Eye on Lithium: Benchmark Minerals says Indo-Pacific tossed around like a GeoPolithium football

Pic: RapidEye / iStock / Getty Images Plus via Getty Images

- Benchmark heads down under for geopolitical critical minerals conference

- Power Minerals signs MOU with global lithium supply chain group for its Salta project

- Anson ups Paradox Long Canyon No. 2 lithium assay grade by 25%

All your ASX lithium news for Monday, July 11

Australia is hosting a geopolitical summit on critical mineral supply chains, and Benchmark Minerals Intelligence boss Simon Moores says it’s the first time he’s seen “such a high level geopolitical gathering that is so specifically focused on decarbonisation technologies and the critical minerals that create them.”

Co-hosted with the International Energy Agency, The Sydney Energy Forum will focus on the key technologies to decarbonisation and zeroes in on building supply chains for electric vehicles, lithium ion batteries and critical minerals, especially lithium, nickel, rare earths, graphite, manganese, and cobalt.

Speakers include the US Department of Energy Secretary Jennifer Granholm, Japan’s Minister of Economy, Trad and Industry Koichi Hagiuda, India’s Minister of Power and Minister of New and Renewable Energy Raj Kumar Singh, plus Indonesian Minister for Energy and Mineral Resources H.E. Arifin Tasrif.

“We are now in a world where geopolitical instability is making governments question their global supply chains and the very building blocks on which their economies have been built,” Moore says.

“Forward looking governments have quickly realised that to get a grip on decarbonisation and invest in future industries, the supply chains for key technologies must be rebuilt.

“Without lithium-ion battery cells, at low cost, at scale and that are readily available, governments will not be able to achieve their decarbonisation goals and they would forgo a major role in future economic engines of electric vehicles and energy storage systems.”

Building supply chains from scratch

If electric vehicles are lithium-ion batteries, then lithium-ion batteries are mining Moores said.

“Those that plan ambitious decarbonisation goals must align with those that build the technology and, crucially, the key actors that are building these new supply chains from scratch,” he said.

“Those that most effectively bridge this great raw material disconnect between mine and market will be the quickest and most significant beneficiaries of the energy storage revolution, both in environmental and economic terms.”

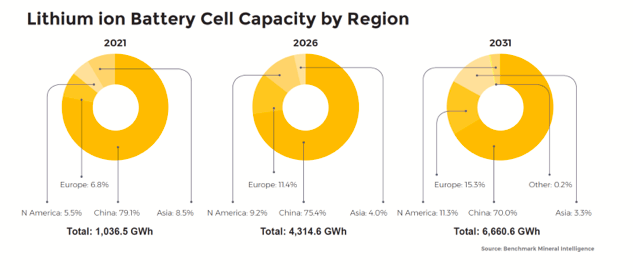

The Indo-Asia-Pacific region accounts for around 87.6% of lithium-ion battery capacity.

And while Benchmark anticipates the Indo-Asia-Pacific region to maintain a leading position in lithium-ion battery cells over the decade, we will rely heavily on China.

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| AUN | Aurumin | 0.155 | -3% | 35% | 35% | $12,560,673.98 |

