Comet Resources gears up to restart Mt Margaret copper project within 24 months

The company is confident of the short term and long-term upside potential at the project. Pic: via Getty Images.

Comet Resources is poised to acquire the historic Mt Margaret Copper Project from Glencore – and has its sights set on a low capex path back into production within 24 months.

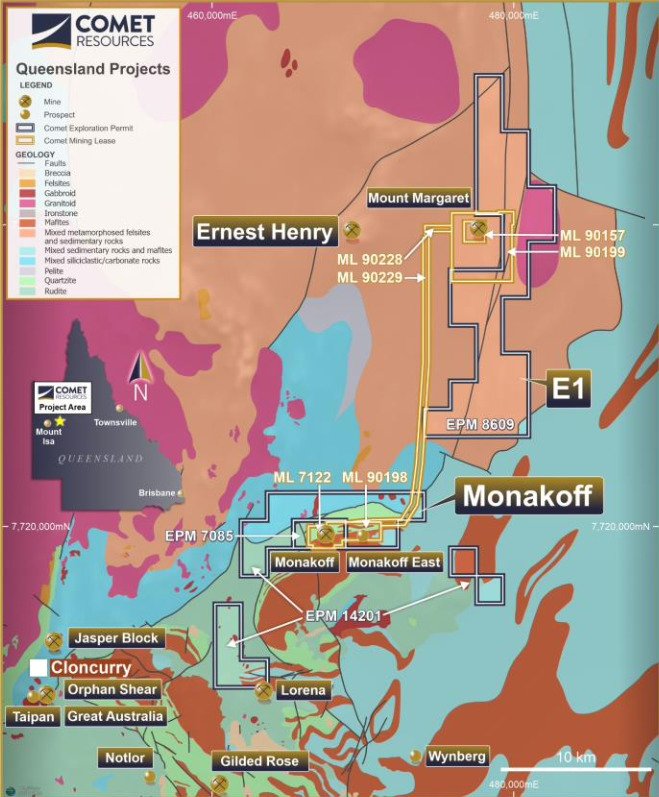

Mt Margaret is just 7km from key infrastructure at the Ernest Henry Copper-Gold Mine in Queensland’s established Mount Isa/Cloncurry mining region, with all the infrastructure in place for a fast restart of mining operations and toll treating of ore.

And the project represents both potential near-term copper production and regional exploration upside, with nine mining, infrastructure and regional exploration tenements hosting known iron oxide copper gold (IOCG) style deposits.

Comet Resources (ASX:CRL) is now raising $27m to fund the acquisition, and once finalised, the plan is to review historical data for drilling targets and kick off resource extension drilling. Drilling is scheduled to commence shortly after the close of the acquisition.

Low capital return to production

Open-pit mining took place at the Mt Margaret Copper Project for approximately two years until production was suspended in 2014 due to copper market conditions and outlook at the time – and Comet MD Matthew O’Kane is confident if the mine was profitable then it’ll definitely be profitable now.

Not to mention, when the mine was put on care and maintenance, two additional open-pits had been pre-stripped covering the majority of the currently defined resource.

“That’s around about a $10 million saving in capital prestrip costs that we will avoid on a restart,” O’Kane said.

“It’s next door to Ernest Henry, which is where the ore from Mount Margaret was successfully processed historically, into export grade copper concentrates and that plant has significant open capacity so there is the option of once again, treating our material through that plant.

“And so that presents an opportunity for an extremely low capital return to production for us, because we avoid the capital expense and the time it would take to build our own plant.”

Short and long term exploration upside

Mount Margaret has a JORC Measured, Indicated and Inferred Mineral Resources of 13Mt at 0.78% copper and 0.24g/t gold – but Comet is confident there’s plenty of room to grow.

“There’s very, very high confidence, very large exploration upside short term and then there’s further targets for possibly large exploration upside long term,” O’Kane said.

“Mt Margaret has an existing resource of 13Mt but historically, there was a much larger resource done historically, it just wasn’t re-estimated less mining depletion

“So, we know that there’s significantly more resource there.”

Another copper project and graphite exposure

Another feather in the cap, is the historically producing Barraba project in NSW, which will also nab a portion of the capital raising for drilling.

“Barraba is a VMS deposit which offers interesting exploration possibilities, and we plan to commence a drilling campaign on that project as well,” O’Kane said.

Plus, the company also holds 25% of International Graphite (ASX:IG6) after spinning out its Springdale Graphite Project in the IG6 IPO in April of this year. Springdale graphite was confirmed in test work completed in Germany in 2021 to be amenable for the production of battery anode grade material – and not many graphite deposits can do that.

International Graphite is a downstream processor set up to take the graphite and turn it into the material that goes into the lithium-ion battery anodes.

A clear peer of IG6 is Renascor (ASX:RNU) which is maybe 18 to 24 months ahead of International Graphite, and valued in excess of $500 million, which Comet says represents the possibility for large upside in the value of its shareholding in IG6 as well.

This article was developed in collaboration with Comet Resources Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.