COP26, Robert Friedland and BHP further highlight the world needs a lot more copper

Pic: Getty

The stars are aligning in the copper space – supply is tightening, demand is robust, there is a dearth of major new discoveries and development projects in the pipeline, and the majors are in growth mode.

The Glasgow climate conference, COP26, held last month further reiterated the structural trend towards decarbonisation and electrification needed to address global warming.

As stated by Goldman Sachs earlier this year in its report “Copper is the new oil”, there is no decarbonisation without copper, which the bank believes is the most critical material in the world’s path towards lower emissions.

In a recent Bloomberg interview, industry legend Robert Friedland provided a timely reminder of the supply side challenge the copper industry is already facing.

Estimated total historic copper consumption is around 700 million tonnes. Friedland stated this same amount of copper was already expected to be consumed over the next 20 years based on existing usages without the electrification of the world economy.

The implications of electrification only places further pressure on a supply side struggling to meet existing demand and usages. BHP’s chief commercial officer, Vandita Pant, estimates that in a decarbonising world we “will need almost double the copper in the next 30 years than in the past 30” to meet this incremental demand.

COP26, Friedland and BHP only reinforced a decarbonising and electrifying world and that this will require a lot more copper.

Tailwind in pricing just the start?

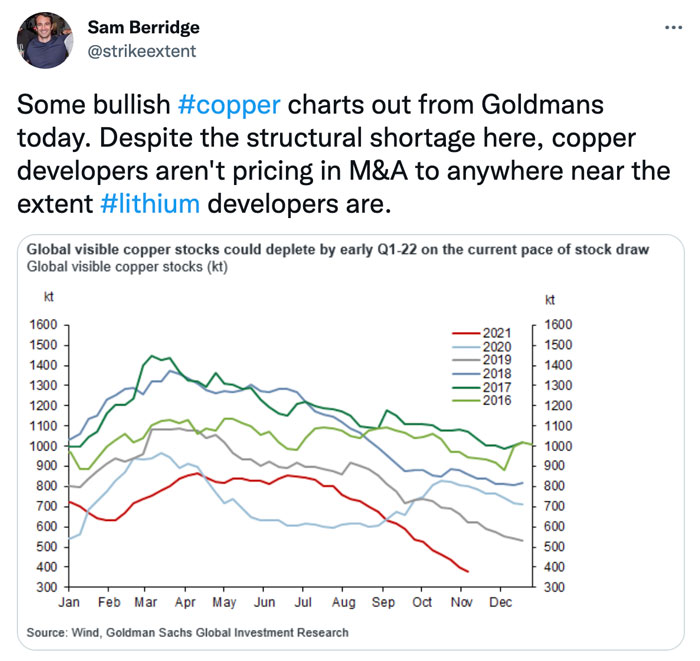

Over the past year the copper price has rallied 26% thanks to a perfect storm of factors placing increased pressure on supply, while at the same time demand continues to be robust.

Additionally, a lack of major new copper discoveries over the past decade has the majors sniffing out potential acquisitions as they look to supplement and grow production.

Pressure to accelerate this strategy is only further compounded by the lack of advanced exploration and project development projects already in the pipeline, with many groups facing a declining production profile.

As Friedland puts it, the revenge of the old economy is now upon us following decades of under investment.

Former Goldman Sachs analyst and CEO of ASX-listed copper explorer Kincora Copper (ASX:KCC), Sam Spring pointed to the spotlight that LME Week and the COP26 Summit had put on the copper market.

“LME Week last month really focused people on the near-term balanced market, and that has seen the copper price rally quite hard,” he told Stockhead.

“What was interesting last month was you had COP26 talking about climate change and global warming. What you’re now starting to see filter through are the implications to a lot of steps proposed to address this, such as renewable energy and electric vehicles, and what that means in transition and increased consumption of raw materials needed to go into decarbonisation and electrification.

“Some of the numbers that started to be bantered around are really significant, with the supply side unlikely to be able to respond in time. LME reinforced the reasons for the recent strong copper price and COP26 supported that this is likely just the beginning.”

Spring said the combination of the balanced market heading into deficit, and the growth expectations and demand needed to decarbonise and make the energy transition, provides a “fascinating outlook for a lot of commodities, with some very clear winners and losers”.

“One winner is particularly copper. This is driven by the number of tonnes needed to go into that decarbonisation in the copper space versus the existing market, the absolute level of dollars of new investment needed, the structure of the supply side, and a market that’s already struggling to keep supply flat and meet expected existing end-use demand,” he explained.

Consultant Wood Mackenzie estimates limiting global warming to 2 degrees Celsius above pre-industrial levels implies 19 million tonnes of additional copper production by 2030, a 60% increase.

Currently the world’s 10 largest mines in total produce only 5 million tonnes a year, and this is decreasing.

