Diggers and Dealers Day 2: Copper rises to the occasion in gold city

Pic: Tyler Stableford / Stone via Getty Images

After years as a sideline act copper has emerged as one of the most celebrated commodities of this year’s Diggers and Dealers Mining Forum in Kalgoorlie, stealing the thunder from the gold, nickel and iron ore crowds.

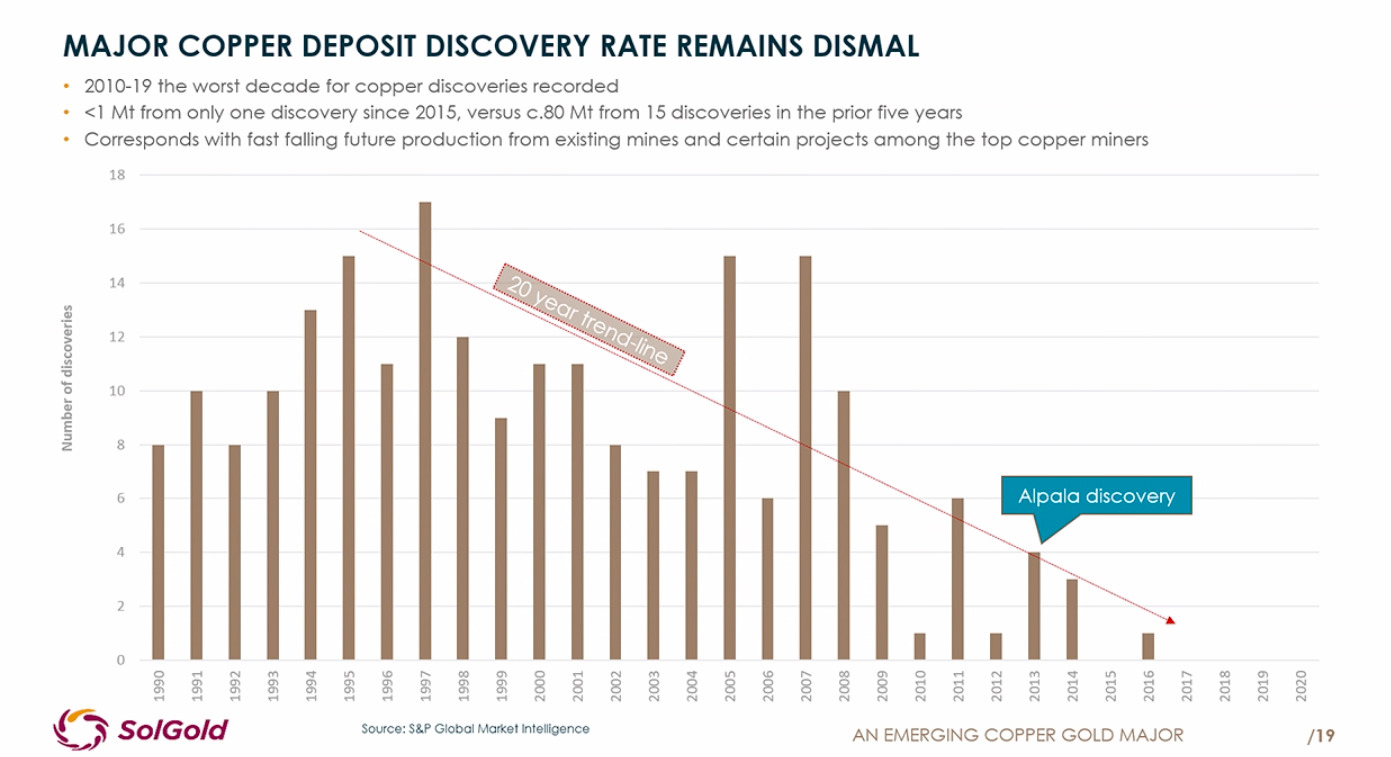

This graph from Solgold chairman Liam Twigger shows why decent copper assets are in demand, with only a handful of discoveries in the past few years.

Quoting Wood Mackenzie, Twigger said new copper developments will be able to take advantage of a looming shortfall in the market.

