of July 2022 and refinery ‘Hub’ study in DecQ 2022.

There have been some delays to the cost study due and MD Chris Reed said Primobius’ commercial success in securing partners and customers “has necessitated the decoupling of the previous integrated model to a two-part ‘spoke and hub’ approach, to enable timely delivery of plant supply contracts to meet LICULAR and Stelco’s requirements.”

“Near-term investment decisions will now be based on more accurate and detailed engineering and cost studies and actual equipment supply contracts from SMS group,” he said.

“This staged rollout addresses the immediate need for safe disposal and recovery of key LIB materials, ahead of truly closing-the-loop with integrated hydrometallurgical refining.”

Lake has retorted to a recent report by J Capital who it says put forth incorrect information on technical matters and inaccurate assertions on Lake Resources’ progress to-date with its technology partner Lilac Solutions for brine from its Kachi project in Argentina.

“The report’s description of Direct Lithium Extraction (DLE) processes does not pertain to Lilac’s ion exchange technology,” Lake says. “It is criticising the wrong process.”

For the uninitiated, Lilac’s ion exchange technology is a chemical process where the targeted ion (lithium) in brine is exchanged for hydrogen in a charged media in the form of a ceramic bead.

The ion exchange process can be operated with zero net usage of fresh water by using small amounts of brackish water which is not fit for human consumption or agriculture and is available in large quantities at the Kachi site.

Pre-treatment of the brine to remove magnesium or calcium is not required as these ions are rejected in the ion exchange process.

The bead is then stripped of lithium using hydrochloric acid to produce an aqueous lithium chloride solution.

“Lilac has worked extensively with Kachi brine, generating the data needed for engineering studies,” the company says.

“Importantly, lithium can be produced cleanly and in a way that respects and involves local communities and protects the environment.”

Lilac’s operating team is set to arrive at the Kachi project site today, with the demonstration plant modules slated for delivery by 20th July 2022 when commissioning will commence.

On ex-MD Stephen Promnitz’s trade of shares in April, the company said there was an “inadvertent non-compliance in respect of trades made during a close period.”

PLS, GGG, NMT & LKE share prices today:

The company says it had ‘outstanding’ initial well test results at its Hombre Muerto West Lithium Project (HMW Project) in Argentina.

High lithium grades, porosity and brine flow rates were recorded with a 72-hour constant rate testing successfully completed at first Pata Pila pumping well (PPB-01-21).

Brine sampling has confirmed a high grade resource (Li > 910 mg/L), plus, hydraulic testing saw aquifer response showing favourable conditions for high volume brine production (15 – 20L per second).

MD JP Vargas de la Vega says high lithium grades, porosity and brine flow rates “are a powerful combination for driving operational efficiency and economic performance.”

“These outstanding hydrological outcomes are paramount to the project DFS foundations and further validates the world-class nature of the lithium brine resource we hold at HMW,” he said.

ESSENTIAL METALS (ASX:ESS)

Resource extension drilling, metallurgical test work, and a mining lease application are currently underway at the company’s Pioneer Dome project in WA.

ESS reckons these activities will pave the way for an updated Mineral Resource and scoping study in the December 2022 quarter.

Plus. diamond drill core obtained from the March quarter drill program returned results of 19.2m at 1.44% Li2O from 15m, and 31.95m at 1.24% Li2O from 45.4m.

MD Tim Spencer says the plan is to determine the optimal project operating scale that the Dome North lithium Resource can support, “to allow us to move ahead with more detailed economic studies”.

“Having thick zones of near-surface, high-grade lithium-bearing spodumene greatly enhances the project and provides a strong foundation for feasibility studies, commencing with a scoping study in the December quarter.”

Arizona Lithium has flagged drill targets at its Lordsburg lithium project in New Mexico, USA.

Passive seismics and Titan magnetotelluric electromagnetic surveys have identified a north trending basin containing targets interpreted to represent potential lithium mineralised brines.

Three drill holes totalling 1,850m have been planned to test these targets and an application will be lodged with the Las Cruces Bureau of Land Management (BLM) for drilling approval.

MD Paul Lloyd says it’s an “outstanding opportunity to progress another project concurrently with the sustainable development of the Big Sandy Lithium Project in Arizona.”

The company says the final drill holes from its winter drilling campaign at the Cancet project in Canada show high-grade lithium intersections including 25.98m at 1.55% Li2O from 5.72m.

“The latest findings give us further confidence to continue the resource development and exploration work across the significant landholding the company has at Cancet,” MD Chris Evans says.

“We remain focused on declaring a maiden resource in the near term.”

More assays from the company’s Mavis Lake project in Canada have returned 7.63m at 1.35% Li2O from 11.57 to 19.2m downhole.

A total of 39 of 42 drill holes have intersected spodumene-bearing pegmatite to date.

“As we start Phase 2 of drilling, we look forward to increasing the strike extent of known mineralisation and testing the identified geophysical anomalies,” ME Alex Biggs says.

“We are very happy with progress to date and are working towards a JORC compliant Resource for the project”.

GLN, ESS, AZL, WR1 & CRR share prices today:

At Stockhead we tell it like it is. While Arizona Lithium is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.