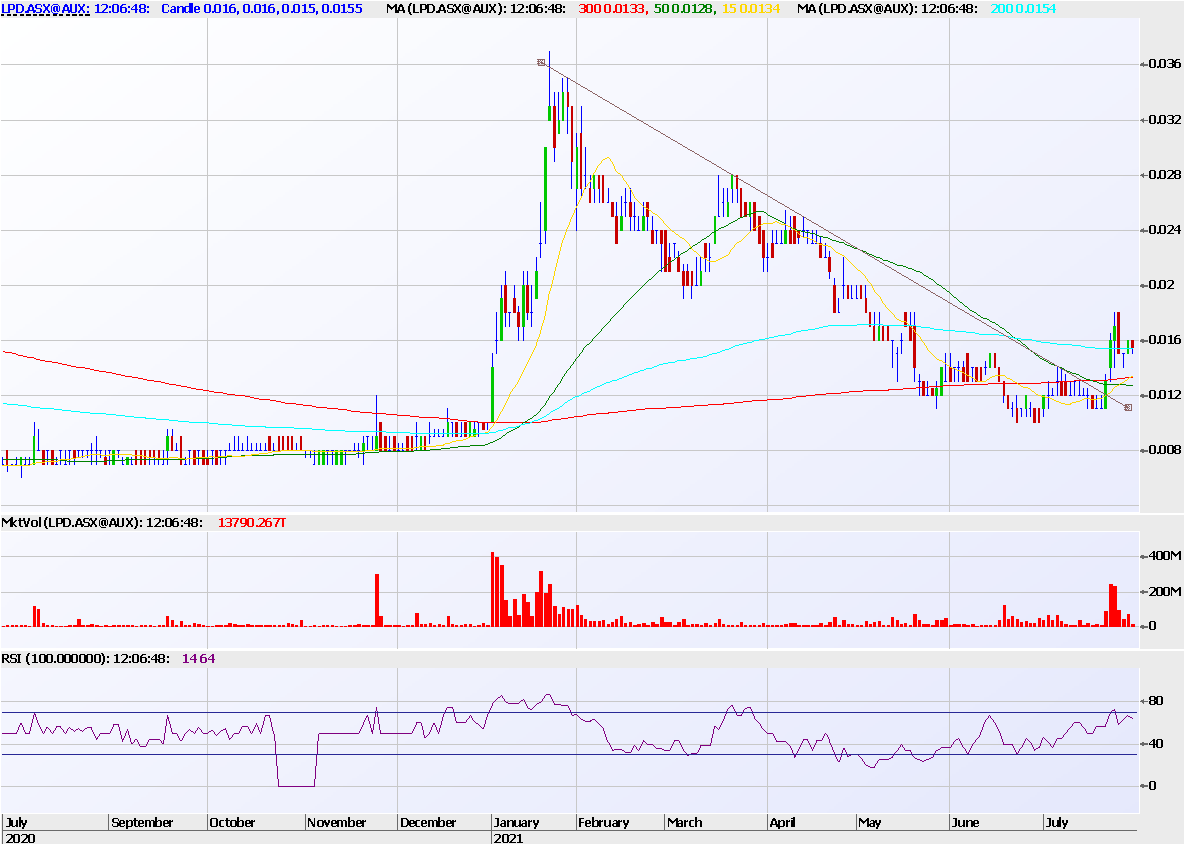

Chart of the Day: Could Lepidico (ASX:LPD) propel itself back to its January high of 3.6c?

Pic: Tyler Stableford / Stone via Getty Images

Don’t look now, but Lepidico (ASX:LPD) is sizing up for another run.

Never one to shy away from novel and divergent takes on what it takes to actually get an asset into production, Lepidico announcements make for interesting reading.

If we stick to the price action, the chart shows us that the company enjoys excellent support back toward 1c, and is prone to significant moves when the stars align.

That means a move back up above the 200-day simple moving average in red – which currently checks in just above 1.3c – sets the stage for another bullish run which could see prices move as high as the January highs of 3.6c.

In its favour also is that there are no immediate gaps below on the chart, which as we have covered in this column, have a pesky habit of filling on a bad day.

Should 1.4 – 1.5c hold in the short term, the first immediate target would be horizontal resistance at 2c, and should that be overcome, 2.8c and then 3.6c.

On the downside, we would like to see the 200day MA hold – 1.3c also being the recent raising level at which the company materially added to its cash pile to see it through its next several years of projected operation.

This is a similar set-up to Stemcell United (ASX:SCU) of last week, and a set-up that we favour – a stock that has recently shown the ability to trade at meaningfully higher levels, in an arena of endeavour that is ultimately hard to quantify should they be successful.

In the case of LPD, whilst a market cap at the guts of 100m is a lot higher than that of SCU, recent price action amongst sector heavyweights GXY / PLS / ORE won’t hurt the market’s ability to get alongside of this name either, should it choose to do so.

We have bought at current levels with a stop at 1.3c, and await further developments.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +25.79% p.a. net of all fees as at the end of June 2021 since inception in January 2015 ( using the Time Weighted Return method of calculating returns ).

Learn more at www.collette.capital

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.