Declining North Sea production could fire up partner interest for Talon

Pic: John W Banagan / Stone via Getty Images

Special Report: The North Sea is again garnering attention from explorers as oil prices stabilise. But the majors continue to make production cuts that will seriously impact long-term supply from the region, opening up opportunities for juniors to continue the oil and gas ‘circle of life’.

The North Sea is a marginal sea of the Atlantic Ocean located between the UK, Denmark, Norway, Sweden, Germany, the Netherlands, Belgium and France.

But the region is highly prospective for oil and gas, especially the UK Continental Shelf (UKCS). According to the most recent UK Oil and Gas: Reserves and Resources report, the UKCS’ petroleum reserves “remain at a significant level”.

The 2P reserves at the end of 2019 were 5.2 billion barrels of oil (boe) equivalent, which could sustain production for another 20 years or more.

‘Reserves’ refer to oil or gas discoveries that are commercially recoverable using existing technology while a resource is an initial, untested estimate.

A 2P reserve means it’s proven and probable.

Meanwhile, the report published by the Oil and Gas Authority (OGA) said the 2C contingent resources were also significant with an estimate of discovered, undeveloped resources of 7.4 billion boe.

A 2C resource is a best estimate of how much oil or gas is in a deposit.

Production heading south

While there is no shortage of oil and gas resources and reserves, production is declining.

It has dropped steadily since its peak at 4.3 million boe per day in 1999, never exceeding 2 million boe per day after 2010, according to Norwegian energy intelligence firm Rystad Energy.

Rystad’s current forecast is that production will now reach a maximum of 1.7 million boe per day in 2035 before “dwindling to nearly nothing by the middle of the century”.

UKCS production stood at 1.65 million boe per day in 2019 and is set to fall to 1.59 million boe per day in 2020, Rystad says.

These types of production forecasts have fed into the OGA’s MER UK Strategy embarked on in 2016. MER stands for “maximum economic recovery” and the strategy has been set to “secure that the maximum value of economically available petroleum is recovered from UK waters”.

To ensure the success of MER UK, the OGA has implemented a regulatory environment which supports the ongoing viability of the industry in the UK North Sea covering the full industry cycle – licensing, exploration, development, production and, eventually, decommissioning.

It is this decommissioning part of the cycle that potentially looms large for the industry in the region, and infrastructure owners will be looking for additional reserves to ensure that their facilities keep working for as long as possible to both maximise returns but to delay expensive decommissioning work.

We touched on discovered reserves and resources earlier in the article, but it is worth considering that there remains the potential for up to 20 billion new barrels of oil to be discovered through exploration. Major discoveries are still being made with Glengorm (250mmboe) in 2019, Glendronach (167mmboe) and Achmelvic (97mmboe) each in 2018.

The conversion of this considerable prospective resource to contingent resources and in turn reserves to feed into and prolong the operation of existing infrastructure can only be achieved through exploration. It is the circle of life in the oil and gas industry if you like.

Opening doors for the juniors

As is the way in many prolific but mature oil and gas regions, there comes a point where the heavyweight companies look to move on with materiality becoming an issue for businesses of that size. This ‘changing of the guard’ presents an opportunity for those already developing projects or those looking to break into the region. Again, the ‘circle of life’ for the industry.

Interest in the North Sea has increased substantially with the last UK licensing round culminating in the award of 113 licences to 65 different companies. While many of the majors picked up new licences – BP, ENI, Equinor and Shell to name a few – many of the new licences were awarded to new entrants to the region, smaller to mid-size players as well as private equity (PE) backed companies.

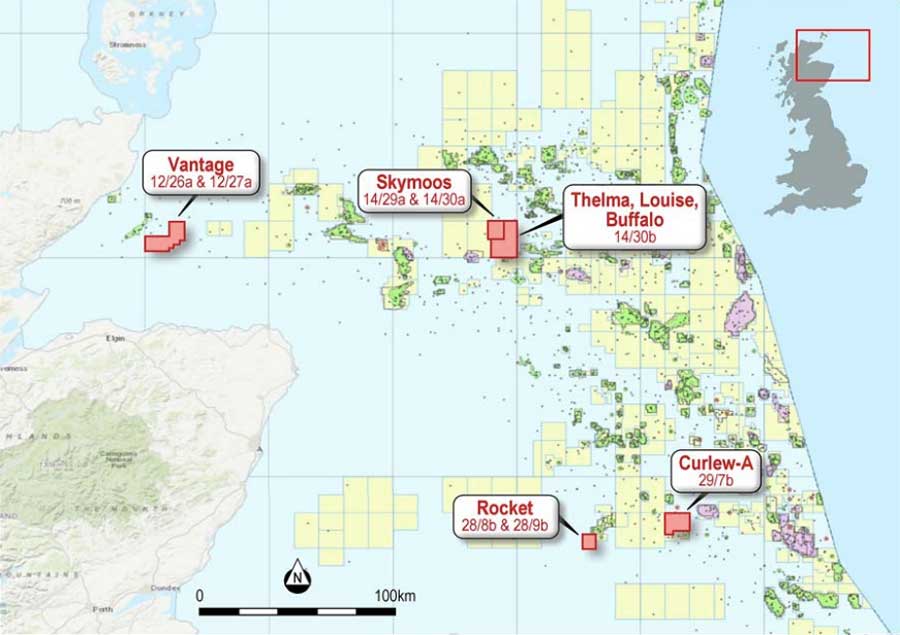

Talon Petroleum (ASX:TPD) made its foray into the North Sea in late October 2018 with its farm-in to a 10 per cent stake in Corallian Energy’s Curlew-A discovery, making Talon the only ASX-listed North Sea-focused company at the time.

Curlew-A has a 2C contingent resource of 3.9 million barrels of oil equivalent net to Talon.

The company then acquired EnCounter Oil, which also had projects in the North Sea. It followed that up with the win of the Vantage prospect in the UK’s 2019 offshore licensing round and it was offered three new licence areas in the most recent licensing round.

All up Talon has seven prospects that collectively host around 228 million barrels of oil/oil-equivalent and 160 billion cubic feet of gas. The portfolio has been curated not only for its prospectivity but also its proximity to existing infrastructure in need of new production.

The company has been on the hunt for potential partners and as oil prices have stabilised, interest has again turned back to the North Sea assets.

Talon’s team comprises highly experienced UK North Sea finders Graham Dorè (EnCore Oil), Paul Young (EnCore Oil) and Steven Jenkins (Nautical Petroleum).

They have been responsible for yielding some of the most significant UKCS oil and gas discoveries in the past two decades, ultimately selling to larger companies at the top of the cycle.

EnCore Oil was snapped up by Premier Oil in 2011 for £221m ($409.1m) and Nautical Petroleum was acquired by Cairn Energy for £414m ($760m).

The team’s track record, the quality and location of the portfolio, as well as timing, position Talon well for future success, the company says.

This article was developed in collaboration with Talon Petroleum, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.