Delecta picks up stake in Colorado uranium-vanadium project

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Delecta is having a tilt at becoming a resources play with the company joining the race to become the next uranium producer.

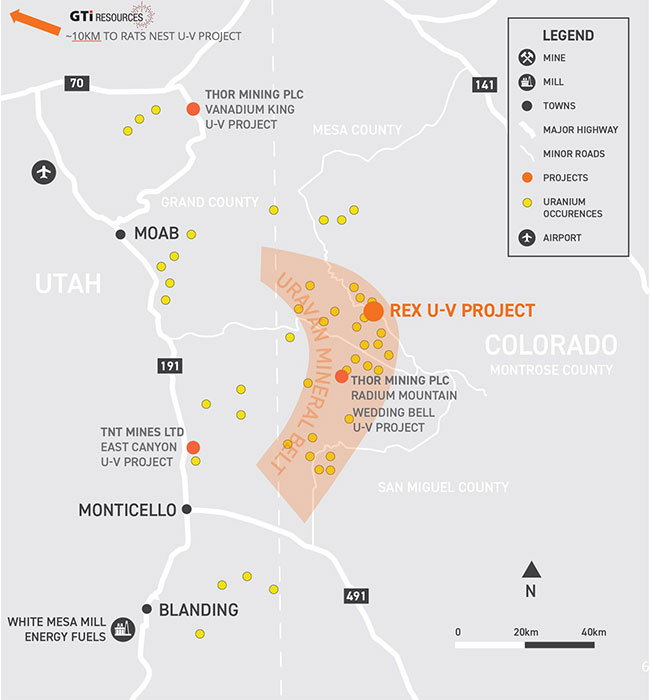

The company has acquired a 60 per cent interest in Colorado-based Sunrise Minerals, which holds the REX uranium-vanadium project that sits in the famed Uravan Mineral Belt – historically a major source of uranium and vanadium in the US.

Delecta (ASX:DLC) says that despite hosting four historic uranium mines, the 2072-hectare project has not being subject to modern exploration.

Uranium-vanadium mineralisation at the REX project is hosted primarily in reduced permeable, sandstones of the Salt Wash Member where they occur as individual deposits or groups of deposits.

The mines within the project were subject to varying levels of exploration, though only limited data regarding drill hole position and grades is available.

Additionally, samples were rarely taken, and the vanadium mineralisation was not documented due to the previous focus on uranium.

The project is also within trucking distance of Energy Fuels’ White Mesa mill, the only fully licensed and operational conventional uranium mill in the US that also happens to have plenty of spare capacity for toll treating uranium and vanadium ore.

READ: The US wants to revitalise its domestic uranium industry. What does this mean for explorers?

“I’m excited about the potential of the project given the regions’ history of uranium mining and the fact that it hasn’t been subject to any modern exploration,” managing director Malcolm Day said.

“Its proximity to operating infrastructure and the prevailing supportive US government regime will assist in the development of the project.

“The predicted uranium shortfall coupled with a positive price trajectory provides for a positive outlook for the US uranium sector.”

Uranium prices have climbed sharply this year, rising more than 35 per cent since January to $US34 a pound in May due to demand outstripping supply.

Delecta has started exploration on the REX project, including mapping and sampling along the sandstone mesa rims using a handheld XRF gun and scintillometer.

XRF provides a preliminary on-the-spot analysis of material while scintillometers are used by geologists to assess uranium mineralisation, with gamma readings of more than 5,000 counts per second considered to be highly anomalous.

It will also geo-reference the existing underground mine plans and carry out mapping and sampling where possible to establish the presence of mineralisation and guide surface drilling.

Initial results from rock chip sampling are expected in early July 2020 and are expected to help with the possible expansion of the planned exploration program.

Capital Raising

Delecta conducted a placement of shares priced at 0.4c each to raise about $1.25m.

Subject to shareholder approval, subscribers will also receive one attaching option for every two shares subscribed that are exercisable at 0.8c each.

Day and non-executive director Hans-Rudolf Moser both plan to participate in the placement by subscribing for $50,000 worth of shares each.

The placement will be completed in two tranches, with the first tranche raising $400,000 while the second tranche will require shareholder approval to place 212.5 million shares to raise the remaining $850,000.

Proceeds will be used to fund the $150,000 cost of acquiring the 60 per cent stake in Sunrise.

This story was developed in collaboration with Delecta, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.