Expert: Three tips to know when picking lithium stocks

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

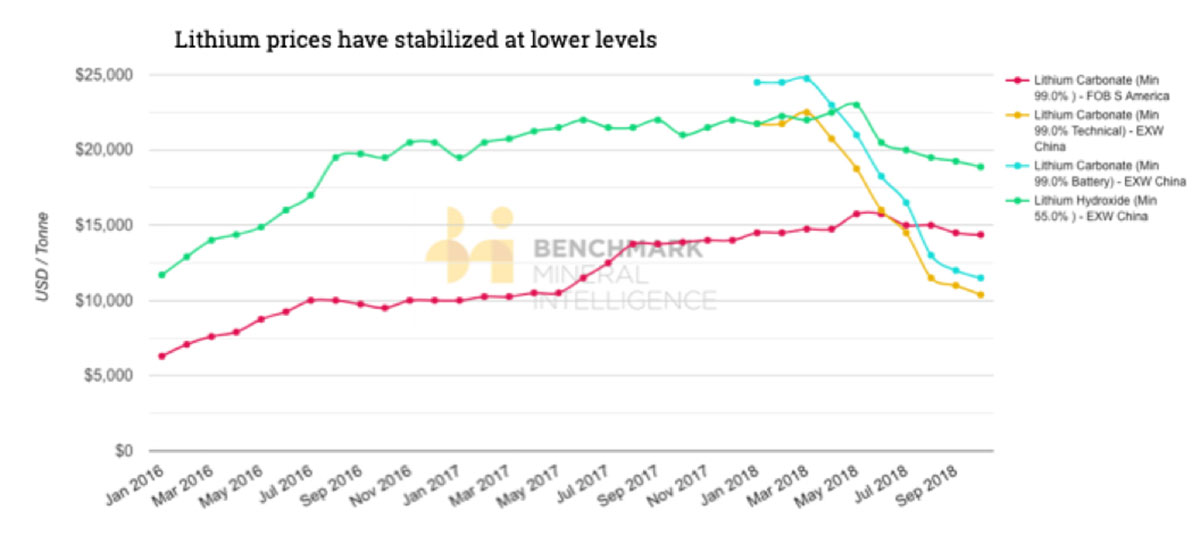

Special Report: Lithium stocks are still a hot topic, despite a recent downturn in the lithium price.

Much of this comes down to projected future demand for the world’s lightest metal.

From a peak of $24,750 per tonne in March, prices in China have since plunged to around $13,000 per tonne.

By 2025, however, demand is set to hit 422,614 metric tonnes.

What does all this mean for investors?

For starters, it means that instead of being a short-term play (for example, just before lithium prices peaked) investors will potentially need to strap in for a longer ride.

Major spot price gains may not materialise for the next five years according to Moody’s Investor Services.

Crucially though, this doesn’t imply you won’t see major movement in the share prices of lithium stocks if their projects are forecast to be profitable.

Secondly, it means that you need to be a bit more discerning than usual when picking lithium stocks.

Betting on the sector might not get you the gains you are looking for — for example The Global X Lithium and Battery Tech ETF (AMEX:LIT) which packages 42 securities has netted just 0.99 per cent annually since it was started in July 2010.

This opens up our discussion to three things to look for when picking lithium stocks.

Different resource types in multiple countries

There is a healthy debate present in the lithium investment community regarding which type of resource is likely to yield the best profit margins and thus the best investment returns.

The two main types are hard-rock lithium and brine-based lithium.

As a general rule of thumb, hard-rock is more capital intensive while brine-based lithium is cheaper initially, but subject to changing weather conditions (because of outdoor evaporative pools) and environmental regulatory uncertainty.

There is significant projected growth, however, to be found in spodumene (hard-rock) and production will increasingly come from sources other than the big four producers.

Our goal is not to profile the big four producers, however, but focus on more exciting, speculative plays.

To do this, it is helpful to understand the distribution of resources around the world.

Clearly, Australia is well positioned with a significant chunk of hard-rock global resources, but Chile and Argentina cannot be forgotten, nor the US which has both brine and hard-rock resources.

One example of a small-cap, ASX-listed, US-based brine play is Anson Resources Ltd (ASX:ASN).

Then of course there is the well-known Australian based hard-rock company Pilbara Minerals Ltd (ASX:PLS), and then the Argentina-based, brine-focused Orocobre Ltd (ASX:ORE).

Another particularly interesting company is Galaxy Resources Ltd (ASX:GXY) which has both hard-rock Australian resources in production and an Argentinian brine project in the pipeline.

So when assessing lithium stocks, look at where their resources our located, the regulatory environment of the country they operate in and whether they are hard-rock or brine-based companies. Also compare balance sheets with one eye on the typical differences in capital needed for the two types of resources.

Current production

Owned by one of the big four producers (Tianqi Lithium), by far the largest current production of lithium in Australia comes from the Greenbushes mine in Western Australia with 350,000 tonnes of lithium products shipped annually.

However, there have been two major mines that have just begun production.

Pilbara Minerals recently announced in October that it had achieved its first shipment of product. The same applies for Altura Mining Ltd (ASX:AJM).

So if you are looking for a more predictable investment, it might be wise to consider lithium miners that are already in the production phase. The share price of a company will be more closely tied to the price of lithium, as this is its bottom line.

Offtake agreements

For those with a bigger risk appetite there are a range of small and micro-cap lithium stocks to explore.

Perhaps one of the key announcements these types of companies make are offtake agreements.

Offtake agreements are agreements between a lithium producer and a buyer of their resources for the producer’s future output. These agreements are crucial as they make it easier for the producer to obtain financing for the construction of the mine.

This is what happened to Pilbara Minerals when it announced an offtake agreement.

Given the critical nature of offtake agreements, they provide clarity to investors as to whether a lithium project will actually commence.

Things to look for in terms of an offtake agreement include the volume of total resources which it secures, any financing made available from the buyer as well as processing plant arrangements.

It is a difficult time for ASX-listed lithium stocks at the moment, but that doesn’t mean these businesses are all operating on failed models. Lithium prices may well recover as demand firms up in response to the rapid uptake of electric vehicle technology.

Sam Volkering is an investment expert with Money Morning, which aims to provide intelligent and enjoyable commentary on the most important stock market news and financial information of the day. For more of Sam’s views, you can also download his free report Battery Boom.

Port Philip Publishing is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.