Delving into Alaska’s prolific Fairbanks mining district, Felix Gold looks ripe for the picking

Mining

Mining

Special Report: Felix Gold is positioning itself as a low-capex miner in Alaska’s Tier 1 Fairbanks gold mining district as gold prices shoot through all-time highs.

ANZ recently stated it expects gold to trade near US$2,500/oz by the end of 2024 and Goldman Sachs has a US$2,700/oz price target by year-end, up from US$2,300/oz in its previous analysis. Both are bullish on a gold run past then too.

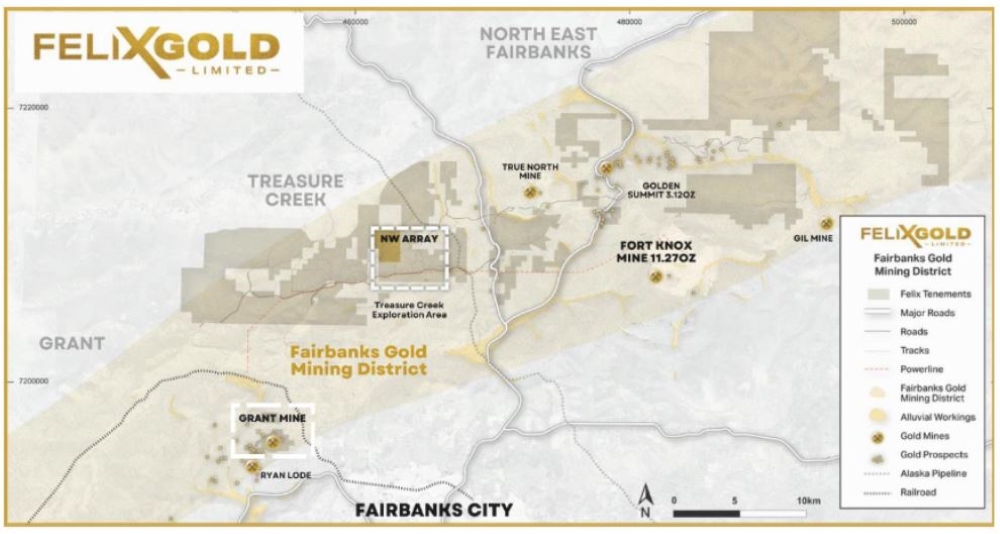

This could be music to the ears of investors and near-term developers such as Felix Gold (ASX:FXG) alike – a resources player which has snapped up the 364,000oz (including 126,000oz @ 6.2g/t gold underground) Grant mine and the highly prospective Treasure Creek project.

It hasn’t been rosy for gold explorers in the recent past, yet the all-time highs of bullion seem to be turning heads towards the juniors market.

FXG Executive Director Joseph Webb says the ability to find something economic and to be able to commercialise it too is important for juniors looking at developing projects.

“These two factors open up capital cost pathways that investors are more likely to be attracted to in a current investment climate where they look at de-risking options to decide where to put their money,” Webb says.

“We’re in a gold mining town where there’s established projects, milling operations and associated infrastructure, and that presents a very clear route to commercialisation.”

The total tenement package is huge at a whopping 392km² and contains dozens of gold prospects. FXG can target these prospects with the backing of MDF Global, a team of geologists and mine builders with >200 years of combined experience which identifies Tier 1 mineral assets in world-class mining jurisdictions.

Wedged between Alaska’s biggest ever gold miner Kinross Gold’s 11.8Moz Fort Knox mine (19km away) and Freegold Ventures’ 19.7Moz Golden Summit (18km away), FXG’s Treasure Creek project contains several – potentially major – gold systems.

A key part of MDF’s thesis for Felix has been its proximity to the Fort Knox Mill which is running out of feed. Fort Knox’ owner, mining giant Kinross, has been actively involved in local M&A activities to keep the mine going, providing some indication as to what boxes Felix needs to tick to be relevant.

Until recently, Fort Knox was mining the Gil-Sourdough deposit which conveniently shares most key characteristics of what Felix are looking to achieve with NW Array.

Now Kinross has moved to hauling ore 400km from the Manh Choh deposit which has several similarities to Felix’s Grant Mine – except that Grant Mine is just 25km from Fort Knox.

Right now, FXG is focused on its NW Array prospect at Treasure Creek where it’s eking out a maiden resource based off of an identified open-at-surface 2km x 600m oxide gold system.

Significant thick, shallow and high-grade drilling results from 2023 included:

Adding to that, a metallurgical bottle roll leach test recently yielded some huge recoveries from oxidised samples of previous drilling at NW Array, showing up to 90% within 50m of the surface.

“We envision the pending maiden resource at the NW Array prospect to set the platform to build towards the profile of the Gill-Sourdough mine, which boasted a Ni-43-101 measured and indicated resource of 533Koz @ 0.55 g/t Au, that has been a vital ore source for the Fort Knox gold mine for the past two years,” Webb says.

“We have multiple walk-up drill targets with evidence of large-scale gold potential. We also possess an existing MRE at Grant-Ester with significant upside opportunity.

“There’s a lot of resource growth to go at our projects.”

This article was developed in collaboration with Felix Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.