Diggers and Dealers: Demand destruction for lithium? Not until people stop buying EVs, Pilbara Minerals says

Mining

Mining

Think demand destruction is coming for lithium?

Folks need to stop buying electric vehicles first. Just ask new Pilbara Minerals (ASX:PLS) boss Dale Henderson.

PLS has the hot hand right now, the company that more than any other has exemplified the stunning rise of the lithium sector over the past 18 months.

Average prices for its spodumene from the Pilgangoora mine ran at US$4,267/dmt in the June quarter, powering a $590 million cash build at margins that would make Rio Tinto (ASX:RIO) blush.

Spot prices are even higher. Fastmarkets estimates they are trading at US$6625/t, Platts a tick lower at US$6100/t, not unreasonable given downstream chemicals are fetching more than US$70,000/t.

Its latest Battery Materials Exchange auction announced yesterday pulled US$6350/t for a 5.5% Li2O spodumene concentrate.

Will chemical converters, automakers and battery companies get fed up with these prices, in some cases almost 10 times what they were paying in late 2020?

“That’s the big one everyone grapples with. What I find amazing about what’s unfolding is I talk about a birth of a new industry for lithium, but it’s a whole birth of an EV industry, all happening at the same time,” Henderson said.

“If we just take the EV, where does the cost base go? Ultimately, if the battery can own a higher proportion of the EV cost because you’re saving on all the other stuff, does that enable that to propagate back through to high commodity costs?

“Who knows? Demand destruction I feel will only occur when the person buying the EV says ‘no, that car’s got too expensive, I’m gonna go buy my combustion engine car’.

“I think that’s what creates demand destruction. Now, we haven’t seen that yet because we’re still seeing sold out EVs and all the rest of it. But when we start getting indicators that people are going ‘bugger the EV I’ll take the dirty diesel’ well, I think that would definitely equal demand destruction.”

EVs remain in many senses a luxury item, but Henderson feels there’s a long way to go before patience runs out with high prices in that portion of the market.

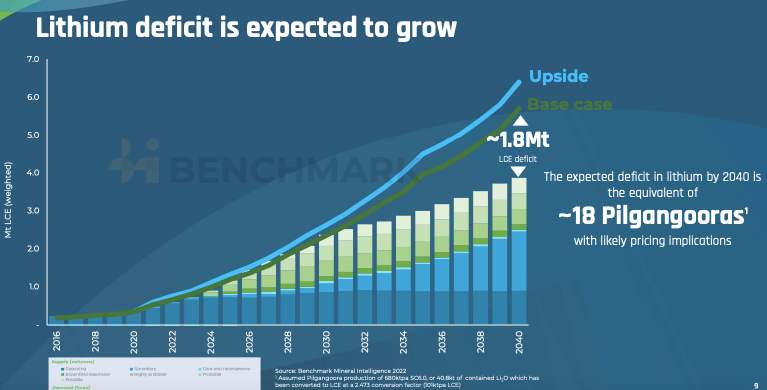

Given the number of pledges around the end of ICE production, he says it would take 18 Pilgangooras – after a $290 million expansion from 580,000tpa to 680,000tpa – to fill a demand deficit of 1.8Mt lithium carbonate equivalent by 2040.

Jesus Christopher.

After two days dominated by gold miners, critical minerals took centre stage in the final day of Diggers and Dealers, with fellow boom stocksLynas Rare Earths (ASX:LYC), Chalice Mining (ASX:CHN), Liontown Resources (ASX:LTR) , Boss Energy (ASX:BOE) and BHP’s Nickel West division all on the bill.

Chalice’s Alex Dorsch warned equipment manufacturers, battery makers and EV producers would need to throw money at junior explorers to support the most difficult part of the critical minerals supply chains – the discovery of new resources that are getting harder to find.

It’s Julimar discovery is the largest nickel sulphide deposit found globally in 20 years.

“There’s just quite frankly not enough existing resource base, especially in the Western world, such that the industry can move quickly to scale up production, it just doesn’t work like that,” he said.

“Hopefully, we’re a case study of why they should come and invest in the earlier parts of the value chain.”

Copper miners were represented by London listed SolGold, which has BHP and Newcrest vying for supremacy on its register, both hoping to snag a role in the delivery of its massive Cascabel project in Ecuador.

New boss Darryl Cuzzubbo faced a baptism of fire in a presser with journos after rumours of a failed capital raising hit its share price last week following a string of administrative challenges for the company.

He remains bullish about Cascabel however, a 50-100 year mining province he says could shine brighter if metal prices rise beyond the “conservative” US$3.60/lb long term copper price assumption used in a recent PFS.

“I think in time that will be seen as very conservative. If you look at where a lot of the growth comes from, if I just use electric vehicles as an example, the copper in electric vehicles constitutes about 3% of their cost,” he said.

“So even if it doubled or tripled, it is probably not going to change the demand.

“So the variable that is most likely to change, I think, is the copper price.

“And that will induce projects that aren’t economic today to become economic. But then you’ve got the lead time right to develop, build, and commission these sorts of mines.”

Becoming a billionaire briefly last year may have been more exciting for mining veteran Tim Goyder, but winning the GJ Stokes award for his contribution to the mining company at last night’s Diggers and Dealers Awards must have been a thrill.

Goyder enjoyed his annus mirabilis in 2021, as share price explosions at his companies Chalice and Liontown sent his personal value skyrocketing.

Liontown, which announced an FID last month on its $545 million Kathleen Valley lithium mine, has grown from a penny dreadful into a $3 billion ASX 200 company.

The aforementioned Lynas Rare Earths was named Digger of the Year after racking up an impressive $950 million in sales as the sole scale producer of the critical commodities outside China.

Capricorn Metals (ASX:CMM) was named Dealer of the Year for the $39.6 million acquisition of its Mt Gibson gold project, which has helped add 124% or $888 million to its market cap over the past year.

Although we could easily credit the enterprising plainter whose managed to wrestle the project off the hands of its previous owner with WA’s sometimes hilarious Use It or Lose It mining rules and made a motza trading it onto the Karlwinda gold mine operator.

The coveted media award went to Jarrod Lucas, the first resident of Kalgoorlie-Boulder to win the prize while still living in the town.

Lucas cut his teeth like yours truly at the Kalgoorlie Miner and still keeps the market up to date with the best and worst of Goldfields mining with the local branch of the ABC.