In particular EV take-up is expected to increase demand for the red metal to unprecedented levels because EVs contain ~5x as much copper as traditional LVs.

“The current demand is around 21 Million tonnes of copper and with the move towards the electrification of the world, the removal of fossil fuels and the focus on electric vehicles there’s going to be a 6.5Mtpa shortfall in copper by 2030,” Tewigger told delegates on Tuesday.

“We need to replace 30% of copper production, or increase it by 30%, and at the same time mines are dropping off.

“There’s been one discovery in the last five years.”

Solgold owns the Alpala project in Ecuador, which has drawn investment from majors like BHP, Newcrest and Franco-Nevada and contains 9.9Mt of copper, 21.7Moz of gold and 92.2Moz of silver.

While many of the big names took to the stage yesterday, there was plenty of interest at the junior end of the sector with Peel Mining (ASX:PEX), Azure Minerals (ASX:AZS), Ora Banda Mining (ASX:OBM), Bardoc Gold (ASX:BDC) and Bellevue Gold (ASX:BGL) nestled among names like Western Areas (ASX:WSA), Sandfire Resources (ASX:SFR) and Northern Star (ASX:NST).

Copper and gold miner Aeris Resources (ASX:AIS) was the big winner on the bourse among the presenters. It spiked 3c or 14.3% up to a five-year high of 24c after a string of resource and reserve updates including life extension plans at its Tritton and Cracow mines.

A good wicket for Aeris chief Andre Labuschagne, who will no longer just be known as “Marnus’ dad”.

Are the big miners circling our exploration success stories?

Few exploration stories are quite as spectacular as Chalice Mining (ASX:CHN), the one time project generator which is now a star player in its own right with the Julimar nickel-copper-PGE development.

Located just 70km north of Perth in and around the Julimar State Forest, it has spurred a wave of nearology despite being yet to host a resource.

It is for that reason Chalice and its young managing director Alex Dorsch are unlikely to sell out to suitors which have no doubt circled since the initial ‘Gonneville’ discovery was made in March last year, sending Chalice shares soaring 4000% to a market cap of $2.65 billion.

“Suffice to say there’s a huge amount of interest in our discovery,” Dorsch said in response to questions after his presentation.

“The inbounds we’ve had so far are obviously very much appreciated, we’re getting inbounds from all over the planet, not just from the usual suspects in Perth.

“We’re getting a lot of corporate interest and for the time being obviously it’s pleasing to see but we have a job to do really to work out what we’re sitting on in terms of the scale of Julimar and the system itself.

“We intend to keep our head down and keep drilling holes, keep demonstrating the world class nature of our discovery and certainly don’t want to get distracted with any corporate engagements or anything like that.”

Chalice’s incredible rise in value may well have priced it out of a takeover until some hard JORC-compliant numbers come out. Jake Klein’s claim earlier in the day that “green metals” proponents may be overvalued comes to mind.

De Grey ‘just getting started’ at Hemi

De Grey Mining (ASX:DEG) is another high profile explorer with its Hemi discovery in the Pilbara.

Unlike Chalice it does already have a major resource there of 6.8Moz at the new intrusive style Pilbara gold deposit, part of the broader 9Moz Mallina project.

Managing director Glenn Jardine says there is more to come, with scoping studies and even more drilling to expand Hemi and satellite resources on the way.

“It’s really still early days,” he told delegates at Diggers.

“It’s a big maiden resource but the guys have really only been at this for about 15 months and we’re learning things new every day about the geochemical and geophysical signatures of these intrusive-style deposits. We’re applying that around Hemi and on the regional tenements.

“We will continue to grow this resource at a reasonable rate … this resource was growing at the rate of 450,000oz a month at a cost of $8.50 an ounce, which is absolutely astonishing.

“That’s the rate that we’re seeing, we can’t guarantee that will continue in the future but obviously that is one of our targets.”

De Grey has a market cap of $1.7 billion on the back of the Hemi find, the first new major open pit gold discovery in WA since the Gruyere deposit was found by Gold Road Resources (ASX:GOR) in 2013.

At Stockhead, we tell it like it is. While Peel Mining, Azure Minerals, Ora Banda Mining and De Grey Mining are a Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.