Diggers & Dealers: Who’s making a comeback on Day 2 of Australia’s biggest mining show?

Pic: Gareth Copley / Getty

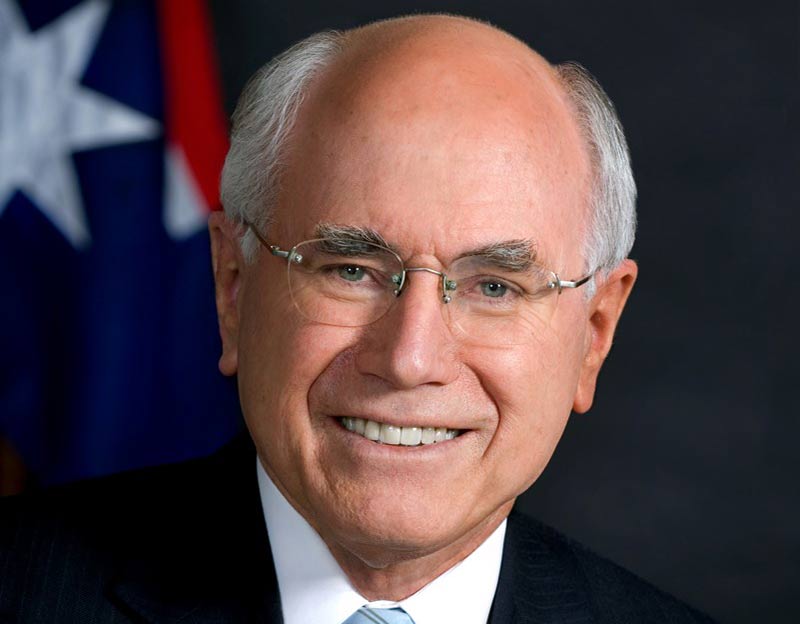

Former Prime Minister John Howard kicked off Day 1 of Diggers & Dealers with a paean to Australia’s mining sector … and born-again cricket superstar Steve Smith.

“To borrow a phrase from our Prime Minister Scott Morrison – How good is the gold price?” he says.

“But more to the point — after last night, how good is Steve Smith?”

Back-to-back centuries (144 and 142) makes Smith’s first Test since returning from a ball-tampering scandal one to remember, says Howard.

“Smith’s return in triumph at Edgbaston is one of the truly great sporting achievements.”

Steve Smith is a great bat, no doubt, but he’s going to have spend some time in the nets to work through this nasty habit of getting out in the 140s.

— Jack the Insider (@JacktheInsider) August 4, 2019

But a question about mining in space (because, of course) had Howard briefly lost for words.

“I’ll take that on notice,” he says, “You’ve absolutely floored me.”

Presentation Highlights: Tuesday

Fosterville was once a middling 100,000oz-a-year open pit operation, until Kirkland Lake Gold (ASX:KLA) uncovered incredibly rich gold grades at depth. This has transformed the marginal Fosterville into the one of the lowest-cost and most profitable gold mines in the world.

Fortescue Metals Group (ASX:FMG) has been a direct beneficiary of the burgeoning iron price. For the year ended 30 June 2019, FMG’s market cap jumped 103 per cent from AU$13.6bn to a whopping $27.76bn.

Salt Lake Potash (ASX:SO4) is one of a handful of ASX-listed companies seeking to pioneer the production of SOP, a premium grade potassium fertiliser, from Western Australian salt lakes.

It is well placed to take honours as the first to achieve commercial production, with construction well under way at Lake Way on the country’s first commercial scale on-lake evaporation ponds.

And the US’ intense focus on its domestic battery supply chain has led to early positives and promises of other benefits for junior players like emerging lithium-boron producer ioneer (ASX:INR).

ioneer is rapidly advancing its low-cost Rhyolite Ridge project in Nevada, which, at full capacity, will produce 20,000 tonnes of lithium carbonate a year.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

Exploring the Exhibition Floor:

Breaker Resources’ (ASX:BRB) 3.2km-long greenfields Bombora prospect is part of the Lake Roe project, 100km from WA’s gold hub of Kalgoorlie.

Breaker started pegging the Lake Roe project in late 2014. In 2016, the company spoke about the potential for a major discovery at the Bombora, which led to its first major re-rating.

Later that year, Diggers and Dealers delegates were told that results to date “were consistent with early stages of discovery of considerable scale”.

They weren’t wrong. High-grade results are still extending the 1.1moz Bombora deposit at depth and along strike, with recent drilling returning results of up to 94.7g/t gold.

Musgrave Minerals (ASX:MGV) is a $22m market cap explorer with a 400,000oz (and growing) gold resource, the Cue gold project in the Murchison province of Western Australia.

It also has a cornerstone investor in $770 million market cap neighbour Westgold Resources (ASX:WGX) — always an encouraging sign.

In May, Saturn Metals (ASX:STM) made a step-change discovery at its flagship Apollo Hill project; a new high-grade hanging wall lode next to the current 685,000oz resource. Drilling already indicates that this near surface, thick and high-grade discovery could potentially replicate the size of the Apollo Hill.

The Silver Mines (ASX:SVL) share price is up 188 per cent over the past 12 months on the back of its advanced Bowdens Silver Project in NSW, which will produce an estimated at 53 million ounces of silver, 116,000 tonnes of zinc and 83,000 tonnes of lead across an initial 17 years.

And well-regarded resources institutional shareholder Sprott Asset Management likes the look of this project, because they’ve just subscribed for $1m in a recent placement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.