Copper prices have just run to three month highs on positive economic outlook

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

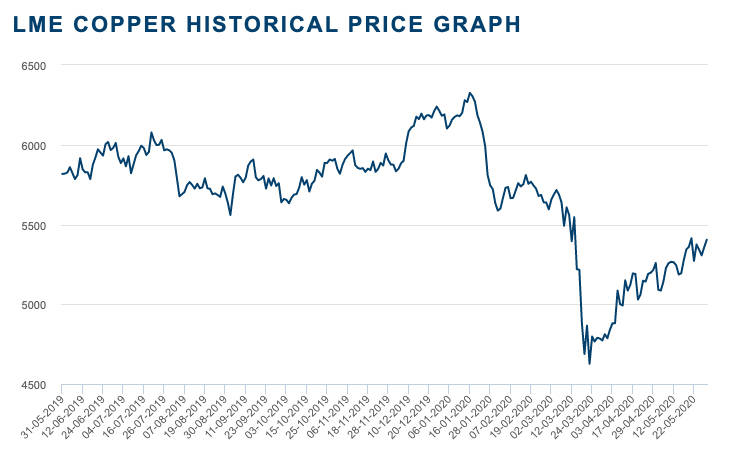

Copper prices have climbed to three month highs on the back of encouraging manufacturing data from China and the loosening of lockdowns across the globe.

Benchmark copper on the London Metals Exchange rose as high as $US5,488 ($8072.67) a tonne — the highest since 13 March — before slipping down to $US5,480/t.

The AAP quoted Capital Economics analyst Kieran Clancy as saying that barring the risks of a second wave of COVID-19 infections, the worse seemed to be over and that the economy appeared to be on a gradual grind upwards.

Chinese domestic demand appears to be on the mend after a private business survey showed that while export orders shrunk, its factory activity returned unexpectedly to growth in May while a similar survey for larger companies showed rising activity in the services and construction sectors.

The Bank of America has increased its price forecast for the red metal in 2020 by 5.4 per cent to $US5,621/t while maintaining its 2021 forecast of $US6,250/t.

Metals analysts from the bank noted that while Western economies might not completely mirror the rebound seen in China, the easing of lockdown measures could result in a rise in raw material purchases globally.

However, stocks of copper in LME registered warehouses remain high at 255,725 tonnes, about double the levels seen in the middle of January.

ASX small cap copper news:

Hillgrove Resources (ASX:HGO) has jumped straight back into its push for early cash flow with the resumption of underground drilling at its Kanmantoo copper-gold project in the Adelaide Hills.

The company says the project presents the best opportunity to resume production in the near-term.

This is thanks to the relatively low capital investment due to the existing open pit haul road to 360m depth providing access to the underground resource, the availability of a low cost processing facility, the approved expansion of the tailing storage facility and the other infrastructure and utilities at the mine site.

Drilling will focus on evaluating the depth extensions of the Kavanagh lodes intersected in the 2019 drill program and commence evaluation of the Nugent ore lodes.

Aus Tin Mining (ASX:ANW) has signed a heads of agreement to sell the Granville tin mine in Tasmania to Ten Mining for $365,000 and a further $625,000 for existing environmental bonding commitments.

The company is divesting Granville to focus on exploration and development. It recently signed a farm-in agreement over exploration licences prospective for copper and gold in New South Wales’ Lachlan Fold Belt.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.