Development progress proves key to unlocking value for mineral sands companies

Progressing projects is the key to unlocking value for mineral sands companies. Pic: Getty Images

- Mineral sands companies create shareholder value through development progress despite weak titanium prices

- Market rewards operational milestones and major discoveries rather than relying on commodity price surges

- Companies such as Petratherm and Titanium Sands are following the path forged by Iluka and Sovereign Metals

Mineral sands are typically old beach, river or dune sands that contain concentrations of heavy minerals such as rutile, ilmenite, zircon and monazite.

Rutile is the purest titanium feedstock while ilmenite is also an important titanium mineral, making mineral sands a major source of the metal.

Titanium is a lustrous, silver-grey metal with higher strength compared with steel despite being 40% lighter.

Its lightweight strength, excellent corrosion resistance and high melting point make it critical for future-facing sectors such as aircraft frames and engine components.

The metal is also non-toxic, making it ideal for hip and knee replacements, dental implants and various surgical instruments.

Meanwhile, its major compound titanium dioxide is valued its used as a white pigment, UV blocking properties and photocatalytic potential.

Despite being classed as a critical mineral across the US, EU, UK, Canada, Australia and Japan, titanium prices softened in July before recovering into August.

The Shanghai Metals Market noted the previous downward trend in the titanium dioxide market has largely halted and that supply is expected to remain tight in September due to continued demand support while the traditional peak season is expected to deliver a slight recovery for titanium sponge.

Meanwhile, zircon is used in the ceramics industry to make tiles while its high melting point and corrosion resistance makes it useful for foundry moulds, refractory bricks and molten metal moulds.

Cygnet Capital founding director Jonathan Rosham told Stockhead that minerals sands haven’t performed in line with the other commodities as it is leveraged to the economy.

However, he believes that while zircon is under pressure, he could see titanium becoming quite strong going forward.

Market recognising progress

While mineral sands companies can’t count on rapidly rising commodity prices – like gold and silver – for quick gains, their achievements are still being recognised by the market.

This is best highlighted by Sovereign Metals (ASX:SVM) – arguably one of the most advanced juniors in the space.

While shares in the company have come off the highs just shy of $1 per share seen in March 2025, they are still up some 70% to 70c from the 41c that they were trading at two years ago.

The gains reflect the company’s progress in advancing its flagship Kasiya rutile-graphite project towards development.

Kasiya has a massive resource of 1.8Bt grading 1% rutile and 1.4% total graphitic carbon that is globally significant as evidenced by mining giant Rio Tinto (ASX:RIO) holding a 19.9% stake in Sovereign, up from the 15% it had initially acquired in July 2023.

Sovereign is currently progressing process plant design optimisation, infrastructure and logistics planning, and environmental and social impact assessments for its definitive feasibility study.

The gains the company has made in the past two years do highlight that while the titanium market itself remains depressed, punters still recognise value from major discoveries and significant developments.

Another notable example is the grand old dame of Australian mineral sands companies Iluka Resources (ASX:ILU), though its tale takes us back all the way to 2004.

Back then, shares in the company quickly doubled following the discovery of the large, globally significant Jacinth Ambrosia mineral sands project in South Australia’s Eucla Basin.

While shares in the company then plummeted in the wake of the 2008 Global Financial Crisis, they exploded past $9 per share in 2011 following the first full year of production from the zircon-rich mine, which started operations in 2009.

Though best known for its zircon content, Jacinth Ambrosia also produced significant amounts of titanium dioxide from minerals such as rutile and ilmenite.

ASX mineral sands plays

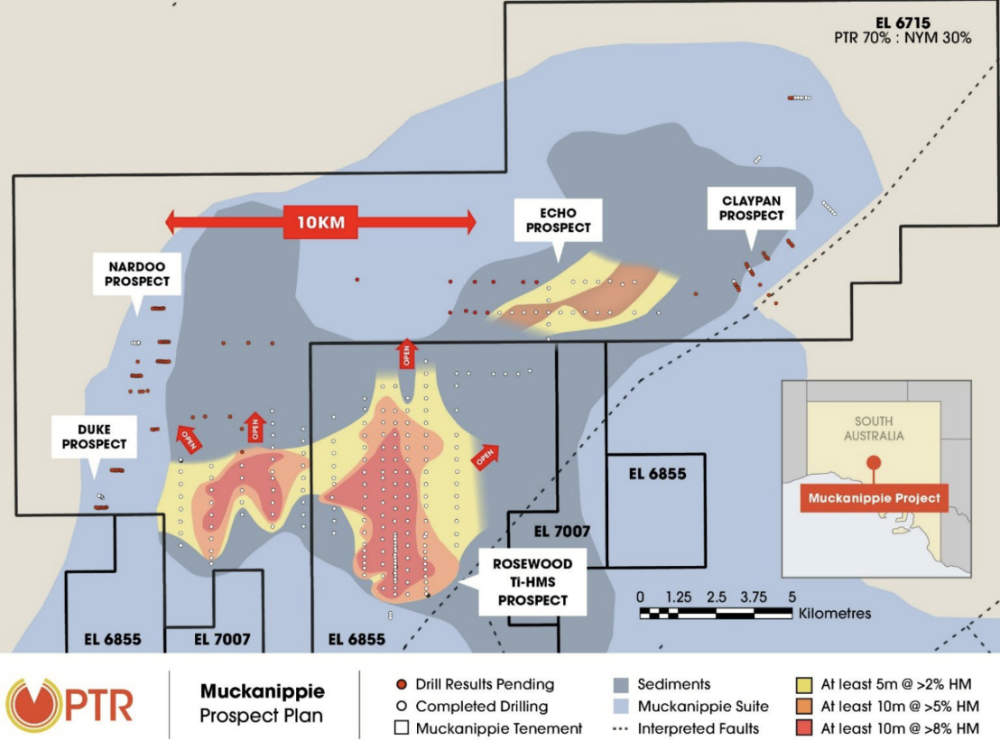

While the examples of both Sovereign Metals and Iluka are encouraging for mineral sands juniors, the latter is especially relevant to Petratherm (ASX:PTR) as its Muckanippie project is close to Jacinth Ambrosia.

