Copper prices just hit 8-year highs. Where to next?

Pic: Schroptschop / E+ via Getty Images

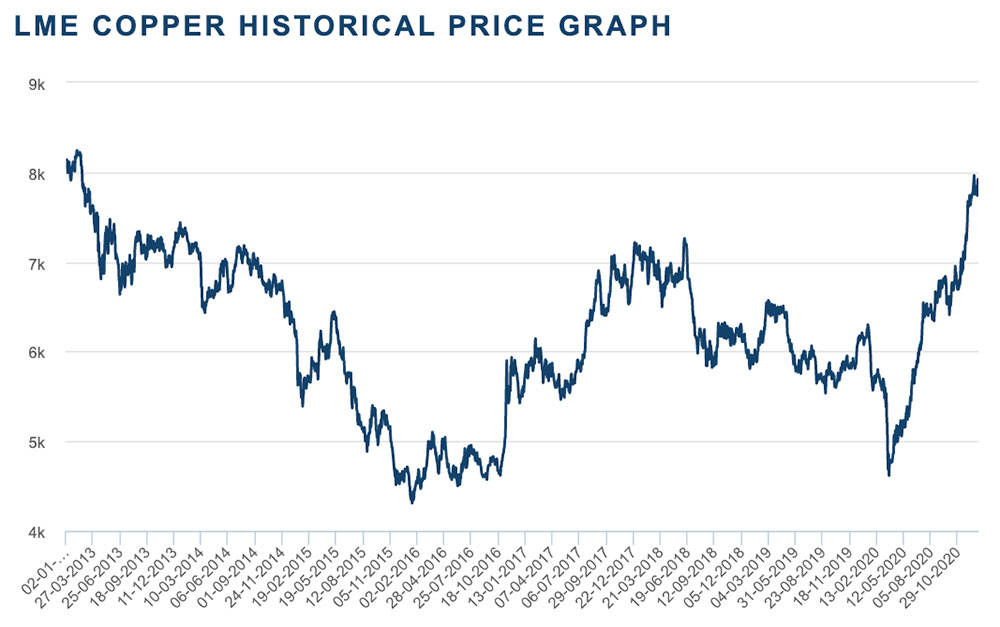

Copper prices – seen a gauge for global economic health – are at their highest point since early 2013.

Three-month copper prices on the London Metal Exchange rose to $US8,103.50 ($10,387) a tonne on Wednesday, which is an eight-year record.

Mined copper ore is typically about 1 per cent copper. This ore is often processed into a ‘concentrate’ which has a copper content of ~30 per cent by weight.

This concentrate is then smelted and refined to create a high purity product.

Researchers at Argus say the copper concentrate market is likely to remain tight throughout 2021, with demand growth poised to significantly outpace production hikes and launches.

This is big market stuff. Global supply of copper concentrate is due to increase by about 1 million tonnes next year as mines expand but this will not be enough to meet projected demand, Argus says.

“Demand growth is likely to outpace the start-ups, particularly as China’s smelting capacity continues to ramp up without the constraints of the COVID-19 pandemic seen in the first half of 2020,” it says.

Overall, about 1.2 million tonnes per year of new Chinese smelting capacity came on stream in 2018-19, a 12 per cent increase on previous capacity.

But so far these smelters have only been operating at moderate utilisation rates, Argus says.

“Mining companies argue that the copper concentrate market will be tighter next year, pointing to higher demand as China’s smelting capacity expands and potential supply disruptions from South America and Australia caused by workforce reductions to combat the Covid-19 virus, plus Australia-China trade tensions,” Argus says.

But smelters – which want lower prices, just as miners want higher prices — argue that the anticipated slowdown of COVID-19 next year, scheduled production hikes at several projects and the redirection of Aussie supply will result in global copper concentrate supply “being less tight than some suggest”.

Either way, the big, sustained copper price uplift hasn’t even happened yet.

Over the next 10 years demand for copper from traditional end-users will remain solid. Its exposure to the “electrification mega-trend” which offers attractive upside.

One electric vehicle uses about 83kg of copper. Under the IEA’s EV30@30 Scenario, EV sales reach 44 million vehicles per year by 2030.

You do the math.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.