Copper prices stage partial recovery after earlier dive

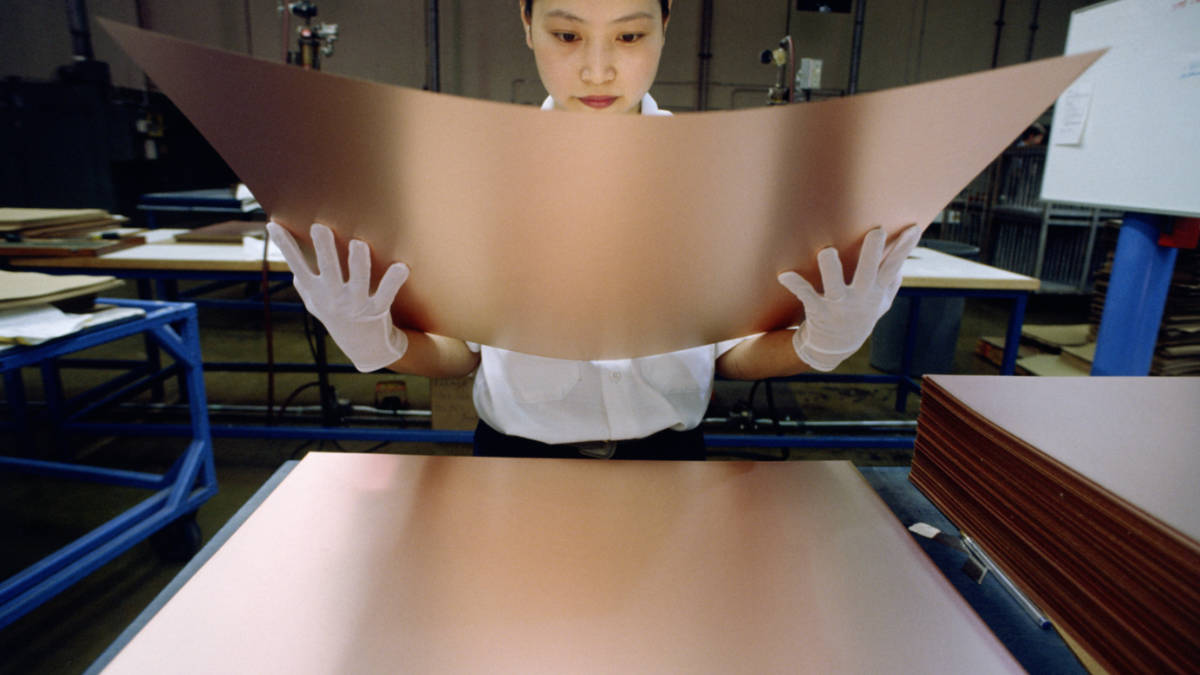

Copper prices have cranked back up after dropping. Pic: Getty Images

Copper prices have staged a partial recovery after falling more than 5 per cent on concerns that China’s manufacturing activity was starting to slow down.

This comes after the industrial metal – commonly seen as an indicator of global economic health – hit an eight-year high of $US8,238 ($10,838) per tonne last month.

The red metal fell to $US7,755/t on Tuesday before copper prices climbed back almost 1 per cent to $US7,832.35 last night.

Reuters reported earlier this week that manufacturing data from China raised the prospect of slowing demand growth though inventories remained at historically low levels.

Stocks of tin in LME-registered warehouses are also approaching the record lows of May 2019.

Meanwhile, zinc also recovered some ground after entering a downward trend at the beginning of this year.

High-grade base metal hits

Anax Metals (ASX:ANX) has struck near-surface, high-grade mineralisation at the Mons Cupri deposit within its Whim Creek copper-zinc project in Western Australia’s West Pilbara region.

Metallurgical drilling that intersected visible mineralisation in November 2020 returned results such as 42m grading 2.34 per cent copper from a depth of 43m including 11m at 4.37 per cent copper from 43m, 62m at 1.9 per cent copper and 1.03 per cent zinc from 78m as well as 18m at 5.2 per cent zinc, 2.8 per cent copper and 1.53 per cent lead from 60m.

Additionally, bulk composites prepared for ore testing work also returned up to 2.08 grams per tonne (g/t) gold and 89g/t silver.

Ore sorting work is currently underway while feasibility study work is progressing well with multiple work streams in progress.

Meanwhile, Golden Deeps (ASX:GED) is preparing a drill program to test near-surface remnant mineralisation identified by a recent study at its Khusib Springs copper-silver mine in Namibia.

The study was carried out to validate historical drilling data and digitally capture hardcopy mine plans including underground development and stoping plans with a view to assess the potential for further mineable ore remaining.

It demonstrated that there are remnant zones of copper-silver mineralisation on the margins of the mined stopes as well as at depth while a priority zone of remnant copper-silver mineralisation has been identified that is within 100m of the surface.

Khusib Springs produced 300,000t of ore grading 10 per cent copper, 1.8 per cent lead and 584g/t silver between 1996 and 2003 before it was closed due to the very low copper price at the time and depletion of easily mineable high-grade ore.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.