Chalice backing Julimar doppelganger at Venture Minerals’ South West project as it finishes first stage of JV

Pic: Schroptschop / E+ via Getty Images

Julimar owner Chalice Mining has finished the first part of a staged JV to test a ‘Julimar lookalike’ at Venture Minerals’ South West project, boosting Venture’s chances of making a major discovery.

The market has been itching for further nickel, copper and PGE finds on the western margin of WA’s Yilgarn craton since Chalice Mining found Julimar and its world class Gonneville deposit 70km north-east of Perth in early 2020.

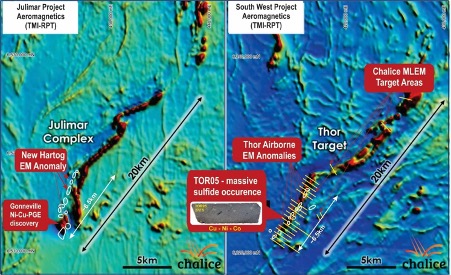

Venture’s (ASX:VMS) South West project may be around 300km to the south, but is located along the same margin and contains a major anomaly that bears a striking resemblance to Julimar.

That attracted Chalice, which has spent the $300,000 required to move to the next phase of its JV. It can earn a 70% share in the project by spending $3.7 million on exploration.

Chalice is running an EM survey over the Thor target, a 20km anomaly in which Venture previously defined 13 highly conductive areas in a 6.5km stretch at its southern end in a airborne EM survey.

Venture says in the initial third of the planned EM program Chalice has already defined new EM anomalies of similar strength conductors to those that yielded wide and significant palladium intervals during early drilling phase at Julimar.

“With Venture’s JV partner Chalice Mining completing the first stage of the JV earn-in through the completion of a detailed EM survey, the company now eagerly awaits the survey results,” Venture managing director Andrew Radonijc said.

“The knowledge gained from Chalice’s Julimar discoveries will be a huge advantage in determining which conductors should be drilled first and this no doubt increases the probability of bringing a discovery forward.

“This is the main reason why Venture decided to partner with Chalice on this project as it clearly increases the chances of success which benefits all of the company’s shareholders.”

Chalice to define drill-ready targets

Chalice can earn an initial 51% of Venture’s South West project by spending $1.2 million, including previous expenditure, by July 29, 2022.

It can then claim a 70% stake by spending a further $2.5m.

Chalice is expected to compile and use the data from the current EM survey to interpret resulting bedrock conductors early next year, ahead of soil geochemistry to define potential drill-ready targets.

Venture has already successfully identified mineralised sulphides in drilling previously at the South-West project, located around 240km south of Perth.

One of the new EM anomalies identified in the Chalice survey is within 10 metres of TOR04, a hole previously drilled by Venture, which intersected 86m of disseminated sulphides with anomalous levels of PGE mineralisation.

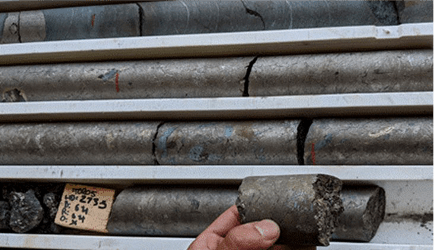

Only two of Venture’s previously identified anomalies have been tested by single drill holes, with the last hole in 2019 TOR05 intersecting 2.4m of massive sulphide averaging 0.5% copper, 0.05% nickel, 0.04% cobalt and anomalous gold and palladium.

Nickel and copper sulphides were also intersected in the only hole drilled at the nearby Odin target, in a mafic-ultramafic unit which extends over 10 strike kilometres.

Chalice made the unique Julimar discovery in similar settings on farmland near Toodyay in early 2020, recently revealing its Gonneville deposit to be the largest nickel sulphide discovery globally in more than 20 years and Australia’s first major platinum group elements deposit.

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.