Copper price moves to seven-year high on Biden plan, weaker US dollar, production decline

The red industrial metal's price is up 58 per cent from its March low. Image: Getty

- Copper up 58 per cent from March low, market headed for a 50,000 tonne deficit in 2020

- ‘It is anticipated that 2020 will be the second consecutive year of decline’

- ASX copper explorers Comet Resources, Freehill Mining and SSR Mining up in morning trade

The price of copper has surged to a seven-year high of $US7,300 per tonne ($9,910/t) cash basis as demand for the industrial metal heats up with a recovering global economy and is supported by a weaker US dollar.

The red metal’s price has gained 58 per cent since it dipped to a multi-year low of $US4,620 per tonne in March as COVID-19 engulfed the world.

Optimism around President-elect Joe Biden’s Clean Energy Revolution plan is seen as boosting US demand for copper-related applications in EVs, solar panels and renewable energy.

The Biden plan carries $US1.7 trillion of government spending over a 10-year period and is expected to leverage up to $US5 trillion when private sector spending is included.

A report from investment bank Goldman Sachs said new government policies introduced to deal with the COVID-19 pandemic are driving demand for metals.

“[This] will likely create cyclically stronger, more commodity-intensive economic growth, that should create the elusive cyclical upswing in demand,” said the bank.

Weaker US dollar, investment funds are other price drivers

Copper, like other commodities, is traded in US dollars, and with the US currency hitting a 30-month low this week the price of the red metal has risen to offset this decline.

“Given the strong negative correlation the dollar has with metal prices, this has had a positive impact on copper prices and will likely continue to do so,” S&P Global Market Intelligence copper analyst, Thomas Rutland said in a report.

Investment funds are also drawn to copper because of its price gains this year.

This speculative investment interest is reflected in the size of long positions in copper futures which have hit a three-year high.

The copper market’s supply and demand fundamentals are another bullish factor, as the two have moved out of kilter.

The influential International Copper Study Group (ICSG) this week noted copper mine production is forecast to be 700,000 tonnes lower this year at 20.4 million tonnes, or down 1.5 per cent on year, and will rise 4.6 per cent in 2021 to 21.7 million tonnes.

“It is anticipated that 2020 will be the second consecutive year of decline in world copper mine production,” said the ICSG.

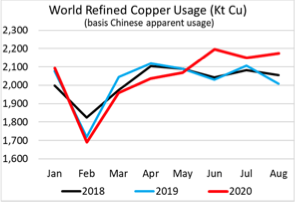

The refined copper metal market is headed for a deficit of 50,000 tonnes in 2020, and will likely see a surplus of 70,000 tonnes in 2021, said the ICSG.

Higher copper price provides a welcome boost to ASX copper explorers

ASX copper stocks have been riding the wave of higher prices and they include Comet Resources, Freehill Mining, and Noronex.

Comet Resources (ASX:CRL) has found evidence of extensive copper mineralisation at its Barraba copper project in the New England area of NSW.

This follows a geological field program that included geochemical soil sampling, rock chip sampling and geological mapping in the Gulf Creek North area of the project.

“We are encouraged by the widespread visual presence of copper mineralisation around the Murchison copper mine as well as the discovery of historical workings and the presence of iron oxides in the area of the IP anomalies at Gulf Creek North,” managing director, Matthew O’Kane, said.

Murchison copper mine had historical production at an average grade of 3 per cent.

Freehill Mining finds large copper structure at Chile project

Freehill Mining (ASX:FHS) announced it had identified a “very large potential copper large structure” at its El Dorado project in Chile.

The discovery at El Dorado was made using induced polarisation geophysics and the structure has a footprint of 32 hectares.

“This is undoubtedly a fantastic development for Freehill and potentially confirms that El Dorado hosts a huge copper structure,” chief executive, Peter Hinner, said.

The El Dorado project, which abuts the company’s Yerbas Buenas iron ore project located 500 km north of Santiago, was acquired by Freehill Mining in October.

Noronex (ASX:NRX) said it has commissioned an airborne electromagnetic survey of its Witvlei and Dordabis copper-gold projects in the southern African country of Namibia.

The Namibian projects are along the Kalahari copper belt that stretches across Namibia and Botswana, for which a drilling program is planned in 2021.

Gold miner SSR Mining intersects copper at Turkey mine

SSR Mining (ASX:SSR) has intersected gold-rich copper mineralisation during drilling at its Çöpler gold mine in Turkey.

“It has long been contemplated that there are copper-gold prophyries associated with the Çöpler mineralisation and recent in-pit exploration mapping identified mineralisation and structures pointing to the possibility of porphyry,” president and chief executive, Rod Antal, said.

Four drill holes all hit the gold-copper mineralisation at the Çöpler mine and included 0.74 per cent copper at 241m from 37m.

ASX share prices for Comet Resources (ASX:CRL), Freehill Mining (ASX:FHS), Noronex (ASX:NRX), SSR Mining (ASX:SSR)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.