Donald Trump is good for resources stocks say analysts

Mining

Mining

He may be a magnet for controversy, but US president Donald Trump is a good luck charm for resources — particularly gold — say industry experts.

There is a strong correlation between US gross domestic product and the ASX200 Resources Index, says Patersons Securities senior resources analyst Simon Tonkin.

“I’ll say President Trump is really good for resources,” he told delegates at this week’s RIU Explorers Conference in Fremantle, Western Australia.

“He’s good for the US economy. He pledged to spend a trillion [dollars] on ageing infrastructure and also is implementing some proposed tax cuts, and now Australia is even considering those tax cuts.”

Gold was the biggest beneficiary of President Trump’s unpredictability, ANZ senior commodity strategist Daniel Hynes told the conference.

Gold shot up $US50 an ounce on the day President Trump was elected.

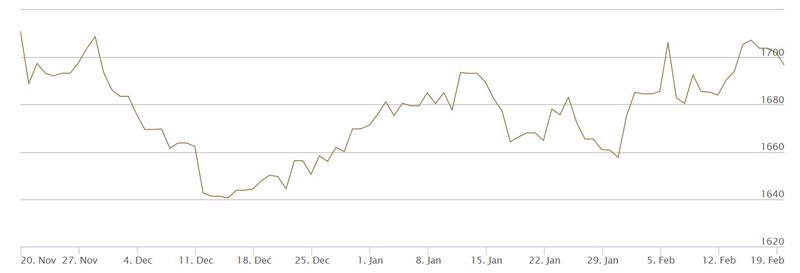

More recently it has jumped nearly 18 per cent since mid-December to around $US1339 ($1705) as a result of a weaker US dollar.

“Political risk does have a relatively good correlation with gold prices,” Mr Hynes said.

“Certainly, outside of the tax cuts that we saw in the US just initiated, the environment is still highly volatile and we expect to see that spread between the two tighten up, in particular from gold prices.”

“Essentially some of the major risk events that we’ve seen over the past 30 years or so have resulted in quite a level of support for gold through that safe-haven buying,”

Tungsten placed on US ‘critical list’

The US has also placed several commodities, including tungsten, on its critical list. There has been no production of tungsten concentrates from mining activities since before 2013.

Tungsten is used to harden steel in ballistic missiles and drill bits.

“At present the US is a significant consumer of tungsten products, and also a significant importer of tungsten concentrates along with scrap and other intermediate products,” said Mick Billing, chairman of tungsten explorer Thor Mining (ASX:THR).

Thor is now fast-tracking its Pilot Mountain project in Nevada after the US last week confirmed tungsten was still on the critical list.

However, other US initiatives could have a negative impact on commodity prices, said Mr Hynes.

Last week President Trump proposed new tariffs on steel and aluminium imports into the US.

“He’s threatened to rip up [the North American Free Trade Agreement] and then obviously he’s poking the bear around North Korea and Iran at the moment as well,” Mr Hynes said.

“So all those issues could have quite significant impacts on commodity markets.”