Cheap, fast and efficient: This is why RapidSX could be a gamechanger for the global rare earths sector

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Called RapidSX, Hexagon Energy Materials’ planned investment in new rare earths separation tech could give producers the edge they need amid a global push to disrupt China’s dominance over the rare earths supply chain.

Used in wind turbines and the nascent electric vehicle sector, rare earth permanent magnets (REPM) will be a significant and lucrative demand driver for rare earths going forward.

But separating the numerous rare earths beforehand is a notoriously expensive and complicated process.

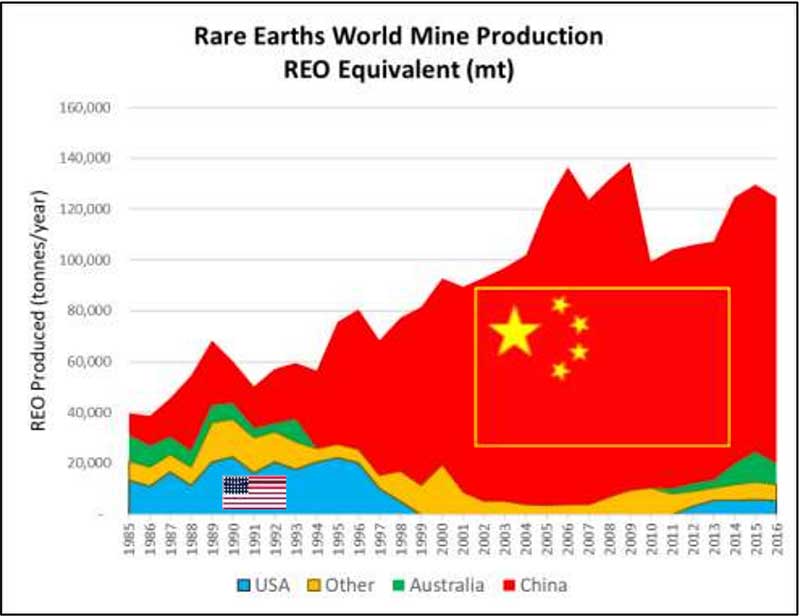

That’s why there aren’t many players in the space outside China, which has an almost total monopoly on established infrastructure for the production and separation of rare earths (and everything else).

That could change very soon. A strong global push to develop new sources of rare earths supply outside China – spearheaded by governments in the US, the EU, and Japan – is well underway.

Recognising this, Hexagon (ASX:HXG) expanded into US downstream rare earth processing in October 2019 , signing a deal to acquire a 49 per cent interest in an advanced, proprietary low-cost downstream REE separation tech called RapidSX.

Black Swan’ events like COVID-19 underscore the supply chain disruptions that can occur when an industry, like rare earths, is concentrated in one country, like China, says Hexagon managing director Mike Rosenstreich.

“I believe the pandemic will create even greater impetus for EV makers, wind turbine makers, and others to be looking for a greater spread of suppliers for raw materials,” he says.

“That’s what the RapidSX technology can unlock.”

What makes RapidSX a gamechanger?

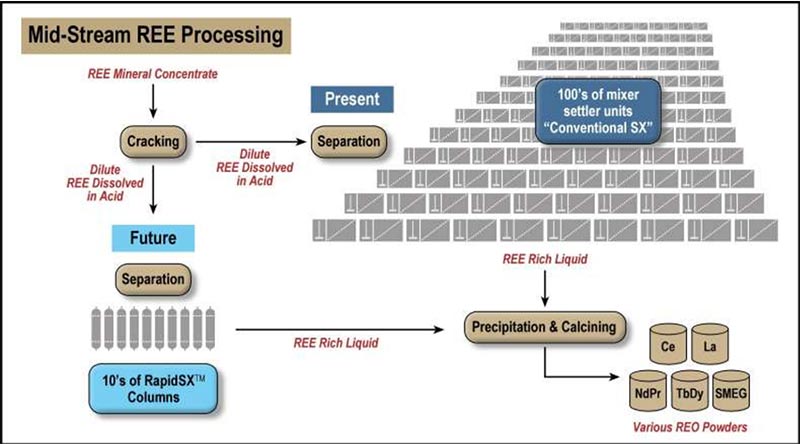

RapidSX is a “turbocharged” form of solvent extraction (SX); a very common, well established method of removing metals from dilute solutions.

