Culpeo Minerals raises $2.2m to advance copper hunt in Chile

The company says the raising validates the prospectivity of the Vista Montana, Lana Corina and Fortuna projects. Pic: via Getty Images.

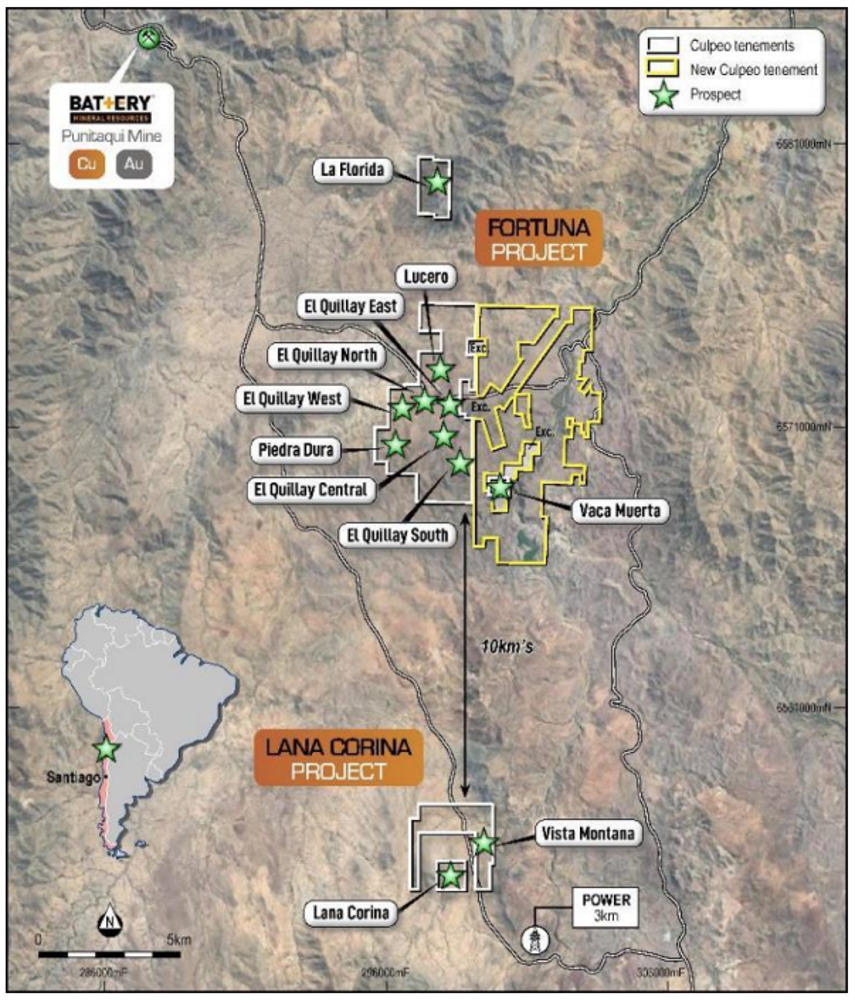

- CPO raising $2.2m to explore the Vista Montana, Lana Corina and Fortuna projects

- Projects are in Chile’s prime copper producing region

- Company directors will participate in placement subject to shareholder approval

Special Report: Culpeo Minerals has secured binding commitments from sophisticated and professional investors to raise around $2.2m via a placement at $0.04 per share to fund exploration at its Chilean copper projects.

The company says the strong placement support from sophisticated and professional investors validates the high prospectivity of its Vista Montana, Lana Corina and Fortuna Projects in Chile.

Culpeo Minerals (ASX:CPO) recently announced a significant copper discovery at Lana Corina of 454m at 0.93% CuEq from 90m, and acquired the promising Fortuna Project.

Both projects are in Chile’s Coquimbo region, renowned for its numerous world-class copper and gold mines.

Accelerating exploration at Vista Montana

The funds raised from the placement will be used for:

- Drilling at Vista Montana and Lana Corina

- Exploration of the Fortuna project

- Project payments for Lana Corina and Fortuna; and

- Working capital as well as costs associated with the capital raising.

“The strongly supported placement allows us to accelerate exploration at the Vista Montana prospect,” said Culpeo managing director Max Tuesley.

He noted that CPO believes the Vista Montana prospect is connected to the Lana Corina prospect, where the company has made “a new high-grade copper discovery, with recent drilling returning a long, high-grade intersection of 454m at 0.93% CuEq from 90m”.

“The company thanks its existing shareholders for their support and welcomes new investors,” said Tuesley.

“We look forward to providing regular updates on the progress of our field programs.”

Placement details

The placement will be conducted by way of two tranches, comprising:

- Tranche 1: 38,250,000 Placement Shares to raise approximately $1.5 million; and

- Tranche 2: 15,625,000 Placement Shares to raise approximately $0.6 million.

Tranche 1 is expected to settle on 8 August 2024.

Subject to shareholder approval, directors have also participated in the equity raising.

Unified Capital Partners Pty and Argonaut Securities will act as joint lead managers to the placement and will receive a 6% management and selling fee (plus GST) on total funds raised.

This article was developed in collaboration with Culpeo Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.