| KAI | Kairos Minerals Ltd | 0.025 | 4% | 32% | 14% | $43,166,056.80 |

| DAL | Dalaroometalsltd | 0.125 | 39% | 42% | 14% | $3,286,250.00 |

| WC8 | Wildcat Resources | 0.028 | -18% | 12% | 12% | $16,131,818.18 |

| BYH | Bryah Resources Ltd | 0.035 | -13% | 40% | 9% | $7,238,629.60 |

| G88 | Golden Mile Res Ltd | 0.032 | -33% | 19% | 7% | $6,111,978.42 |

| ALY | Alchemy Resource Ltd | 0.017 | -19% | 21% | 6% | $15,249,184.91 |

| ASN | Anson Resources Ltd | 0.115 | -15% | 24% | 5% | $113,070,356.85 |

| LIT | Lithium Australia | 0.073 | -10% | 30% | 4% | $72,478,652.75 |

| ZEO | Zeotech Limited | 0.049 | -20% | -2% | 4% | $71,671,027.09 |

| LPD | Lepidico Ltd | 0.028 | -3% | 12% | 4% | $175,693,631.39 |

| TON | Triton Min Ltd | 0.018 | -33% | -5% | 3% | $22,028,723.10 |

| LIS | Lisenergylimited | 0.565 | 13% | 20% | 3% | $91,252,802.85 |

| MMG | Monger Gold Ltd | 0.22 | -27% | 5% | 2% | $8,608,600.00 |

| KZR | Kalamazoo Resources | 0.225 | -27% | 32% | 2% | $31,942,762.28 |

| INF | Infinity Lithium | 0.115 | -21% | -2% | 2% | $46,688,969.93 |

| MXR | Maximus Resources | 0.048 | -24% | 7% | 2% | $14,941,571.10 |

| CHR | Charger Metals | 0.49 | 7% | 41% | 2% | $15,638,896.80 |

| MQR | Marquee Resource Ltd | 0.073 | -22% | 18% | 1% | $22,724,465.76 |

| RAS | Ragusa Minerals Ltd | 0.083 | -14% | 8% | 1% | $10,310,364.79 |

| PNN | Power Minerals Ltd | 0.42 | -16% | -5% | 1% | $25,529,498.98 |

| GT1 | Greentechnology | 0.565 | -37% | -6% | 1% | $103,191,000.08 |

| EMH | European Metals Hldg | 0.695 | -22% | 8% | 1% | $82,705,377.54 |

| ADV | Ardiden Ltd | 0.007 | -30% | -13% | 0% | $18,678,347.49 |

| AML | Aeon Metals Ltd. | 0.029 | 9% | 32% | 0% | $28,742,808.37 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| EUR | European Lithium Ltd | 0.062 | -9% | 11% | 0% | $85,838,467.61 |

