CZR Resources moves to join growing ranks of ASX iron ore producers

Iron ore juniors are playing their part in expanding supply to the market. Image: Getty

- Robe Mesa project could generate $96.4m for a capital cost of $51.1m

- ‘The strategy is aimed at unlocking the maximum value of the project at the earliest opportunity’

- GWR Group and Fenix Resources have recently brought iron ore mines into production

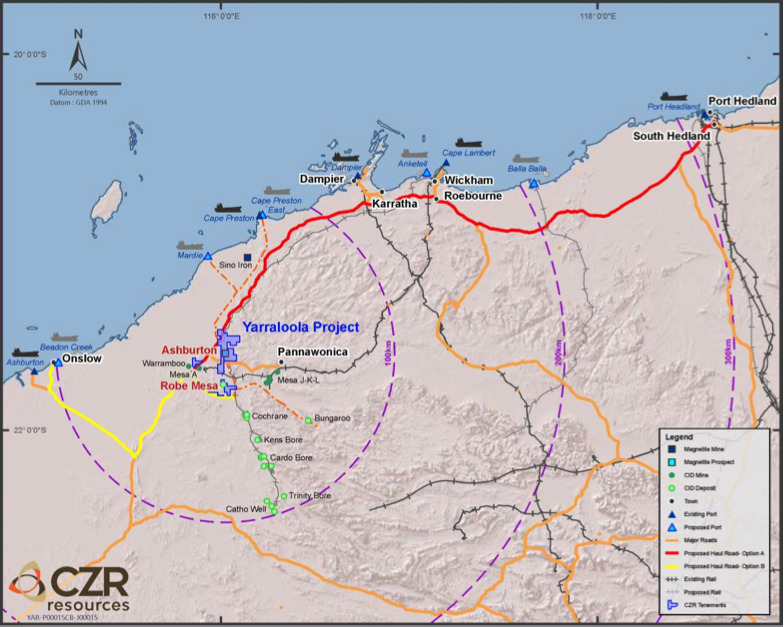

Iron ore exploration company CZR Resources (ASX:CZR) is aiming to follow a raft of new producers into the booming sector with its Robe Mesa project in WA’s West Pilbara region.

A definitive feasibility study is being readied for the project that will pave the way for mining approvals after a pre-feasibility study last year showed it would generate strong returns.

“The [company’s] strategy is aimed at unlocking the maximum value of the project at the earliest opportunity by pursuing a range of desk-top, field studies and other activities at the same time,” managing director, Rob Ramsay, said.

The pre-feasibility study showed Robe Mesa could generate a life-of-mine cashflow of $96.4m based on a 62 per cent iron ore price of $US90 per dmt ($116.30/dmt), for a capital cost of $51.1m.

Average cash operating costs for the project are $64.78 per dry metric tonne, and CZR Resources has a production target for Robe Mesa of 2 million tonnes per year for direct shipping ore which requires minimal processing.

Iron ore spot prices were trading at $US164.75 per tonne ($213.15/tonne), Thursday and steady on-day, according to Metal Bulletin.

May-settlement iron ore futures contracts on China’s Dalian Exchange were 4 per cent lower at ¥1,098 per tonne ($US168.90/tonne), according to exchange data.

CZR Resources looks at shorter export corridor

CZR Resources has started work on selecting the optimum area within its Robe Mesa deposit for conversion into a mining lease from an exploration licence.

Robe Mesa deposit covers a geological area that abuts Rio Tinto’s Warramboo, Mesa A and Mesa J-K mines which export around 34 million tonnes per year of iron ore.

The deposit hosts a resource of 89 million tonnes at 53.7 per cent iron, and a near-surface higher grade resource of 24.7 million tonnes at 56 per cent iron.

The company is preparing to finalise the definitive feasibility study budget and is examining the scope of the project for further cost reductions.

Direct shipping ore from Robe Mesa was intended to be shipped through Port Hedland, a distance of 300km, however the company is now looking at closer port options.

The port options under consideration lie between Onslow (Ashburton) and Dampier, a distance of around 100km.

Using Onslow’s port facilities would reduce the haulage distance for Robe Mesa iron ore by 260km, compared to a pre-feasibility study case of using Port Hedland’s Utah facility.

“CZR has an outstanding opportunity to develop an iron ore project in the world’s most desirable iron ore region with low costs and simple production methods,” said Ramsay.

Fenix Resources achieves production increase

Fenix Resources (ASX:FEX) recently joined the ranks of Australia’s iron ore producers and has ramped up its production to deliver two shipments per month to Geraldton port.

Road haulage rates for the company’s Iron Ridge mine in WA have reached nameplate levels of 1.25 million tonnes per year, a feat achieved one month ahead of schedule.

“We have built a sustainable iron ore export business in a short space of time and have done so with due respect for the heritage value of the area around Iron Ridge, the environment and the health and well-being of our people,” managing director, Rob Brierley, said.

The company’s production rate is now enough to schedule two bulk shipments of 60,000 wet metric tonnes per month for the foreseeable future, said Fenix Resources this week.

Fenix Resources has sold 100,000 wmt of iron ore lump and fines products to date, and two further ships are booked for loading in the second half of March.

Iron Ridge is a premium direct shipping ore mine located 490km from Geraldton port in WA that started production in December and dispatched its first export cargo in February.

High-grade shipments of iron ore attract a premium from Chinese buyers who are increasingly demanding purer steelmaking raw materials to lower pollution emissions.

GWR Group follows up maiden cargo shipment

Another recent iron ore exporter is GWR Group (ASX:GWR) which said this week it has completed its first cargo delivery to its off-take customer, a Hong Kong trader.

Pacific Minerals received a 52,425-tonne shipment of high-grade lump product from GWR Group in February, and a second shipment is scheduled to depart in late March.

GWR Group has increased production at its C4 deposit at Wiluna in WA’s Pilbara region and its crushing unit is running at 90 per cent of nameplate capacity.

The company is taking steps to bring a second stage of its C4 deposit for 20 million tonnes of iron ore into production.

GWR Group ships its iron ore through the port of Geraldton where it has a stockpiling facility capable of holding 100,000 tonnes of product.

Magnetite Mines examines transport options for Razorback mine

South Australia-focused iron ore explorer Magnetite Mines (ASX:MGT) is busy expediting its Razorback high-grade project for which it has appointed technical experts.

Electricity provider, ElectraNet, has been commissioned to study power supply for the mine site, assisted by global engineering company GHD Group.

Transport and logistics firm Bis Industries is to carry out a study into transport options for the Razorback project including a train load-out operation.

A rail siding at Razorback could connect the proposed mine site to Australian Rail Track Corporation’s Broken Hill to Adelaide railway.

ASX share prices for CZR Resources (ASX:CZR), Fenix Resources (ASX:FEX), GWR Group (ASX:GWR), Magnetite Mines (ASX:MGT)

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.