Chart of the Day: Stemcell United (ASX: SCU) is toying with a ‘something different’ close

Pic: REB Images / Tetra images via Getty Images

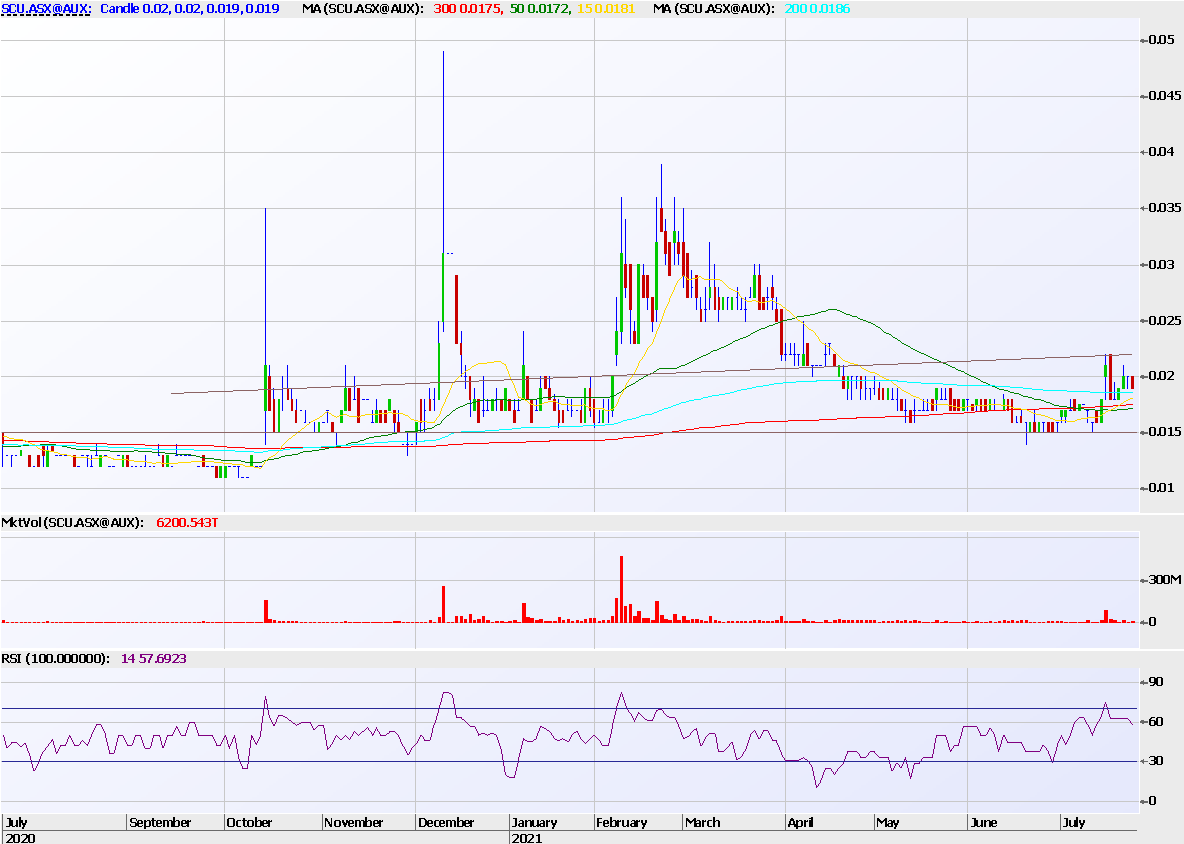

After experiencing some digestion post a placement dating back to April at 1.9c ( including a 1 for 2 option struck at 3c), Stemcell United (ASX:SCU) again looks poised to move higher.

The overall trend in the last year has been positive as seen on the chart, and the stock has made a good go of periodically capturing speculative interest in the market.

This has led to several short and incisive upside blow-offs, the most impressive of which was the move to almost 5c dating back to December of last year.

Having spent the best part of three months now consolidating between 1.5c and the placement price of 1.9c, SCU has again begun to ease higher, trading up to 2.2c a couple of times on the 15th and 16th of this month and testing a modestly up-trending line as can be seen in black.

Naturally given recent price action, the moving averages have also all begun to converge, which can set the stage for a more explosive move in either direction.

Short term, a close at 2.2c on reasonable volume would signify ‘something different’, with immediate upside targets then being 2.5c and 3c before entertaining higher levels.

On the downside, we are certainly looking for 1.5c to hold no matter what.

It’s a favourable risk reward set-up, and certainly a position that we have held from the placement at 1.9c and which we continue to entertain for its upside prospects.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +24.57% p.a. net of all fees as at the end of February 2021 since inception in January 2015 (using the Time Weighted Return method of calculating returns).

Learn more at www.collette.capital

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.