Explorer to Mine-builder: MST outlines case for re-rate at IVR’s Paris silver project

MST believes Investigator Resources’ Paris asset is set up to become a substantial silver producer with potential for ~$200m EBITDA. Pic: Getty Images

- MST Access analysts have called Investigator Resources’ Paris project in South Australia the top silver prospect on the ASX

- Paris hosts Australia’s only development scale primary silver deposit

- A PFS has been completed and a DFS is set for delivery in CY2026

Special report: MST Access has wrapped a fresh set of numbers around Investigator Resources and its Paris project in South Australia, now shaping up as Australia’s front-running build-ready silver project.

The timing is now right for the project, with silver prices hitting a record US$54.20/oz on Thursday. They subsequently fell 4% to US$51.8/oz, but remain more than 67% up year to date and have risen for nine straight weeks.

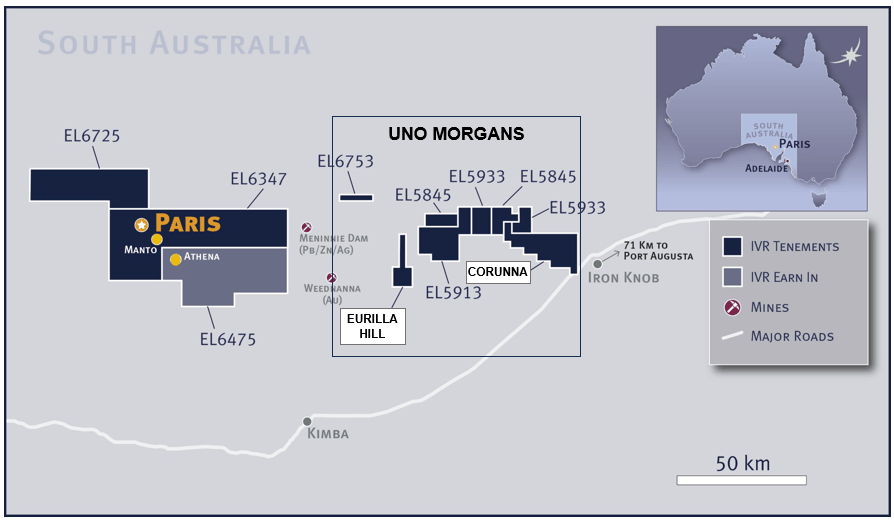

Sitting in South Australia’s Gawler Craton, Paris is the country’s only development-scale pure silver deposit, with a resource of 57Moz at 73g/t and a DFS due in the first half of CY26.

It’s a mix of factors that MST argues positions Investigator Resources (ASX:IVR) for a re-rate as the market finally starts paying for projects capable of delivering cashflow into a tightening silver market.

Senior analyst Michael Bentley has placed a 16c valuation on the stock, which currently commands a 5.9c share price and market valuation of $100m.

Silver revival

For years, silver was dismissed as ‘poor man’s gold’ but it has quietly stepped into a once-in-a-generation re-rating as two forces collide – industrial demand that can’t be substituted and a supply base that can’t keep up.

Solar now absorbs ~19% of global silver consumption and keeps rising as panel efficiency pushes silver intensity higher.

EVs, grid electrification, 5G, data centres and advanced medical tech are layering on top of that demand curve.

Meanwhile ~72% of global silver still comes as a by-product of copper, lead/zinc and gold mines, meaning supply doesn’t react to high prices the same way as those other metals.

In parallel, investment demand has strengthened – ETF holdings are at record levels, macro hedging flows have risen, and the gold-silver ratio remains above historical averages, implying relative undervaluation.

The result is a price environment that has outpaced the major bank targets for 2025, with silver trading above US$50/oz and revisiting 2011 levels on fundamentals rather than speculation.

In a world short of new silver, Paris stands out

In a market where new primary silver capacity barely exists, and almost none in tier-1 jurisdictions, Paris is the style of deposit the market is beginning to pay for.

IVR’s PFS was already robust when prices were around ~US$24.70/oz, delivering a free cash generation of A$487m, with pre-tax NPV of A$202m, a 54% IRR and a 2.3-year payback, underpinned by an initial capex of ~A$131m. Running the current silver price over the PFS production would yield more than A$1.2B of additional free cash flow assuming all else stayed the same, highlighting the enormous leverage the project has to the silver price.

A DFS is now being reset specifically to capture today’s price regime – more than double the PFS assumptions – to embed key optimisations including a larger pit shell, a leaner capital configuration and a revised 1.5Mtpa throughput case.

Its location is a major advantage as well. South Australia’s mining regime is stable, infrastructure exists, permitting is transparent, and skills are local, materially de-risking the pathway from PFS to build.

That tier-one jurisdiction premium matters in a metal where ~75% of supply still comes from higher-risk Latin American and Asian sources.

And the MRE, totalling 24Mt at 73g/t silver containing 57Moz silver at a 25g/t silver cut-off grade, covers just the Paris pit footprint of a 15km silver corridor with multiple mineralised satellites and fresh drilling planned at Athena, Apollo and Manto — none of which are in the current resource.

In a silver deficit world, additional feed in the same jurisdiction and same metallurgy compounds value quickly.