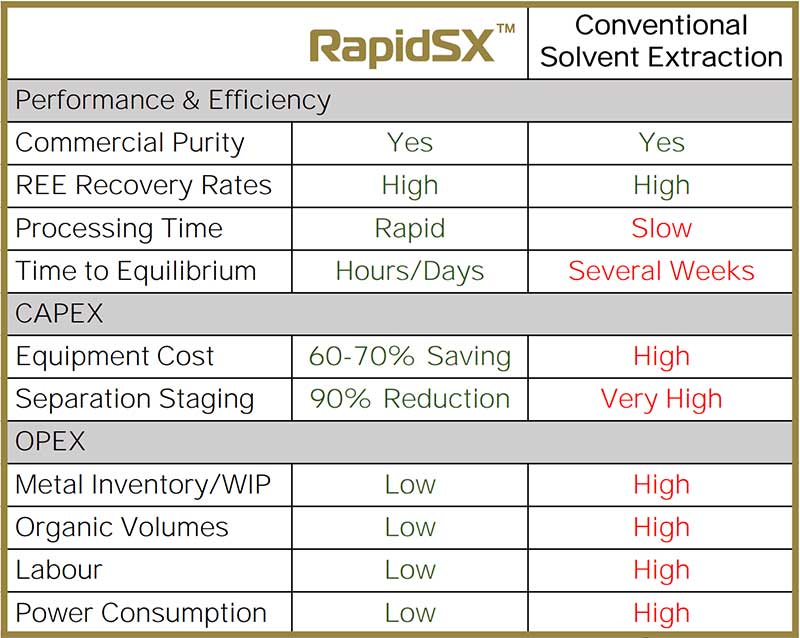

But conventional SX is slow, and very capex and opex intensive applied to rare earths.

“Importantly, RapidSX uses the same chemicals, so we aren’t talking about a brand-new scientific paradigm here,” Rosenstreich says.

“But the way the interaction between the acid and the organic is done though RapidSX’ patentable process is unique.”

That’s what speeds up the process of separating rare earths, which makes the operational footprint and therefore the capital required for each of the separation stages much, much smaller:

Hexagon estimates a 60 to 70 per cent capital cost saving for a RapidSX separation plant as opposed to a conventional SX plant.

“That’s 10s of millions of dollars,” Rosenstreich says.

“We also estimate 15 to 20 per cent savings on operating costs between conventional SX and Rapid SX.”

Importantly, RapidSX also gives the next generation of miners the option of capturing more downstream value from their operations.

“Most emerging rare earths miners are looking to create some sort of rare earths mineral concentrate and then sell that material to an overseas separation plant,” Rosenstreich says.

“The most likely purchaser for that material at the moment would be the Chinese, which import feedstocks for their separation plants.

“Rather than selling an intermediate concentrate, emerging producers can look at capturing an extra 30-40 per cent value by selling a high purity rare earths oxide.”

To adopt something like RapidSX — given its established chemistry and piloting success — is a low risk way of adding downstream processing into [a rare earth producer’s] flowsheet, Rosenstreich says.

The speed of RapidSX also means producers have a lot less metal – and consequently money — tied up in inventory.

“I believe it can take months for metal to start off at one end of a conventional plant and end up as product on the other side,” he says.

“We think that becomes literally a matter of hours, perhaps a day or so, with RapidSX.”

The next step: a commercial demonstration plant

A successful pilot plant, supported by US$2.0 million of funding from the U.S. Dept. of Defense (a small version of the real thing) has already proven that RapidSX works outside the lab.

A commercial demonstration plant (CDP) is now planned for completion in Q4 this year (pandemic willing) with a production capacity of 60,000 to 80,000kg of REO’s per annum from a site in North America.

It will enable near term producers who are interested in utilising RapidSX, or current producers looking to taking that extra value add step, to put their own feedstock material through the demo plant.

“What these [near-term/current producers] get out of that is capital cost data for their feasibility and financing; they get operating cost data; and importantly, they also get product samples to be able to give to their customers,” Rosenstreich says.

“This demo plant is a really important step in the RapidSX commercialisation process. It proves to our clients, our potential customers that this project works on their material.”

The ball is well and truly rolling. Under an agreement with Hexagon’s partner Innovation Metals Corp (IMC), TSX-listed Ucore will assess this tech for the separation of rare earth elements concentrates into high-purity REE oxides (REO).

Ucore plans to develop heavy and light REE downstream processing capabilities through its planned Alaska Strategic Metals Complex. It already has $US145 million in designated financing from the Alaska Industrial Development and Export Authority.

Hexagon is also in ‘remote’ discussions with other potential users as well as several parties to source the ~$US2m ($3.5m) required to complete the CDP in Q4 this year.

“The process has been slowed down by COVID-19 — in fact I cut a trip short when I returned to Australia prematurely in the 14th of March,” Rosenstreich says.

“But these discussions were already well and truly underway, and I’m still hopeful of being able to do a financing of around $US2m for the commercial demonstration plant in May.”

WATCH: 90 Seconds With…Mike Rosenstreich, Hexagon Energy Materials

This story was developed in collaboration with Hexagon, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.