To help further put this into perspective, Friedland’s Ivanhoe Mines’ exceptionally high grade Kamoa-Kakula mine in the DRC is expected to ramp up to peak production of about 800,000t/pa copper over this period, making it the second largest copper mine in the world.

Clearly though there are not already 20 other projects equivalent to the size of Kamoa-Kakula known of, yet to met these forecasts there needs to be and they need to be in construction now.

Porphyries – the preferred choice for majors

Due to their size, porphyry style deposits are responsible for approximately 60 per cent of the world’s current copper supply and will play an increasing role going forward to meet even a fraction of the forecast demand from the likes of Wood Mackenzie, Friedland, BHP or Goldman Sachs.

Declining production and lack of existing projects in the pipeline has seen an increase in M&A activity.

Recent deals include Newcrest Mining’s (ASX:NCM) $US2.8 billion ($3.8 billion) acquisition of Canadian gold miner Pretium Resources for its flagship Brucejack mine in British Columbia, and Evolution Mining’s (ASX:EVN) $1 billion transaction with Glencore to own 100% of the Ernest Henry copper-gold mine in Queensland.

This continues a trend that has seen gold giants such as Newcrest, Barrick and Newmont pursue more exposure to copper.

Newcrest has big plans to make its copper exposure its point of difference among the major gold stocks, with plans to increase copper production by 37% to 175,000tpa by 2030 even as its gold production remains stagnant, but it also has big plans in Canada, as part of its focus on Tier 1 mining jurisdictions.

What’s interesting about the Red Chris and Brucejack acquisitions is they are both located in British Columbia’s ‘Golden Triangle’, propelling Newcrest to the position of the biggest producer in that region. Spring states that the Golden Triangle is “Canada’s leading porphyry belt” and an analogue of the Macquarie Arc in the prolific Lachlan Fold Belt of NSW, and Newcrest will be the largest producer in both these regions (with Cadia still being its flagship asset, located in NSW).

Within this landscape it is unsurprising for good porphyry discoveries to be rewarded. A recent example is Sunstone Metals’ (ASX:STM) 10x re-rate in the last couple of months, driven by drill results in Ecuador.

Closer to home and potentially the next porphyry success story is Kincora Copper as it seeks to become the leading pure play porphyry explorer in Australia’s foremost porphyry region.

Kincora’s Trundle project is located in the Macquarie Arc and bears striking similarities to the neighbouring Northparkes mine – Australia’s second-largest porphyry mine that hosts a series of five economic intrusive systems – and Newcrest’s Cadia-Ridgeway mine, one of the largest and lowest cost mines globally.

“What you’re increasingly seeing is this consolidation taking place both in the gold and the copper space, where often single producing companies or advanced exploration/development projects are increasingly in focus as the industry looks for growth opportunities,” Spring said.

“So that theme of growth is increasingly coming through into the sector from the majors and the mid-tiers alike, with a premium paid and preference for Tier 1 jurisdictions.”

Clear scale potential and overhangs cleared

Recent drilling by Kincora indicates the junior explorer is getting very close to a big porphyry target.

The most recent hole, TRDD014W1, intersected multiple skarn horizons and broad intervals of porphyry style intrusions at the Trundle Park prospect, with assay results due soon.

This hole was a wedge, drilling off previous hole TRDD014 and confirmed previous skarn intervals as well as extended the intrusive systems returned in both TRDD014 and TRDD022.

TRDD014 returned intercepts of 65.5m at 0.25 grams per tonne (g/t) gold and 0.04% copper, including 10m at 0.73g/t gold and 0.10% copper; while TRDD022 returned 162m at 0.24g/t gold and 0.04% copper, including 18m at 0.75g/t gold & 0.09% copper.

“Our drilling has demonstrated a significant size and multiple intrusive system is present with the features suggestive of being in a proximal environment to a target that offers clear scale potential,” technical director John Holliday said in a recent exploration update.

Spring added, “The width of the porphyry orebody cores in the Macquarie Arc are often very narrow, only hundreds of metres wide, and you don’t see much encouragement unless you are right next to or in them.

“However, they make up for this with very good grade, gold credits, being vertically extensive, amendable for low cost mining methods and occurring in a series or cluster of deposits.

“To see the width of gold results in TRDD022, and the right rocks, with the right alteration in that hole and then the extension of TRDD014, provides significant encouragement we are very close to hopefully where we want to be. From here, only further systematic drilling will confirm or downgrade this target.

“A follow-up hole (TRDD028) is testing the emerging porphyry system target zone with the south remaining open for further drilling.”

On the corporate front, Spring noted that a couple of legacy shareholder overhangs had recently been worked through which “weighted on our share price”, with the most recent block crossed only this morning.

“With these out of the way we are well positioned for good exploration results to again be rewarded and reflected in our valuation – unfortunately this wasn’t the case in the last couple of months”.

This article was developed in collaboration with Kincora Copper, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.