There are distinct differences, chief of which is predominance of titanium over rutile at Muckanippie.

No resource has been defined at the project to date but drilling has returned promising results of up to 55.7% heavy minerals.

Mineralogy results from the Rosewood East prospect have indicated HM sands with >95% valuable heavy mineral content, with an assemblage dominated by high-grade titanium minerals in excess of 70% titanium dioxide without the zircon and monazite seen in other projects.

Petratherm has increased its equity position in EL 6715, which hosts the Duke, Nardoo and Claypan prospects to 70% with partner Narryer Metals (ASX:NYM) advising it will form a joint venture.

Rosewood is contained primarily in the wholly-owned EL 6855 though the prospect also extends westwards into EL 6715.

Cygnet Capital, which is a significant shareholder in the company, is confident of the project’s prospects due to its significant grades of titanium oxide.

Rosham added that in addition to its significant grades of titanium oxide, Muckanippie mineralisation appeared to be coarse-grained and amenable to gravity processing.

“The interesting thing about this is it looks like it’s not in a clay. So, the metallurgy on it is fairly easy to separate the mineral sands (from the surrounding material),” he noted.

“It should be fairly easy to mine and it’s really close to surface as well.”

He also pointed out that leucoxene – the dominant titanium mineral at the project – is fairly high in the basket in terms of price as well.

Additionally, Rosham highlighted the most recent drill results, saying it demonstrated a very significant system is present.

The Phase 3 drilling program extended the heavy mineral zone at Rosewood by 2.6km to the north, taking it up to 6.5km north to south and up to 3.4km east to west.

“They’ve found a new area called the Echo Prospect, which is 4km northeast of Rosewood, with high grade results there,” he added.

“It’s a very exciting project and strategic things to look forward to are more drill results coming out in late October, a JORC resource of Rosewood and advancing this newly discovered Echo type target.”

Other mineral sands players include Titanium Sands (ASX:TSL), which operates the Mannar Island heavy mineral sands project in Sri Lanka, which has a resource of 318Mt at 4.17% total heavy minerals (THM) containing ilmenite.

Under a scoping study completed in 2023, a stage 1 development at Mannar will be capable of delivering NPV of $545m and IRR of 52% for a low capex of $122m and payback period of just under two years.

The 4Mtpa operation will produce globally competitive ilmenite over a mine life of 20 years.

The company has already received the terms of reference to progress environmental studies, retention licences for the high-grade zone, finalisation of corporate funding solutions with its largest shareholders and progress of environmental studies.

Over in Cameroon, DY6 Metals (ASX:DY6) has continued to advance its Central rutile project with its most recent activity being the expansion of soil sampling over the newly acquired Yaoundé West licences.

The sampling is aimed at targeting areas of higher rutile grades ahead of a maiden drilling program.

Yaoundé West’s inclusion takes the size of the Central rutile project up from 5901km2 to 8789km2, and it’s notable as it was a major rutile-producing area between 1935 and 1955.

Exploration carried out by the company in an adjacent licence has already demonstrated coarse rutile of up to 97.5% TiO2.

Central Rutile borders Lion Rock Minerals’ Minta rutile project, where initial sampling revealed widespread, high-value mineral assemblages with valuable heavy minerals of up to 93% of total heavy minerals and with the dominant ones being rutile (up to 69.8%), monazite (up to 35.6%) and zircon.

Recent studies have highlighted the similarities of the region to the Lilongwe Plain of Central Malawi, where Sovereign Metals is advancing towards developing the Kasiya project – the world’s largest primary rutile deposit at 1.8Bt at 1% rutile.

Meanwhile, Astron Corporation (ASX:ATR) is progressing its Donald rare earths and mineral sands project in Victoria, which recently secured state government approval for its work plan.

Under the Phase 1 development, which covers 17% of its total resource of 1.8Bt at 4.6% heavy minerals, Donald is expected to generate pre-tax net present value and internal rate of return of $837m and 22.1% respectively.

Capex is expected to be $439m with 94% of that based on tendered or market prices.

Donald is the subject of a joint venture agreement with US critical minerals producer Energy Fuels.

The company also owns the Jackson rare earths and mineral sands project that adjoins Donald to the southwest and has a resource of 823Mt at 4.8% HM.

Rounding up the list of companies featured here is IperionX (ASX:IPX).

The company is best known for its technologies that produce titanium alloys from minerals or scrap at lower cost, energy use and emissions than traditional methods, but it also owns the Titan project in Tennessee.

Titan is one of the largest titanium, zirconium and rare earth minerals deposits in the US with a resource of 431Mt at 2.2% heavy minerals in unconsolidated, near-surface material that allows for simple, low-impact, low-cost and sustainable mineral extraction.

Work is currently underway on a US government-funded definitive feasibility study to build on a scoping study that estimates after-tax NPV and IRR of US$692m and 40% respectively.

Capex is estimated at US$237m with payback expected in 1.9 years.

At Stockhead, we tell it like it is. While Petratherm, Titanium Sands and DY6 Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.