Even at conservative lithium prices, AVZ’s Manono looks set to be a big money-maker

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: With every step AVZ Minerals takes at its Manono lithium and tin project in the Democratic Republic of the Congo, the development picture just keeps looking better.

An extended scoping study for the proposed 5-million-tonne-per-annum (Mtpa) operation has strengthened the economics and shown the potential for Manono to be a world-class, high margin, long-life mine.

The study estimates that Manono will have a net present value (before tax and royalties) of US$2.63 billion ($3.82 billion) and an internal rate of return (IRR) of greater than 64 per cent.

IRR and NPV are used to estimate the profitability of a potential operation – the higher they are above zero, the better they are.

“Not only does the results of the 5 Mtpa (Case 2) study confirm the excellent quality of the Manono project, it further underlines the expandability of the project,” managing director Nigel Ferguson said.

>> AVZ toasts a ‘high margin, long-life mining project’ from 2 Mtpa scoping study

The scoping study outcomes are based on a lithium concentrate sale price of US$750 per tonne.

The scoping study has yielded an exceptional and industry leading IRR of 64 per cent even at a more conservative lithium price to reflect market changes in the last seven months.

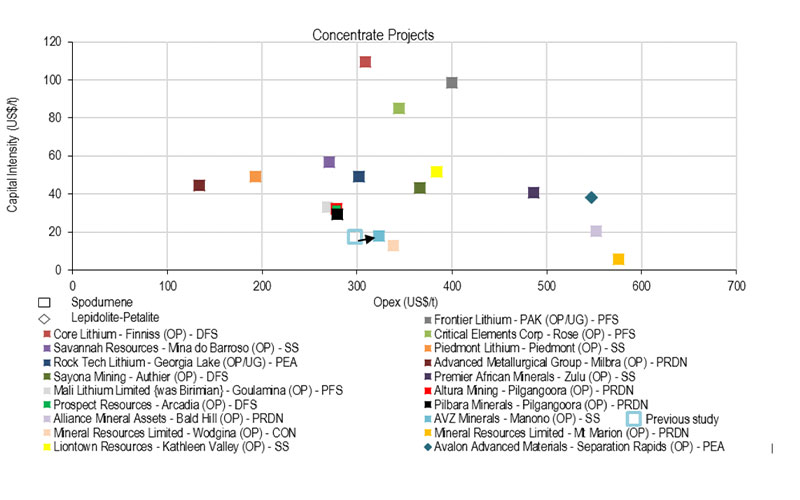

Just as importantly, the expected capital outlay of roughly US$380m to $400m makes Manono the third lowest cost lithium mine in the world.

Ryan Long, a director of mining at investment research firm Edison Group, said that even though the capital cost had increased by between 138 per cent and 150 per cent, Manono continued to be the “third least capital intensive igneous or sedimentary lithium deposit we know of and lowest of any operation that doesn’t leverage existing mining infrastructure”.

AVZ has also lowered the expected mining and processing costs from US$120 per tonne to US$91 per tonne thanks to a lower strip ratio resulting from improved mine scheduling.

The strip ratio refers to the amount of dirt that needs to be moved to get to the mineral-bearing ore.

In this case, the strip ratio has been lowered to 0.55 to 1, which means AVZ only needs to move roughly half a tonne of waste rock to mine 1 tonne of ore over life of mine.

Although transport costs are expected to be a bit higher, AVZ says the scale and quality of the mining operation, with low mining and processing costs, allows the project to easily bear the estimated higher transport costs. Tin credits have not been applied at this stage and will be assessed in the current metallurgical test-work being undertaken at Nagrom Laboratories.

“Despite both opex and capex being increased in this updated scoping study, the Manono project’s economics remain attractive and robust with its huge scale making it an asset of strategic importance,” Long said.

Right now, AVZ’s Manono mine has a potential mine life of about 20 years at 5Mtpa.

Metallurgical test work, meanwhile, shows the potential for high recoveries of over 80 per cent.

This would deliver around 1.1 million tonnes at a minimum of 5.8 per cent lithium concentrate each year.

That is a 150 per cent increase and gives Manono the second highest production target per annum of any global igneous and sedimentary lithium project, Long noted.

Tin bonus

The resource at Manono also contains valuable tin, but the extended scoping study has not taken into account the by-product credits the metal would deliver.

These tin credits, however, will be included in the definitive feasibility study, making a solid case for even better economics.

“Management will now turn its attention to selecting the optimal throughput level in

conjunction with consultants working on the DFS,” Ferguson said.

Earlier this week, AVZ’s share price witnessed a nice rally of over 26 per cent to an intra-day high of 5.3c on Tuesday.

This follows recent news that the company now also has the largest, highest confidence lithium resource in the world.

AVZ revealed earlier in May that it had increased the level of resources in the top “measured” and “indicated” categories for its Roche Dure deposit by 41.7 per cent.

Mineral resources are categorised in order of increasing geological confidence from inferred to indicated to measured.

A “measured” resource represents the highest level of geologic knowledge and confidence and allows a company to start work to convert the resource to a reserve — discoveries that are commercially mineable. (note Indicated Resources can also be converted to mining reserves)

An “indicated” resource means a company has sufficient information on geology and grade continuity to support mine planning.

The combined measured and indicated resource for Roche Dure now stands at 269 million tonnes at grades of 1.65 per cent lithium, 816 parts per million (ppm) tin and 36ppm tantalum.

The total resource remains the same at 400 million tonnes, but now 67 per cent of it is in the higher confidence categories as opposed to 47 per cent previously.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with AVZ Minerals, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.