Drilling ready to begin after Silver City completes ‘transformational’ Austin gold purchase

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Silver City Minerals has completed the “transformational” purchase of the Austin Gold Project in the 17 million ounce Murchison gold district in WA, paving the way for the start of a major drilling campaign.

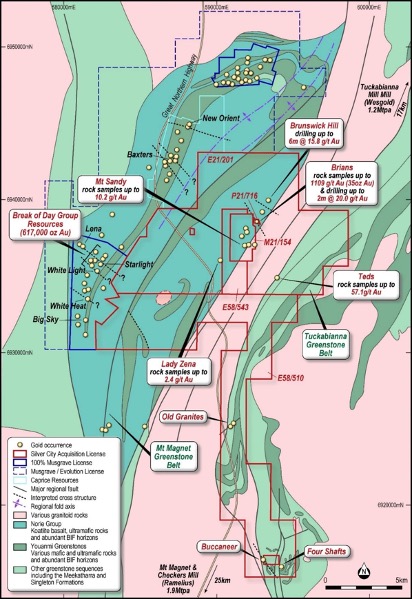

The project, which is just down the road from Musgrave Minerals’ 617,000oz Break of Day deposit, has excited all involved since Silver City Minerals announced the joint venture deal in April.

The project, an 80-20 JV with prospecting company Gardner Mining, is located around 45km north of Mt Magnet over 175sqkm of tenure near the Tuckabianna processing plant owned by Westgold Resources.

Darren White, whose company vended the ground and whose experience in the WA mining industry spans three decades including in drill and blast, will become a director of Silver City.

Historic exploration results provide plenty of ideas to work with, including a drill hit of 6m at 15.8 g/t Au from 36m at the Brunswick Hill prospect and visible gold in surface veins that have returned assays of up to 1,109 g/t gold.

A diamond drilling campaign will begin in August with RC and aircore rigs secured for September and October in what is a booming WA exploration market.

Large gold potential

Finds like those visible gold veins have Silver City’s tail up about the potential to uncover high grade and shallow gold at the Austin project.

“Successful settlement completion of the transformational Austin Gold Project along with the appointment of Mr Darren White to the board represents a significant step towards advancing Silver City’s gold exploration portfolio and creating shareholder value,” SCI director Sonu Cheema said.

“The company is well positioned and funded to generate value commencing with the exciting maiden drill program on the project in August.

“Our work to date has shown extensive gold present at surface which supplements the limited previous drilling that has intersected some incredibly high grade and shallow gold. We look forward to keeping the market informed as drilling commences.”

Location is certainly in favour. Along with Tuckabianna, Ramelius’ Mt Magnet mill is also within 50km of the site.

In a geological sense it is promising too, with the Mt Sandy, Brians and Brunswick Hill prospect all located along the eastern limb of the regionally folded Norie Group, on the Mt Magnet greenstone belt.

Musgrave’s Break of Day and Lena deposits are located on the western limb, with new high grade discoveries like Starlight and White Light trending north-west on structures interpreted to project under and over into Silver City’s Austin project.

Little modern exploration

Austin contains one granted mining licence at Mt Sandy surrounded by three larger granted exploration licences and one small prospecting licence.

It has been privately held over the past 20 years, resulting in little modern day exploration programs taking place although the presence of alluvial and hard rock gold has been found by prospectors near surface for a number of years.

A handful of shallow drill programs have been conducted in the past with significant gold results that have never been followed up to a great extent.

Silver City’s new drilling program will look to do just that, with contractor Hagstrom Drilling to conduct strategic drillholes in key areas of known gold mineralisation to better understand and characterise the orientation of mineralisation at Austin.

RC and aircore drilling will follow to explore targets across the broader package.

The fine print

Silver City is expected to spend $2 million on the JV over the next three years, with vendor White’s 20 per cent interest free-carried until a decision to mine or the JV ends.

It has also raised $1.5 million to support the acquisition via the issue of 100 million new shares at 1.5c each, including a $859,224 placement to new and existing sophisticated investors.

Separately White has subscribed for ~$590,000 worth of SCI stock, with other directors tipping in a further $50,000.

This article was developed in collaboration with Silver City Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.