Explorers & investors aren’t seeing eye to eye on the 2030 copper crunch

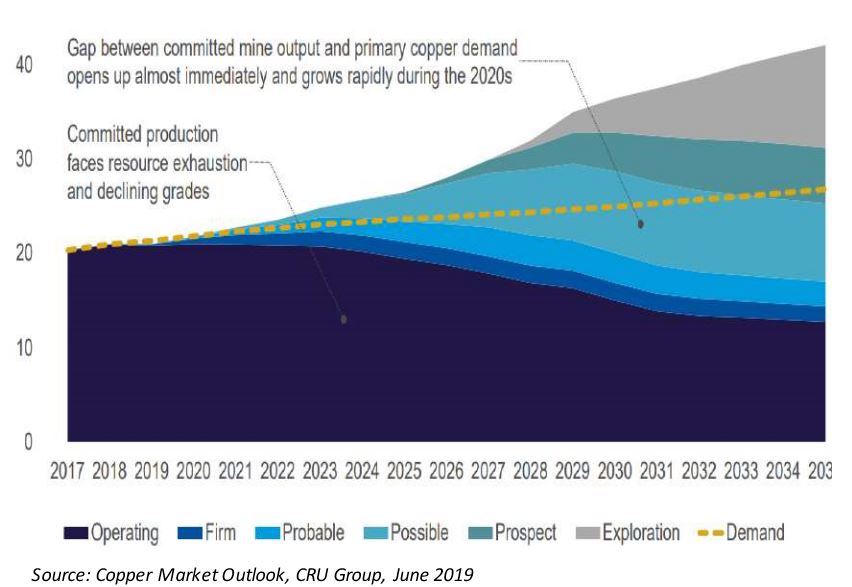

The copper market is facing a shortfall of 8 million tonnes in 2030.

Commodity research firm CRU predicts a supply gap between mine output and copper demand will open up during the 2020s and expand rapidly.

On one hand demand will continue to rise because of copper’s use in infrastructure and consumer products.

On the other, supply will be challenging with a large portion of copper producing mines reaching the end of their productive lives by 2035. Replacing them will be easier said than done due to community opposition and investment costs.

But in the short-term the picture is less rosy. According to Bloomberg, copper futures on the London Metals Exchange have fallen nearly 11 per cent since April.

The picture is very similar in the lithium and graphite markets with the promise of the metals’ long-term importance – most notably to electric vehicles. But an oversupply of these minerals relative to global demand for electric vehicles means prices have suffered.

The ASX stock that has risen the most in 10 years is gold producer Northern Star Resources (ASX:NST), which was 1.9c in May 2009 but is $10.06 today – a gain of over 50,000 per cent. No other stock comes close – the runner up Audio Pixels (ASX:AKP) is only up 13,000 per cent in that time.

Not only was Northern Star’s share price lower a decade ago but so were its cash reserves – to the point where the ASX asked the company if it had enough cash to operate. Patience certainly paid off for those who held the entire time.

But the current sentiment suggests today’s investors are not willing to wait that long.

Companies are thinking long term

Copper explorers are thinking that far ahead even if investors aren’t, hoping they’ll be well placed to capitalise as the copper crunch emerges.

Stockhead spoke with the managing director of Minotaur Exploration (ASX:MEP), Andrew Woskett. His company owns several projects, the majority of which are in base metals.

Woskett agrees that resources’ investors typically aren’t looking as far ahead as companies.

“I think that’s probably true,” he said.

“People tend to react on a daily basis to whether the price goes up and down in most commodities. They have short term horizons, make a big buck and move on.

“But I look at the big producers particularly those that have some sort of scale and mine life ahead of them and in that respect look at companies such as Oz Minerals (ASX:OZL).

“Those guys are planning a pipeline of projects that will take them 20 to 30 years. So they see demand in the future and are trying to develop new mines.”

Minotaur is in three partnerships with Oz Minerals in western Queensland. Oz Minerals has invested $10.6m in one (Jericho) and $4m in another (Eloise). Minotaur anticipates the maiden JORC resource for Jericho will be a catalyst for a re-rating.

Stavely gives copper explorers hope

A more positive sign for copper explorers was the success of Victorian explorer Stavely Minerals (ASX:SVY) which recently made a 40 per cent copper hit. The share price has gone up five times since then.

Stockhead asked Woskett for his thoughts on Stavely’s project and he revealed his company attempted to buy the copper project from its previous owners and got beaten on price.

“That’s a very good project,” he said. “Their discovery was a vindication of what we wanted to do.

“But in terms of a market perspective I think it’s good for investors to see that price spike because that is what it’s all about at a junior end.

“That sort of result, going from 22c to $1.27, is a pretty good result for those investors and good luck for them.

“And it helps bring back positive sentiment to junior exploration where risks are high and probability of a discovery is low.”

Read More:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.