| QPM | Queensland Pacific | 0.13 | 0% | 13% | 0% | $203,269,707.03 |

| PSC | Prospect Res Ltd | 0.985 | 2% | 3% | 0% | $455,325,570.07 |

| TKL | Traka Resources | 0.006 | -29% | 0% | 0% | $4,132,647.37 |

| BMM | Balkanminingandmin | 0.175 | -27% | 6% | 0% | $5,731,250.00 |

| AAJ | Aruma Resources Ltd | 0.065 | -4% | -2% | 0% | $10,202,497.70 |

| AM7 | Arcadia Minerals | 0.15 | -38% | -9% | 0% | $7,004,683.80 |

| AS2 | Askarimetalslimited | 0.25 | -32% | 0% | 0% | $10,398,567.50 |

| DTM | Dart Mining NL | 0.065 | -7% | 30% | 0% | $8,791,910.40 |

| EMS | Eastern Metals | 0.15 | -14% | 7% | 0% | $5,340,000.00 |

| FG1 | Flynngold | 0.13 | 0% | 30% | 0% | $8,327,936.50 |

| FRS | Forrestaniaresources | 0.15 | -3% | 25% | 0% | $4,392,945.60 |

| GSM | Golden State Mining | 0.041 | -32% | 5% | 0% | $4,773,274.08 |

| IMI | Infinitymining | 0.145 | -12% | 0% | 0% | $8,337,500.00 |

| MMC | Mitremining | 0.12 | -8% | 0% | 0% | $3,250,212.00 |

| SHH | Shree Minerals Ltd | 0.008 | -11% | 0% | 0% | $9,907,895.14 |

| TSC | Twenty Seven Co. Ltd | 0.003 | 0% | 50% | 0% | $7,982,441.72 |

| WML | Woomera Mining Ltd | 0.018 | -18% | -5% | 0% | $12,362,995.19 |

| CRR | Critical Resources | 0.041 | -33% | -7% | 0% | $61,008,624.80 |

| KGD | Kula Gold Limited | 0.029 | -6% | 26% | 0% | $6,240,093.33 |

| WR1 | Winsome Resources | 0.2 | -41% | -2% | 0% | $27,022,798.80 |

| MTM | Mtmongerresources | 0.12 | -29% | 0% | 0% | $4,501,203.96 |

| AZI | Altamin Limited | 0.095 | 0% | 0% | 0% | $37,213,091.44 |

| ENT | Enterprise Metals | 0.01 | -29% | 25% | 0% | $6,446,468.55 |

| STM | Sunstone Metals Ltd | 0.046 | -10% | 5% | 0% | $118,424,535.23 |

| PGD | Peregrine Gold | 0.42 | -3% | 11% | 0% | $16,080,400.98 |

| AVW | Avira Resources Ltd | 0.003 | -25% | 0% | 0% | $6,356,370.00 |

| BNR | Bulletin Res Ltd | 0.115 | -30% | 5% | 0% | $33,647,976.50 |

| RMX | Red Mount Min Ltd | 0.006 | -20% | 9% | 0% | $9,854,183.15 |

| CAI | Calidus Resources | 0.63 | -20% | 9% | 0% | $256,227,903.54 |

| SRZ | Stellar Resources | 0.018 | -5% | 6% | 0% | $15,107,447.27 |

| NWM | Norwest Minerals | 0.031 | -23% | 7% | 0% | $5,598,829.00 |

| AOA | Ausmon Resorces | 0.006 | -14% | 0% | 0% | $5,143,736.06 |

| VKA | Viking Mines Ltd | 0.006 | -14% | 0% | 0% | $6,151,550.59 |

| IPT | Impact Minerals | 0.007 | -22% | 0% | 0% | $17,369,593.89 |

| SRI | Sipa Resources Ltd | 0.04 | -5% | 14% | 0% | $8,200,992.12 |

| ZNC | Zenith Minerals Ltd | 0.25 | -32% | -7% | 0% | $86,190,569.75 |

| EPM | Eclipse Metals | 0.02 | -20% | 11% | 0% | $38,422,528.26 |

| THR | Thor Mining PLC | 0.01 | -23% | 0% | 0% | $10,689,009.73 |

| CZL | Cons Zinc Ltd | 0.02 | -5% | 11% | 0% | $7,267,156.26 |

| MM1 | Midasmineralsltd | 0.195 | -26% | 0% | 0% | $10,615,434.38 |

| M2R | Miramar | 0.1 | -5% | 16% | 0% | $6,418,666.30 |

| XTC | Xantippe Res Ltd | 0.009 | -10% | 13% | 0% | $71,650,337.08 |

| WMC | Wiluna Mining Corp | 0.22 | -54% | -4% | 0% | $79,670,081.70 |

| GW1 | Greenwing Resources | 0.215 | -22% | -2% | 0% | $26,498,180.04 |

| DAF | Discovery Alaska Ltd | 0.044 | -17% | -20% | 0% | $9,866,326.71 |

| IR1 | Irismetals | 0.27 | -10% | 15% | 0% | $16,098,750.00 |

| LNR | Lanthanein Resources | 0.016 | -11% | 0% | 0% | $13,405,209.12 |

| TKM | Trek Metals Ltd | 0.056 | -31% | 2% | 0% | $17,394,168.40 |

| CY5 | Cygnus Gold Limited | 0.16 | -6% | 3% | 0% | $18,877,650.40 |

| OCN | Oceanalithiumlimited | 0.36 | 0% | 20% | 0% | $12,069,000.00 |

| MIN | Mineral Resources. | 46.76 | -23% | 1% | 0% | $8,869,755,396.96 |

| INR | Ioneer Ltd | 0.4575 | -3% | 8% | -1% | $964,682,928.00 |

| WES | Wesfarmers Limited | 44.5 | -2% | 6% | -1% | $50,750,689,231.92 |

