Everest to divest Uranium projects

EMC’s newly acquired Mukinbudin uranium project will be spun into the Cobold Metals IPO in Q4. Pic via Getty Images

- EMC has also executed a term sheet to divest its Uranium projects, including Mukinbudin uranium project in WA’s Wheatbelt region

- The uranium projects will be held by Cobold Metals, which seeks to list in Q4 this year

- This divestment means Everest can focus on its gold and critical metals projects

Special report: Everest is divesting its Mukinbudin uranium project into new IPO Cobold Metals.

Everest has made its name in recent times for gold and rubidium projects in WA, with the new IPO designed to tap into enthusiasm for the glowing metal.

Analysts are betting the global drive for a quicker and more affordable clean energy transition will see uranium prices trek higher as governments look to adopt nuclear fuel to achieve stringent carbon emission reduction goals.

Although the historic rapid run in the uranium spot price has weaned after hitting 16 year highs in January, Sprott’s Jacob White believes the recent weakness is not an indication of deterioration in market fundamentals, which are characterised by a structural supply deficit.

By 2035, the global demand for uranium is expected to reach 209mlb annually, but supply will fall short at 114mlb , a little over 54% of end user demand.

Coupled with its assets in a Tier-1 mining jurisdiction, Everest Metals Corporation (ASX:EMC) believes the newly acquired Mukinbudin project provides significant exposure to the right commodity at the right time.

This divestment means EMC will be able to further focus on its gold and critical metals projects.

Adding to current uranium package

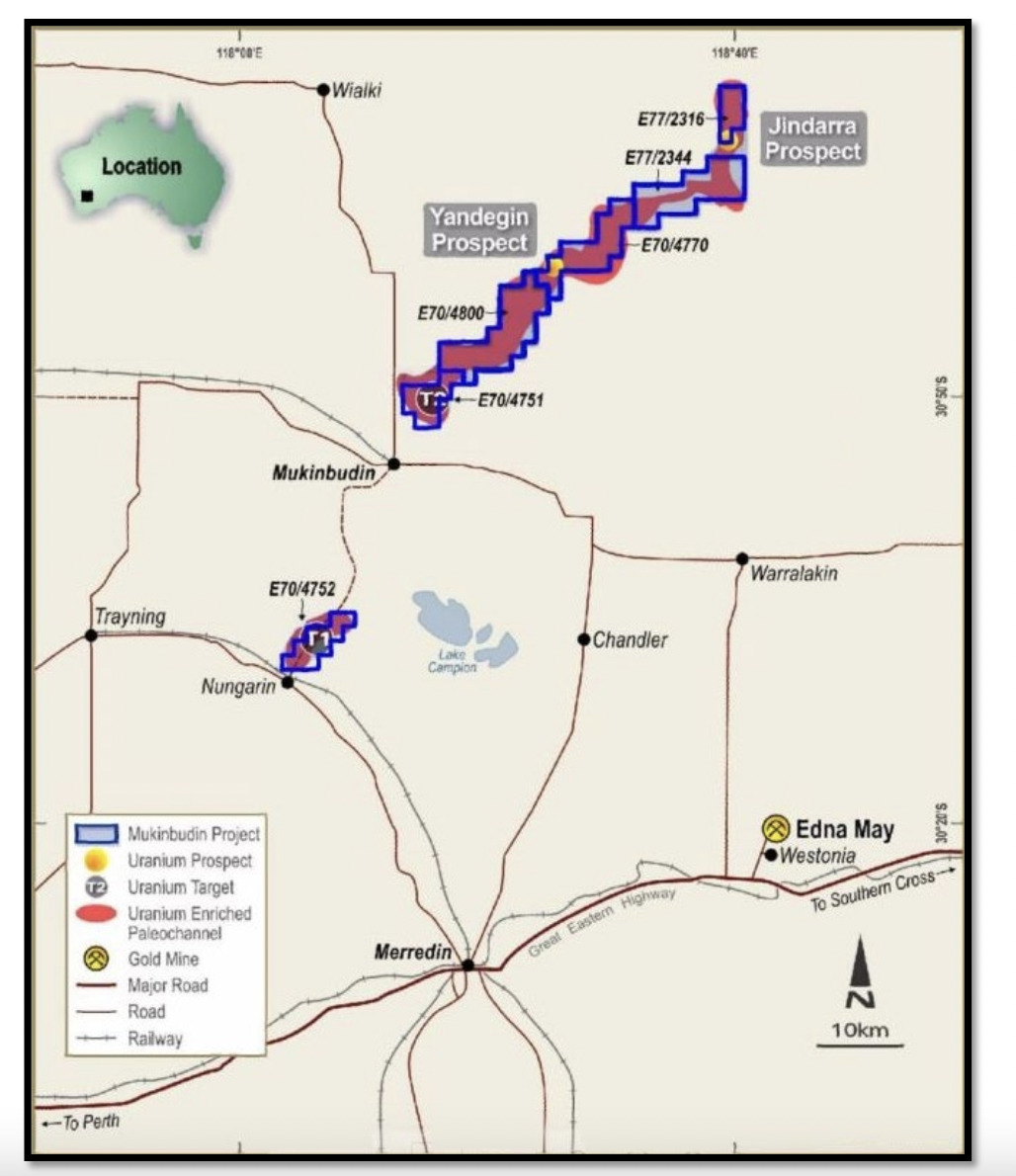

Mukinbudin is located near the eastern Wheatbelt town of the same name about 300km northeast of Perth and is covered by freehold farmland used primarily for broadacre wheat production.

The project covers six granted exploration licences for a total area of 219km2 and over 80km of strike length confirmed in a paleochannel.

In 2011, Mindax reported an inferred resource of 6.2Mt at 237ppm uranium over two areas including Jindarra and Yandegin, the first uranium resource estimated on a prospect.

EMC has acquired the project and executed a non-binding term sheet with public unlisted company Cobold Metals, which will see Cobold acquire 100% interest in Mukinbudin along with EMC’s Northern Territory uranium projects – The Amadeus and Georgina projects.

EMC’s uranium projects cover an aggregate area of 10,417km2 in the Northern Territory and Western Australia.

Members of the Cobold Board and current shareholder base were instrumental in the listing of Alligator Energy, which now has a market cap of over $200 million.

Cobold will seek to list on the ASX in Q4 2024, after a $5m IPO backed by Henslow as lead manager.

Post IPO, EMC will retain an indicative 22.8% equity interest in the new listing with its investment having an implied market value of $2.6m.

Upside to uranium strategy

“Cobold, together with its experienced management team, provides a great home for EMC’s Uranium development aspirations,” EMC CEO and executive chairman Mark Caruso says.

“This transaction allows EMC to continue to focus on its core gold and critical mineral assets whilst giving shareholders maximum upside to its uranium strategy.

“The uranium market outlook continues to be very strong with nuclear demand expected to continue outpacing supply over the mid-term to enhance long-term energy security and attainment of net-zero goals,” he says.

The WA Government does not currently support uranium mining, with one operation approved during a period from 2008-2017 when the prohibition was at the time lifted.

But there is confidence within the mining industry that sentiment is shifting towards supporting uranium production in the State – with the Liberal-National Opposition placing the policy on their next election platform – as its critical role in reducing global CO2 emissions garners support across both developed and emerging economies.

This article was developed in collaboration with Everest Metals Corporation, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.