Major upside in valuation

MST’s valuation of 16c comes in at more than 2.5x IVR’s share price, with Bentley calling the stock “substantially undervalued” with upside from both study uplift and silver momentum.

With the appointment of experienced mining executive Lachlan Wallace in July, MST says the company has implemented a new strategy – one that aims to start production earlier.

But investors, MST argues, are still pricing IVR as an explorer rather than a near-developer with a tier-1 jurisdiction, high-grade, scale, a funded study runway and access to catalysts in the next 6–12 months.

“We see potential for the project to deliver ~A$200m of EBITDA per annum at margins of 65% based on our pre-DFS estimates and see potential for this number to increase further as a result of the upcoming DFS,” Bentley said.

“Paris is a high-grade project and compares favourably to its silver pre-production peers. Further growth opportunities exist via optimisation and exploration programs.”

While work continues at Paris, a geochemistry program is about to launch at Uno Morgans (80km east of Paris) which involves soil sampling across a newly acquired tenement called Eurilla Hill.

That work will be followed by a broader gravity survey over the newly secured Corunna tenement to define priorities for the 2026 drill program.

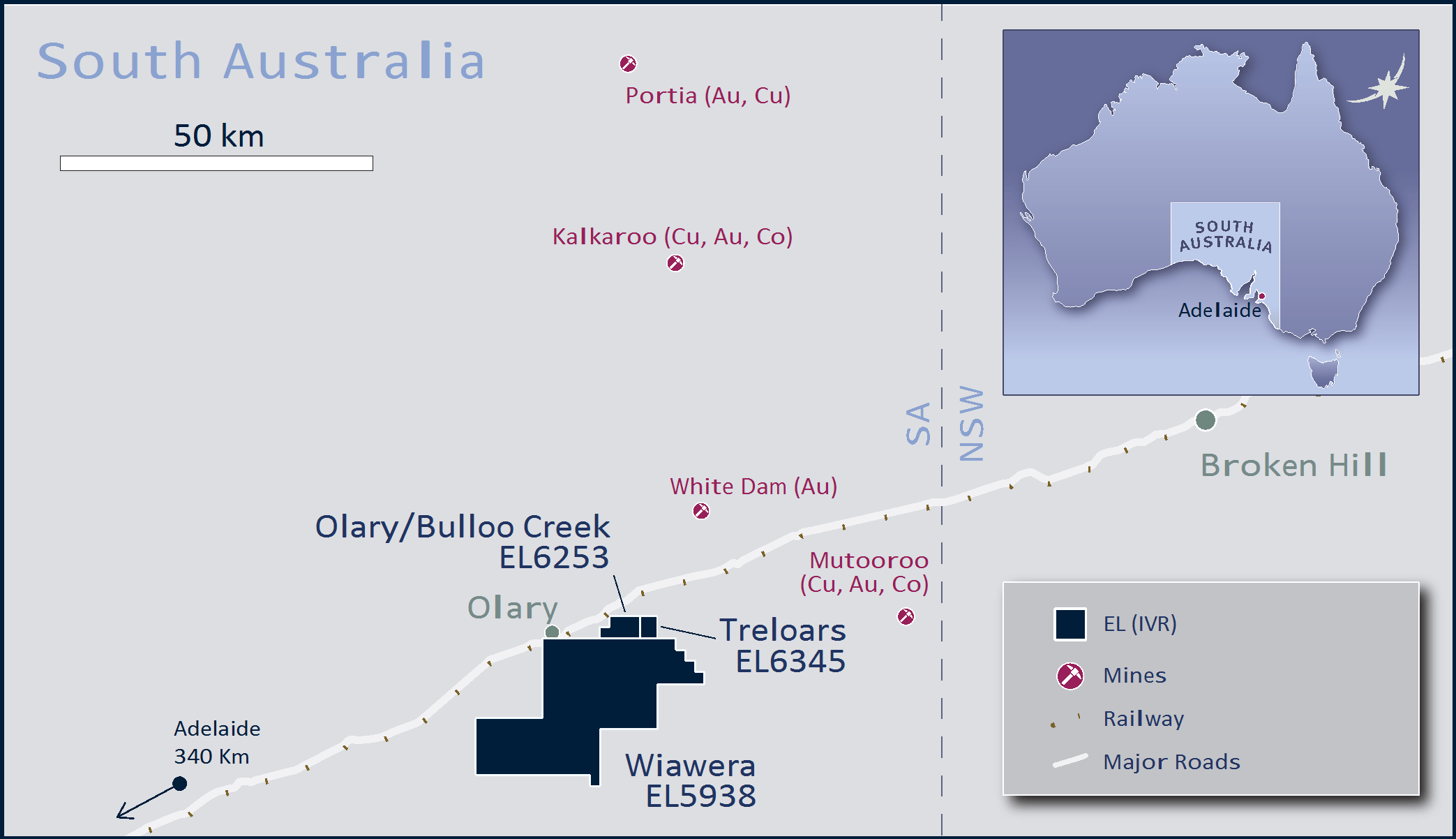

Drilling at the Curnamona asset will begin in November, chasing a gold-silver-copper system across four high priority targets.

This article was developed in collaboration with Investigator Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.