| JRL | Jindalee Resources | 2.9 | -13% | 1% | -1% | $167,546,580.72 |

| AGY | Argosy Minerals Ltd | 0.3375 | -20% | 1% | -1% | $461,057,335.58 |

| TUL | Tulla Resources | 0.545 | -9% | 2% | -1% | $88,119,279.60 |

| SCN | Scorpion Minerals | 0.07 | -13% | -1% | -1% | $23,560,014.63 |

| AOU | Auroch Minerals Ltd | 0.068 | -15% | 17% | -1% | $25,492,174.13 |

| CXO | Core Lithium | 0.935 | -26% | 0% | -2% | $1,645,981,130.20 |

| RIO | Rio Tinto Limited | 95.72 | -20% | -5% | -2% | $36,167,595,730.02 |

| KTA | Krakatoa Resources | 0.052 | -20% | 0% | -2% | $18,269,625.60 |

| PLS | Pilbara Min Ltd | 2.305 | -5% | 3% | -2% | $6,995,593,702.40 |

| LTR | Liontown Resources | 1 | -16% | 0% | -2% | $2,236,069,701.96 |

| TEM | Tempest Minerals | 0.049 | 0% | -49% | -2% | $25,238,308.80 |

| DRE | Dreadnought Resources Ltd | 0.045 | 18% | -6% | -2% | $130,579,443.35 |

| NVA | Nova Minerals Ltd | 0.72 | 24% | 6% | -3% | $133,349,690.90 |

| IGO | IGO Limited | 9.7 | -20% | -1% | -3% | $7,549,960,095.61 |

| PLL | Piedmont Lithium Inc | 0.535 | -34% | 3% | -3% | $290,163,940.00 |

| LRS | Latin Resources Ltd | 0.071 | -13% | 6% | -3% | $140,894,652.87 |

| MRR | Minrex Resources Ltd | 0.035 | -15% | 13% | -3% | $38,165,290.60 |

| AKE | Allkem Limited | 10.16 | -13% | -1% | -3% | $6,669,903,579.56 |

| VMC | Venus Metals Cor Ltd | 0.165 | -11% | -3% | -3% | $27,213,376.11 |

| ARN | Aldoro Resources | 0.16 | -22% | 19% | -3% | $16,370,242.19 |

| LLL | Leolithiumlimited | 0.46 | 0% | -12% | -3% | $468,662,033.20 |

| MNS | Magnis Energy Tech | 0.3 | -15% | 0% | -3% | $299,610,451.99 |

| WCN | White Cliff Min Ltd | 0.0145 | -15% | 32% | -3% | $9,804,050.43 |

| AZL | Arizona Lithium Ltd | 0.087 | -28% | -1% | -3% | $201,014,729.10 |

| RGL | Riversgold | 0.029 | -17% | 4% | -3% | $22,691,279.97 |

| TMB | Tambourahmetals | 0.135 | -31% | 8% | -4% | $5,766,963.72 |

| LKE | Lake Resources | 0.6925 | -52% | -9% | -4% | $1,000,591,132.32 |

| NMT | Neometals Ltd | 0.995 | -14% | 9% | -4% | $567,569,569.86 |

| ESS | Essential Metals Ltd | 0.36 | -23% | -1% | -4% | $92,432,784.38 |

| FTL | Firetail Resources | 0.225 | -38% | -10% | -4% | $14,518,887.50 |

| LPI | Lithium Pwr Int Ltd | 0.435 | -6% | 5% | -4% | $158,860,905.84 |

| A8G | Australasian Metals | 0.205 | -40% | -11% | -5% | $8,851,656.21 |

| GLN | Galan Lithium Ltd | 1 | -22% | -3% | -5% | $319,619,330.10 |

| LRD | Lordresourceslimited | 0.2 | -15% | -15% | -5% | $6,674,770.41 |

| RAG | Ragnar Metals Ltd | 0.039 | -9% | 8% | -5% | $15,546,580.45 |

| PAM | Pan Asia Metals | 0.385 | -27% | -9% | -5% | $29,937,698.01 |

| SYA | Sayona Mining Ltd | 0.1425 | -8% | -8% | -5% | $1,237,012,900.50 |

| TYX | Tyranna Res Ltd | 0.019 | 19% | 6% | -5% | $30,647,213.34 |

| LEL | Lithenergy | 0.71 | -30% | 3% | -5% | $33,862,500.00 |

| MLS | Metals Australia | 0.049 | -28% | -2% | -6% | $29,537,881.93 |

| GL1 | Globallith | 1.12 | -26% | -4% | -6% | $189,644,415.92 |

| QXR | Qx Resources Limited | 0.029 | -24% | 4% | -6% | $26,640,231.95 |

| RDT | Red Dirt Metals Ltd | 0.36 | -21% | -5% | -6% | $117,253,454.01 |

| VUL | Vulcan Energy | 5.36 | -22% | -2% | -7% | $822,744,627.74 |

| AX8 | Accelerate Resources | 0.028 | -15% | -7% | -7% | $8,113,766.97 |

| LSR | Lodestar Minerals | 0.0065 | -19% | 8% | -7% | $12,169,061.44 |

| 1MC | Morella Corporation | 0.018 | -10% | 6% | -10% | $103,524,279.72 |

| RLC | Reedy Lagoon Corp. | 0.018 | -14% | -5% | -10% | $11,148,538.24 |

| EFE | Eastern Resources | 0.027 | -4% | 29% | -10% | $29,833,098.93 |

| LRV | Larvottoresources | 0.195 | -29% | -9% | -13% | $9,344,812.50 |

| EVR | Ev Resources Ltd | 0.0275 | -21% | 10% | -14% | $29,631,490.27 |

A total of 23 stocks were in the green today, 55 were flat and 53 were in the red.

Who’s got news out today?

Power has entered an Memorandum of Understanding (MoU) with Xiamen Xiangyu New Energy Co. for the development of the Salta project in Argentina.

Xiamen Xiangyu is a diversified Fortune-500, Shanghai Stock Exchange-listed (SSE:600057) supply chain and logistics company, providing an end-to-end supply chain for battery technology metals, sourcing supply of lithium, nickel, cobalt and other raw materials for processing plants and battery manufacturers and, end-use by automobile manufacturers and other battery technology industries.

“Xiamen Xiangyu is vastly experienced in the provision of closed-loop supply chain solutions for battery metals, and we look forward to working with them to fast-track the development of the Salta Lithium Project,” Power Minerals executive director Mena Habib said.

The parties will conduct due diligence investigations and enter negotiations with a view to executing a binding off-take, funding and logistics agreement for the Salta project.

Anson has delivered a 25% increase in lithium assay grade in its targeted drilling of Mississippian Units at the Long Canyon No. 2 well at its Paradox project in Utah, USA.

Drilling reported an assay value of 100ppm lithium and 2,460ppm bromine compared to minimum 80ppm lithium estimated in the exploration target.

The company says this confirms the massive, supersaturated brine aquifer in the Mississippian Units are lithium and bromine rich – plus they don’t form part of the project’s current resource and could deliver a ‘significant upgrade.’

Anson’s resource expansion drilling program is currently progressing on the Mississippian Units at the high priority Cane Creek 32-1 well and historic wells on the western side of the project area have also been drilled through the Mississippian Units and will be re-entered for testing.

The company has picked up four prospecting licences (PLs) prospective for lithium in Tanzania.

The PLs cover around 300km2 and host historical pegmatite occurrences with a a lithium and tantalum discovery just 700m from the company’s licence border found in 2015 when Liontown Resources (ASX:LTR) owned the Mohanga project.

“We have assessed many potential projects over the last two years to add shareholder value,”

“With a renewed worldwide interest in lithium due to its key status in the surging green industries of batteries and electrification in all walks of life, we have carefully considered and acquired these four tenements in a known lithium region with exciting geological characteristics and documented lithium presence,” CEO James Arkoudis said.

“Our ongoing significant African experience will hold us in good stead as we strive to make this project successful for the benefit of our shareholders.”

Exploration work to be carried out in the first year is based around a desk top review, early exploration reconnaissance, geological mapping and rock chip sampling.

The company has received assays for a further 10 holes at its Reung Kiet Lithium Project in Thailand, with results including 4.05m at 0.78% lithium, 0.05% tin and 168ppm tantalum from 83.6m, 1.2m at 0.78% lithium, 0.11% tin and 165ppm tantalum from 51.35m, and 7.05m at 0.68% lithium from 126.85m.

PAM says the results demonstrate extensions at depth and along strike of the existing mineral resource and that the tin, tantalum and other by-products like rubidium, cesium and potassium compounds potentially add to the revenue of any future operation.

Infill and extensional drilling is ongoing with a mineral resource upgrade and scoping study expected later this year.

PNN, ASN, CMD and PAM share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.